Without a doubt, the easiest way to obtain cryptocurrency is through a cryptocurrency exchange. Most cryptocurrencies provide user-friendly platforms for their users, making it easier for anyone interested in crypto to invest in them. However, these exchanges are, more often than not, centralized. Being centralized goes against the very basics of cryptocurrencies since they aim for decentralization.

Because they play the role of institutions, the major centralized cryptocurrency exchanges (CEXs) are often regulated in most countries – this happens to avoid any lawsuits by the government. This means that they require KYC (Know Your Customer) and that different stages of identity verification are a must if you want to use that exchange to buy, sell, or convert your crypto.

Even though most of the market is driven through centralized cryptocurrency exchanges, many cryptocurrency enthusiasts claim that being a regulated exchange does not benefit the market as a whole. Unlike Binance and Huobi Global, Bybit is a cryptocurrency derivatives exchange that is not regulated by any country.

Throughout this article, we will do our best to explain what the Bybit exchange actually is. Furthermore, we will try to briefly touch upon its features, pros, and cons.

What is Bybit?

To begin with, Bybit was founded by Ben Zhou in March 2018. Moreover, Bybit is considered to be a crypto derivates exchange under the Bybit Fintech Limited company. This company has a very qualified team behind, including individuals with professional backgrounds in tech firms, investment banks, and even early adopters of blockchain. This crypto exchange is based and headquartered in Singapore but supports traders from many other countries such as Canada, European countries, and South Korea.

This crypto exchange caught the attention of the media because it is specialized in Derivatives and Futures trading. To be more exact, the attention came because of the up to 100x leverage on ETH/USD and BTC/USD trading pairs.

According to Coinmarketcap, Bybit is the 4th largest cryptocurrency derivate exchange when it comes to trading volume – with Binance, OKEx, and CoinTiger being part of the top 3. At the time of writing, Bybit has a trading volume of $14.2 billion. Furthermore, Cryptorank claims that Bybit has more than 20 cryptocurrencies available and 24 live trading pairs, with 4 of them being fiat-to-crypto pairs. These crypto/fiat pairs are BTC/USD, XRP/USD, ETH/USD, and EOS/USD.

When compared to its competitors, such as Coinbase and Kraken, Bybit stands out for its extremely low trading fees and its Insurance Fund. First off, its trading fees are even lower than those of Binance. Secondly, its Insurance Fund protects the funds of the users of Bybit if the exchange is not able to liquidate a trade at bankruptcy price or better. To add to these positive sides of Bybit, we must mention its top-notch security.

Read More: Top 9 Cryptocurrency Exchanges in 2021

Bybit claims that they have implemented bank-like security features and procedures in order to keep the funds of its users safe. Through cold wallets, two-factor authentication, and a multi-signature withdrawal requirement, Bybit is one of the safest cryptocurrency exchanges out there. We can say that their security has been proved since Bybit has never been hacked.

We must note that Bybit has launched its mobile app. At the time of writing, the Bybit app is available both on Android and iOS.

Bybit Features

Crypto Derivates

Since Bybit specializes in Crypto Derivates, we will take a brief look into what they are. In simple terms, Crypto Derivates serve as contracts or tools that obtain their value from another asset. This means that they are secondary contracts that acquire value based on a primary underlying asset such a Bitcoin or Etheruem. Some examples of crypto derivates are perpetual contracts and crypto futures.

So, crypto derivates make it possible for investors to benefit from crypto solely on the price movement of that specific crypto, removing the need to own a specific cryptocurrency in order to gain profit. Basically, you bet on whether the price of a crypto asset will rise or fall, and if you guess correctly, you gain profit.

To better portray how crypto derivates work, let’s say that Ethereum has a trading value of $5000 and you bet that its price will fall. On the other hand, someone bets that its price will rise. Now, if the trading value of Ethereum decreases to $4000 by the time the contract is settled, the counterparty will pay you $1000; however, if the price increases to $6000, you will have to pay the opposing trader $1000. Crypto derivates are a bit more complicated, however, but this should serve as an over-simplified explanation to give you a better idea.

