UniSwap is a decentralized cryptocurrency exchange among the largest in the world. It allows you to easily exchange cryptocurrency tokens without creating an account. Via UniSwap’s liquidity pools, you can earn income on your crypto assets. On the other hand, high fees hinder this exchange to some degree. Read down below to find out about UniSwap’s ins and outs.

How Does UniSwap Work?

UniSwap is an “automatic market maker” (AMM), a form of a decentralized exchange. To establish prices and perform deals, AMMs employ smart contracts. These exchanges don’t have a centralized regulatory system to manage orders due to them being decentralized. They also have the ability to provide DeFi, short for; decentralized financial services.

Contrary to most exchanges designed to profit from trading, Uniswap is dedicated to the common benefit. It’s a solution that allows members to effortlessly exchange tokens without paying platform fees or dealing with middlemen.

AMMs like UniSwap, which have large liquidity pools, can provide fast crypto trading. Liquidity pools are cryptocurrency funds that users provide. They are secured by a smart contract. The liquidity pool is a source of funds that users can tap into when they want to trade cryptocurrencies.

UniSwap takes a small fee from each transaction and distributes it to liquidity providers in a poo, making it a win-win situation. UniSwap’s liquidity providers make this cryptocurrency trading possible, who all get a cut of the exchange’s transaction expenses in return for their services.

Some Of UniSwaps Top Features

There are plenty of features that UniSwaps offers to its users; some of them are unique and some are available on other top cryptocurrency exchanges.

Swap Ethereum-based tokens

On UniSwap, you may easily exchange any Ethereum-compatible digital asset (also known as “ERC-20” assets). Because Ethereum is used to produce multiple cryptocurrency tokens, you may trade a wide variety of cryptocurrencies on this exchange.

Crypto Wallet Support

You must link to an Ethereum digital wallet to use UniSwap. Many of the most prominent digital wallets are supported, such as Trust Wallet, MetaMask, and Coinbase Wallet.

UniSwap’s Ample Liquidity

Liquidity is essential for decentralized cryptocurrency exchanges. To execute deals, they require a large number of crypto assets. If a decentralized exchange is short on crypto assets, traders and liquidity providers may not be able to swap the cryptocurrency they need. Due to a decrease in trading activity, the exchange’s liquidity providers get less revenue.

UniSwap has a sufficient amount of crypto assets that can be utilized, leading to a more pleasant experience on the exchange. The size of UniSwap is a considerable advantage in this case. It is one of the largest decentralized exchanges in terms of total value-locked (TVL), the number of crypto assets in its liquidity pools. UniSwap is quite likely to meet your needs, whether you wish to trade crypto or earn income as a liquidity provider.

User-friendly Design

Some cryptocurrency exchanges have clumsy interfaces and poor user experiences. UniSwap was one of the first popular decentralized exchanges because of its simplistic design. Using the UniSwap app doesn’t take long since it’s extremely user-friendly. You will see further down below just how easy it is to link a cryptocurrency wallet, swap crypto, or deposit cryptocurrency into a liquidity pool.

How To Use UniSwap

You must link your crypto wallet to utilize UniSwap. Here are the main things you can do on the exchange after that:

- Trade Crypto: Choose “Swap” from the drop-down menu, then choose the coin you want to exchange and the crypto you want to receive.

- Stake Crypto: Select “Pool” from the drop-down menu. You can create a new account and deposit any cryptos that already have a UniSwap pool. If you’re not certain which cryptos to stake, you may also take a look at the top pools.

Numerous free digital wallets are available, such as CoinBase Wallet, MetaMask, and Trust Wallet. You should create an address and transfer your crypto to it once you have a digital wallet. Then you can use UniSwap to exchange or stake that cryptocurrency.

How To Earn Interest On UniSwap

UniSwap relies on crypto assets from its customers through liquidity pools, which are pools comprising two cryptocurrencies because it is a decentralized exchange. Anyone can become a liquidity provider by staking assets in these pools. UniSwap charges a tiny fee on each cryptocurrency exchange, which it splits with all liquidity providers for those two currencies.

And here is an idea of how this works. Assume you hold Bitcoin (BTC) and Ethereum (ETH). You may fund UniSwap’s BTC/ETH liquidity pool with equal quantities of each cryptocurrency. Then you receive crypto every time someone uses UniSwap to swap ETH and BTC.

Earning on UniSwap involves a different type of risk and profit than those who invest in long-term ETH. It’s more likely that there won’t be any lasting adjustments in the pair’s price compared in the near to medium term. In the long run, it’s more of a wager on the UniSwap pool’s trading volume.

How To Trade On UniSwap

You may buy any of the ERC20 coins offered by the platform using UniSwap.

To do so, you’ll need sufficient ETH in your account to cover any transaction costs and something to exchange for the ERC20 coin you desire.

Here’s a short tutorial to help you begin your own trading journey on UniSwap.

- Firstly, head over to the Uniswap exchange platform.

Click the ‘Connect to a wallet’ option in the top right corner, then log in with the digital wallet you want to trade with.

- Once you’re logged in, an interface will appear.

