As astonishing as cryptocurrencies may have been for the last 10 years, they also have their own setbacks. Such setbacks can be the reason why the developers behind a certain cryptocurrency project may decide to update the network. These updates are known as soft forks and hard forks. Soft forks are backward compatible, so even the nodes that do not update the information can still play their role in the network. Hard forks are the opposite. There have been cases when a considerable part of a network did not want to update the network and remain as they are. Because of this, the blockchain forks into two different blockchains. This has been the case with Ethereum Classic.

Ethereum Classic is a hard fork of Ethereum. Even though it might not have had as big a success as Ethereum, it is still one of the best cryptocurrencies to invest in. If you were thinking of investing in ETC, then you need to take note of some of the main features, price factors, and possible future outcomes of this cryptocurrency.

Fundamental Analysis Of Ethereum Classic

The name Ethereum Classic signifies that it is the original blockchain of the Ethereum network. So the creators of Ethereum are also the creators of Ethereum Classic, which are Vitalik Buterin and Gavin Wood. Ethereum was launched in 2015.

But why did Etthereum fork in the first place? Ethereum uses smart contracts, which are sets of codes that users can use to launch their own projects in the Ethereum network. A Decentralized Application (DApp) within Ethereum known as DAO was hacked in 2016. Around $50 million were stolen by the hacker. The hacker took advantage of a flaw in the smart contracts to help him steal all that money from users. Due to this incident, the team behind the Ethereum proposed a DAO hard fork so that the same mistake is not repeated again by changing some of the protocols in the network. One change was to switch Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in the future because it would inevitably make the mining process much harder until PoS is finally established.

Rank: 27

A portion of the network did not like the idea and did not vote on making such changes in Ethereum. 13% of the active voters in that time were not in favour of such changes. Because of this, that 13% remained on the original blockchain of Ethereum, now known as Ethereum Classic. However, the likes of Vitalik Buterin are not part of the developers. Instead, the team behind ETC is ETC Labs, which promotes a community-driven network because even the developers say that there is no official team behind it.

The PoW mechanism of Ethereum Classic is similar to Bitcoin. The network is secured by nodes who compete with each other on verifying transactions in the blockchain. Each verification rewards the nodes with additional ETC as an incentive. The mining reward rate is determined by the computational power of the node. Powerful nodes have a much higher chance of succeeding, even though energy costs are much higher. Hackers would need to control 51% of the nodes if they would want to manipulate the data for their own interests. Since Ethereum Classic is considerably smaller than Etheruem, there have been several cases where these attacks have occurred. To fix this issue, Ethereum Classic changed its mining algorithm known as Ethash, changing the duration from 30,000 to 60,000. Noticeably, the Ethereum Classic network is much more secure now. This algorithm is now known as EtcHash.

Even though Ethereum has become much bigger than Ethereum Classic, the latter is still a successful network that promotes user activity by allowing them to launch projects within the network.

A big difference between Ethereum Classic and Ethereum is the tokenomics aspect. While Ethereum does not have a limited supply, Ethereum Classic has a maximum supply of around 210 million ETC. The circulating supply as of June 2021 is around 116 million ETC (55% of the max supply). This makes Ethereum Classic much less inflationary than Ethereum.

Similar to Bitcoin, the Ethereum Classic block reward is decreased after certain periods of time. Currently, a block reward generates 3.2 ETC. The reward size is planned to decrease to 2.56 at one point in 2022.

Ethereum Classic is a widely accepted currency in many cryptocurrency exchanges. If you want to purchase ETC, you can use exchanges such as Binance, OKEx, Huobi, etc.

After you purchase ETC, you need to store your coins in a safe cryptocurrency wallet, which can either be software (hot) or hardware (cold). The best hot wallets for ETC are Exodus, Trust Wallet, etc. The best cold wallets for ETC are Ledger and Trezor.

Ethereum Classic Price Prediction 2021

Ethereum Classic has undergone several challenges throughout its history, but it has still managed to overcome them and be a top cryptocurrency. Since it has already established itself among other big cryptocurrencies, the price can increase in the following months if the likes of Bitcoin keep starting another bullish run. It is likely that the price of ETC can go up to $200

Ethereum Classic Price Prediction 2022

The new updates of ETC have made it much safer and have got the attention of many investors. Furthermore, institutional investors such as Barry Silbert, CEO of Grayscale, are big supporters of ETC. They can easily drive the price of ETC high in the coming years. Additionally, the block reward is planned to decrease from 3.2 ETC to 2.56 in 2022. This makes ETC scarcer and can cause an increase in its price. It is predicted that the price of ETC can go up to $400 in the upcoming year.

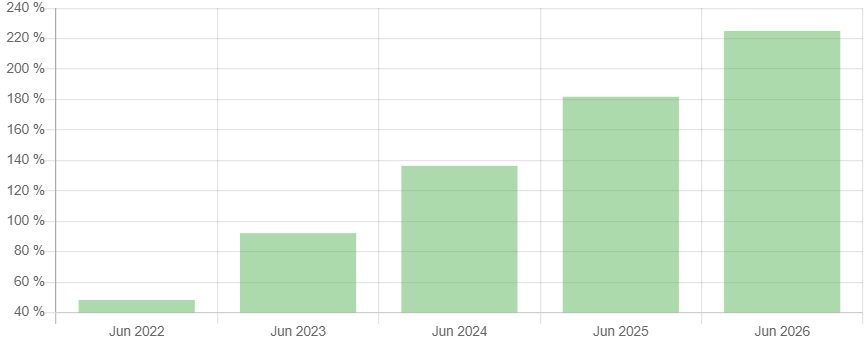

Price Prediction For The Next 5 Years

As more people become interested in cryptocurrencies, their prices go higher. Most daily transactions are planned to be replaced with cryptocurrencies in the long run. Since ETC is already a popular cryptocurrency with a big community and large support, it is likely that it may be implemented in many companies, countries, etc. This increases the demand for ETC even more, while the scarcity decreases due to its limited supply. The price increase is inevitable in the long run. ETC might even go to $1000 in the next 5 years.