Advanced Orders

Bybit offers many financial tools for experienced traders through its complex platform. Even though this may be considered a drawback by newbie traders, these tools come in handy for more experienced traders. Through these advanced orders, Bybit allows its users to set up a “take profit” and “stop losses” instantly. This means that you are not obligated to manually fill in orders for “take profit” and “stop-loss”.

There are quite a few types of orders available. These options include “limit order”, “market order”, and “conditional order”. The platform also gives great flexibility to maneuver with the order as you please through the options to control the duration of each order. These options are:

- Good Until Cancelled

- Immediate Or Cancel

- Kill or Fill (almost instant)

Pros Explained

Moving on, let’s talk about some of the pros that come with using the Bybit exchange.

Extremely Low Trading Fees

Trading fees play a major part in the performance of a cryptocurrency exchange. Some major exchanges have trading fees that go higher than 1% per trade. One example would be Coinbase, the biggest cryptocurrency exchange in the United States. The highest trading fee in Coinbase goes as high as 3.99%.

Related: Coinbase Review 2021 – What are the Pros and Cons of Coinbase?

When it comes to Bybit, this cryptocurrency exchange has a taker trading fee of 0.075% and a maker trading fee of NEGATIVE 0.025% in Perpetual Contracts. This means that makers earn a 0.025% rebate on each trade. For Spot Trading, the maker trading fee is 0% while the taker trading fee is 0.10%. This makes Bybit one of the cheapest cryptocurrency exchanges, next to BitMEX. Even Binance, the biggest cryptocurrency exchange in the world, has higher trading fees than Bybit – with a maker trading fee of 0.10% and a taker trading fee of 0.10%.

| Exchange | Spot Maker Fee | Spot Taker Fee | Perpetual Maker Fee | Perpetual Taker Fee |

| Bybit | 0.00% | 0.10% | -0.025% | 0.075% |

| OKEx | 0.08% | 0.10% | 0.02% | 0.05% |

| Binance | 0.10% | 0.10% | 0.02% | 0.04% |

| Huobi | 0.20% | 0.20% | 0.02% | 0.04% |

High Liquidity

Being one of the top 5 crypto derivate exchanges and having a trading volume of more than $14 billion gives Bybit high liquidity. Having high liquidity makes it possible for traders to instantly trade cryptocurrencies with minimum price slippage. In other words, liquidity makes it possible for users to trade crypto with one another at any time. The higher the liquidity of a market, the quicker the trade and the lower the price slippage.

Cons Explained

Now, let us elaborate on the cons of using the Bybit exchange.

Low Number of Cryptocurrencies Available

As we mentioned before, only about 20 cryptocurrencies are available for trading on the Bybit exchange. This is quite a low number of cryptocurrencies available considering that most exchanges have more than 50 cryptocurrencies available for trading. Moreover, there are cryptocurrency exchanges such as Binance that have more than 300 cryptocurrencies listed. You can find these cryptocurrencies on Bybit:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- EOS (EOS)

- Dotcoin (DOT)

- Ripple (XRP)

- Cardano (ADA)

- Ethereum Classic (ETC)

- Polygon (MATIC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Litecoin (LTC)

- Binance Coin (BNB)

- Sushi (SUSHI)

- Uniswap (UNI)

- Solana (SOL)

- Aave (AAVE)

- Tezos (XTZ)

- Filecoin (FIL)

- NEM (XEM)

Being Unregulated

Even though being unregulated is seen as a good thing by a part of the cryptocurrency community, the drawbacks of being unregulated outweigh the benefits. The main issues with being unregulated arise by governments. When an exchange is unregulated, it is more likely to be banned from certain countries. This has happened many times in the past, and it will probably happen again.

Despite the fact that Bybit is legit and safe to use, traders from the United States, Singapore, Quebec, and many other countries, are not allowed to use the Bybit exchange because of the exchange being unregulated – and other reasons.

