Cryptocurrency Wallets Explained

The idea behind cryptocurrency transactions is that the person initiating the transaction signs the transaction with a private key to confirm it, while other nodes use public keys to verify transactions. Many consider these private keys to be ‘passwords’ for your transaction address. Judging by this, private keys need to be stored somewhere safe so that no one has access to your address and misuses the assets that you own. The way to achieve this safety is by using cryptocurrency wallets.

Cryptocurrency wallets are hardware or software wallets that anyone can use for storing their cryptocurrencies. Usually, multiple cryptocurrencies can be stored in a crypto wallet at the same time. Through crypto wallets, you can manage all the assets that you have stored, control your private keys by confirming transactions, as well as send or receive cryptocurrencies from any cryptocurrency address. Moreover, some crypto wallets allow you to access decentralized applications (dApps) as well as other decentralized services.

Types of Crypto Wallets

Software Wallets

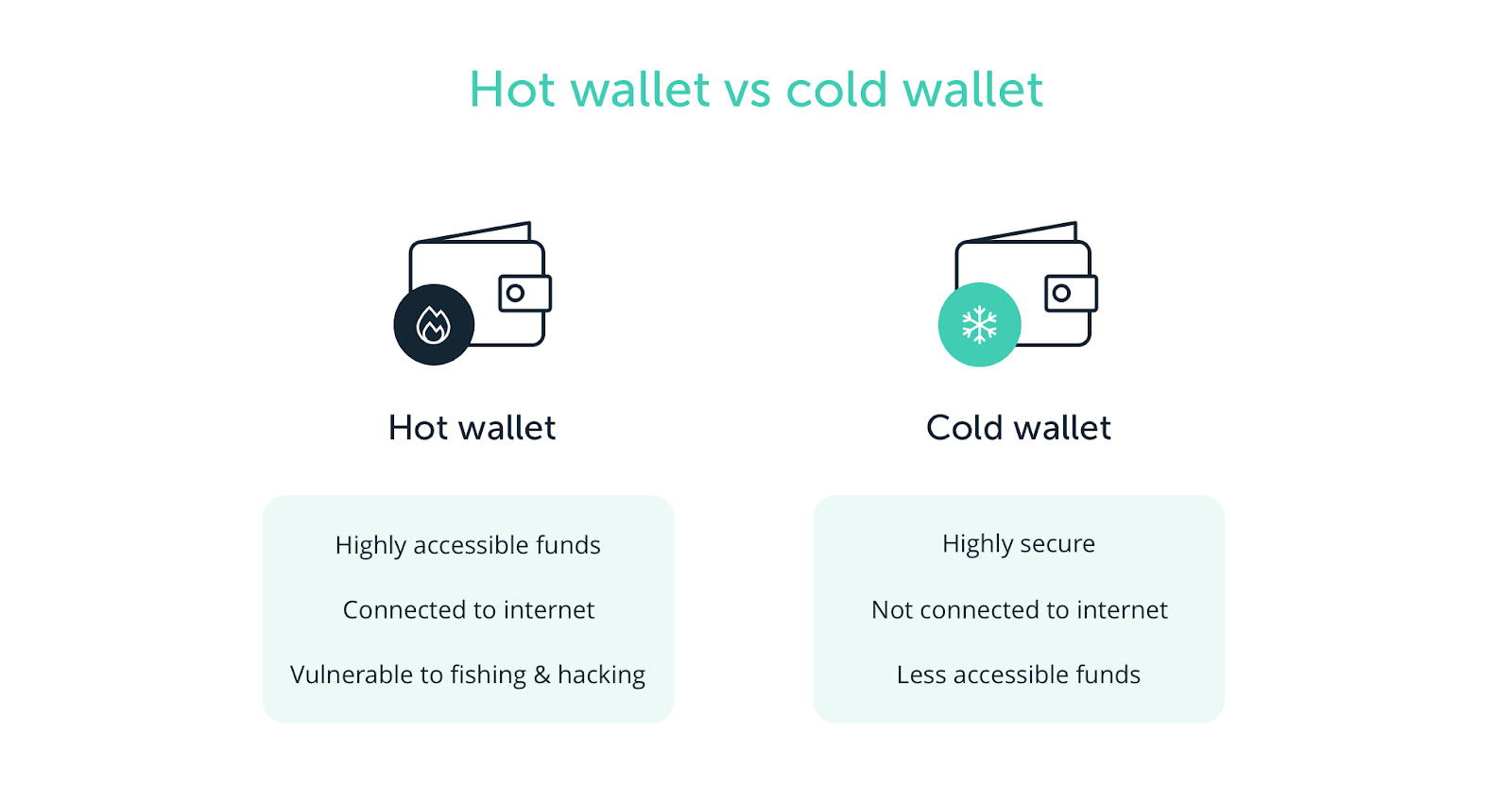

Software wallets are also known as hot wallets because they are online applications or browser extensions. Private keys are stored online. The verification process is done through a password and through a seed phrase (a set of 12-14 random words).

They are not necessarily the safest way of storing cryptocurrencies due to the fact that they are only accessible online, and the internet is full of hackers and malware programs that might want to have access to your address. Nonetheless, they are the most used wallets in the world due to the easy accessibility. To have access to a hot wallet, you need a smart device and safe access to the internet. Some of the best hot wallets are Coinbase wallet, Exodus, Trust Wallet, Gemini, etc.

Hardware Wallets

Different from software wallets, hardware wallets are completely offline, so they are commonly referred to as cold wallets. Cold wallets are usually shaped like a USB flash drive, and private keys are stored without ever being vulnerable to internet threats. The only time when the internet is needed while using cold wallets is when you are confirming a transaction; You need to connect your wallet to the smart device which you are using to complete transactions, and you simply need to confirm or abort the transaction with your hardware wallet. You also need a seed phrase for having access to your cold wallet.

As such, they are the safest way for storing your cryptocurrencies. However, this safety does not come for free as do most hot wallets. Cold wallets can range from $50 to $170, depending on the wallet model you are choosing. The best cold wallets that you can use are Ledger Nano X or Ledger Nano S and Trezor One or Trezor Model T.

Paper Wallets

Lastly, paper wallets are sheets of paper that contain your private keys information. This paper needs to be stored somewhere safe. However, paper wallets are no longer widely used since they are not very practical and other types of wallets have emerged.

What Wallet Is The Best Choice For You?

When it comes down to what wallet you should use, it should be a choice between a hot or a cold wallet.

If you are a day trader, hot wallets might suit you more because they are easily accessed and save you some time while completing transactions.

If you are a swing trader, you might prefer cold wallets for cryptocurrencies you plan to hold (HODL) in the long run since it is safer.

The best choice might be a combination of the two, where you trade some cryptocurrencies through hot wallets while storing others in a cold wallet.

Also Read: Trezor vs Ledger – A Detailed Comparison Between the Two Hardware Wallets

Takeaways

- Cryptocurrency wallets are hardware or software wallets that anyone can use for storing their cryptocurrencies.

- There are three types of crypto wallets: software, hardware, and paper wallets.

- Some of the best hot wallets are Coinbase, Exodus, Trust Wallet, Gemini, etc.

- The best cold wallets that you can use are Ledger Nano X or Ledger Nano S and Trezor One or Trezor Model T.

- If you are a day trader, hot wallets might suit you more because they are easily accessed and save you some time while completing transactions.