What is cryptocurrency “market cap”?

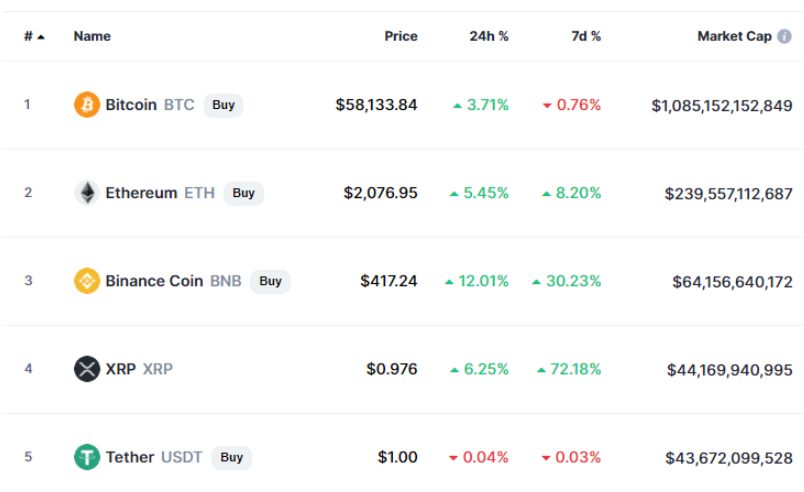

When checking the live prices of cryptocurrencies on websites like Coinmarketcap, you can also see a cryptocurrency’s market capitalization. So what is that crypto market capitalization?

The cryptocurrency market cap is the total market value of a cryptocurrency. The higher the crypto market capitalization, the larger the share that a cryptocurrency has on the total market.

Coinmarketcap also shows you the total crypto market capitalization of all the cryptocurrencies circulating in the market.

As of April 2021, the total crypto market capitalization is around $1,9 trillion.

Since Bitcoin is the largest cryptocurrency in the world, it holds the largest market capitalization compared to other cryptocurrencies. Holding roughly more than 50% of the total market capitalization, the Bitcoin market cap is around $1,09 trillion.

How is the Market Cap Calculated?

So what determines the cryptocurrency market capitalization?

The answer is quite simple. The formula for calculating the market cap is as follows:

Current price of a cryptocurrency * Total circulating supply = Crypto Market Capitalization

In this logic, if Bitcoin is valued around $58,000 and the total circulating supply is around 18.6 million BTC, then:

$58,000 * 18,600,000 BTC ≈ $1,078,800,000,000

Hence, calculating the total market capitalization would be the addition of all the market capitalization values for every cryptocurrency.

Types of Market Capitalization

Cryptocurrency market capitalization can be categorized into three types:

1. Large-Cap

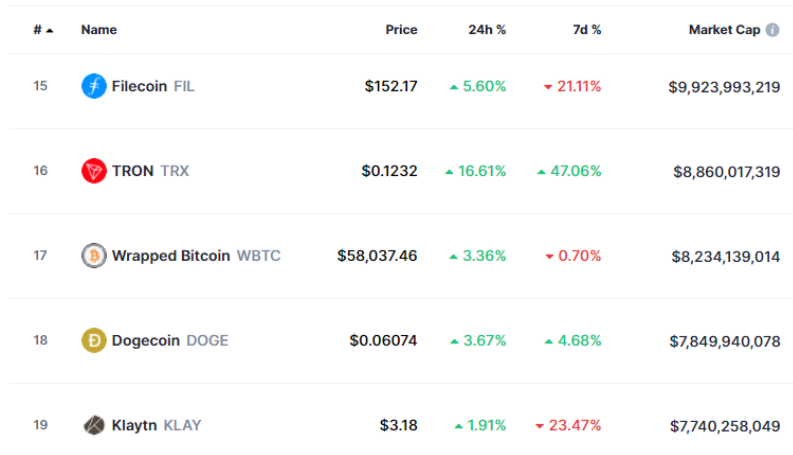

Cryptocurrencies that have a market capitalization value of more than $10 Billion are considered large-cap cryptocurrencies. Some examples would be Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), etc.

2. Mid-Cap

Cryptocurrencies with a market capitalization between $1 Billion and $10 Billion are considered medium-cap cryptocurrencies. For instance, Tron (TRX), Dogecoin (DOGE), BitTorrent (BTT), etc.

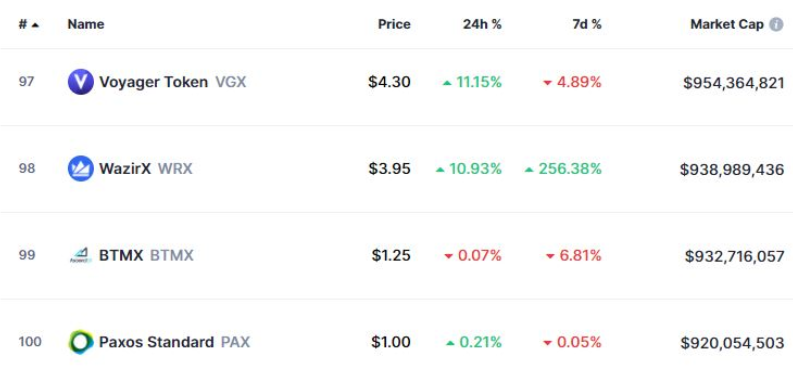

3. Small-Cap

Small-Cap cryptocurrencies are those that have a market capitalization of less than $1 Billion. Relevant examples would be DODO, IOST, CELO, etc.

Small-Cap cryptocurrencies are relatively new currencies that may either increase immensely or simply fail sometime in the future.

Importance of Market Capitalization

Why would you need to know the market capitalization of a cryptocurrency in the first place?

Well, in order to estimate the risk of your investment in cryptocurrencies, you need to look at their market capitalization. The higher the market capitalization of a cryptocurrency, the lesser is the risk that the cryptocurrency will fail. The likes of Bitcoin and Ethereum (large-cap cryptocurrencies) are unlikely to fail in the future, so the investment is not as risky as with small-cap cryptocurrencies.

However, small-cap cryptocurrencies have more growth potential than large-cap cryptocurrencies. Higher risk entails higher profitability.

So, when investing in cryptocurrencies, you should look at the price of the cryptocurrency, its circulating supply and whether it is limited or not (total supply), and its market capitalization.

Takeaways

- The cryptocurrency market cap is the total market value of a cryptocurrency.

- The formula for calculating the market cap is:

- Current price of a cryptocurrency * Total circulating supply = Crypto Market Capitalization

- Market capitalization can be categorized into three types: large-cap, mid-cap, and small-cap.

- You should look at the market capitalization of a cryptocurrency before deciding to invest.