LUNA Technical Analysis – February 2022

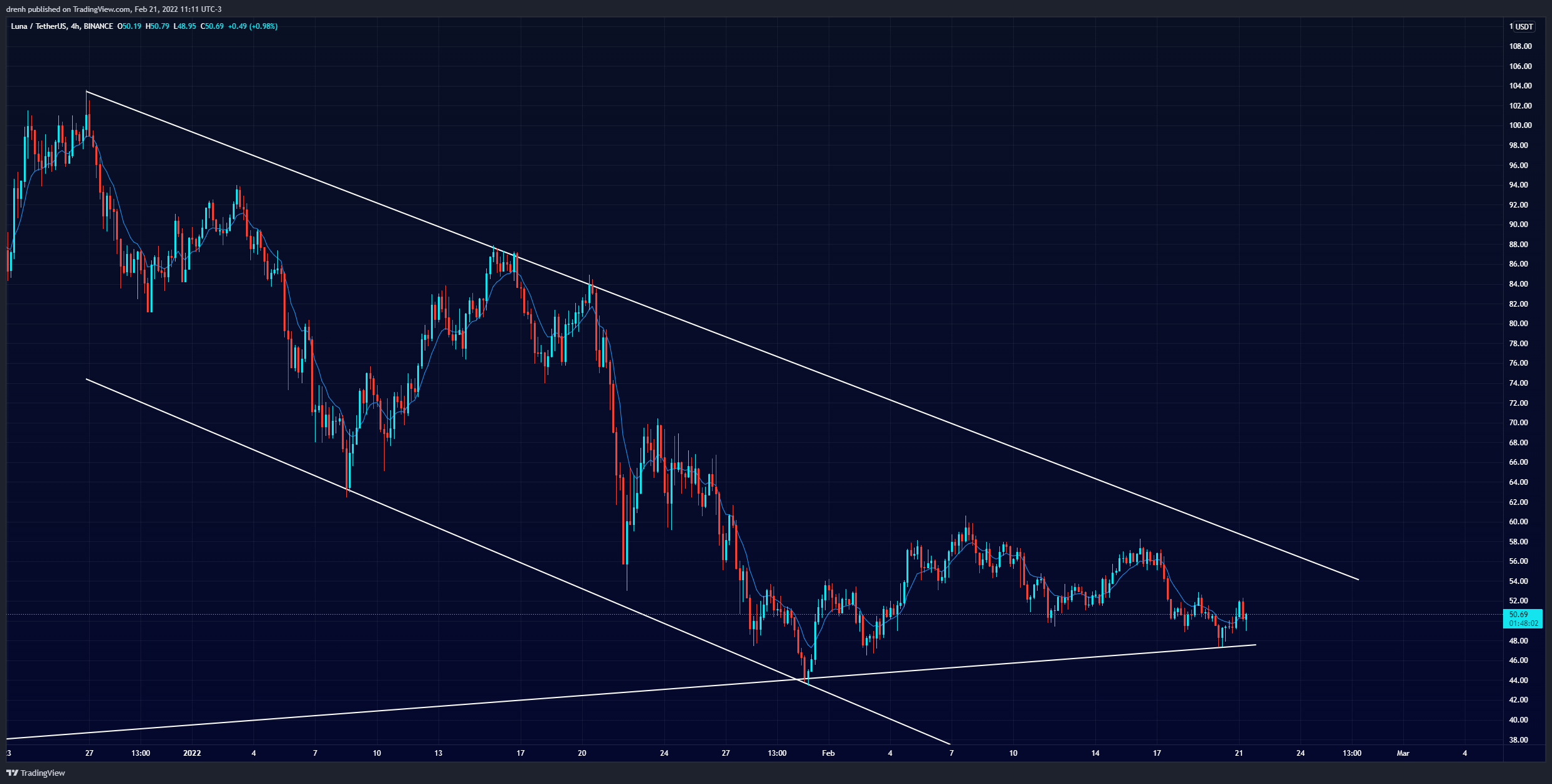

Terra (LUNA) reached its all-time high late in December of 2021 at a price of $103. While 2021 was a wonderful year for LUNA, the price went downhill after that. It initially declined by around 40% in the first week of January. After the price had a correction of 40% and faced resistance at $87, it continued to decline.

