Throughout history, civilizations have experienced both prosperous and challenging times. From natural calamities to wars, periods of instability have often disrupted progress. Currently, we find ourselves in a challenging era marked by global conflicts and the aftermath of a major pandemic. As a result, economies are feeling the strain, and the financial stability of many is at risk. When we examine the value of the US federal minimum wage over the past century, an alarming trend emerges. According to Statista Research Department, the real purchasing power of 2023’s minimum wage is about 40% lower than it was in 1970. While nominal salaries are increasing, the actual buying power seems to be on the decline.

In uncertain times like these, people often turn to assets that can provide a safeguard against inflation. Traditionally, gold has been the go-to hedge. However, in recent years, Bitcoin has captured the attention of many investors. The pressing question now is: how have these assets performed historically during economic downturns? Are they robust enough to support our increasingly interconnected global economies? As we delve into the attributes of gold and Bitcoin, we aim to uncover which, if either (or both), is better suited for long-term financial security.

Historical Role of Gold in Economic Crises

Gold is one of the most well-known investments in today’s world; and it has been for centuries now. People gave gold value because this precious metal had the properties to be treated as such. Apart from its aesthetic appeal in jewelry, gold’s malleability allows it to be crafted into various objects and shapes. Beyond its ornamental use, gold has been integral to many technological products we use in our everyday lives, from electronics to electricity.

Historically, gold was not just a luxury but an economic cornerstone. In times of financial uncertainties, gold acted as a safeguard against the fluctuating economic winds. For instance, in a system called the gold standard, currencies were either gold itself or had a value pegged to a specific amount of gold.

The Great Recession and Gold’s Response

The years 2008-2012 were pivotal in understanding gold’s reaction to economic upheavals. During these years, the Producer Price Index (PPI) for gold ores witnessed significant changes. According to a report from the U.S. Bureau of Labor Statistics, from a mere 1.2% annual percentage change in 2008, gold rocketed to a staggering 32.8% in 2012. Such a surge underscored gold’s role as an economic barometer.

The rationale behind this is simple: when economies tremble, the price of gold often rises, reflecting global uncertainties. The price of gold isn’t merely a reflection of market demand; it acts as a sentinel, indicating looming economic storms.

During the Great Recession, which began in late 2008, the gold price’s upward trend highlighted its role as a safety net; an inflation hedge. Investors, wary of the market’s volatility and uncertain about the future, turned to gold. This shift was even more pronounced in times of economic stability, where the metal’s price would reflect a lower, more stable range.

Gold as an Inflation Hedge

Gold’s reputation as an inflation hedge was evident during this period. A rising gold price often signals an economy in distress. Conversely, during economically stable times, gold’s price tends to stabilize or even decrease.

For instance, post the 2008 economic crash, the gold price increased by ~12%, reflecting the economic hardships faced by the U.S. and global economies. This trend continued with gold prices increasing by 27.4% in 2010, emphasizing its role as a protection against inflation.

Gold’s role during economic crises, especially as an inflation hedge, is undeniable. The Great Recession only reinforced gold’s historical significance, proving once again that in times of uncertainty, gold remains a steadfast protector of economic value. Whether as a standard or as an investment, gold continues to shine, reflecting the state of global economies and standing tall as a bulwark against financial adversities.

The Rise of Bitcoin: A Digital Alternative to Gold

At its core, Bitcoin operates on a straightforward mechanism: the blockchain technology. Imagine a chain meticulously constructed of individual blocks. Each of these blocks is a robust container holding up to 2,000 transactions. To ensure the authenticity of the data within, timestamps are used, making any foul play virtually impossible. As these blocks build upon each other in chronological order, we see the birth of the “blockchain.”

Read More: What Is Blockchain – A Step-By-Step Guide

What sets Bitcoin apart is its unparalleled efficiency. Transactions are lightning-fast (through the Lightning Network), data remains highly secure, fees are minimal, and its operational footprint is surprisingly light. Just to illustrate, each Bitcoin block occupies a mere 1 Megabyte—astonishingly compact for 2,000 transaction details.

Diving deeper into its mechanics, Bitcoin’s decentralization stands out, primarily through its utilization of the Proof-of-Work (PoW) mechanism. Picture a vast global network of validators (or miners). These guardians of the Bitcoin network use their computing prowess to endorse transactions. A consensus among a majority (at least 51%) of them is required for a transaction’s approval. Think of it as a global server, not housed under one roof but scattered across continents. This worldwide distribution makes any nefarious attempt to compromise Bitcoin an incredibly daunting task.

