Ethereum is a decentralized cryptocurrency, where people are allowed to launch and complete different tasks without a central authority or government that controls them.

The cryptocurrency that is used to complete transactions in the Ethereum network is commonly known as Ether.

The whole Ethereum network works through codes that condition all the transactions in the platform, known as smart contracts, which eliminate the need for a third party.

People of the Ethereum network have the ability to launch and run various applications, which are commonly referred to as dApps.

Everything in the Ethereum network is written in Solidity, a programming language.

How Does Ethereum Work?

To begin with, let’s briefly explain what decentralization and Bitcoin are so it is easier to understand the concept of Ethereum.

Bitcoin is the first cryptocurrency in the crypto economy that implemented the concept of decentralization. This decentralization meant that every payment was done in a peer-to-peer or ‘face-to-face’ method, where third parties, such as banks, were eliminated. This meant that the Bitcoin clients had total control over their assets, and it removed the need for a central authority. Thus, if payments could become decentralized, then other services could become decentralized.

As such, the Ethereum network came into realization to promote many other services, such as launching and running different applications that do not have a central authority. These applications are known as Decentralized Applications, dApps.

In order for every service to go as smoothly as possible, the Ethereum network runs through Smart Contracts, which are sets of computer codes that decide how every service is conducted. Smart Contracts are a derivation of the need to remove third parties that would control the network.

Similar to Bitcoin, Ethereum is maintained through a blockchain that records every data through computer nodes, known as miners. These nodes verify every transaction and service occurring in the Ethereum Network, consequently rewarding the miners with additional Ethereum Tokens for every block of information added to the blockchain.

Ether is the cryptocurrency token that is used in the Ethereum Network in order to complete transactional services.

There are other various tokens in the Ethereum Network that are used for different services. These tokens that run in this network are known as ERC-20.

ERC-20 tokens are distributed through a process known as Initial Coin Offerings (ICO), where tokens are initially bought by investors by legal tenders or fiat currencies.

Who Is The Founder Of Ethereum?

After co-founding Bitcoin Magazine, one of the biggest crypto magazines in the world, Russian-Canadian programmer Vitalik Buterin proposed the idea of Ethereum through the Ethereum White Paper in 2013. Together with Gavin Wood, Vitalik Buterin turned that idea into realization in 2015 when Ethereum finally went live for the public.

In 2018, Forbes Magazine estimated Vitalik Buterin’s net worth to be around $400 million.

Gavin Wood, on the other hand, who also invented Solidity, the programming language that Ethereum uses, left the foundation of the Ethereum network and went on to create another cryptocurrency, known as Polkadot.

Timeline of Ethereum

In 2013, the Ethereum white paper was released to the public by Vitalik Buterin.

In 2014, Gavin Wood, co-founder of Ethereum, released the yellow paper that explained in depth every technical feature proposed in the Ethereum white paper.

That year, the Ether token went for sale temporarily.

On July 30, 2015, Ethereum was fully released to the public. The Ethereum price on August 8, 2015, was roughly $0.90.

Throughout the years, Ethereum underwent several protocol changes, known as Forks.

The first implementation of Ethereum was known as Frontier.

In September 2015, Ethereum forked to Frontier Thawing.

In 2016, Ethereum forked several times to Homestead, DAO Fork, Tangerine Whistle, and Spurious Dragon.

The DAO Fork came as a result of the DAO attacks in 2016, where a hacker stole $50 million worth of tokens because of some flaws in the Smart Contracts. Others that refused to fork again but maintain the original idea of Ethereum went on to form what is known today as Ethereum Classic.

By the end of 2016, Ethereum (ETH) was worth around $8.

Ethereum reached $1000 on January 4, 2018, and topped an all-time-high for that time at $1412.71 by January 13, 2018.

By 2020, Ethereum forked several times to Byzantium, Constantinople, Petersburg, Istanbul, and Muir Glacier.

The latest changes to Ethereum come from Ethereum 2.0, major upgrades that are done to increase Ethereum’s market efficiency.

Ethereum 2.0 will undergo three phases, the first one released in December 2020, known as Beacon Chain. The Beacon Chain serves as a consensus platform for the Ethereum 2.0 blockchain. Ethereum had a value of $605 when Beacon Chain was released on December 1, 2020. The other phases will be released in the future.

