Bitcoin is a digital currency (cryptocurrency) that is decentralized, which means that it is free from third parties, such as banks. It can be used to make online transactions and uses a peer-to-peer (user to user) system for these transactions.

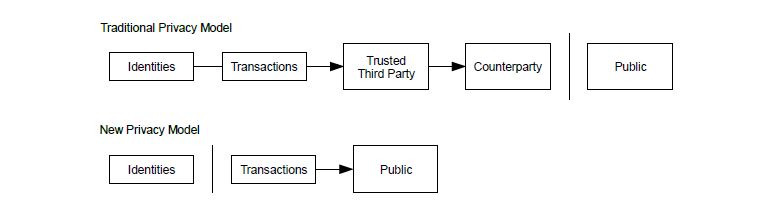

Unlike traditional currencies, cryptocurrencies have no physical form and are not controlled by a government, and their privacy protocol involves a direct link to the public.

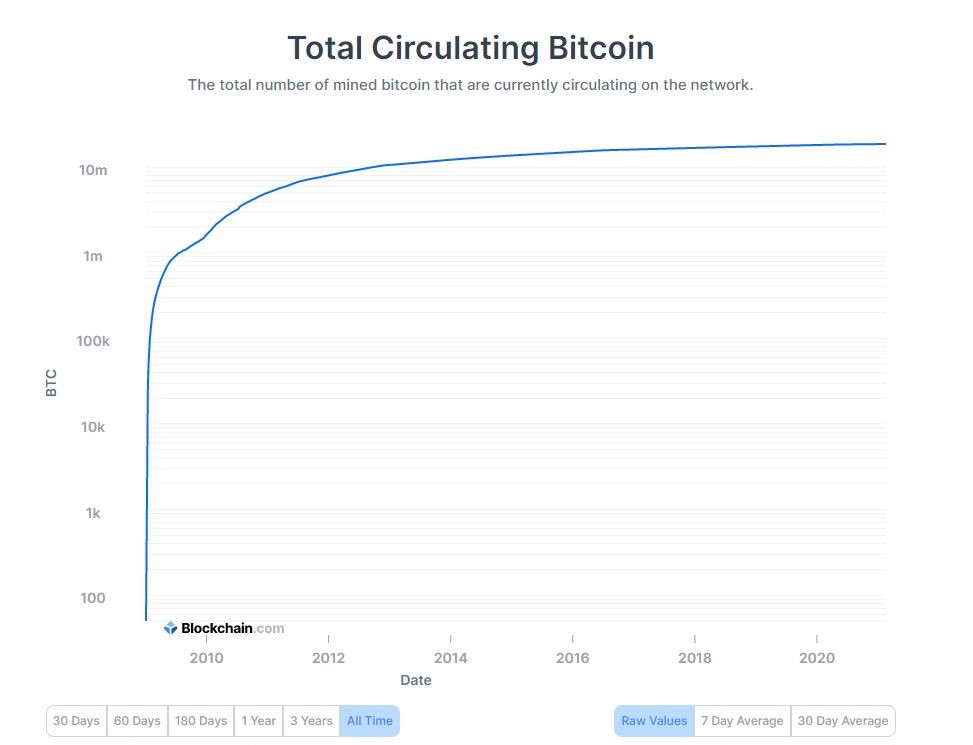

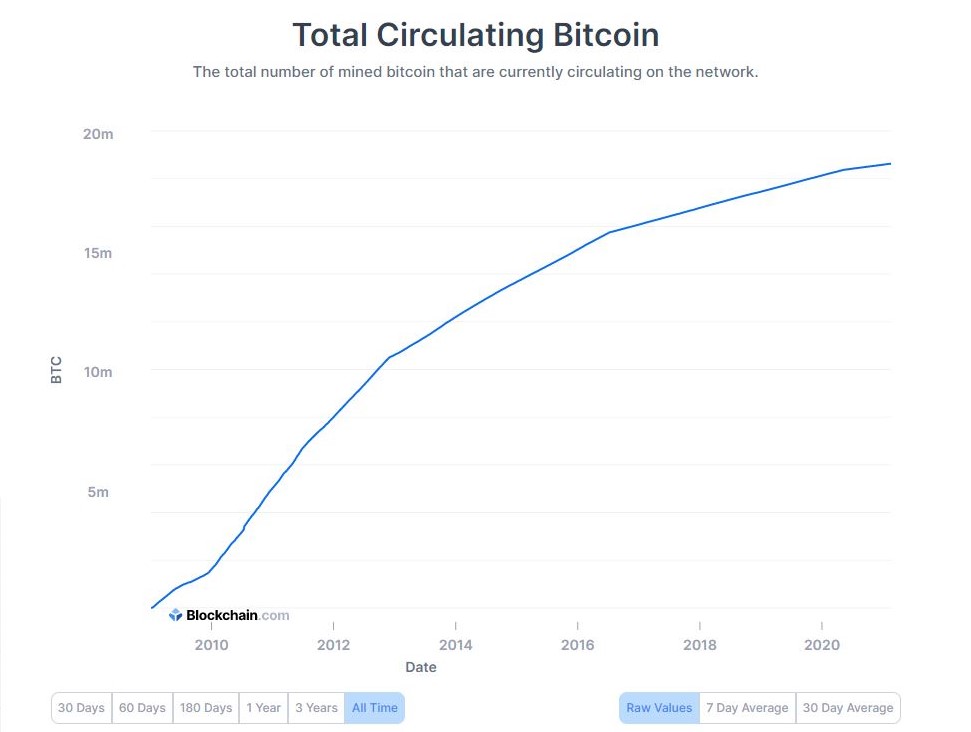

Bitcoin and some other cryptocurrencies have a limited number that can be mined in order to promote an inflation-free market. Bitcoin’s limit is 21 million tokens, which are programmed to run out in the year 2140.

How Does the System of Virtual Currencies Work?

How does this system of virtual currencies work such efficiently that it has the potential to replace all traditional currencies? The transactions are not as simple as they seem.

All the transactions that are done in the cryptocurrency market are registered in a virtual ledger, which is known as the blockchain.

Every transaction includes a private key that functions as a signature by the person initiating the transaction. These transactions are verified by public keys from other individuals in the cryptocurrency network. With every verification, new data is added to the blockchain. However, these verifications involve advanced mathematical problems that require artificial intelligence (computers) to solve. Whenever a new block (data) is added to the blockchain, the network awards the solver with crypto tokens (i.e. Bitcoins). This process is commonly known as mining.