Bitcoin’s Predictable Inflation Rate

Another feather in Bitcoin’s cap is its predictable inflation rate. Unlike fiat currencies, where central authorities have the power to adjust monetary policies, Bitcoin operates on a fixed schedule. Its inflation rate is set to halve every four years, providing a degree of stability. But it’s essential to understand that the world of inflation isn’t black and white. While Bitcoin has set a pioneering path in redefining currency concepts, it’s too soon to declare if it can entirely replace traditional money systems. Some argue that the Bitcoin halving feature, as well as its other features, make it more fit to serve as a store of value.

When it comes to assessing Bitcoin’s performance against inflation, it’s proving its mettle. Yet, it’s not immune to the whims of the market, often exhibiting wild price swings. But for the ardent believers in a borderless, decentralized currency, this volatility barely causes a ripple of concern. I propose that we shift our perspective—see Bitcoin not just as an investment, but as a revolutionary ideology. It’s our first real stride towards reimagining a financial system, one that, despite its strengths, is riddled with shortcomings that ripple through the global economy.

Comparative Analysis Between Gold and Bitcoin: Volatility, Liquidity, and Returns

Gold Analysis: Volatility, Liquidity, and Returns

One recent study conducted by Takashi Miyazaki unveils the nuanced ballet between gold returns and the shifting sands of financial variables, such as stock returns and market conditions. At the heart of the study is the exploration of gold’s conduct, particularly in the extreme tails of financial distribution, where most assets dare not tread.

Employing a methodological lens of quantile regression, the study peels back the layers of gold’s asymmetric response to market changes, akin to a seasoned captain steering steadfast amidst a storm, when other vessels are tossed by the tempest.

The empirical choreography unfolds a telling tale: as stock returns take a bow, gold returns rise to the occasion; when stock market volatility orchestrates a dramatic crescendo, gold pirouettes with grace, augmenting its return; and as the general financial market tightens its strings, gold’s performance hits a higher note. One interesting fact that helps portray the role of gold during economic uncertainties is that gold rose for roughly 67% during the Great Recession, marking an increase of ~14$.

The remarkable duet between gold and market variables was especially resonant during the epoch of the Global Financial Crisis. Post-crisis, the narrative saw gold dancing to the rhythm of a tightening financial market, showcasing its inherent resilience and perennial value. Along the gold market’s ballet, a notable pas de deux unfolds with crude oil, where a nearly constant positive correlation pirouettes through the financial stage, while a contrasting duet with the US dollar resonates a negative correlation, painting a riveting tableau of economic interrelations.

Gold During Periods of Economic Uncertainties

The veiled choreography between gold and financial variables isn’t just a spectacle for the economic aesthete, but a pragmatic composition for portfolio architects, financial risk managers, and policy maestros striving for a harmonious financial realm. The golden threads of correlation with stock and market conditions, if woven adeptly, could fortify the fabric of individual portfolios, institutional risk management frameworks, and the broader tapestry of financial stability.

