Uniswap is a non-custodial automated market-maker based on the Ethereum Virtual Machine. The recent version of the protocol, Uniswap v3, gives an increased capital efficiency, improved accuracy, a flexible fee structure, controlled liquidity providers, and a convenient price oracle. They get liquidity in the pool, and availability to traders is owed to Automated market makers (AMMs). Uniswap is a member of Constant function market makers (CFMMs), a broad category of AMMs, and has experienced an immense utility in terms of decentralized finance. They usually implement smart contracts for trading tokens on an independent blockchain.

Uniswap (UNI) Fundamental Analysis

Uniswap itself as an organization does not get any revenue due to its decentralized protocol and its users. Its users provide it with liquidity, and the fee directly goes to the liquidity providers, unlike centralized exchanges. It also provides its services with low transaction fees, and liquidity providers receive 0.3% at each transaction that automatically goes to the liquidity pool. Its V3 version is much more efficient and upgraded than the V2 version. Its native governance ERC-20 token is UNI and is tradable.

The basis of Uniswap v3 is on several significant new features but has the same constant product reserves curve as earlier versions. One of these features is its flexible fees, as the swap fee is no longer locked at 0.3%, and the fee tier of 0.05%, 0.3%, and 1% for each pool is decided on initialization. However, it is able to add additional values to this set. It also has more flexibility in setting protocol swap fees. Another feature is concentrated liquidity. Liquidity providers (LPs) are able to concentrate and bound their liquidity within an arbitrary price range. This makes the pool’s capital more efficient and enables LPs to estimate their preferred reserves curve while being efficient with the rest of the pool.

This also has an improved price oracle as Uniswap v3 has the way to provide price accumulation and avoid the need for checkpoints in order for accumulator value. The growing network of decentralized financial apps lets all the developers, traders, and liquidity providers participate together with equal and open accessibility. Uniswap’s V2 contracts were non-upgradeable in design. So the V3 with a completely new set of contracts was implemented, and these contracts give a time-weighted average liquidity oracle. Even though these contracts are not upgradable, governance controls some of its parameters.

How Uniswap Works

In the Uniswap ecosystem, users are basically the liquidity providers, which means that they will provide equal amounts of their various pairs of tokens and hold them for some time. This is called staking, and users get a reward for it in the form of tokens.

Tokenomics

UNI token was launched on September 17, 2020. It has never run any other pool or ICO for a token sale. Uniswap has extended 400 UNI tokens with a value of $1500 through airdrop for the old users of the services of Uniswap. Users can also earn UNI tokens through staking. This process is known as liquidity farming or Yield Farming. Team members got 40% of the tokens, and the other 60% of the tokens went to the investors.

From this 40%, 21.5% token was given to employees and 18.5% to be set aside for investors. In the next four years, it will try to unload a capped total of UNI. As one billion UNI was minted in the genesis block, the community will require to earn their 60% allocation by initiatives in the community or for providing liquidity.

Roadmap

They have not launched any roadmap for future versions, like V4. However, they have fulfilled their commitments regarding V3 of Uniswap. At the end of the first half of the year 2021, CoinMarketCap announced that they had enabled the cryptocurrency community to make the token swaps possible on the platform. The community of Uniswap was very excited to know that the Uniswap was already natively integrated. This move makes it easy for all the users to trade a token with Uniswap and effortlessly connect with an Ethereum wallet. Other wallets supported were Coinbase Wallet, MetaMask, WalletConnect, Portis, and Fortmatic. This decision of CoinMarketCap was to prefer Uniswap over PanCakeSwap, and it will have a significant effect on the various users on Uniswap. The decision gave a very beneficial strike on the price of the UNI token.

Uniswap also has added intelligent automation and is an excellent development in the UniSwap protocol. This advancement looks at the united components of artificial intelligence in a decentralized financial system. It also provides the users with the power to make “DeFi Agents. These factors also stimulate the withdrawal of funds spontaneously from UniSwap v2 by fulfilling some conditions.

Uniswap (UNI) Price Analysis

Today, the Uniswap price is $7, with a trading volume of more than $150 million. CoinMarketCap has currently ranked it as #28, with a live market cap of about $5 billion, and has a maximum supply of one billion UNI coins. Its circulating supply is 690 million UNI coins. In the initial phase of Uniswap, it did not face much acceptance, but with time, UNI has built trust by working and leading in the market. Despite being recent, Uniswap is an example for other developers in the community to optimize their goals and maximum prices. This gives it hope for a better and brighter future.

