The cryptocurrency market capitalization has mooned throughout 2021, reaching an all-time high of $2.49 trillion. This increase in the value of the market – which started in the year 2021 with a value of $800 billion – meant an increase in the portfolios of everyone who owned cryptocurrencies, leaving them with massive gains. 2021 was the year that showed how profitable the cryptocurrency market can be, with some cryptocurrencies experiencing increases of 20000% in a matter of months. This kind of value increases in such a short time is nearly impossible to find in any other industry.

Overview and Examples

The perfect example of how profitable has the cryptocurrency market been throughout the last decade would be comparing the returns from one of the world’s most successful hedge funds with a cryptocurrency called Dogecoin. An initial investment of $1000 on Quantum Fund in 1970 would leave you with $4 million in a span of three decades; however, an investment of $1000 on Dogecoin before four years would turn into $6 million when the coin reached its current all-time high earlier this year.

There are several ways you can accumulate profit from the cryptocurrency market; you can even make a profit by using the Brave browser, which monetizes surfing the internet through it by rewarding you with Basic Attention Tokens. Some other ways that have proved to be very beneficial for many are:

- Investing

- Trading

- Staking

- Mining

Mining cryptocurrencies means providing your computing power, usually done from individuals with very high-tech and powerful computers, to secure and validate a certain network – keeping it decentralized. In return, you get rewarded with cryptocurrency. Like mining, staking is the process of holding/staking a specific cryptocurrency and acting as a validator to secure and validate a certain network, for which you get rewarded with cryptocurrency.

