ELON Technical Analysis – February 2022

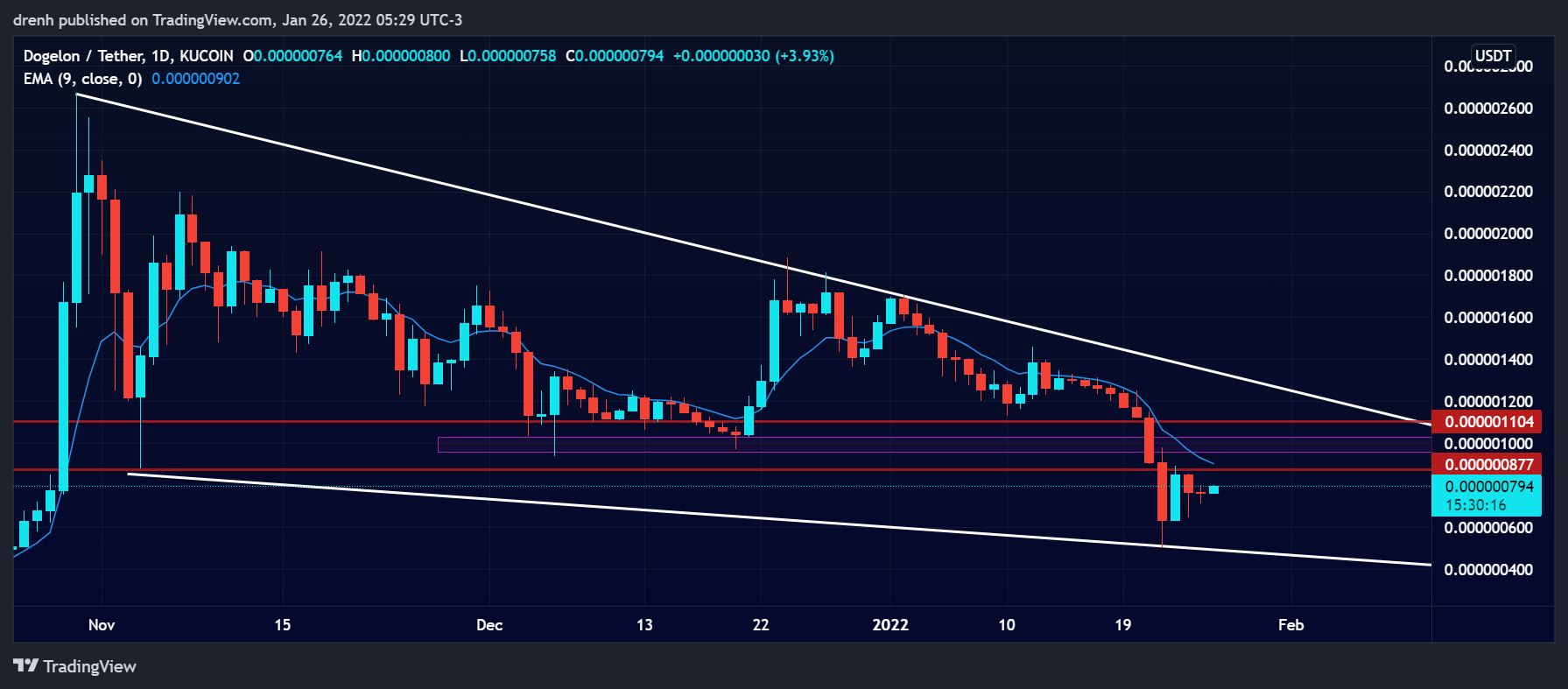

Over the past few weeks, the price of ELON has been overall bearish. The price has declined by around 80% ever since it hit an all-time high at $0.0000026. In the last few days of 2021, ELON had another surge in the price of around 100%, indicating a trend reversal. Nonetheless, the price encountered resistance at $0.0000019, forming a double top, and going further down.

Since ELON is currently in a downtrend, we could expect the price to keep declining in the coming days. It has declined by around 70% in January of 2022 alone. Nonetheless, it has recently found support at $0.0000005. Because of that, the price is currently having a bullish impulse, but t may soon face resistance once again in the coming days. There is also a lot of fear in the fear and greed index for ELON. However, extreme fear often leads to reversals.