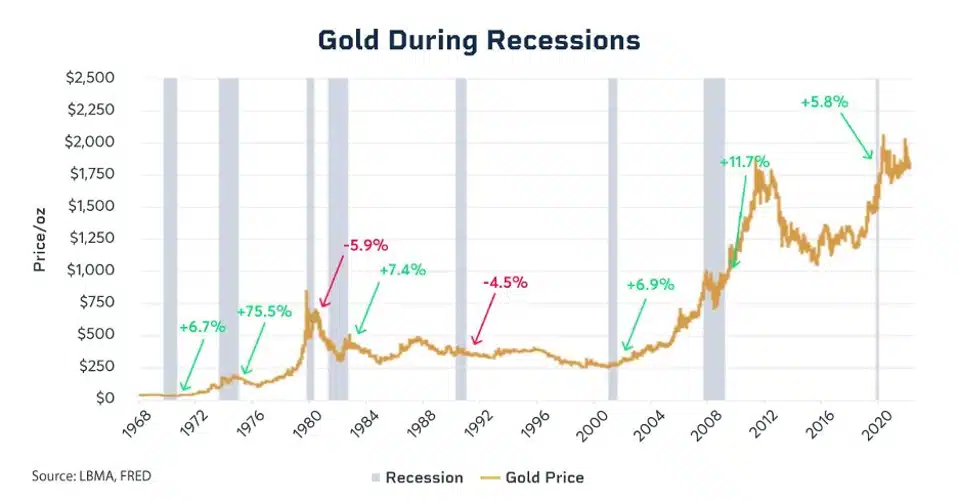

Miyazaki’s discourse invites a further delve into the golden enigma, suggesting a promising entente of extending the analysis to embrace the correlation with stock returns, predictive regression, and exploring the dependence structure through contemporary financial theories such as copula or extreme value theory. Like a tale with more chapters to unfurl, the exploration of gold’s relationship with the financial market variables is a narrative awaiting further elucidation. But will gold protect you during economic collapses?

The saga between gold and the complex tapestry of financial variables is a timeless one. With each twirl of market conditions, gold continues to affirm its role as a silent guardian, an unyielding partner in the financial ballet, rendering a sense of security and stability amidst the ever-evolving market choreography.

Bitcoin Analysis: Volatility, Liquidity, and Returns

Bitcoin, often hailed as the king of cryptocurrencies, has been the subject of intense scrutiny, especially in the wake of the COVID-19 pandemic. While Bitcoin is known for its high liquidity, it is also known for its high volatility. To pain a better picture on Bitcoin’s volatility and liquidity, we will use a recent study by Barbara Będowska-Sójka, Agata Kliber, and Aleksandra Rutkowska. This study delves into the intricate relationships between Bitcoin and other leading cryptocurrencies, focusing on liquidity, volatility, and returns.

The Numbers Game

The study employs the Garman–Klass estimator to approximate volatility and the closing quoted spread of Chung and Zhang to measure liquidity. The research spans from January 2019 to June 2021 and includes seven highly capitalized cryptocurrencies. The statistics reveal that Bitcoin’s price, which hovered around $7,200 at the beginning of 2020, skyrocketed to over $61,500 by April 2021. While this is a known fact, we must also mention the fact that no other “asset” has provided investors with returns as much as Bitcoin.

Investing News Network and several other sources claim that Bitcoin’s initial price was around $0.001. If that is the case, the return on investment from the debut of BTC to today is around 3,000,000,000%. When Bitcoin was at its all-time high, the returns were around 6,100,000,000%. While the supermajority of Bitcoin holders got onto Bitcoin years after its debut, most people racked up some unprecedent returns from this digital asset.

Liquidity and Volatility: A Double-Edged Sword

Interestingly, the study finds that liquidity has increased since the pandemic began, especially for XRP. This is attributed to XRP’s fast transaction processing algorithm. While Bitcoin leads in terms of liquidity, Monero is identified as a close follower, likely due to growing interest in privacy-oriented cryptocurrencies.

The research shows that information transfer from Bitcoin in terms of volatility is mostly insignificant. This is in line with the general observation that mutual information contained in volatility and returns is higher than in liquidity. The study suggests that the cryptocurrency market values risk differently for each coin, indicating a segmented market with diverse investor groups.

Returns: The Real MVP

The study finds that smaller and younger cryptocurrencies like XRP and Litecoin have started to influence Bitcoin’s returns since the pandemic began. This challenges the conventional wisdom that Bitcoin is the primary influencer in the cryptocurrency market. The research also notes that investment strategies based solely on observing Bitcoin may be inadequate.

The study concludes that Bitcoin’s dominance is not as definite as it once seemed. It emphasizes that the biggest cryptocurrencies like Bitcoin, Ethereum, and Litecoin share a large amount of mutual information with others, but these relationships are weakening over time. The research suggests that investors should consider the information flow from other currencies as well.

Check Out: Bitcoin & Inflation – Review of the Correlation Between The Two

In a nutshell, while Bitcoin may still wear the crown, it’s no longer the sole monarch of the cryptocurrency kingdom. The throne is shaky, and other cryptocurrencies are vying for a seat at the table.