Bybit vs. Binance

Until now, we have briefly touched upon the most important parts of the Bybit exchange. We have also mentioned that Bybit is a platform that is better suited for more experienced traders, with its 100x leveraged margin contracts and its complex trading view. When comparing the options offered for professional traders, Bybit is roughly the winner.

Yet, Binance is the biggest cryptocurrency exchange by trading volume and has more than 300 cryptocurrencies listed on its platform. Moreover, Binance has an average number of 25.8 weekly visits, sealing this aspect of the comparison.

All in all, both cryptocurrency exchanges prosper in their own fields. Since both of them have a considerable number of unique benefits, it is hard to determine which one is better. Therefore, always use the cryptocurrency exchange that suits you best.

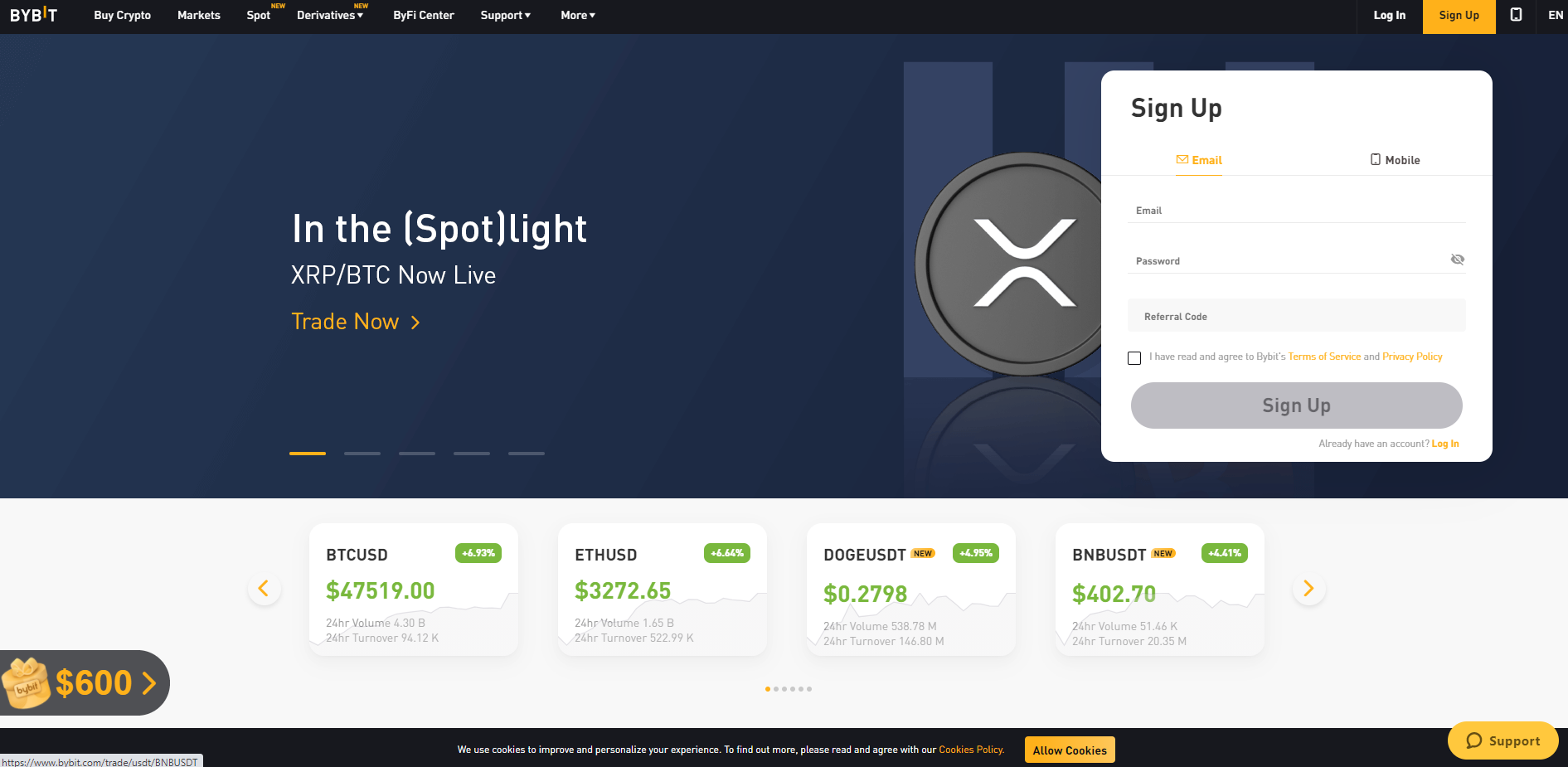

How to Open a Bybit Account?