The amount of bitcoin provided for every block added is 6.25 BTC, and this amount is halved approximately every four years. Every 10 minutes, a miner is awarded for adding a block of information to the blockchain. Since the founders of Bitcoin capped the number of Bitcoins that can be created (21 million tokens), and with around 18.5 million tokens already mined, it is projected that the last Bitcoin will be mined in 2140. Check out CryptoRunner if you want to learn more about bitcoin and virtual currencies.

Who is The Bitcoin Founder?

As huge as Bitcoin is now, its founder is still unknown. Satoshi Nakamoto is a pseudonym for the presumable founder of Bitcoin because his name appears on the Bitcoin white paper.

However, there was never enough evidence to support that. As a result, there are many internet conspiracies regarding the founder of Bitcoin.

Found in 2008, it is believed to have derived due to the 2008 economic crisis, but it became public in 2009.

Furthermore, Software developer, Gavin Andersen took charge of the Bitcoin project by the end of 2010.

Timeline of Bitcoin

After its release in 2008, Bitcoin was not a familiar term for the majority of the world’s population. One block addition to the blockchain earned (mined) 50 Bitcoins.

It took three years for a token to be worth $1. By 2011 the price went as high as $29.60.

In 2012, the mining capacity halved to 25 Bitcoins.

The Bitcoin ‘forked’ (added new versions) in the crypto world over the years with Litecoin, Bitcoin Cash, Bitcoin Gold, etc. These forks were categorized as soft forks or hard forks. Soft forks are versions of Bitcoin that have backward compatible updates, while hard forks are versions of Bitcoin with a whole set of new protocols.

