Ripple (XRP) is a digital currency and a technology platform that facilitates fast and low-cost international money transfers. It was created by Ripple Labs Inc., a technology company founded in 2012. Ripple aims to improve the efficiency of cross-border payments and enable instant, secure, and low-cost transactions.

Unlike traditional cryptocurrencies like Bitcoin, which operate on a decentralized network and rely on proof-of-work mining, Ripple operates on a distributed consensus mechanism. The Ripple network consists of a group of servers that validate transactions, and consensus is achieved through a consensus algorithm called the Ripple Protocol Consensus Algorithm (RPCA).

What is Ripple (XRP)?

Ripple’s main goal is to enable secure and near-instantaneous transfer of funds between different financial institutions globally. Unlike many other cryptocurrencies, Ripple is not designed as a decentralized currency for individual use, but rather as a tool for banks and payment providers to settle transactions quickly and efficiently.

The Ripple protocol uses a consensus algorithm called the XRP Ledger (formerly known as Ripple Consensus Algorithm or “Ripple Protocol Consensus Algorithm”) to validate and confirm transactions. The XRP Ledger is maintained by a network of independent validator nodes, including Ripple’s own nodes, ensuring the integrity and security of the network.

XRP, the native cryptocurrency of the Ripple network, plays a vital role in facilitating transactions. It can be used as a bridge currency to facilitate the transfer of value between different fiat currencies or cryptocurrencies. XRP has a maximum supply of 100 billion coins, and a significant portion of it is held by Ripple Labs.

It’s important to note that Ripple Labs and XRP are separate entities, although Ripple Labs has a significant influence over the XRP ecosystem. Ripple Labs has developed partnerships with various financial institutions and payment providers worldwide to leverage the Ripple protocol for cross-border transactions.

However, it’s worth mentioning that Ripple has faced legal challenges and regulatory scrutiny from the United States Securities and Exchange Commission (SEC) regarding the status of XRP as a security. The outcome of these legal proceedings may impact the future of Ripple and the XRP cryptocurrency.

How Does Ripple Work?

Ripple works through its decentralized payment protocol and digital currency, XRP, to enable fast and cost-effective cross-border transactions. Here’s a simplified explanation of how Ripple works:

Consensus Protocol: Ripple operates on a consensus protocol called the XRP Ledger. Unlike traditional blockchain networks that use proof-of-work or proof-of-stake, Ripple’s consensus protocol relies on a consensus algorithm that doesn’t require extensive computational resources. This enables faster transaction confirmation times.

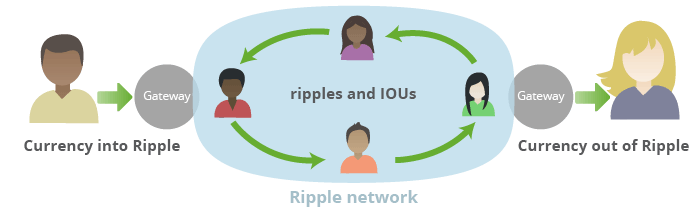

Gateways: Ripple’s network consists of gateways, which are entities, such as banks or financial institutions, that serve as entry and exit points for money and other assets on the Ripple network. These gateways facilitate the conversion of fiat currencies and cryptocurrencies into representations on the Ripple network called “issuances.”

XRP as a Bridge Currency: XRP, the native cryptocurrency of Ripple, plays a crucial role as a bridge currency. Suppose two parties want to transact with different currencies, such as USD and EUR. They can use XRP as an intermediary currency to facilitate the exchange. This helps eliminate the need for multiple direct currency pairs and reduces liquidity costs and settlement times.

RippleNet: RippleNet is the network of financial institutions and payment providers that utilize Ripple’s protocol for cross-border transactions. Participants on RippleNet can establish trust relationships by connecting directly or through intermediary gateways. This network enables the secure transfer of funds and other assets.

Pathfinding: When a transaction is initiated on RippleNet, the protocol uses a pathfinding algorithm to find the most efficient route for the transaction. It considers factors such as liquidity and exchange rates to ensure the transaction achieves the best possible outcome.

Consensus and Validation: Once a transaction is submitted, validator nodes on the XRP Ledger work to reach consensus on the validity and ordering of transactions. Consensus is achieved when a supermajority of nodes agree on a specific set of transactions. This decentralized consensus process ensures the integrity and security of the network.

Transaction Finality: Transactions on the XRP Ledger are designed to have finality within a few seconds. This means that once a transaction is confirmed and included in a validated ledger, it is considered settled and cannot be reversed.

Crypto Academy Ripple (XRP) Price Prediction

Ripple (XRP) Price Prediction 2023

Some experts believe that Ripple (XRP) is poised to be one of the most remarkable cryptocurrencies to emerge this year. According to our XRP price forecast for 2023, there is anticipation of a substantial surge in the second half of the year, with the potential to reach around $0.91.