Ethereum Classic Market Prediction

Wallet Investor

Wallet Investor predicts an increase in the long run for Ethereum Classic. The price can go higher than $222 in the long run.

The Right Trader

The Right Trader showcases on his ETC analysis that the trading volume of ETC has been bigger than the trading volume of ETH itself numerous times this year. Many people are beginning to realize that ETC is as impactful as ETH and may even become a bigger competition. If Ethereum itself goes up to $10,000 as it is predicted, ETC may easily go to $500 in the coming months.

Our Ethereum Classic Prediction

By looking at several price factors such as supply, efficiency, plans, popularity, as well as its correlation with Ethereum, we at Crypto Academy predict that Ethereum Classic can go up to $300 in 2021. As of the long-term price, ETC may easily go up to $1500 in the next five years, primarily because of the mining reward being decreased, as well as the BTC halving of 2024 that may probably cause another bullish trend in the crypto market.

Historic Market Sentiments

2016

The hard fork of Ethereum occurred in 2016, creating Ethereum Classic as a result. The ETC token was released in July of 2016 at a price of around $0.60. Within one day, the price went to reach $2.55 and as high as $2.76 at the beginning of August. Followed by a price decline, ETC was around $1 in December of that year.

2017

2017 was a rather successful year for ETC, as the price was bullish throughout the year. Beginning the year at $1.40, the price went to $23.40 in June. This run continued by reaching $44 in December, marking a 3000% increase.

2018

Early 2018 was similar to late 2017, but the price was later followed by a bearish run since the price of ETC decreased in the following months. By December, the price of ETC had dropped to around $4.

2019

In 2019, price changes were less potent. The price of ETC ranged from $3.5 to $9.5 the whole year.

2020

At the beginning of 2020, the price of ETC reached $12.30 but then dipped again to around $4. ETC ranged from $4 to $7 in the rest of the months.

2021

2021 was by far the most successful year of ETC. The update of the EtcHash algorithm might have played a role along with the bullish trend caused by the BTC halving in 2020. On January 1st, the price was $5.70. In April, the price had reached $38.54. ETC reached its highest of all time in May at $177. This was yet another 3000% increase in the price in a matter of months. As of June, the price has dipped back to around $56.

An average price of $56 and a circulating supply of around 116 million ETC gives Ethereum Classic a market cap of around $6.5 billion, ranking it at number 22 in the crypto market. The fully diluted market cap of ETC is around $11.7 billion.

FAQ

Is Ethereum Classic a good investment?

Ethereum Classic is generally a good investment. In 2021 alone, the price of ETC had a 3000% increase. In both the short term and the long term, the price of ETC is predicted to increase, making Ethereum Classic a potentially good investment. Moreover, investing in DApps within the Ethereum Classic network might be a good idea since they have proven to be profitable over the years.

Can Ethereum Classic price ever reach $500?

Yes, Ethereum Classic can reach $500 in the coming years. This is based on the price factors of Ethereum Classic, which are its limited supply, which is planned to decrease even more due to the block reward rate decreasing from 3.2 to 2.56 in 2022. Moreover, institutional investors have shifted their focus on ETC. Since they are generally whales, they can surge the price of ETC even higher than $500.

Is Ethereum Classic worth buying in 2021?

If the price of ETC increases in the way that experts forecast, then Ethereum Classic is still worth buying in 2021. It was definitely worth buying in the first two quarters of the year, and this might continue in the following quarters as well. Furthermore, if you hold (HODL) your ETC for the long run, the profits might be even larger, making ETC a worth-considering investment in 2021.

Can Ethereum Classic price increase?

The price of ETC can increase for many reasons. Firstly, the supply of ETC is limited to around 210 million ETC, making the price less inflationary. Secondly, the mining rate is decreasing in 2022, causing a potential shortage that can increase the price of ETC. The third reason might be the increase in the demand for ETC since it is getting widely accepted by many companies. Lastly, ETC is still a mid-cap cryptocurrency with the potential to outgrow its highest of all time.

How to buy ETC?

Today, ETC is widely accepted by many cryptocurrency exchanges. Some of the most trusted and well-functioning exchanges that support ETC are Binance, Huobi, OKEx, etc.

Also Read: Ethereum (ETH/USD) Might Fall Into Consolidation as $3,350 Represses Bullish Momentum

Takeaways

- Ethereum Classic is a hard fork of Ethereum, which was a result of a DAO attack in the original Ethereum blockchain.

- The native token of Ethereum Classic is ETC. The consensus mechanism in Ethereum Classic is Proof-of-Work (PoW).

- There are 116 million ETC in circulation from the maximum of 210 million ETC.

- The price of Ethereum Classic has increased over the years.

- The price of ETC is likely to keep increasing in the future.