The price had a bearish surge of 37% in the next few days. While LUNA tried to rebound numerous times, it failed to do so and kept declining. By the end of January, the price of Terra (LUNA) found support at around $43. Ever since that, the price is in recovery.

It increased by another 40% in February, but it faced resistance at $60, failing to reverse the trend in the 4-hour chart. The price then had a retracement of 19%. Currently, LUNA is trading at around $52, showing bullish tendencies in the recent candlesticks and demonstrating less fear in the fear & greed index. Nonetheless, the overall trend of LUNA is bearish for the coming weeks.

When looking at the longer run, we can notice a wedge pattern taking shape. Since we are approaching the end of the wedge, we may see the price of LUNA to have a breakout soon in the coming days.

Key Structures

Support

- $43

Resistance

- $58

Indicators

Moving Average

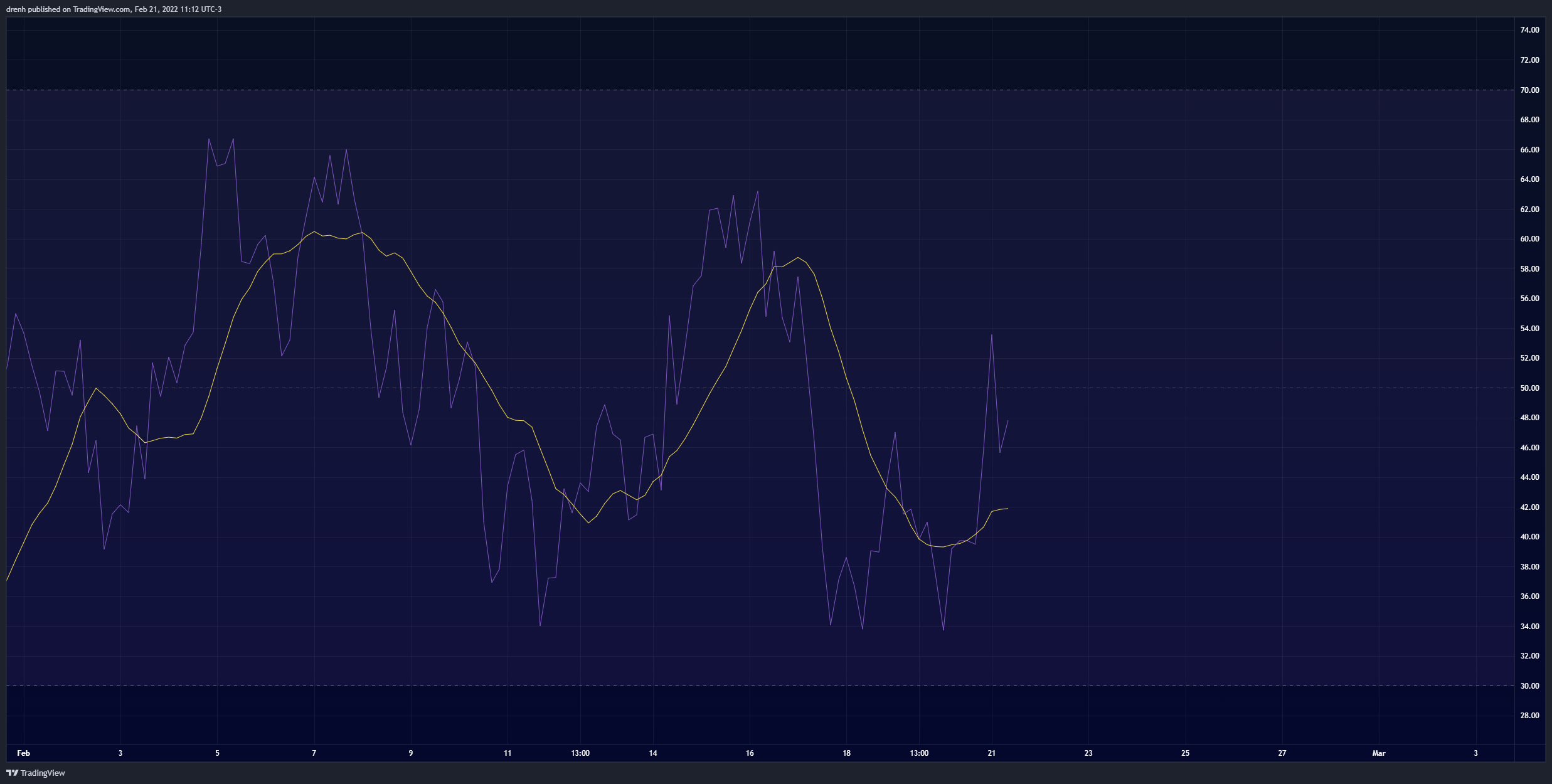

The 50-MA of a 4-hour chart is still above the price, indicating that the longer-term price of LUNA is still bearish and that the price could keep declining in the coming weeks. The 20-MA of a 4-hour chart, on the other hand, is now below the price, indicating that LUNA is bullish for the coming days.

The 9-EMA is also currently below the price of LUNA due to the recent increase in the price. This suggests that LUNA is bullish in the short run and that the EMA line could act as support to the price in the coming days.

