Sushi, often known as SushiSwap, is a well-known crypto platform in the rapidly growing DeFi market. The exchange is among the first Automated Market Makers (AMMs) to return 100% of its revenues to the community that runs and supports it.

From farming and lending, this review describes how SushiSwap works. We also address pricing, services, and other topics. To discover more about SushiSwap, continue reading down below.

What Is SushiSwap?

SushiSwap is a derivative of UniSwap, one of the most prominent decentralized exchanges, and so shares the platform’s design.

SushiSwap, on the other end, is still evolving, with over 20 digital wallets supported and 14 chains supported, including the most important ones such as Ethereum and Binance Smart Chain. In addition, SushiSwap also has its own cryptocurrency, known as SUSHI, which has over 150,000 holders at the moment.

SushiSwap was developed by an individual known as Chef Nomi back in 2020. Chef Nomi abruptly left the company in September 2020, taking $14 million in Ether with him. He later handed it back and transferred control of SushiSwap to Sam Bankman-Fried.

How Does SushiSwap Work?

SushiSwap’s main purpose is to make decentralized cryptocurrency trading easier. The exchange uses Automated Market Makers to do this (AMMs). It is easy to swap tokens on the SushiSwap platform, which uses smart contracts rather than relying on a single central institution. Users also store their crypto on the platform, which can be accessed and used by traders. Trading against locked assets costs a fee, which is split evenly among all liquidity providers based on the size of their crypto contributions to the pool of available assets.

SushiSwap’s History

SushiSwap was founded around 2020 by Chef Nomi, a pen-named individual or a possible group, and another co-founder known as 0xMaki. To develop the basic components of SushiSwap, the group borrowed the open-source code used by Uniswap.

Users were enticed by the promise of SUSHI token prizes if they put money in a specific pool on Uniswap. The assets in that pool were shifted over once the programming for SushiSwap was completed.

SushiSwaps Features

SushiSwap has a wide variety of features that it offers its users; some of them are quite common among cryptocurrency exchanges, and some make SushiSwap unique.

SushiSwap Farms

Liquidity providers can contribute to SushiSwap pools and receive incentives by connecting their Ethereum digital wallet to the SushiSwap farming software and entering multiple assets inside a smart contract.

After doing so, buyers can exchange tokens inside the pool in accordance with the protocol’s requirements. In order to maintain a constant pool price, SushiSwap smart contracts collect the buyer’s tokens and return an equal amount of tokens.

In return for providing liquidity in these pools, providers receive fees and a share of the newly produced SUSHI tokens each day. Making this a win-win situation for both parties involved. Providers have full access to their funds and the crypto they’ve created through farming.

SushiSwap Staking

Just simply staking your SUSHI tokens for xSUSHI is another option to make a profit. SUSHI is provided as 0.05 percent of the charges for each swap on the exchange. Once you stake your SUSHI, you will be rewarded with xSUSHI, which may be used to vote on the community. You will also receive all of the initially donated SUSHI plus any extra costs when you decide to unstake.

SushiSwap Lending

“Kashi,” is a lending and leveraging platform that can be accessed on SushiSwap. Kashi is a lending platform that lets users earn money by lending their tokens to others, while borrowers may utilize the funds.

On Kashi, each market is maintained independently in order to isolate risk to individual markets rather than the entire process. Users can establish a leveraged position in a single transaction as a result of this. Although it is not tied directly to SushiSwap, it is a DApp that is available in conjunction with the exchange.

APIs

SushiSwap offers an API that allows you to gather liquidity from different platforms and exchange coins at the best possible price. To receive an API Key, customers must contact SushiSwap directly. For more information, check SushiSwap’s website.

BentoBox Dapps

BentoBox is basically a cryptocurrency vault for liquidity providers that offers a unique ecosystem for effectively using dapps’ gas and generating additional income.

Its customers who invest in coins get a percentage return. This is earned by paying a charge to customers who make flash loans with the liquidity in the BentoBox and using community-approved techniques towards the liquidity inside the vault.

Automated Market Makers (AMM)

SushiSwap is an AMM that has lately gained a lot of popularity. This is due to the protocols used by an AMM; they also address many of the flaws found in traditional exchanges.

AMMs use smart contracts to establish markets for any pair of tokens, unlike a centralized exchange, which depends on an order book to connect traders and determine the price. Trading liquidity among crypto-assets can be established in this modern method.