Rank: 24

Crypto Academy Uniswap (UNI) Price Prediction

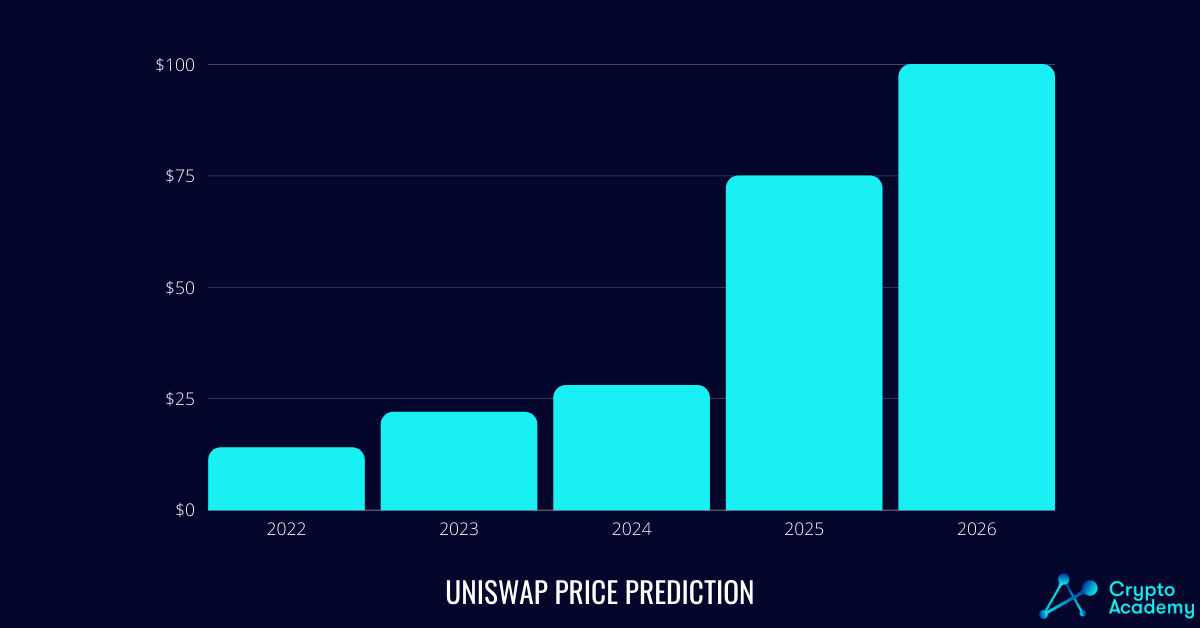

We have given below the price prediction of Uniswap from the years 2022 to 2026 on the basis of its fundamentals and price trends.

Uniswap Price Prediction 2022

Like the previous year, Uniswap price can go through a very bullish trend this year due to its popularity. Also, it is an automated market maker that would not need someone to buy or sell ERC-20 tokens to let someone swap the tokens. If we consider the bullish trend, the highest possible price might be $14 this year, through a delicate attempt to improve its ecosystem. By considering its price trends, we can predict its price to be at a minimum of $12 and an average price of $13.

Uniswap Price Prediction 2023

The bullish trend of 2022 will continue in 2023, elevating the price to a minimum level of $16. According to Uniswap price prediction, its price may sustain the remarkable changes in the crypto industry and market, financial overruns, policies, or any other environmental reason that can affect a coin’s performance on exchange. Due to its competent, resilient, and uniform global economy, the maximum price of Uniswap can hit $22. The average price might be $15.

Uniswap Price Prediction 2024

Experts predict that the price can also rise, reaching the maximum price level of $28; according to the UNI price prediction, Bitcoin halving, changes in the region, and futuristic goals take Uniswap’s minimum price to around $23 in 2024. The average price would reach up to $25. So, we can anticipate the UNI token to act as a bright star with its revolutionized era of global transactions. The UNI token seems to leave a remarkable footprint on this ecosystem’s journey toward success.