Relative Strength Index

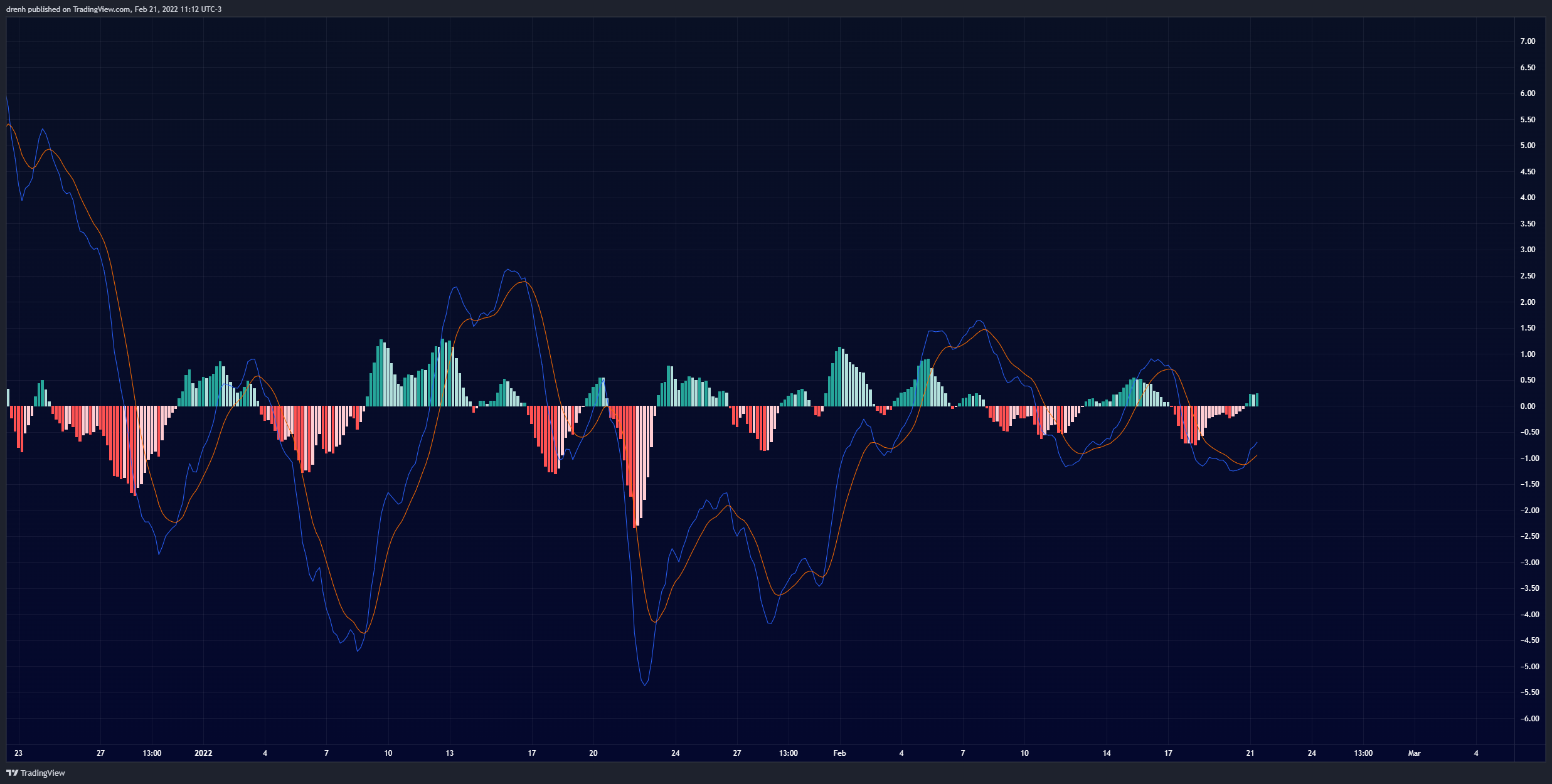

The RSI of a 4-hour chart was recently close to 30, but LUNA was not oversold. Nonetheless, the price increased and went above 50 momentarily. The RSI is still bearish, but it also indicates that there is plenty of room for growth in the price of LUNA.

MACD

The MACD line of a 4-hour chart is currently above the signal line and is moving toward the upper side of the baseline. This suggests that the momentum is building up to be bullish for LUNA in the 4-hour chart, other things equal. If this continues, then we could see LUNA keep increasing in the short run.

Fibonacci

The Fibonacci retracement levels of a 4-hour chart suggest that the price of LUNA faced resistance right at the 61.8% Fibonacci level, suggesting that the price could keep declining below 0%. Nonetheless, there was plenty of buying pressure to prevent that from happening right away, hence the price of LUNA might not follow that bearish pattern.

Price Prediction LUNA – February 2022

Based on this technical analysis on Terra (LUNA), we could see the price of LUNA increase in the coming days and retest resistance at $58. If that structure is broken, then we could see LUNA soar upward and reverse the trend. Eventually, it may surpass $80 in February, other things equal. Nonetheless, the trend is still bearish and indicators are not necessarily indicating a reversal. Hence, LUNA could continue its current movement with time-to-time bullish impulses, but it may imminently move below $40.

