The world as we know it today works and functions based on sets of rules that most of the world’s countries agreed upon. These sets of rules are supposed to maintain a functioning society and they did not fail to do so until now. However, new flaws are continuously identified in the global systems; be that the global financial system or the global internet network. We need a change, and blockchain technology may be the necessary tool in order to pursue this change.

It is well-known that the goal of blockchain technology is to decentralize the world. Taking a look at the global financial system at the moment, there are numerous major flaws that come with it; and blockchain technology aims to improve this global system by presenting a new one known as Decentralized Finance (DeFi). One of the most vigorous sectors in the DeFi ecosystem are Decentralized Exchanges (DEXs). Decentralized Exchanges have a self-explanatory name – they are cryptocurrency exchanges that are decentralized and there is no authority above the user. They let you trade cryptocurrencies without a policing party, which technically means there are no terms and conditions and no exchange downtime.

At the time of writing, the most frequently used DEX is Uniswap (UNI). But what makes Uniswap different from the others? How does Uniswap contribute to the DeFi ecosystem? What about their native token UNI? These are just a few questions that we will elaborate upon throughout this article.

Uniswap (UNI) Fundamental Analysis

First off, let us elaborate on what the Uniswap exchange is and how it functions. The Uniswap DEX is built on the Ethereum blockchain and it was founded by Hayden Adams, a mechanical engineer, in 2017. Initially, Uniswap was built as a Proof-of-Concept for an Automated Market Making (AMM) protocol. This means that trading in a decentralized exchange that uses the AMM protocol is made possible by Liquidity Providers (LPs) that fill the AMM pools with cryptocurrency in return for a cut of the trading fees taking place in that pool. As for Uniswap, swapping tokens in their platform has a 0.3% trading fee. For example, if a $100 trade is executed on a pool, 30 cents are proportionally distributed between liquidity providers. Nevertheless, being a liquidity provider is not always fun and games. There are risks that come with providing liquidity to AMM, and one of these risks is known as Impermanent Loss.

In May 2021, the 3rd version of the platform, known as Uniswap V3, was released, marking a new phase for the exchange. This upgrade was more than necessary for the exchange and it gives us a glimpse of how powerful DEXs can be. The benefits that come with this update are numerous. In short words, this upgrade provides Uniswap users with increased flexibility and better speed, making trading in Uniswap more efficient. In addition to those improvements, Uniswap users will be able to benefit from a new feature called Concentrated Liquidity.

Moving on, the native token of Uniswap is UNI. The primary function of this ERC-20 token is governance, however, one more aspect of UNI is potential revenue share. Its total supply is 1 billion, while only 587 million UNI tokens are in circulation at the time of writing.

Read more: ERC-20 Tokens Explained – What is an ERC-20 Token?

What is Concentrated Liquidity?

The idea that defines Uniswap V3 is concentrated liquidity. What concentrated liquidity means is that liquidity is assigned within a specific price range; while in earlier versions liquidity was spread out equally between 0 and infinity. This meant that the majority of the liquidity provided was never really used in many pools.

What is Impermanent Loss?

Impermanent loss stands for a temporary loss that happened to an LP because of the volatility in a trading pair. When the volatility increases in a trading pair that you provided liquidity to, you may lose parts of your staked funds. This temporary loss occurs only when the value of the staked funds providing liquidity fluctuates significantly. However, it is called impermanent for a reason – it is not permanent obviously. This means that you can recover from impermanent loss by waiting for the price of the token that you staked to AMM to return to its original price – the trading value that it had at the time you staked your funds.

Uniswap (UNI) Price Analysis

Even though the Uniswap exchange was launched in 2017, the UNI token joined the cryptocurrency market in late-2020. Regardless of being this new to the crypto industry, UNI has had quite the experience, undergoing drastic price changes in short periods of time.

According to Coinmarketcap, UNI joined the market with a trading value of $0.48 on the 17th of September 2020; surprisingly enough, its price skyrocketed to $2.91 by the end of the day, experiencing a 506% increase in its price. The coin’s price continued to increase, hitting $6.85 by the 20th of September. Yet, after some weeks, UNI was trading at $2.48 per coin, which meant a 64% decrease from its all-time high. That being said, UNI’s first weeks on the market were a rollercoaster.