12.5 Bitcoins were mined for each block of information added to the blockchain by 2016.

In December 2017, Bitcoin reached $19,834. However, the cryptocurrency market crashed, causing the Bitcoin price to drop as low as $3,747. The end of this depreciation initiated another bull run in 2019, with the price reaching close to $13,000, and then dropping back to $5,000 on the verge of the COVID-19 pandemic in March of 2020. Bitcoin amount mined in 2020 was halved to 6.25.

Ever since, the Bitcoin price has been constantly increasing, closing 2020 with a value of $28,837.

Bitcoin Today

As of the 18th of February 2021, Bitcoin has reached its highest ever value at $52,547.

Visual representation of the change in the price of Bitcoin (BTC), as well as its market cap. Source: Coinmarketcap.com

Where does that leave Bitcoin now? What best defines the cryptocurrency market is its uncertainty and unpredictability. Thus, it is difficult to depict whether it is a good time to invest in Bitcoins.

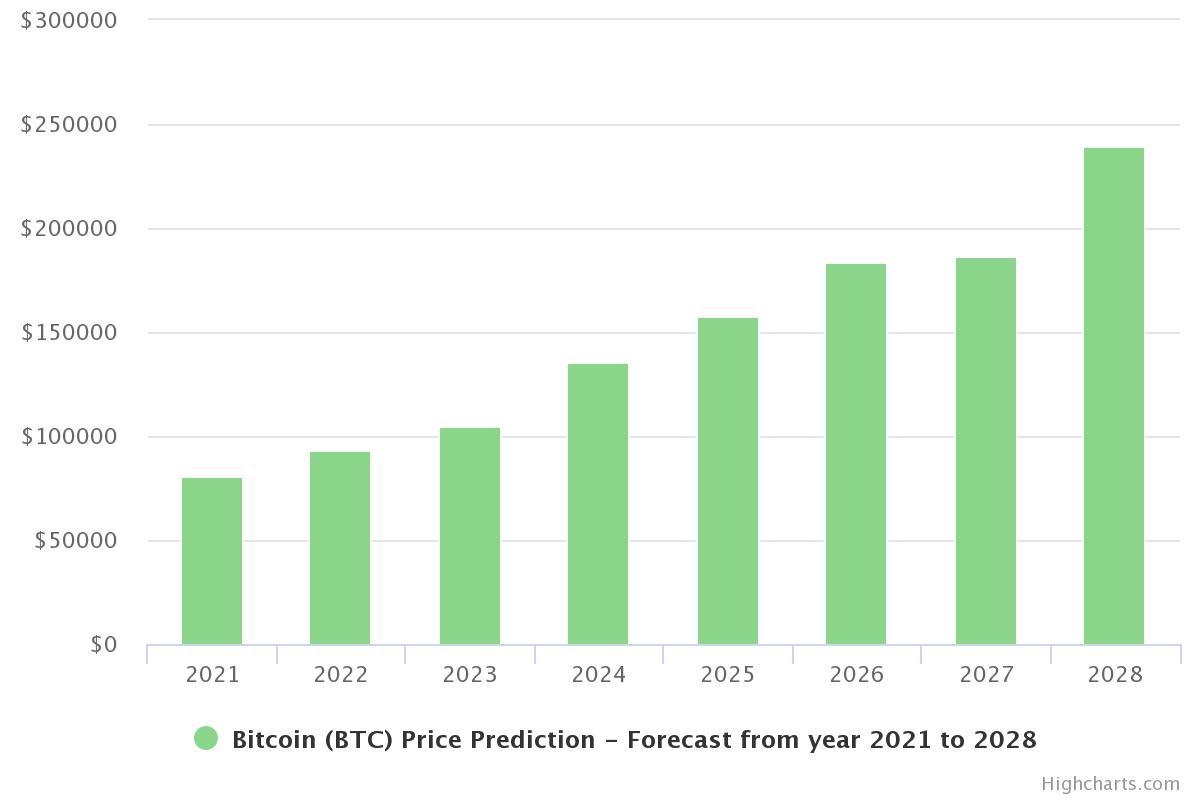

Future of Bitcoin – BTC Price Prediction 2021, 2025, 2028

We have overviewed the early phases of Bitcoin. We have briefly gone through the timeline of Bitcoin up to 2021. It is easy to say where Bitcoin stands now. But, what about the future of Bitcoin?