Diversifying Portfolios: Combining Gold and Bitcoin

In the financial landscape, the adage “Don’t put all your eggs in one basket” rings particularly true. Portfolio diversification has always been the linchpin of robust financial planning. Traditionally, gold has been a favorite among investors looking to hedge against volatility and economic downturns. Its history of holding intrinsic value and its non-correlational behavior with stock markets make it an asset class of its own. Yet, in the 21st century, a new contender has emerged: Bitcoin. As both a digital currency and a speculative investment, Bitcoin brings unique characteristics to the table that gold cannot offer. But how do these two assets compare, and can they co-exist in a modern diversified portfolio?

Gold vs. Bitcoin: Volatility

Firstly, let’s consider volatility. Gold, being a physical asset with diverse utility, from manufacturing to jewelry, has a lower volatility profile. When stock markets tumble, gold often behaves as a counter-cyclical asset, providing a refuge for investors. On the other hand, Bitcoin, still in its adolescence compared to gold, displays substantial price swings. However, its volatility has been decreasing gradually as market adoption broadens, signaling a maturing asset – but speculations and fake news often tend to shake Bitcoin’s price, causing unexpected price increases or decreases.

Gold vs. Bitcoin: Liquidity

Liquidity is another essential factor for investors. Gold, with its centuries-old markets, offers high liquidity but usually requires physical storage and insurance, unless you’re investing in ETFs or futures contracts. Bitcoin, as a digital asset, simplifies the process with instant, worldwide transactions. However, its liquidity can differ significantly between trading platforms and can be impacted by regulatory news or technological updates.

Gold vs. Bitcoin: Volatility

When it comes to returns, both assets tell a compelling story. Gold provides steady, albeit generally lower, returns over the long term. It also adds an inflation-hedging quality to portfolios. Bitcoin, still in a phase of price discovery, has the potential for astronomical returns, as demonstrated in its past. Yet, this comes at the expense of higher risk and volatility.

Gold vs. Bitcoin: Which Will Outlast the Other?

The tax implications also differentiate these two. Gold sales are subject to capital gains tax, whereas Bitcoin transactions can be a tax event depending both on the jurisdiction and the nature of the transaction (trading, mining, or spending).

What truly sets them apart, however, is the underlying technology for Bitcoin. The blockchain is a foundational innovation with potential applications far beyond cryptocurrencies. This may add an extra layer of value to Bitcoin, separate from its role as a digital ‘gold’. Gold has been around for centuries and, no matter how innovative Bitcoin is, the chances that it will take its place are low. The best take at the moment is believing that gold and Bitcoin will coexist with one another, helping build a better global financial structure.

Author’s Opinion

So, can gold and Bitcoin coexist in a diversified portfolio? Absolutely. In fact, they can complement each other. Gold offers a time-tested store of value with physical tangibility. It has a steadying effect, reducing portfolio risk during economic downturns. Bitcoin, although more speculative, offers higher returns and serves as a hedge against different kinds of risks, such as fiat currency devaluation or geopolitical turmoil.

Allocating a smaller percentage to Bitcoin can help boost overall returns while maintaining a risk profile that isn’t dramatically higher. While investors should be cautious of Bitcoin’s regulatory environment and potential for short-term price corrections, Bitcoin has the best historical run in the history of investing. Some experts might claim that gold is a better, more serious investment; nevertheless, its digital alternative is as serious as it gets. The only major issue with Bitcoin is volatility. The volatility of Bitcoin can be attributed to three main factors: relatively small market capitalization, speculation, and regulatory uncertainty.

Bitcoin’s Volatility: Small Market Cap, Speculation, and Regulatory Uncertainty

The market capitalization of Bitcoin is “a child” when compared to the market cap of gold. While this leaves room for more profit, it also makes Bitcoin’s price more prone to volatility.

Next, speculation is a huge issue when it comes to Bitcoin. This was proven yesterday when one fake news caused mayhem in the market. However, speculation is powerful when the public is not well informed on a certain asset. Speculation is so powerful that there have been times where it has damaged the power of the US dollar. The next issue is the uncertainty around the upcoming regulations of Bitcoin and the whole crypto market – and this is likely to be resolved soon.

Gold and Bitcoin are two valuable elements of the future of the global economy, with one embodying endurance and the other innovation. We don’t know what will happen in the future, but one thing is sure – Bitcoin has the potential to serve as a store of value in today’s ever-evolving world. Moreover, Bitcoin is easier to transport and is far more divisible, making it a good fit to serve as the backbone of the world’s economy – a digital universal currency.