Decentralized Finance (DeFi) Explained

Bitcoin was the world’s first successful cryptocurrency that offered decentralized money transactions, where the need for a third party was eliminated. Bitcoin’s early success was an indication that many other people will try and create better cryptocurrencies that would compete with it (altcoins).

Vitalik Buterin, a Russian programmer, came up with the idea that blockchain technologies should offer other decentralized services besides decentralized transactions. With the creation of Ethereum (ETH), Buterin and Gavin wood managed to create a network that included various decentralized services, including Decentralized Finance (DeFi)

What Is DeFi?

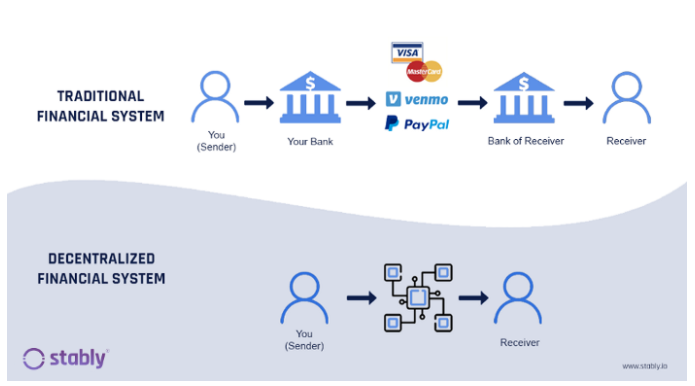

DeFi is a decentralized financial service. Most of the financial services so far have been centralized, where banks were the central authority that regulated these services and took additional fees from customers. These services could range from loans, savings, exchanges, etc. So, DeFi is a solution to the centralization of all these services.

DeFi works through dApps (decentralized applications) that are initially created through smart contracts.

Smart contracts are sets of codes that regulate services in a blockchain without the need for a third party. These smart contracts ensure security and efficiency for dApps and DeFi. Most of DeFi projects are launched on the Ethereum network because it is the first cryptocurrency that made such services possible. DeFi can be in various forms. The most important DeFi types are exchanges, borrowing, lending, insurances, mortgages, issuing stablecoins, etc.

Can other cryptocurrencies be used for DeFi services?

Not every cryptocurrency is supported in the Ethereum blockchain. For instance, Bitcoin is not supported in the Ethereum blockchain, therefore it cannot be used to run decentralized services such as DeFi. However, through the use of a custodian (i.e. smart contracts), Bitcoins can be ‘wrapped’ through the custodian from a process known as minting to become Wrapped Bitcoin (WBTC), which then can be used for various DeFi.

What makes DeFi even greater is composability. DeFi apps are open-source. Open-source apps are accessible by anyone in the blockchain. Since the coding of a decentralized is accessible, people can use that coding and add on it to create a new decentralized application. This would save programmers time and also help them innovate by exploring other people’s ideas. This composability, the ability to compose DeFi on top of one another, has given DeFi a new name: Money Legos.

The same way Lego toys are stacked up on top of each other to create new shapes, the same way new DeFi applications can be formed by combining various other DeFi.

Main Uses Of DeFi

Exchanges

Decentralized Exchanges (DEX) are one of the most popular uses of DeFi. They are exchanges that work without a custodian and decentralized, where extra costs are emitted. Gas fees may need to be paid, however, but they are relatively small. One of the most popular Decentralized Exchanges is Uniswap.

Borrowing or Lending

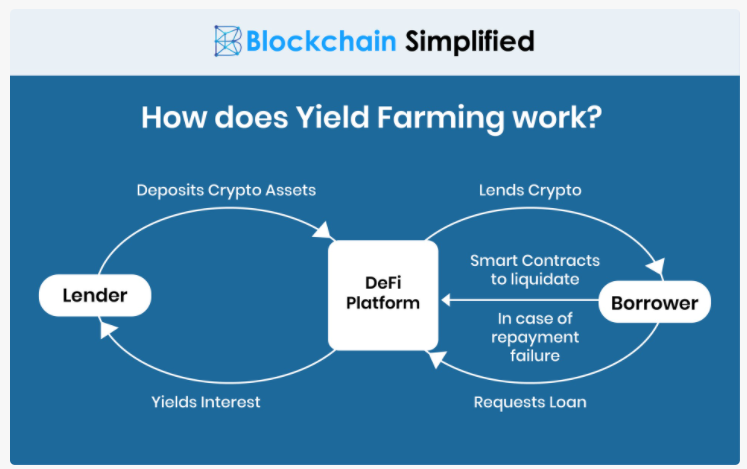

Borrowing or lending tokens is one way that DeFi can be used. Users can lend money through DeFi and earn interest after a certain amount of time Users can also borrow money and then pay the money back with interest. This process is also known as Yield Farming.

The same idea as traditional, centralized financial services of a bank, but without the need of a bank because smart contracts regulate the services with pre-agreed terms from the users. One of the most popular DeFi for borrowing or lending is Compound.

Stablecoins

Another very important use of DeFi is the issuance of stablecoins. Stablecoins are fiat-based coins that do not have high volatility as other cryptocurrencies. Stablecoins are used to ensure people from possible slippages due to their unchanging price. Many people convert their cryptocurrencies into stablecoins before they transfer them somewhere else. Some of the most important stablecoins are DAI, USDC, etc.

Insurance

Last but not least, DeFi can be used as insurance applications. As the name suggests, these insurance services are decentralized, whether they provide insurance for your wallet or smart contracts. Decentralized Insurance has made it possible to protect investors over the last years. The most used DeFi insurance is Nexus.

Pros And Cons

So as you learn more about Decentralized Finance (DeFi), you become aware of all the benefits that come with the utilization of DeFi. However, some setbacks come with those benefits. Here are the main pros and cons of DeFi.

Advantages

-

Lower costs

Since DeFi services differ from traditional banking services because of decentralization, additional costs that banks usually take are not needed in DeFi. So DeFi can benefit you by providing cheaper services.

-

Profitable

DeFi can be a good way to earn profit. By lending money, you can gain interest when the money is paid back to you. Moreover, the interest rates are higher in DeFi than in centralized finance. So even savings accounts through DeFi yield more profit than a bank savings account.

-

Easy access

One big advantage that DeFi offers is that it is accessible by anyone who has access to a blockchain. Traditional financial services can be limited to some people or offer higher interest rates to one group and lower to another group. Hence, DeFi manages to make its services equal to everyone.

Disadvantages

-

User error

One potential drawback is the fact that smart contracts cannot be changed once they are deployed in the blockchain. So if a smart contract has flaws in its coding, it cannot be changed again. Hackers can profit from this by finding creative ways on how to exploit these coding errors for their own good and others can lose funds.

-

Scalability

At times when there is congestion, decentralized services can take quite some time to be confirmed. Moreover, because of this congestion, transactions may be higher than usual.

Takeaways

- DeFi is a decentralized financial service such as a decentralized exchange, decentralized banking services (loans, savings, etc), decentralized insurance, etc.

- DeFi apps are created through smart contracts and are open access. Various DeFi can be combined.

- Stablecoins that are based on fiat currencies can be issued through DeFi to ensure safer asset transfers.

- Some of the advantages that DeFi offer, when compared to centralized finances, are lower costs, profitability, easy access, etc.

- Some of the disadvantages that DeFi offers are potential user errors when creating smart contracts and scalability.