Predictions on the value of a cryptocurrency (i.e. Bitcoin) are done based on the historical patterns that the cryptocurrency has had.

As such, many credible sources, such as Digitalcoin predict a constant rise of cryptocurrencies, especially Bitcoin (BTC).

One of the ingredients for this prediction is the scarcity of Bitcoin and the fact that it is slowly reaching its limitation of 21 million Bitcoins. Basic laws of economics suggest that whenever there is a shortage of a product, in this case, Bitcoin, its price must rise in order to balance the economy and reach market equilibrium.

Based on the predictions made by Digitalcoin, Bitcoin can reach as high as $80,500 in 2021, $157,800 in 2025, and approximately $238,900 in the year 2028.

The study conducted by Digitalcoin suggests that the increase in the price of Bitcoin (BTC) is inevitable, even if the values do not reach the exact number.

No matter how much the price of Bitcoin or other cryptocurrencies will change in the future, humanity could become much more reliant on the crypto market.

Advantages of Bitcoin

Why buy Bitcoins (BTC) or other cryptocurrencies in the first place? Besides the possibility that an individual might become so rich while trading cryptocurrencies, there are also many other advantages to buying and using cryptocurrencies, especially Bitcoin (BTC).

Some of the pros of Bitcoin:

- No third-parties

- One of the key features of the peer-to-peer system, which promotes direct trade without the need for a medium (third-party), such as banks to regulate the payment. Users have more autonomy over their money and do not pay additional fees for any completed transactions

- Anonymity

- Discretion is yet another important element of the cryptocurrency market. Through the peer-to-peer system, individuals have the possibility to keep their identities hidden from other people.

- Easy Access

- An individual can access his virtual wallet any time that he wants through his/her smart device and also constantly check on the price changes of any cryptocurrency (i.e. BTC).

- Accepted in major companies

- Companies like Starbucks, Microsoft, and Home Depot now accept payments through cryptocurrencies if an individual does not have fiat currencies or legal tenders available.

- Easy international trades

- Bitcoin’s superiority makes it the easiest cryptocurrency to be used in international trades since it has gained popularity over the years. Consequently, transaction fees are less for Bitcoin (BTC).

Drawbacks of Bitcoin

As expected, every cryptocurrency has its setbacks that complement the advantages. As such, Bitcoin (BTC) together with the other cryptocurrencies entail disadvantages as well.

Some of the cons of Bitcoin:

- Not accepted worldwide

- While some countries have quickly adapted to the crypto market in their respective economies, other countries have not accepted it yet. Some countries, like India, Bolivia, Denmark deem cryptocurrencies as illegal and have banned Bitcoin (BTC) as a currency.

- Online Scams

- Individuals that trade in the crypto market are vulnerable to hackers and online scams that want to steal their information. As a result, many people that do not protect their data carefully lose all their virtual assets.

- Purchases are never refundable

- The main problem with using Bitcoins to purchase consumer goods is that the seller might not give the buyer the products, and still, the Bitcoins will not be refunded because every transaction is irreversible. This could be prevented by only using third parties. However, this would transform Bitcoins (BTC) and other cryptocurrencies into traditional currencies.

- Lost Data

- The most unfortunate event that can occur to an individual with virtual assets is losing private data, such as passwords. If a person fails to access his/her virtual wallet, he/she can never get those assets back, despite the total investment made.