While the rise in price is projected to be gradual, there are no significant drops expected. The ambitious average price estimate of approximately $0.82 seems feasible considering the anticipated collaborations and advancements in the near future. It is predicted that XRP will maintain a minimum value of $0.47, indicating a level of stability and potential growth for the cryptocurrency.

Ripple (XRP) Price Prediction 2025

According to our market analysis and predictions, XRP Coin is poised to achieve another all-time high (ATH) level in 2025, marking a significant milestone after a three-year journey. Based on technical analysis, it is projected that the XRP Coin could reach a maximum price level of $3.41 during this period. This indicates a potential for substantial growth and an optimistic outlook for investors.

Furthermore, considering the current growth trajectory, the average price of an XRP Coin in 2025 is estimated to be around $3.06. This signifies a steady increase in value and demonstrates the potential for sustained upward movement in the cryptocurrency market. The average price serves as an important benchmark and showcases the growth potential of XRP Coin.

However, it is crucial to acknowledge the volatility of the market. If the market experiences a downturn or unfavorable conditions, there is a possibility that the minimum price of an XRP Coin in 2025 could be around $2.35. This highlights the need for investors to exercise caution and consider the potential risks associated with investing in cryptocurrencies.

Ripple (XRP) Price Prediction 2030

Looking ahead to 2030, there is potential for XRP coin to achieve new milestones if it continues to attract more investors to the project. This year could mark a significant turning point for numerous cryptocurrencies, and real project-based coins like XRP may gain stronger positions in the market.

Based on our price prediction, the minimum value of XRP coin in 2030 could reach approximately $6.18. This suggests a notable increase compared to its current value. If favorable market conditions and positive movements are witnessed, there is a possibility for the maximum price level of XRP to rise as high as $8.24.

On average, we anticipate the price of XRP coin to be around $7.93 in 2030 if the current growth trajectory persists. However, it’s important to note that the cryptocurrency market is highly volatile and subject to various external factors. Therefore, there is a chance that XRP’s performance could exceed our price forecast if the market becomes particularly bullish during that period.

Is Ripple (XRP) A Good Investment?

XRP, the cryptocurrency running on the RippleNet network, operates on the XRP Ledger, which sets it apart from traditional blockchains. This unique architecture has led to concerns about the decentralization of Ripple (XRP). Additionally, unlike many other cryptocurrencies, XRP cannot be mined, and its total supply is capped at 100 billion coins.

When considering the inclusion of XRP in your investment portfolio, it’s essential to weigh its advantages and limitations. This digital asset distinguishes itself from competitors with its remarkable transaction speed and low transaction costs. Furthermore, its relatively affordable price may appeal to investors seeking entry into the cryptocurrency market. However, it’s important to note that XRP, like other cryptocurrencies, is characterized by high volatility, making it challenging to predict price fluctuations. Additionally, the ongoing legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC) adds a significant level of uncertainty to the future prospects of XRP and the broader crypto market as a whole.

Frequently Asked Questions (FAQs)

Is Ripple a good investment in 2023?

Investing in Ripple (XRP) carries a significant level of volatility, presenting traders with the potential for both substantial gains and losses. The outcome largely relies on the trader’s expertise and understanding of the market. Nevertheless, industry experts suggest that if XRP breaks free from its downward trend, there is a possibility for it to emulate Bitcoin’s performance and experience a surge in value.

Is XRP the next big thing?

Considering an investment in XRP requires careful analysis of your trading experience, goals, and risk tolerance. While many experts see potential for XRP to become a significant player in the crypto market, it is important to align your investment decision with your personal circumstances and objectives. Assessing whether this digital asset fits within your trading expertise and willingness to accept risk is crucial before making any investment commitments.

What future does Ripple have?

The future of Ripple (XRP) garners various predictions, with many experts expressing optimism about its long-term prospects. A key factor contributing to this positive outlook is the increasing scarcity of XRP. As the coin’s supply diminishes, there is potential for its price to rise accordingly.

Takeaways

- Ripple (XRP) is a digital currency and a technology platform that facilitates fast and low-cost international money transfers.

- Ripple operates on a distributed consensus mechanism.

- Ripple’s main goal is to enable secure and near-instantaneous transfer of funds between different financial institutions globally. Unlike many other cryptocurrencies,

- Ripple works through its decentralized payment protocol and digital currency, XRP, to enable fast and cost-effective cross-border transactions

- We predict a surge in the second half of the year 2023, with the potential to reach around $0.91.

- By 2025, it is projected that the XRP Coin could reach a maximum price level of $3.41 during this period.

- There is a possibility for the maximum price level of XRP to rise as high as $8.24 in 2030.