Today, building wealth is one of the main goals of many individuals. One way of acquiring such wealth is done through investing in different things. A young, ever-emerging industry worth over $1 trillion has taken the spotlight throughout the last few years – and this is the blockchain. Making its official appearance in 2009 through the Bitcoin whitepaper, blockchain technology has been experimented with ever since; with developers continuously testing the capabilities of this technology.

Everything started with a cryptocurrency known as Bitcoin, a digital asset that claimed to provide a better payment system than banks and other financial institutions. From the day this cryptocurrency was brought to light, thousands of people who invested in it became millionaires, with some even becoming billionaires.

But what is Bitcoin? Why is it this valuable? Is it worth investing in it? These are just some of the questions that we will try to answer in this article.

Bitcoin Explained Briefly

Let us begin with the basics of Bitcoin. This cryptocurrency was founded in 2009 by an anonymous developer with the pseudonym of “Satoshi Nakamoto”. It was the first digital asset to be built using blockchain technology. Furthermore, Bitcoin claims to be completely decentralized, meaning that transactions done on the Bitcoin network have no supervisor or third-party monitoring them and are completely Peer-to-Peer (P2P). The Bitcoin network uses a Proof-of-Work (PoW) mechanism to verify transactions and secure its network. This means that all transactions are registered in a virtual ledger – also known as the blockchain – and are verified by miners spread throughout the globe.

Moving on, miners are extremely powerful computers that are programmed to solve advanced mathematical problems. These advanced mathematical problems must be solved in order for a transaction to be verified and executed. In return for verifying transactions and keeping the network secure, miners are rewarded by the network in cryptocurrency. This process is known as the process of mining.