Many dApps, Decentralized Applications, have been launched and started running throughout Ethereum history.

According to Coindesk, there are approximately 3000 dApps running in the Ethereum blockchain as of 2021. These dApps include games, exchanges, marketplaces, decentralized finance (DeFi), etc.

Ethereum Today

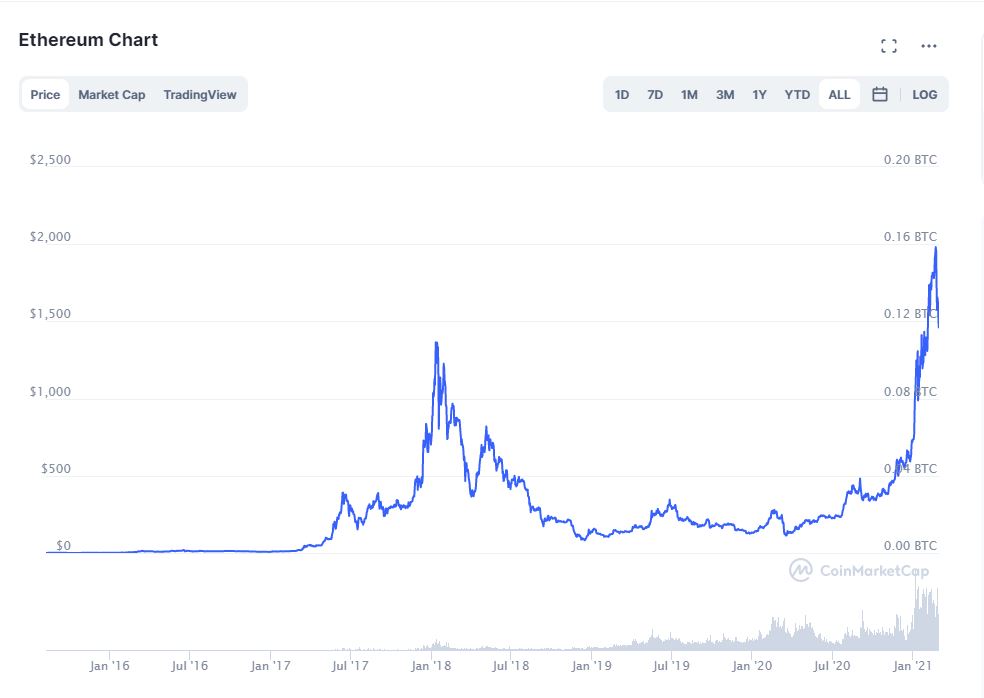

Today, in the early months of 2021, Ethereum is the second most valued cryptocurrency in the crypto market, second to Bitcoin (BTC). In February 2021, Ethereum reached its all-time high with a value of $2036.29.

Ethereum (ETH) linear market value throughout the years. Source: coinmarketcap.com

While Ethereum still remains lower than Bitcoin, Ethereum is prone to inflation because it does not have a limited amount of supply. Bitcoin has a maximum of 21 million tokens expected to run out in 2140. Ethereum does not have a limit and it has already reached 114 million tokens as of February 2021.

Ethereum (ETH) circulation throughout the years. Source: ycharts.com

Decentralized Applications (dApps) that run in the Ethereum blockchain have utilized the crypto market even more.

Some of the most important dApps that are up and running in 2021 are:

- Uniswap – exchange application used to swap tokens efficiently

- Synthetix – decentralized finance application

- Axie Infinity – a pokemon-inspired game that is accessible in the Ethereum blockchain

- Rarible – Marketplace for turning products into virtual assets in the Ethereum blockchain

- Audius – A decentralized streaming platform that enables the producers to profit directly and not be connected to labels.

New dApps are launched every day in the Ethereum network.

Ethereum is also used to make online transactions, and now it is accepted by many companies worldwide, such as Shopify, Overstock, Travala, Gamerall, etc.

Future Of Ethereum – ETH Price Predictions 2022-2028

But what should we expect from Ethereum in the following years? Will the implementation of Ethereum 2.0 increase or decrease the value of Ethereum (ETH)?