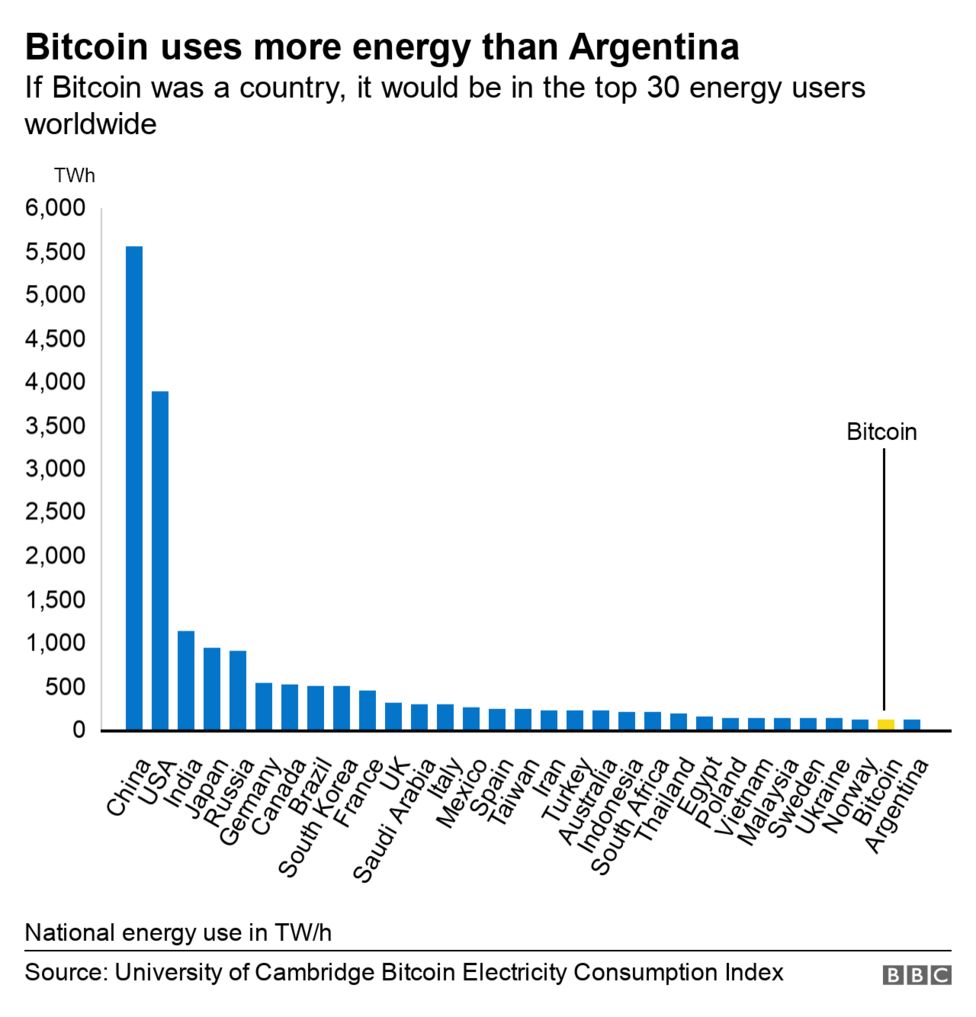

- Mining costs

- Mining cryptocurrencies, and especially the biggest cryptocurrency that exists, Bitcoin, is not cheap. Mining Bitcoins today, in February 2021, might prove to be more costly than directly buying a Bitcoin. According to technology researcher Michel Rauchs, in a podcast with BBC, there is more energy spent per year by Bitcoin miners than the entire country of Argentina.

Is Investing in Bitcoin (BTC) a Generally Good Idea?

Whether it is worth investing in Bitcoin or not remains a normative statement. Not everyone has the same opinion on whether it is the right time for a cryptocurrency to appreciate.

Some might feel like it is better to invest now as it is still on a bull run, as of February 18th, 2021. Others might perhaps argue that it is better to wait until Bitcoin (BTC) halves again (around 2024), but three years from now seems like a long time without investing.

Thus, it is up to an individual’s personal choice to decide about investing in BTC or other cryptocurrencies.

Takeaways

- Bitcoin (BTC) is one of the first and biggest cryptocurrencies in the world.

- It works on a peer-to-peer decentralized system, where every transaction is registered in a virtual ledger, known as the blockchain.

- Transactions are verified using mathematical problems, where the solver of the problem is awarded tokens by the currency network.

- Bitcoin was founded in 2008 by a person or a group of people with the pseudonym Satoshi Nakamoto.

- Ever since it received public attention in 2009, Bitcoin (BTC) has been constantly increasing.

- The maximum amount of Bitcoins that will ever be circulating in the market is 21 million.

- Today, February 18th of 2021, Bitcoin’s price is as high as $52,547.80.

- Bitcoin is projected to rise in value even more in the following years.

- Buying and using Bitcoins has its advantages and disadvantages.

- Investing in Bitcoin (BTC) can be very lucrative, even if there is a short-term loss.