Key Structures

Support

- $0.00000051

Resistance

- $0.000001

Indicators

Moving Average

The 20-MA of a 1-day chart is quite above the current price of ELON. This suggests that ELON is in a downtrend and that the price could keep declining, other things equal.

The 9-EMA of a 1-day chart is also currently above the price of ELON, indicating that the trend is bearish in the short run and that the price could keep declining in the coming days. The EMA line could also act as resistance if the price triest to have another go upward.

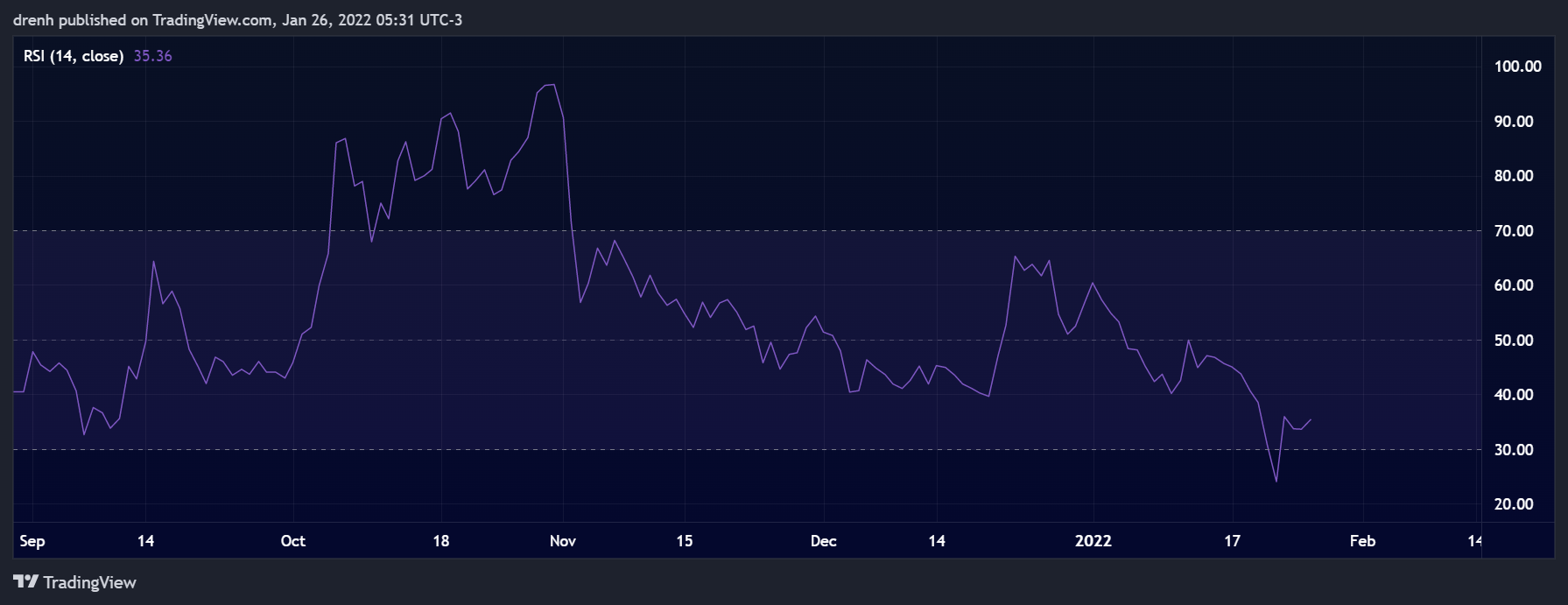

Relative Strength Index

The RSI of a 1-day chart recently hit below 30. This indicated that ELON became oversold. Hence, the price has recently increased in the last few days. Nonetheless, the RSI suggests that ELON is quite bearish, but there is also plenty of room for growth.