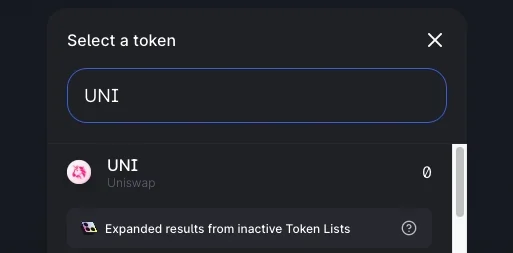

Select the coin you want to trade for the coin you want in the top field. Look for the coin you want to buy in the bottom field, or choose it from the drop-down option.

- You’re now ready to place your order.

You can either enter a number in the top section to indicate how much you’d like to spend or a value in the bottom field to indicate how much you’d like to purchase.

And finally, click the ‘Swap’ button when you’re ready to make the exchange.

Some Of UniSwap’s Drawbacks

As is the case with every cryptocurrency exchange, UniSwap does have its drawbacks-some of these are quite common and might deter people from deciding to use UniSwap.

High Gas Fees

Gas fees are the transaction costs charged by a blockchain. Ethereum is the foundation of UniSwap. Because of Ethereum’s enormous popularity, its blockchain has been clogged, resulting in higher gas prices. UniSwap has cheap costs; however, traders must additionally pay Ethereum’s gas fees. These can be costly, particularly for small transactions.

Ethereum might soon move to a proof-of-stake system that could potentially lower gas fee prices, but they remain quite high now.

Doesn’t Accept Fiat Money

It’s still a major annoyance. You must first purchase cryptocurrency somewhere before using UniSwap. Many customers do so on another cryptocurrency exchange, then transfer the cryptocurrency to a wallet, which they then link to UniSwap. This is why many decentralized crypto exchanges don’t demand personal information from their users.

Risk Of Temporary Loss When Staking

One of the most intriguing parts of UniSwap is its ability to stake crypto in liquidity pools. You may earn income and expand your crypto assets instead of just holding them. Many liquidity pools generate very high-interest rates. They also run the danger of being lost in the short term. When the value of your cryptocurrency falls below what it was when you staked it in a liquidity pool. You could lose money if this happens.

Frequently Asked Questions (FAQ)

Is Your Crytpo Safe With UniSwap?

UniSwap should keep your money safe, but there are several threats you won’t find on centralized exchanges.

UniSwap does not store your assets when you’re trading. You keep them in your own cryptocurrency wallet. There’s a bit more of a learning curve here than simply holding crypto on an exchange. In the end, it’s up to you to keep your crypto-wallet secure. Fortunately, most high-quality wallets provide instructions on how to do so.

Is UniSwap Open Source?

Yes, UniSwap Exchange is indeed an open-source project, and anybody interested in looking at the code can do so. Some other swaps, such as SushiSwap, are effectively Uniswap’s code disguised as something else.

Why Are UniSwap Fees So Expensive?

Because Ethereum needs “gas’ for transactions, UniSwap has no influence over the fees charged. Fees paid are affected by data traffic and current Ether pricing. Because you’re executing a more sophisticated smart contract, which involves higher gas costs, supplying liquidity to a UniSwap pool is a slightly more expensive transaction.

Is UniSwap a Coin?

As we mentioned before, UniSwap began as a decentralized exchange system that enabled users to swap or give liquidity to pools. But due to its popularity, the project team decided to launch the UniSwap Token, which has the ticker UNI.

Why Does UniSwap Take So Long?

Because of network traffic, UniSwap exchanges might take a very long time. It’s probable that the fee you paid was too little, and the transaction may fail, or that inclusion in the block and verification will take a long time. You must pay a larger gas price when making transactions if you really want your transactions to speed up.

What Makes Uniswap Unique?

Uniswap developed the UNI token to provide community ownership of the system, letting stakeholders vote on critical protocol updates and development projects, after years of extensive operation and on its route to total decentralization. Uniswap employed a unique distribution method when it distributed the token in September 2020, “airdropping” 400 UNI tokens to every Ethereum address that has ever used the protocol.

How can I invest in UniSwap (UNI)?

By purchasing UNI, you can invest in UniSwap. A centralized cryptocurrency exchange, such as Coinbase or Kraken, is the most convenient option to purchase UNI. You can also buy UNI using another cryptocurrency through the Uniswap platform.

Takeaways

- UniSwap is a decentralized cryptocurrency exchange that is among the largest in the industry; it allows users to easily exchange crypto through liquidity pools.

- There are a handful of features that UniSwaps offers to its users; some of them are unique, and some are available on other top cryptocurrency exchanges.

- UniSwap relies on crypto funds from its customers through liquidity pools, which contain two cryptocurrencies; this allows faster trading and more assets.

- UniSwap charges a tiny fee on each cryptocurrency exchange, which it splits with all liquidity providers for those two currencies, making it a win-win situation.

- UniSwap has high gas fees due to the clogged network traffic on the Ethereum network on which UniSwap relies for transactions.

- Due to UniSwap’s popularity, the project team decided to launch the UniSwap Token (UNI), which was a major success.

- By purchasing UNI, you can invest in UniSwap.

- UniSwap is a great choice for a decentralized exchange, offering many benefits, but it does also have its own drawbacks.