Latest News for LUNA – Affecting Price

Recently, Terra was investigated by the Securities & Exchange Commission (SEC) of the United States about Mirror Protocol, a DeFi project in the Terra blockchain. Do Kwon, the co-founder of Terra, was given subpoenas by the SEC because Mirror Protocol was involved in creating crypto-like shares for major companies such as Tesla, Microsoft, Airbnb, etc.

While this cause a lot of uncertainty in the Terra community, Do Kwon reacted to those subpoenas by suing the SEC for not keeping the case confidential and just stirring the market sentiment on Terra. Furthermore, Do Kwon recently stated that many DeFi projects have been under scrutiny by the regulatory authorities such as the SEC, which is now starting to become a trend.

Hence, the Terra community is attempting to keep a positive look at the recent FUD caused by the SEC.

On a bullish note, Mars Protocol, a largely hyped project, recently in Terra. This project entails leverage yield farming, and it is supported by a lot of crypto experts, enthusiasts, and investors. As the project develops, we could see the demand for LUNA and UST increase in the coming weeks.

INCOMING TRANSMISSION

The Mars lockdrop begins now at https://t.co/1SlWbwpDgT

Mission critical details below 👇 pic.twitter.com/UuqA2JlVJm

— Mars Protocol (@mars_protocol) February 21, 2022