After some months of small price changes, the cryptocurrency joined the whole market on this year’s bull run. By January 18th, UNI had reached a new all-time high, trading at $9.31 per coin – and its growth did not stop there. The price of UNI grew rapidly throughout the beginning of 2021, reaching a price of $31.15 by the end of February and breaking its all-time high – again. UNI reached its peak on the 3rd of May, during which time it traded at a value of $44.97 but experienced a huge dip shortly after; with its price decreasing as low as $15.49 by the end of May.

At the time of writing, UNI is trading for $22.68 with a market capitalization of $13.39 billion and a 24-hour trading volume of half a million $.

Uniswap (UNI) Market Prediction

Coin Bureau

One big cryptocurrency Youtuber that constantly talked about UNI is Coin Bureau. He made his opinion regarding UNI public before nine months or so, sharing his bullish forecast for UNI; and he was right. In his latest video regarding this cryptocurrency, Coin Bureau restated that he believes UNI may continue its bullish run against all odds. Moreover, he says that with the growth of the Uniswap DEX, the price of the UNI token will also grow.

BitBoy Crypto

Another big cryptocurrency Youtuber is BitBoy Crypto. According to him, UNI may continue to grow in price, potentially surpassing Binance’s native token, BNB. He states that the need for decentralization is what might give a push to Uniswap towards being the most widely used crypto exchange; and to do so, Uniswap would have to grow bigger than Binance. In February 2021, BitBoy Crypto claimed that Uniswap’s UNI token may 15x throughout this year, reaching a potential high of $225 by the end of 2021.

GovCapital

When it comes to GovCapital’s forecast, it shows a bullish future for UNI. Their prediction shows us that the coin may close the year 2021 with a price of $55 and that of 2022 with a price twice as high, reaching above $110.

Moving on, the coin might continue its price increase throughout the years, possibly hitting the price of $252 exactly five years from now.

DigitalCoinPrice

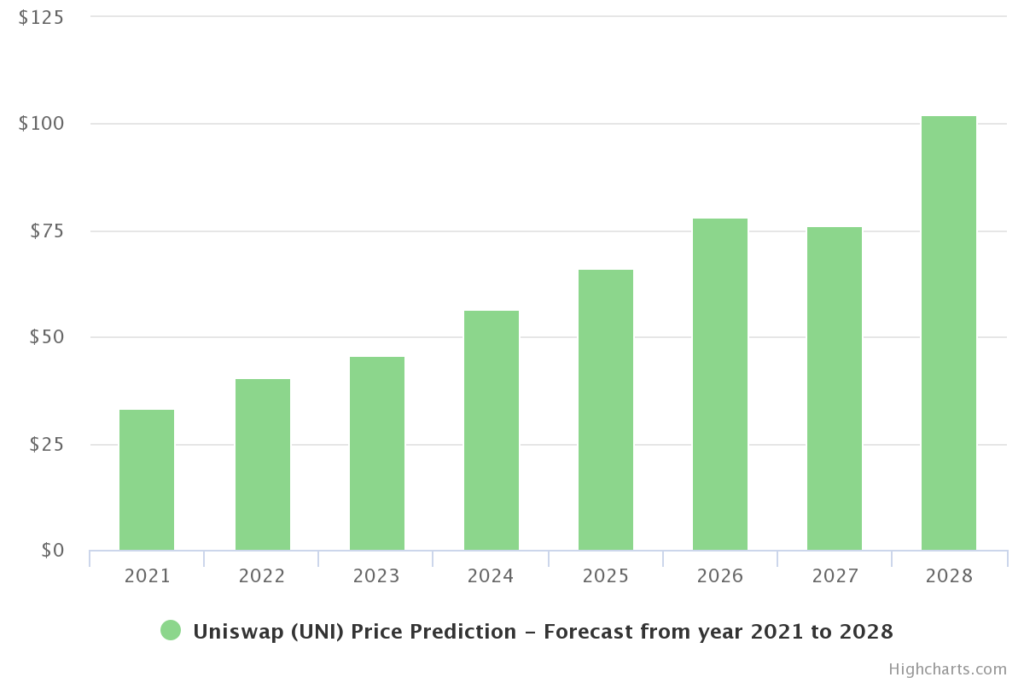

Another prediction regarding UNI is that of DigitalCoinPrice. Their forecast shows a slower but more stable growth of the coin, giving it a price of $33.72 by the end of 2021. Moreover, their prediction shows a huge increase in February 2022, with the coin possibly reaching the price of $44.44, nearly breaking its current all-time high.

