A guide to gas fees

Gas Fees are referred to as the fee users pay in order to complete a transaction or execute a contract on the Ethereum blockchain platform. The gas is used to distribute resources of the Ethereum virtual machine (EVM) so that decentralized applications such as smart contracts can be implemented in a stable yet decentralized matter. It is priced in small fractions of the cryptocurrency ether (ETH), commonly referred to as gwei and sometimes also called nanoeth.

How are Gas Fees Determined?

The price is set depending on the supply and demand between network miners and network users looking for computing capacity. If the gas price falls below their threshold, they may refuse to process a transaction. Since Ethereum is one of the most widely used blockchains, gas costs can often be quite high. The Ethereum network has so much activity all time that gas fees grow with each increase in demand when all the blocks are full.

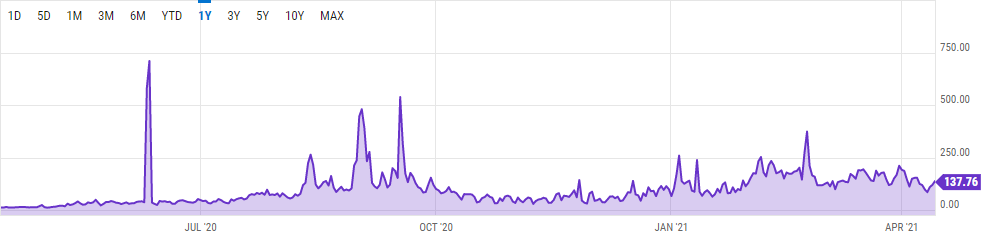

Although they’re not necessarily always high, they have soared to absurdly high heights in the past. For example, in the 2017 ICO boom and the DeFi summer of 2020, the demand for Ethereum and the number of ventures in the room skyrocketed, resulting in the clogging of the network.

Yes, gas prices can be expensive in many ways. On the bright side, however, rising gas fees imply that Ethereum and the decentralized apps (DApps) developed on top of it have real-world applications and are being used to an advantage.

How do Gas Fees Work?

Gas fees were created as a concept in order to establish a separate value source that represented the amount of gas needed to cover computing costs on the Ethereum network. This extra layer of value uses a different unit for the purpose of differentiating between the cryptocurrency’s real value (ETH) and the computing expense of using the network. It’s important to note that the term “gas” refers to Ethereum network transaction costs and not oil.

Users pay gas fees to compensate for the computational power used to process and verify transactions on the Ethereum blockchain. There’s a cap placed on the maximum amount of petrol (or energy) you’re able to expend on a purchase, this is referred to as a “gas cap.” The higher the gas cap, the more effort you’ll have to put in in order to complete an ETH purchase or smart contract deal.

Let’s put it into perspective. Sending X amount of money from your bank account to your friend’s bank account may cost Y in transfer fees. Or if you were to drive your car in X miles from one place to another, it may cost Y in gallons of gas. With this analogy, X represents the utility value, whereas Y represents the expense of carrying out the bank transfer or the car trip.

When we talk about Ethereum gas fees, a contract or exchange on Ethereum might be worth 25 ETH, the utility value. The gas price to process it at the time might be 1/100,000 ETH, which is the expense in this case.

In exchange for their cryptographic resources, Ethereum miners are paid a premium that covers all of the essential tasks of verifying and handling transactions on the network. Miners may sometimes choose to skip those purchases if the gas price cap is set too tight. Because of this, the price of gas (priced in ETH) fluctuates with the availability and demand for refining power.

Takeaways

- Gas Fees are referred to as the fee users pay in order to complete a transaction or execute a contract on the Ethereum blockchain platform.

- The price is set depending on the supply and demand between network miners and network users looking for computing capacity.

- Since Ethereum is one of the most widely used blockchains, gas costs can often be quite high.

- Gas fees were created as a concept in order to establish a separate value source with a different unit.

- The higher the gas cap, the more effort you’ll have to put in in order to complete an ETH or smart contract deal.