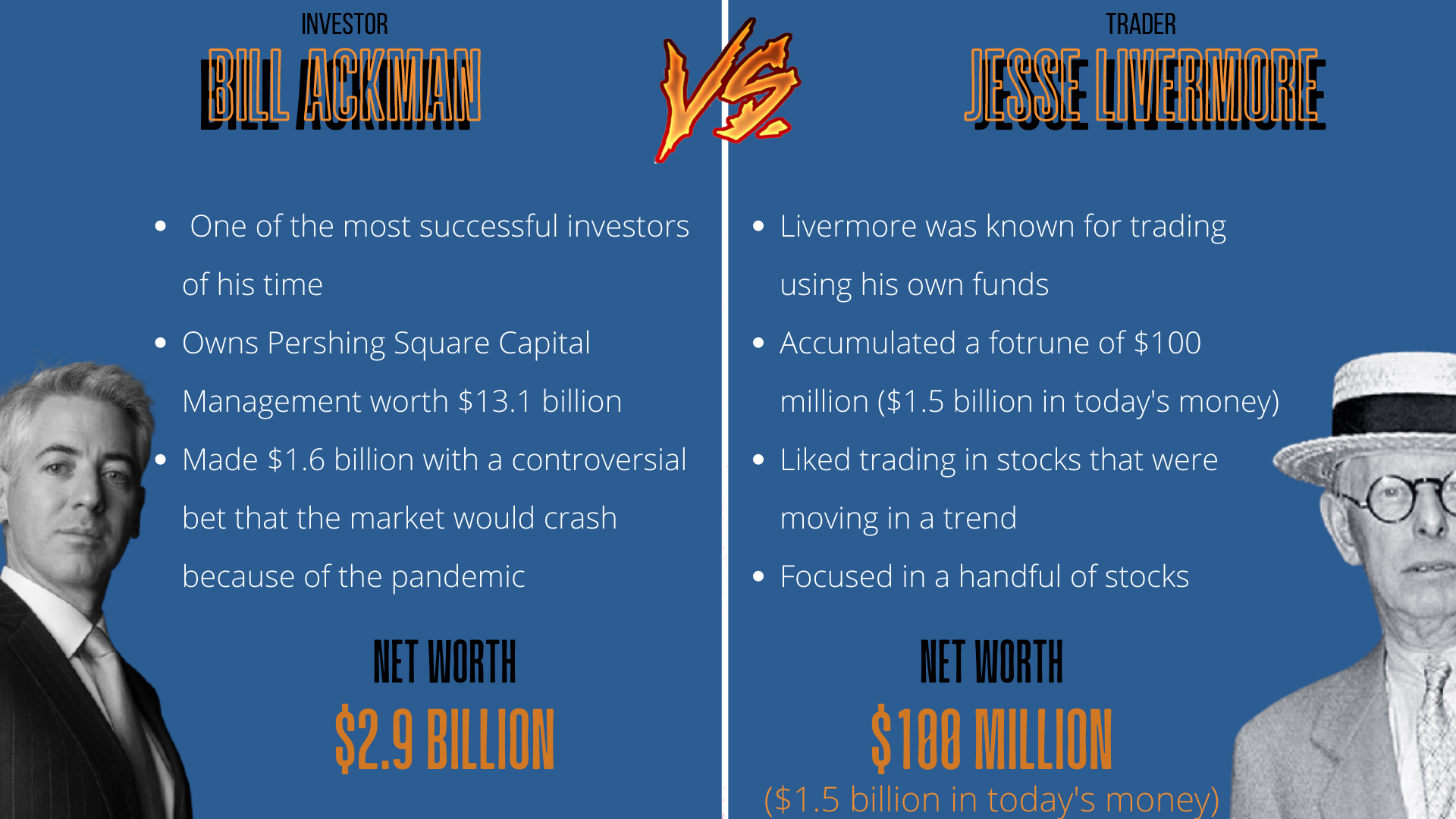

Before we get into the details, let us quickly discuss two well-known giants that are living examples of how investing and trading work; one being a successful investor and the other being a famous trader. However, both of them have one thing in common, and that is accumulating huge amounts of money in a short time.

Bill Ackman is a well-known investor with a series of controversial bets. His trading practices sparked many investigations, though no charges were filed. Ackman reached his peak in March 2020, when he predicted the crash of the stock market because of the pandemic. At that time, he made a profit of $1.6 billion.

Oppositely, Jesse Livermore was a ‘legendary trader’ who traded on his own and only used his own funds and system to profit. Jesse did not trade ranges, however, he traded breakouts from ranging markets. Livermore believed that every investor should wait for the market to confirm their beliefs regarding a stock, and only then to make their trades. Trading is a risky process to engage in, and that can be confirmed by the story of Livermore. He lost all of his assets and because he was not able to cope with his losses, he tragically took his own life in 1940.

Investing in Cryptocurrency – Explained

Investing in the cryptocurrency market is the same thing that investing in any other market is. Being very volatile, the cryptocurrency market can generate enormous profits for an investor the same way it can generate enormous losses for that same investor. Investing is usually done to see long-term rewards, meaning that an investor lets their investment sit in their wallet for months or even years to profit from it.

Investing in this volatile market may be risky, but only if you got paper hands – a term that refers to the people who sell under pressure, often when they start to see decreases in the value of their investment. Holding (HODL) is a strategy that most crypto investors use to gain profits, and this strategy often proved to be the key to making huge gains by investing. Some people invested small amounts of money in Bitcoin when it first came out and sold their investment for a 100% profit; if they were to hold onto their investment until this year, they would be left with 70,425,809% profit – you do the math. Staking is a method that suits investors for their long-term investments. When you stake a cryptocurrency, you gain considerable amounts of that same cryptocurrency as a reward. The higher the amount of crypto staked, the bigger rewards you get.

Nevertheless, only invest what you can afford to lose since you can never be sure what the future might hold for that specific coin you put your investment on. Read more at 6 Tips For Investing in Cryptocurrency in 2021.

What is Trading Cryptocurrency?

Trading in the cryptocurrency market is one of the most common ways people make a profit and gain from this market – mainly because of the market’s high volatility. Just as for investing, the market’s high volatility may prove to be very beneficial for some traders while devastating for others. It is a high-risk/high-reward type of market. In contrast to investors, traders do not seek long-term profits and rather try to accumulate profit in the short-term – be that in a matter of hours, days, or weeks. There are many types of traders, but some of the most common are:

- Scalping Traders: This type of trader, also known as a scalper, is a trader who participates in tens or hundreds of trades in just a day, trying to gain a small profit from each trade. These traders are the most common ones on the market.