Advantages Of SushiSwap

SushiSwap’s design serves to reduce market centralization. Users can trade using liquidity pools. As a result, SushiSwap is less prone to being hacked and offers consumers greater coin selection options. Here are some benefits of choosing SushiSwap over other platforms.

Passive Income

One of the most appealing aspects of SushiSwap is that the majority of expenses are reimbursed to its users. Liquidity providers are richly rewarded for their additional services. SushiSwap is the very first AMM to return 100% of its proceeds to the community that supports and sustains it.

Support

Several DeFi platforms have given the platform high reviews. Days after the platform’s launch, a few of the world’s top major crypto exchanges adopted the platform’s coin, SUSHI. SushiSwap rapidly gained popularity as a result of this mix of marketplaces and user support.

Community Governance

SushiSwap’s community governance system gives consumers the ability to decide on any important updates and protocol modifications. Furthermore, a portion of the newly issued SUSHI is reserved for the project’s future growth. The community has the opportunity to vote on whether or not ideas are worthy of financial support.

Affordable Fees

SushiSwap’s fees are less expensive than those of major exchanges. When consumers join a liquidity pool on SushiSwap, they only have to pay a 0.30 percent fee. A minor transaction fee is also charged when you support a new token pool.

Customer Support

SushiSwap can be reached by email or social media. The exchange also has a number of forums available, which can be found on the website. These instructions can assist with detailed issues as well as learning how to use the platform and its many features.

Disadvantages of SushiSwap

SushiSwap’s only significant drawbacks at this moment are impermanent loss and being less positive on SUSHI than ETH. The systems are practically identical to most other platforms in relation to security and resource availability.

Every liquidity pool experiences impermanent loss as a trade-off for obtaining fees; as long as the fees you get surpass the profit you lose on your provided assets, the exchange is beneficial. Another potential disadvantage of SushiSwap is that the exchange is new to the industry, and it does not have a rich history or track record.

What Makes SushiSwap Unique?

The introduction of the SUSHI token was a massive breakthrough for SushiSwap. Liquidity providers are compensated with SUSHI tokens via SushiSwap. The platform differentiates from Uniswap in this regard since the tokens reward holders with a portion of transaction fees after they’ve stopped supplying liquidity.

SushiSwap addressed criticism made against Uniswap for allowing venture investors to tamper with its platform. There were also significant complaints regarding UniSwap’s governance mechanism, which lacked decentralization. Sushiswap solved Uniswap’s decentralization problems by granting governance powers to SUSHI holders.

SushiSwap vs. Uniswap

The rise of decentralized exchanges like Uniswap has created several chances for the DeFi ecosystem to grow. Nonetheless, it is early to conclude that one decentralized exchange is the best, especially since there are rivals like SushiSwap. The comparison of the two decentralized exchange systems reveals a clear picture of DeFi’s long-term status.

SushiSwap is much more commonly accessible and has equivalent yields; therefore, it may be argued that it is superior. SushiSwap is indeed a clone of Uniswap, which has a variety of features. It takes the Uniswap framework and adds a good amount of features to make it a more advanced form of Uniswap.

Both platforms use a simple algorithm to equalize exchange pairings automatically. They both function on the Ethereum network. Sushiswap essentially drained up Uniswap’s liquidity when it properly carried out a vampire attack against Uniswap.

The contrast between Uniswap and SushiSwap demonstrates how both decentralized exchanges provide different ways to profit from DeFi. Because of the additional benefits and possibilities for liquidity mining, lending, and margin trading that SushiSwap provides, it has a great success in being adopted by people. Uniswap, on the other hand, has a greater TVL and trade volume, indicating that consumers trust the platform.

