Volatility explained

Volatility is defined as a statistical quantitative approach that is used to calculate the price fluctuations of a traded financial instrument or commodity over time, may it be stocks or cryptocurrencies. When we refer to the volatility of cryptocurrencies, we talk about analyzing the average price change for different coins over a period of time, such as Bitcoin or Ethereum.

What Does Volatility Mean?

What can we make out of this definition? When we measure levels of risk associated with certain assets, volatility plays a huge role. There are volatility indexes that operate within stock markets to calculate and predict future volatility levels of various stocks. The Volatility Index (VIX) of the Chicago Board of Options Exchange, for example, is used in the U.S. stock market.

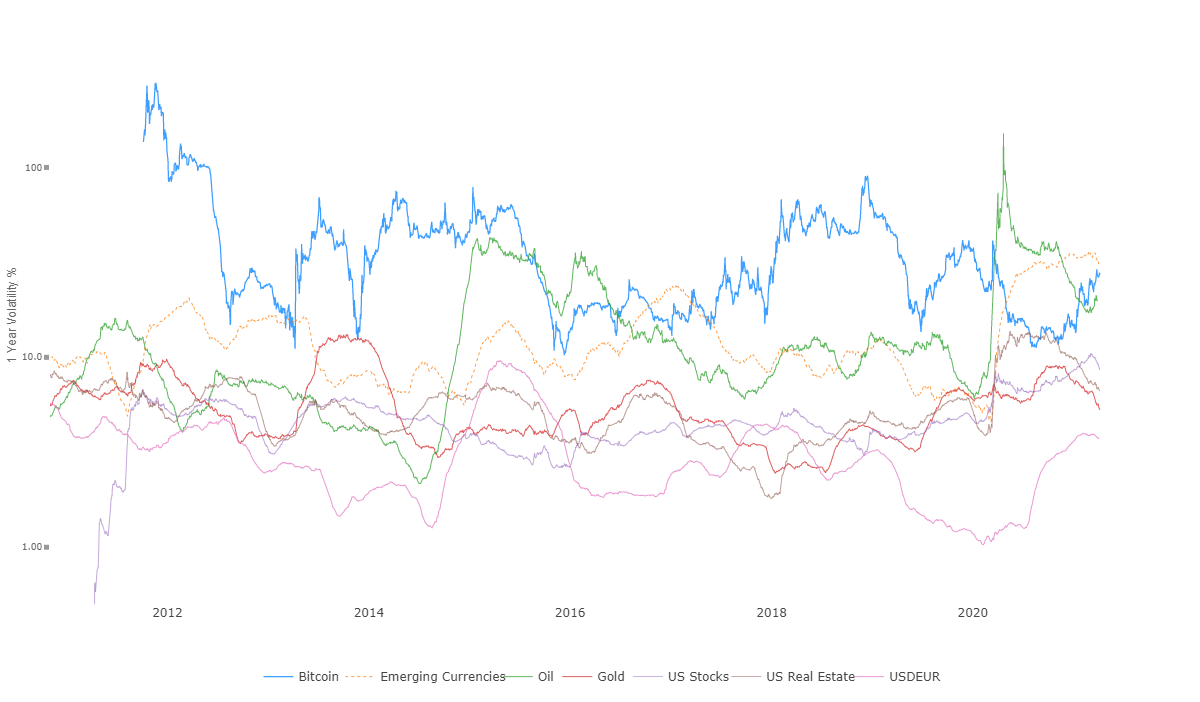

However, there are yet no indexes that calculate crypto price volatility. This, however, doesn’t mean that we can’t look at historical price charts to notice skyrocketing highs and lows of deflation that crypto values have experienced in the past. Price fluctuations in cryptocurrencies often occur at a faster and more severe rate than prices of traditional assets such as stocks. To put it in perspective, Bitcoin’s price increased by 125% in 2016 and then increased again in 2017 by more than 2,000%.

Why is Volatility Important?

Volatility is one of the main risk factors in cryptocurrencies. The value impacts investment decisions by depicting whether an asset is dangerous or not, and how its price may change on a daily basis. Investors will often look to limit their exposure to a risky commodity by either not owning it or hedging it. Speaking of hedging, volatility also affects the cost of hedging, which is a significant factor in merchant service pricing. The cost of converting fiat currency into and out of Bitcoin is highly correlated to the coin’s volatility. Meaning that when volatility decreases, so does the cost of buying and selling.

Volatility In The Cryptocurrency Market

Cryptocurrencies are generally more unpredictable than most other forms of assets due to their limited market cap, digital nature, and current low degree of oversight. Since they’re so unpredictable, volatility is crucial to keep in mind when deciding whether or not and when to invest in a cryptocurrency. A very volatile cryptocurrency would be one that is highly unpredictable, with frequent and drastic price changes. Investing in a very volatile asset can be risky. A non-volatile cryptocurrency, however, is less risky because the price is more secure and predictable.

Cryptocurrencies are known for their volatile nature. Many of the conditions that affect price fluctuations in conventional markets often apply to cryptocurrencies as well. There are multiple indicators that investors use to assess volatility. For instance, the price of a coin is expected to rise if a country or financial institution decides to adopt the concept of cryptocurrency or chooses to invest in it. Price fluctuations in cryptocurrency markets can also be very influenced by news events and opinions. However, since crypto markets lack the liquidity and stable network of major trading companies and institutional investors, as opposed to traditional financial markets, their influence is undermined.

The topic of volatility may seem unsettling, however, there are indicators that cryptocurrency volatility is easing. Financial institutions, countries, and institutional investors are becoming increasingly confident in the asset. It’s uncertain when the volatility levels of cryptocurrencies will reach those of conventional assets, however, it will undoubtedly hit its full development at some point in the future.

Takeaways

- Volatility is defined as a statistical quantitative approach that is used to calculate the price fluctuations of a traded financial instrument or commodity over time, may it be stocks or cryptocurrencies.

- Price fluctuations in cryptocurrencies often occur at a faster and more severe rate than prices of traditional assets such as stocks.

- Volatility also affects the cost of hedging, which is a significant factor in merchant service pricing.

- A very volatile cryptocurrency would be one that is highly unpredictable, with frequent and drastic price changes.

- Cryptocurrencies are known for their volatile nature.