- Momentum Traders: This type of trader tries to locate cryptocurrencies that are increasing rapidly. After finding a cryptocurrency that fits their goals, they attempt to ride the momentum to gain profit.

- Day Traders: Day traders carry out their trades within a day and do not hold any overnight positions. This means that trades in which day traders participate may last minutes or hours, but never days.

Opposite to investors, traders are only concerned with hourly and daily price movements regarding the cryptocurrency they are seeking to profit from. An unwritten law of traders is “Buy Low – Sell High” meaning that you should buy a coin at a low price and sell it when it has a higher price than when you bought it. The cryptocurrency market is often highly profitable for traders because of its high volatility. High volatility means more price movements, and these price movements are crucial for traders to profit.

As the cryptocurrency market gets bigger, new ways of profiting from it are presented. A platform that is continuously experimenting with ways to make people interact with the market is Pancake Swap – a decentralized crypto exchange. Pancake Swap offers games through which traders can gain. One game that fits the way traders want to profit is Prediction. As its name suggests, this game allows people to predict whether a market will go up or down in the next 5 minutes, and if their prediction is correct, they are rewarded with cryptocurrency. For more information regarding this exchange, check How to Use Pancake Swap? A Detailed Guide 2021.

When we compare the two, investing means aiming for long-term profits and is relatively safe while trading aims to take short-term profits and is of higher risk than investing.

Investment Period

A very important factor when putting your money into cryptocurrencies is the amount of time you want to keep that money in that cryptocurrency. Investors more often than not look at the long-term horizon and aim to let their money sit in markets for quite a while. So, an investor will invest in a cryptocurrency by looking at its long-term potential, with the aim of selling it and realizing a profit in a couple of years. The cryptocurrency market and the technology behind it are only a decade old, meaning that much has yet to come. The market gathered $2.49 trillion earlier this year with nearly no implementation in the real world, who knows how much will the prices increase when it gains mainstream adoption. At the time of writing, when we compare the cryptocurrency market with the stock market, we notice how shorter the market cycles of the crypto market are – lasting less than a year.

On the other hand, traders only possess a short-term horizon and value high volatility in the market. Unlike investors, traders are focused only on hourly and daily price movements on the cryptocurrency market, participating in trades with the aim of short-term profits. As mentioned before, traders seek to buy a coin at a low price and sell it immediately after its price gets higher.

Trade Frequency

Trade Frequency is the frequency of participating in trades. Therefore, low trade frequency means that only a small amount of trades were executed during that time while a high trade frequency means that a high amount of trades were executed during that period of time. This links trade frequency with the investment period since the longer you hold on to a particular cryptocurrency, the lower your trade frequency will be and vice versa.

Investors have a low trade frequency because of their tendency to hold on to a coin for the long run. A typical cryptocurrency investor invests in their preferred coin and uses a crypto wallet to store that coin until the desired price is met in the long term. For more information about how cryptocurrency wallets work, check out Cryptocurrency Wallet Definition – What are Crypto Wallets?

While investors seek to hold their coins for a long time, traders try to sell them as quickly as possible. Traders have a high trade frequency and try to execute as many trades as they can throughout the day. Trying to gain small profits from each trade, traders aim to generate high profits by the end of each day. Trading is a ‘High risk/High reward’ type of activity, meaning that you gain a huge fortune the same way you can lose everything in a matter of days. To make this process easier, cryptocurrency traders often use cryptocurrency exchanges in order to pursue day-to-day trading.