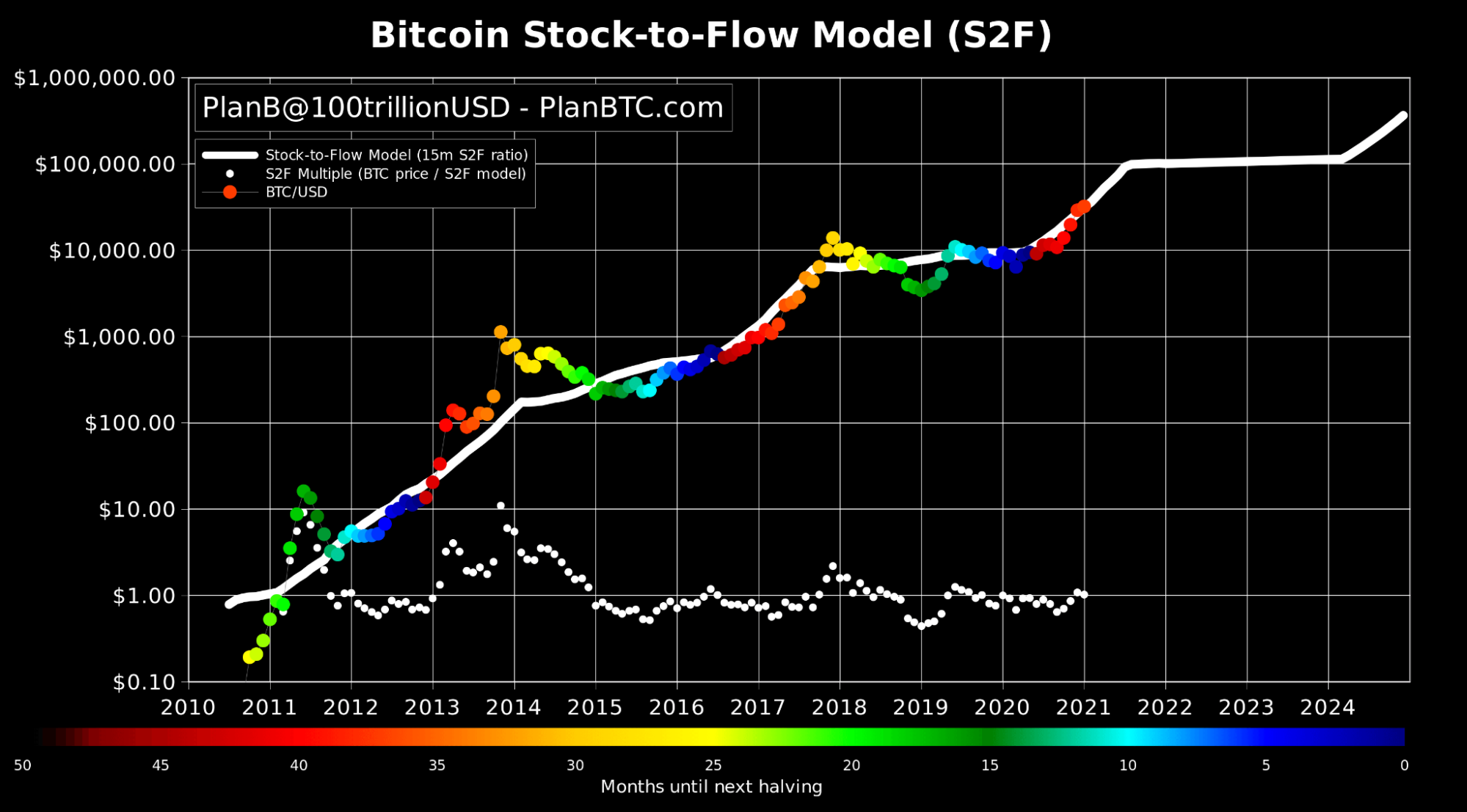

Every four years, an event is known as Bitcoin halving occurs. Since its release in 2009, Bitcoin halving has occurred three times. Halving means that rewards given to miners are divided by two. For example, when Bitcoin was initially launched, an amount of 50 BTC per block was mined; then, after the first halving occurred in 2012, this amount was decreased to 25 BTC per block mined. This continued for the upcoming years, leading to us having a block reward of 6.25 BTC per block mined.

One of the most important factors that affect the market performance of Bitcoin is its scarcity. Bitcoin has a capped maximum supply of 21 million – meaning that there will be only 21 million BTC ever produced. At the time of writing, Bitcoin is one of the few cryptocurrencies with a supply this low.

BTC Price Analysis

Bitcoin entered the market with a price of $0 since it held no funding rounds. However, by 2010, Bitcoin reached a trading value of $0.0008, which was amazing for the coin at the time. By the end of 2010, Bitcoin’s price experienced a huge increase, reaching the price of $0.08 during the last months of the year. This meant a 9900% yearly increase in the price of Bitcoin which meant huge profits for investors.

Moving on, the year 2011 was even bigger for Bitcoin. By April 2011, Bitcoin had surpassed the $1 milestone and by June, Bitcoin’s value had reached $32 per coin, experiencing a 39900% increase in just six months. To put this into perspective, a $100 investment in January would turn into $39900 by June 2011. Following this huge increase, Bitcoin dropped back to $2 per coin. Being a new market, it was extremely volatile, more than it is today.

During the next few years, Bitcoin continued to experience extreme price movements, moving up to tens of dollars and then dropping again to one dollar. By April 2013, Bitcoin had surpassed yet another milestone, hitting the price of $220. However, Bitcoin did not fail to impress us once again, surpassing YET another milestone in the same year by hitting the price of $1230 in December 2013. Its price fell again, however, with the coin dwelling around the price of $340 at the beginning of 2015.

The first bull run that got the attention of the media was that of 2017-2018, during which Bitcoin skyrocketed, reaching a price above $16,000. Something similar also happened this year, with Bitcoin’s price mooning and setting a new all-time high of $64,863 per coin. This occurred while Bitcoin had a market capitalization above $1 trillion.

At the time of writing, Bitcoin is trading at $34,238 per coin and has a market capitalization of $641 billion.

Read more: A Look at Bitcoin Price From 2009 to 2021

BTC Price Prediction

As per the future of Bitcoin, numerous predictions show both the negative and positive possibilities. However, with the governments of countries like the US and the UK working on their stablecoin cryptocurrencies, and with some even launching their cryptocurrencies like Sweden did with eKrona, the future of this industry seems brighter than ever.

Since we are just entering the third quarter of 2021 there is a lot more to be seen. According to many prediction websites, Bitcoin might reach a price between $100,000 and $1 million during the next five years. According to Paul Barron, a cryptocurrency Youtuber, Bitcoin is likely to end the year 2021 with a price way above $100,000 – and he might be correct. WalletInvestor also predicts that Bitcoin may reach prices way above $100,000 during the next few years.

Michael Saylor, CEO of Microstrategy, a company that has invested more than $3 billion in Bitcoin continuously states that Bitcoin is likely to last more than any financial system until today. His tweets include comparisons of Bitcoin and gold, with him calling Bitcoin “the digital gold”. He and some other famous people even blame hyperinflation for the fall of the Roman Empire.

#Inflation is a cancer that has been killing civilizations throughout history. #Bitcoin is the cure. https://t.co/nmj753S8fj

— Michael Saylor (@michael_saylor) July 25, 2021

The global financial system is flawed and one of the most promising solutions out there is the mass adoption of cryptocurrencies. This is what makes Bitcoin one of the most valuable investments available since it is the first cryptocurrency to be introduced to the public – making it the king of cryptocurrencies. Below you can see a meme regarding the inflation USD experienced throughout the years.