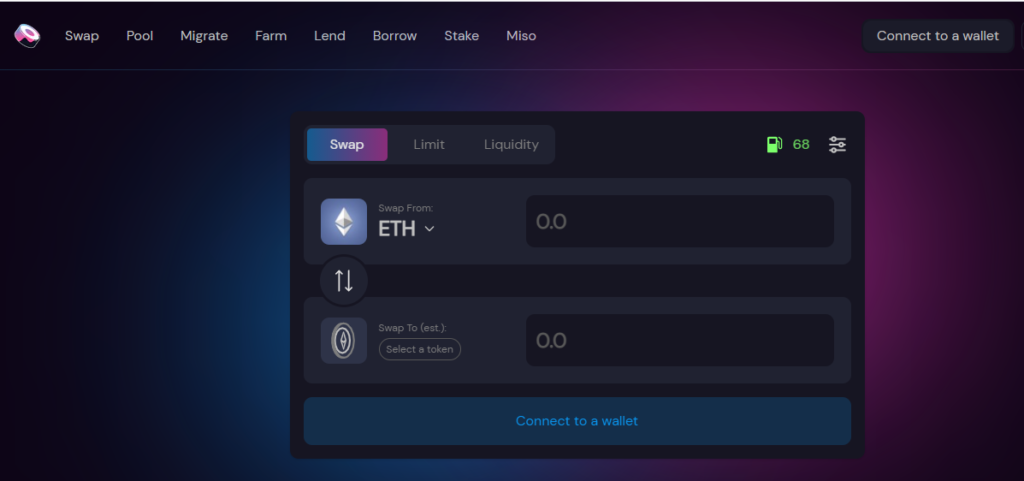

How To Swap On SushiSwap

Swapping two tokens on SushiSwap is quite simple. The first step is to go to the SushiSwap official exchange web page, where you’ll see a description box for the swap. There, you can automatically connect the wallet with the exchange.

The next step is to select the foundation token, which in our instance is ETH, as well as the token we want to swap it with.

Additionally, when inputting the sum, you may either type the amount you would like to spend on the top of the sum you want to purchase on the bottom while inputting the amount.

Frequently Asked Questions (FAQ)

Is SushiSwap Safe?

SushiSwap has still not been hacked as yet. Nevertheless, even if maintained by a respectable team of cybersecurity engineers, no cryptocurrency exchange is immune to the industry’s security worries. As a consequence, we always advise our readers to invest only as much as they can afford to lose.

How Do You Swap With SushiSwap?

You can use SushiSwap to swap any cryptocurrency you want by navigating to the Trade page and choosing the 2 tokens you wish to swap. Choose the required amount and verify the transaction using your digital wallet.

Is SushiSwap better than Uniswap?

Whether SushiSwap is superior or not compared to Uniswap depends on your intentions. Both offer liquidity pools, with Uniswap charging 0.05 percent extra. SushiSwap is more widely available and has similar yields; therefore, it could be considered that it is superior. But at the end of the day, it totally depends on the user’s goals.

How To Store SUSHI?

SUSHI is a token that may be stored in any digital wallet that supports the ERC-20 protocol. Many individuals use MetaMask.

What is SushiSwap Used For?

SushiSwap is an Ethereum-based platform that aims to persuade a group of users to create a platform where they may buy and trade crypto assets. SushiSwap achieves this purpose using a set of liquidity pools comparable to other major crypto exchanges.

How To Earn Money In SushiSwap?

SushiSwap lets users participate in various liquidity pools and get rewards in SUSHI tokens. Even when they quit actively engaging in the supply of liquidity, users will keep earning a share of the protocol fees in SUSHI.

The network is now set up to split the 0.3 percent profit across all transaction costs between liquidity providers. The remainder, 0.05 percent, is transformed to SUSHI and delivered to token holders, whereas the current providers will earn 0.25 percent.

Takeaways

- Sushi, often known as SushiSwap, is a popular crypto platform in the fast-expanding DeFi market.

- SushiSwap is a clone of UniSwap, one of the most well-known decentralized exchanges, and thus shares its similar design.

- SushiSwap, a decentralized cryptocurrency network, was created in 2020 by an individual or group known as Chef Nomi.

- SushiSwap’s major goal is to make decentralized cryptocurrency trading easier; to do this, the exchange employs Automated Market Makers (AMMs).

- SushiSwap’s only major disadvantages right now are impermanent loss and being less bullish on SUSHI than ETH.

- The fact that SushiSwap reimburses the majority of its users’ spending is one of its most appealing features to users.

- SUSHI is a token that can be stored in any digital wallet that supports the ERC-20 protocol.

- The difference between Uniswap and SushiSwap shows how both decentralized exchanges provide different ways to profit from DeFi.

- SushiSwap is much more commonly accessible and has equivalent yields; therefore, it can be argued that it is superior compared to UniSwap.