The first phase of Ethereum 2.0, Beacon Chain, has already been integrated on December 1, 2020. Ever since that, Ethereum (ETH) has reached new highs in its value, with the all-time high reaching $2036.29 in February 2021

The second phase will include the creation of shards, parallel blockchains that will perform together.

The third phase will integrate the shards to the existing network and connect them to the Beacon Chain.

Ethereum 2.0 is believed to increase efficiency in the services offered in the Ethereum network.

How will that impact the market price of Ethereum (ETH) in the future?

Here you can see the Ethereum price forecast from Coindataflow based on the extrapolation of the growth of various well-known stocks.

According to Digitalcoin, Ethereum (ETH) will constantly appreciate in the following years of this decade. In 2022, Ethereum (ETH) might go as high as $2632.30. Between 2025 and 2026, Digitalcoin predicts that Ethereum (ETH) may reach $5000 for the first time in its history.

Ethereum (ETH) price prediction for the following years. Source: digitalcoinprice.com

Of course, these are only predictions, and it is impossible to know what will happen in the future due to the uncertain nature of cryptocurrencies.

Perhaps, Vitalik Buterin and his team will decide to put a limit on the maximum of Ethereum tokens that will circulate in the market. That would alter the inflating nature of Ethereum (ETH) in the future.

Pros And Cons Of Trading Ethereum

Similar to trading Bitcoin (BTC) and other cryptocurrencies, besides the fact that it can be lucrative but also risky, trading Ethereum (ETH) has its advantages and disadvantages. The most notable ones are:

Advantages of Ethereum

- Decentralized

- Same as Bitcoin (BTC), Ethereum also uses a peer-to-peer system for every service it provides, which eliminates the need for additional fees taken from third parties.

- Not only a cryptocurrency

- One of the most important features of Ethereum (ETH) is the many services it provides to its network with decentralized applications (dApps).

- No limited amount

- Unlike Bitcoin (BTC) Ethereum does not have a limited capacity that will be circulating in the future. Some might favor cryptocurrencies that are capped, but Ethereum provides a much faster, efficient, and practical system when it comes to transactions.

- Regularly updated

- When looking through the history of Ethereum (ETH), we can notice that the founders and owners of the Ethereum network regularly upgrade their network protocols to enhance the efficiency of Ethereum (ETH)

Disadvantages of Ethereum

- Internet Vulnerability

- Ethereum users are vulnerable to online hackers. Even the Ethereum Network as a whole is vulnerable to online hackers, as seen in the DAO attacks in 2016.

- Mining Costs

- While the mining costs may vary from time to time, very often miners were not satisfied with the electricity costs from their computer nodes.

- Not so recognized when compared to Bitcoin (BTC)

- While Bitcoin (BTC) has been adopted in many countries around the world, Ethereum (ETH) is still rising in popularity in some countries.

Should You Invest In Ethereum?

It is never a bad time to invest in cryptocurrencies and investing in Ethereum (ETH) may generally seem like a good idea. After all, it is the second most important cryptocurrency after Bitcoin (BTC). Ethereum paved the way for many other cryptocurrencies to create networks that provide many decentralized services.

Also Read: Ethereum Price Prediction 2021 and Beyond – Can ETH Reach $20,000 in 2021?

Takeaways

- Ethereum is a decentralized software platform where users can launch and run decentralized applications and complete transactions through Ethereum tokens.

- Ethereum works through various sets of codes, known as smart contracts, to establish a neutral control over the network without the need for a central authority.

- Ether is the cryptocurrency token used to complete transactions in the Ethereum blockchain.

- Ethereum was founded by Russian-Canadian programmer Vitalik Buterin and British programmer Gavin Woods in 2013. It was released to the public in 2015.

- Ethereum has forked many times throughout the years.

- DAO fork was a result of hacker attacks in 2016, where around $50 million worth of Ethereum tokens were stolen. This led to major changes in the Ethereum protocol. The ones who refused to fork formed Ethereum Classic.

- Ethereum (ETH) reached an all-time-high in February of 2021 with a value of $2036.29

- Ethereum (ETH) value is predicted to constantly rise in the following years.

- Investing in Ethereum (ETH) has its advantages and disadvantages.