#Bitcoin fixes this pic.twitter.com/EHoeA1U5Tz

— Bitcoin Magazine (@BitcoinMagazine) July 25, 2021

Read more: Here is Why Bitcoin Price Will Hit $100,000 in 2021

How Does Halving Affect the Bitcoin Price?

Every mineable cryptocurrency has to undergo the process of halving – dividing the amount of mining rewards by two. As above-state, this is also the case with Bitcoin, undergoing this process every four years.

What characterizes this occurrence is the price movements that happen after the halving happens. Each time that Bitcoin was halved, its price skyrocketed during the upcoming year. For example, in 2016, Bitcoin held a price of around $500 when the halving happened, however, by the end of 2017, Bitcoin reached a trading value way above $10,000. The same thing happened with the last halving, with Bitcoin reaching the price of $60,000 one year after its halving.

The next halving is set to happen on 2024, three years from now. Analyzing the price movements around the previous halvings, the same is likely to happen again during 2024-2025, with Bitcoin’s price potentially skyrocketing to new heights – maybe even reaching the price of $500,000 per coin.

Read more: What is Bitcoin Halving – Everything You Need to Know!

Conclusion: Should You Invest in Bitcoin in 2021?

Investing in Bitcoin in 2021 could be one of the greatest decisions you might take this decade, considering all the above-mentioned factors that indicate huge growth in the price of BTC. Bitcoin has proven that it is not a scam by having a totally transparent ledger of transactions and a list of how many bitcoins every cryptocurrency wallet has. Just as the cinematic industry did not like Netflix when it was introduced to the public, banks and other financial institutions do not like Bitcoin and the cryptocurrency market as a whole; therefore, do your own research when it comes to investing your money and building wealth.

How to Invest in Bitcoin (BTC) in 2021?

You can buy Bitcoin in three easy steps;

Step 1: Create a crypto exchange account

First off, you can either buy Bitcoin through a cryptocurrency exchange or directly from someone who owns Bitcoin.

- If you want to buy Bitcoin through a cryptocurrency exchange, you must open an account on that specific exchange and verify it. If you want to know what exchanges you could use to buy Bitcoin check out The Top 9 Crypto Exchanges in 2021.

- If you want to buy Bitcoin through another individual, all you need to do is open a Bitcoin wallet. Using the address of your Bitcoin wallet, the seller will send you the amount that you are interested in buying.

Step 2: Fund Your Account

Next, you must deposit the amount of money you are interested in investing in Bitcoin onto your account. You can do so by using a credit/debit card, or by using a direct bank deposit. Now, you locate a market pair that involves both BTC and your deposited fiat currency.

Step 3: Buy Bitcoin

Simply write down the amount of Bitcoin you are interested in buying and press “BUY”. After you buy Bitcoin, you can either store them on a hot wallet or a cold wallet; however, we strongly suggest you use a cold wallet since Bitcoin is a very valuable asset.

Also read: Investing in Cryptocurrencies: A Beginner’s Guide

FAQ

If I invest $100 in Bitcoin Today 2021, How Much Will I Earn?

The cryptocurrency market is a very volatile place, therefore, we can never know how much will we earn or lose when we enter it. Yet, as stated above, most predictions regarding Bitcoin show a very bright future, with the potential of Bitcoin reaching the price of $1 million by the end of this decade.

Is Bitcoin Safe?

If its history is taken into consideration, Bitcoin is one of the safest investments in the cryptocurrency market. Right now, it is nearly impossible for Bitcoin to crash and not take the whole market with it – and this shows its dominance.

Why is Bitcoin Considered the King of Cryptocurrencies?

Bitcoin is considered the king of cryptocurrencies because it was the first cryptocurrency to ever exist. Moreover, it has held the number one spot regarding market capitalization since 2009 – and that is quite a long journey.

Takeaways

- Investing in the cryptocurrency market is high risk/high reward investing.

- Bitcoin is the first cryptocurrency ever, launched by the anonymous Satoshi Nakamoto in 2009.

- Bitcoin uses a Proof-of-Work (PoW) mechanism to keep its network secure and running. The Bitcoin network needs miners to function and rewards them in Bitcoin for helping keep the network secure.

- Bitcoin Halving is a process that occurs every four years, which results in block rewards being divided by two.

- Bitcoin is predicted to hit the price of $100,000 by the end of 2021; furthermore, by 2026, many experts think that Bitcoin may have surpassed the price of $1,000,000.

- Some cryptocurrency experts even called Bitcoin “digital gold”.

- You can buy Bitcoin through cryptocurrency exchanges or through any Bitcoin holder that is interested in selling his/her assets. Moreover, you can obtain Bitcoin by participating in the mining process.