Uniswap Price Prediction 2025

As Uniswap is a decentralized exchange, it is used in a trustless manner and does not need any KYC identification. Hence, no one can hack the central server. Uniswap has never experienced a hack or major bug damage to the protocol. This ever-increasing trust and vault to the top of the DeFi Pulse rankings can make its maximum price to be $75, the minimum price of $30, with the average price of $53.5.

Uniswap Price Prediction 2026

According to UNI price prediction after the mining events and bullish movement, the minimum price level can be $66, and the maximum price can be $100. In the first half, it may reach the average price of $88, and in the long term, it would reach $39. Thus, Uniswap would be the point of attraction for traders and investors to invest their money into UNI, as the DeFi sector is emerging faster than ever before.

Uniswap (UNI) Market Price Prediction

We have given below the price of Uniswap (UNI) in the coming years, as predicted by popular crypto-related platforms.

Gov.capital

They also consider its price as declining, so they believe that UNI could not be a good addition to your investment list. They predicted its future price to be $58 in a year, which is a 523% increase from its present price. This indicates that your current investment of $100 might be about $623.74 on the same day next year.

Priceprediction.net

They expect the UNI price to reach the maximum level of $14.87 by the end of 2022, and the average price can be $13.02 at that time. Their estimation for a five-year investment indicates the coin to effortlessly hit the $61.51 mark. Their special experts and business analysts predict its highest price of $419.91 by 2030, which is a high increase in its value.

Digital Coin Price

They predict the UNI price for the end of 2022 to be at least $11.05, while the minimum price was $11.77. The Maximum price might be $12.50 till December 2020. By the end of 2023, the minimum price of UNI can be $12.10. The average Uniswap trading price can be $14.35, while the Uniswap price value may also hit a maximum of $15.22. In the next five years, Uniswap’s maximum value can be about $29.11. The average price can even hit $25, with the minimum value being $17.89. They predicted the maximum price level can be $44.47 and the minimum price of Uniswap to be at least $40.47 in 2030. The average trading price may be $43.90 throughout 2030.

How to buy Uniswap

You can buy Uniswap with a cryptocurrency, like ETH or BTC. However, suppose you do not want to buy another cryptocurrency first. In that case, you can buy UNI using fiat currency, such as USD, CAD, or EUR by going through some additional supporting documents to verify your identity. It would be helpful if you followed the steps below to buy UNI on Kraken.

Step 1: Create an Account

You would need to use a valid email address to create an account with a unique username. You also need to set a strong password to secure your account.

Step 2: Select a Payment Method

Select a payment method from a bank transfer or credit card once you have given the necessary information about your identity, e.g., date of birth, location, and phone number. Their experts would require additional information for verification of your identity while using fiat money. Select a payment method depending on your location and preferences.

Step 3: Deposit Funds

With the selected payment method, fund your account with the cash needed to purchase your required amount of UNI.

Step 4: Buy UNI

You will also get advanced charting tools, 24-hour global client support, and use spot trading on margin. If all the policies of Kraken for trade with UNI satisfy you, add the amount of money you want to exchange with UNI. Confirm your purchase to buy ‘UNI’.

Frequently Asked Questions (FAQs)

Is Uniswap a good investment?

Yes, Uniswap is a very good investment, especially for the long-term, as similar decentralized financial systems are trending in crypto markets.

Can Uniswap reach $100?

Uniswap might not reach $100 very soon. If it maintains its pace and momentum, there are high chances for it to hit $100 in 2026.

Where to buy Uniswap?

You can buy Uniswap (UNI) on Kraken, Uphold, Binance, Gate.io, Coinbase, KuCoin, BitYard, and Huobi Global.

Takeaways

- Uniswap itself as an organization does not get any revenue due to its decentralized protocol and its users.

- Its users provide it with liquidity, and the fee directly goes to the liquidity providers, unlike centralized exchanges.

- It also provides its services with low transaction fees.

- Uniswap is a very good investment, especially for the long-term, as similar decentralized financial systems are trending in crypto markets.

- Due to its competent, resilient, and uniform global economy, the maximum price of Uniswap can hit $22 in 2023.

- The maximum price can be $100 in 2026.

- You can buy Uniswap with a cryptocurrency, like ETH or BTC.

- You can buy Uniswap (UNI) on Kraken, Uphold, Binance, Gate.io, Coinbase, KuCoin, BitYard, and Huobi Global.