As for the next five years, UNI may continue its rapid growth, hitting prices as high as $89 by August 2026. Additionally, UNI might trade for as high as $110 by August 2028.

WalletInvestor

According to WalletInvestor, the coin is likely to increase in price throughout this year, possibly trading for $62 exactly one year from now. As stated by WalletInvestor, UNI may surpass the $100 milestone by June 2023 and potentially end that same year with the price of $123.

Furthermore, the next five years look very positive for the coin based on the forecast done by WalletInvestor. According to their prediction, the cryptocurrency may reach the price of $227 exactly five years from now, in July 2026.

Crypto Academy Price Prediction for Uniswap 2021-2025 ( UNI )

As per us folks at Crypto Academy, we believe that decentralized exchanges are slowly taking over, with the likes of Uniswap and PancakeSwap in particular. With upgrades like V3, Uniswap is paving its future.

Uniswap (UNI) Price Prediction For 2021

Based on our research and analysis, at Crypto Academy, we believe that UNI may continue its uptrend throughout this year. This steady growth might leave UNI with a price above $40, potentially finishing the year 2021 just a little bit under its current all-time high.

Uniswap (UNI) Price Prediction For 2022

UNI might be able to hold onto its price throughout the first half of the year 2022. Moving on, our predictions show that, by the end of 2022, this cryptocurrency may even reach the price of $73, setting a new all-time high for UNI.

Uniswap (UNI) Price Prediction For 2023

The year 2023 may just be the year during which UNI surpasses the $100 milestone. The Uniswap team and community are dedicated to making this DEX the best DEX there is. Our forecast shows that UNI might have a trading value between $115-$130 by December 2023.

Uniswap (UNI) Price Prediction For 2024

As for 2024, this cryptocurrency’s price might drop under the $100 mark. However, we predict that UNI may recover shortly after and continue its positive run towards the end of the year. That being said, we give UNI a possible price between $170-$190 by the end of this year.

Uniswap (UNI) Price Prediction For 2025

For the upcoming years, our forecast shows that UNI may be seeing huge gains in the future. We give UNI a price above $250 by the end of five years and a price between $280-$340 by 2030.

Historic Market Sentiments

2020

In the fall of 2020, Uniswap’s UNI joined the cryptocurrency market with a price of $0.48. The first weeks on the market for UNI are characterized by huge price changes with the crypto’s price reaching prices as high as $6. The crypto left the year 2020 with a trading value of $4.65, around 865% higher than when it entered the market earlier that year.

Also read: PancakeSwap Price Prediction 2021 and Beyond – Is CAKE a Good Investment?

Frequently Asked Questions

Where can I buy Uniswap (UNI)?

At the time of writing, the major platforms where you can buy Uniswap (UNI) are Binance, eToro, and Coinbase.

Is Uniswap (UNI) a security token?

No, UNI tokens are considered governance tokens.

Can I stake Uniswap (UNI)?

Yes, you can stake Uniswap (UNI) on many staking platforms. Cryptolocally is one of the best platforms for staking your UNI.

Read more: What Is The Next Big Cryptocurrency To Explode in 2021?

Takeaways

- Decentralized Exchanges (DEXs) are slowly taking over the cryptocurrency market.

- Uniswap (UNI) is one of the leading DEXs with a 24-hour trading volume of $714 million.

- The main competitor of Uniswap is Pancakeswap. According to Coinmarketcap, Pancakeswap currently holds the number one spot as the DEX with the highest 24-hour trading volume.

- Trading on Uniswap (UNI) is made possible by numerous liquidity providers.

- You can provide liquidity to any trading pair in the platform by staking your funds. Consequently, you get rewarded from trading fees for providing liquidity to any of the trading pairs.

- UNI is the governance token of Uniswap. It is an ERC-20 token because Uniswap is built on the Ethereum network and does not have a network of its own.

- There are 587 million UNI tokens circulating the market right now, and only 1 billion UNI tokens will ever exist.

- According to many prediction websites and experts, investing in UNI today might prove very fruitful to you in the upcoming years.