In order to use the Bybit exchange and enjoy its features, you must open a Bybit account. To do so, simply follow the steps below.

- Go to Bybit.com and hit the “Sign Up” button.

- Now, choose whether you want to use your email or your mobile to set up a new account. After doing so, fill in the required gaps.

- Confirm your email and activate your account.

- Your account should be activated by now. Feel free to deposit any cryptocurrency or to use their “Buy Now” option to buy some cryptocurrency using fiat.

How to Buy Cryptocurrency on Bybit?

Step 1: Open a Bybit account by following the steps above

Before starting to trade your favorite cryptocurrencies on the Bybit platform, you must first open an account. To do so, simply follow the steps above. Since Bybit is unregulated, it does not require KYC, therefore, your legal full name and country of residence will not be necessary.

Step 2: Locate the “Buy Crypto” tab on the Bybit platform

After successfully opening a Bybit account, explore their platform a bit and locate the “Buy Crypto” tab. Tap on it and proceed with the following.

Step 3: Choose your payment method

Different cryptocurrency exchanges have different payment methods available. For Bybit, you can use a debit/credit card or a bank transfer to buy cryptocurrencies. This is done through different providers that offer different payment methods, with some being limited only to debit/credit card payments.

These service providers are Banxa (zero fees), Moonpay, Mercuryo, and Simplex. For each service provider, there are different processing times and fees. For example, buying from Banxa would take 2-30 minutes to process, while buying from Moonpay would take 2-10 minutes.

Step 4: Select which cryptocurrency you are interested in

Choose the fiat currency you are going to use to buy crypto. There are +40 fiat currencies available on the platform. Afterward, select the cryptocurrency (only BTC, ETH, and USDT are available for direct purchase) of your preference and choose the amount you are interested in. After selecting those two, select the service provider that suits you best and press on “Buy”.

Read More: How To Buy Cryptocurrency? – A Step-By-Step Guide

Frequently Asked Questions FAQ

Is Bybit safe?

As we said earlier, Bybit is a very safe exchange. They include an Insurance Fund that partially protects your funds. However, no cryptocurrency exchange can secure your account if you don’t secure it for yourself. First off, implement security measures provided by Bybit such as two-factor authentication. Now, protect your private information and do not share it with anyone. Even though storing your crypto in an exchange is not recommended, there are very few occurrences of individuals losing their money while storing them on a major exchange such as Bybit.

Is Bybit good for beginners?

It works, but it is not one of the best in this aspect. As we stated before, Bybit contains lots of complex options when you go to the trading section. The trading view is a bit more complicated than on some other exchanges. Even though Bybit may not be the most complex crypto exchange, it sure isn’t one of the simplest.

Also Read: Kraken Review 2021 and A Definitive Guide to Using the Popular Crypto Exchange

Takeaways

- Bybit is a Singapore-based cryptocurrency derivate exchange that offers up to x100 leverage.

- It was founded in 2018 by Ben Zhou, who first showed interest in crypto back in 2016.

- As stated on Coinmarketcap, Bybit is the fourth largest crypto derivate exchange with a trading volume of around $14 billion.

- Crypto derivates serve as secondary contracts that are linked to the price of an underlying asset often called the primary asset.

- The main benefits of using Bybit are its very low fees and its high liquidity.

- On the other hand, the drawbacks of using such an exchange are its limited number of cryptocurrencies and its issues with different governments that arise because Bybit is unregulated.

- To wrap it up, Bybit is a decent crypto exchange to pursue your crypto trading activity, especially if you are a more experienced trader.