Risk Profile

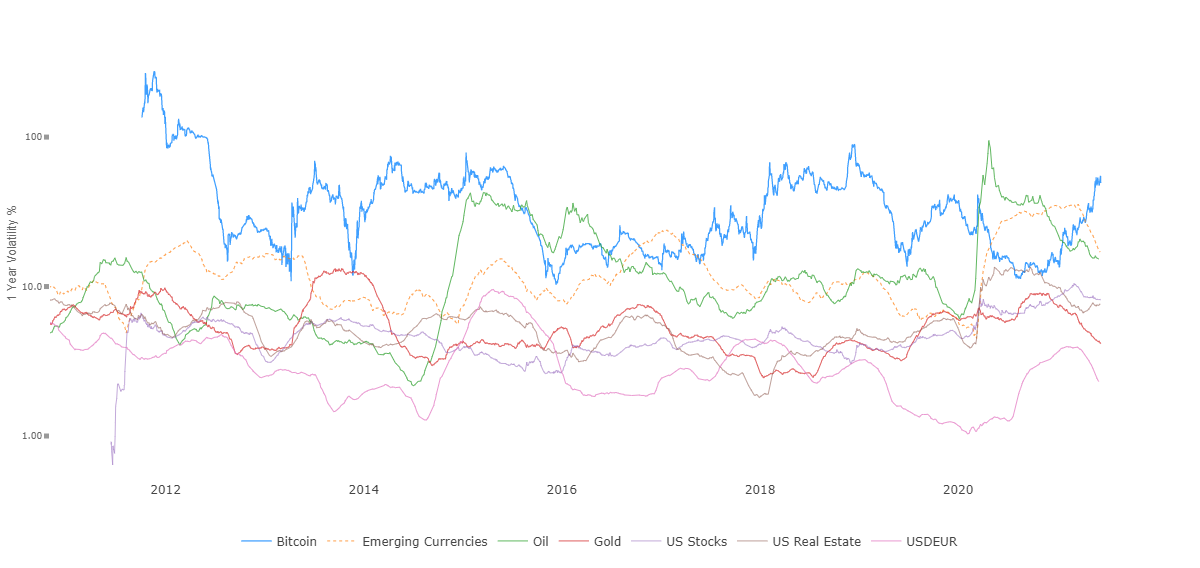

Also known as risk appetite, a risk profile is the level of risk that is considered normal by an individual. We must note that participating in the cryptocurrency market is very risky because of its high volatility. Risk is calculated with price movements, both increases, and decreases. However, the higher the risk, the higher the potential returns for a particular market. At the time of writing, Cryptocurrencies are considered markets with the highest risk; and this comes as no surprise. The crypto market often experiences extreme price movements making it one of the riskiest markets to invest or trade-in. To put it into perspective, the average stock market return is 10% annually, an increase that a cryptocurrency can experience in a day or even in a matter of hours.

Even though investors are not that fond of taking risks, joining the cryptocurrency market is a very high risk on its own, no matter how safe they play. Cryptocurrency investors have accumulated massive profits throughout the last decade, however, with some becoming crypto billionaires. As for traders, taking risks is what they live for. Cryptocurrency traders are continuously taking risks by executing hundreds of trades each day in the most volatile market as of right now.

Profiting Method

Every investor and trader aims to leave the market richer than they entered. The method that an investor or trader aims to use in order of generating wealth is known as profit methodology. There are four main ways that investors and traders use to accumulate profit from this market:

- Price Uptrends – waiting for the price of a cryptocurrency to increase than earning a profit from it.

- Coin Burns – refers to the destruction of a certain amount of coins by the company that distributed them in order to reduce the coin supply and initiate an increase in the value of the coin.

- Hard Forks – when a halving happens, the holders of the original coin gain coins known as ‘free coins’. For example, Bitcoin holders were rewarded with Bitcoin Cash, or Ethereum holders were rewarded with Ethereum Classic.

- Airdrops – airdropping is a form of publicity or marketing for a specific coin. Additionally, it can be considered as a form of staking. This happens when the holders of a coin get rewarded with a reward token version of the coin that they are holding. For example, Venus holders were rewarded with Venus Reward Token with a ratio of 1:1000.

Takeaways

- The main ways for generating a profit in the cryptocurrency market are investing, trading, mining, and staking.

- Cryptocurrency investing means long-term investments that are relatively safer than trading.

- Cryptocurrency trading means short-term trading in order to accumulate a profit from each trade.

- The average trader executes hundreds of trades each day, while an investor participates in trades less frequently.

- The cryptocurrency market is very volatile, making it a market of high risk.

- There are several ways to earn a profit by being a crypto investor or trader. The main ones are Price Uptrends, Coin Burns, Hard Forks, and Airdrops.