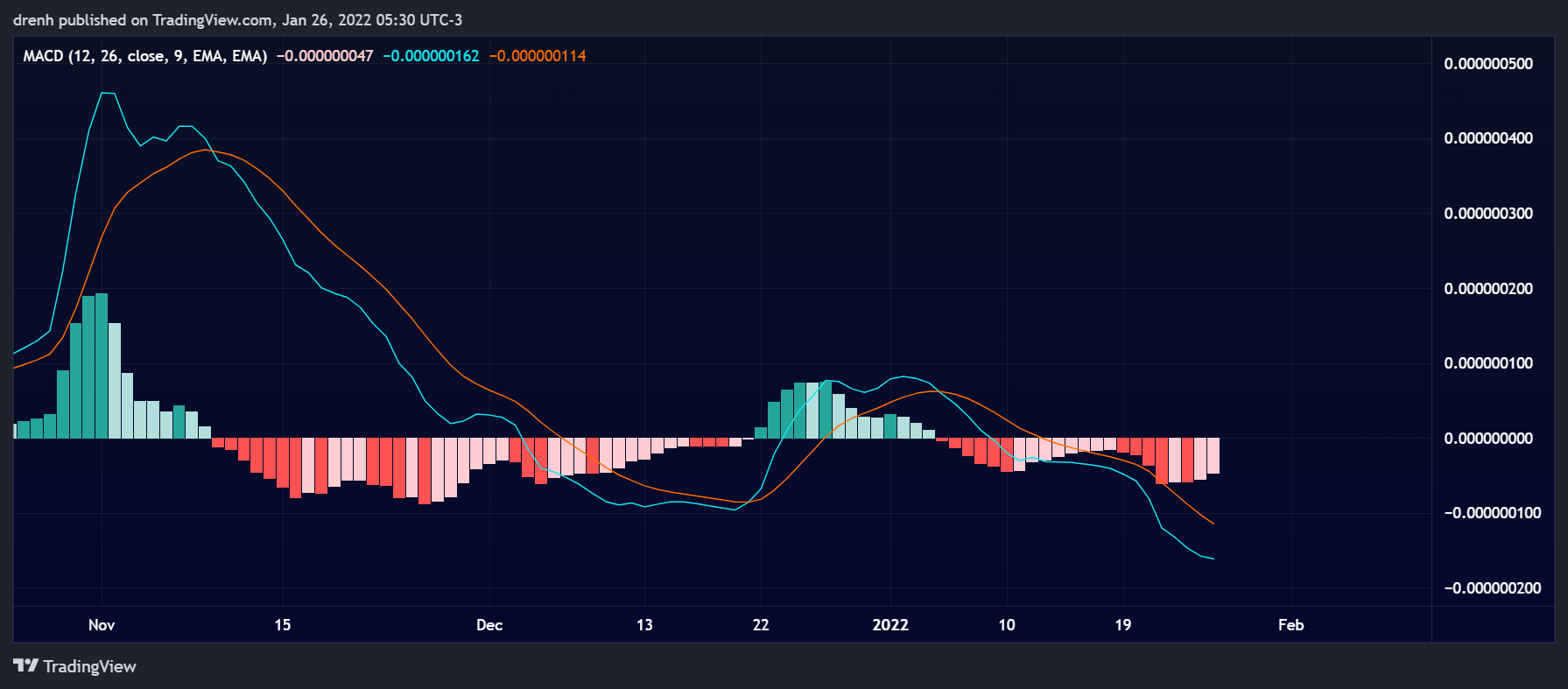

MACD

The MACD of a 1-day chart is below the signal line and below the baseline. Judging by this indicator, the momentum is bearish for ELON and the price could decrease in the coming days. Due to the recent correction of the price, the lines have slightly converged, but ELON remains bearish in the short run.

Fibonacci

The Fibonacci retracement levels of a 1-day chart suggest that the price is currently increasing and retracing. Other things equal, ELONcould face resistance at around the 38.2% level, but the 61.8% could also prove to be a strong structure. Hence, for ELON to reverse, breaking these two structures is essential in the coming days.

Price Prediction ELON – February 2022

Based on this technical analysis on Dogelon Mars (ELON), the price of ELON could slightly increase in the shorter run. However, it could be stopped at around $0.00000096. After that, the price could go further down to around $0.0000003. Nonetheless, if ELON breaks our projected resistance, then the price could as well go to around $0.0000015 once again in the coming days. Nonetheless, ELON remains bearish entering February, other things equal.

Latest News for ELON – Affecting Price

Recently, there has been plenty of Twitter exchanges between the likes of Elon Musk, one of the most influential people in the crypto market, and McDonald’s one of the biggest fast-food companies in the world.

Musk, who is a long known supporter of Dogecoin, publicly stated that he would be willing to have a McDonald’s happy meal on TV if McDonald’s would accept payments in DOGE. This created a lot of stirring for DOGE and all the other memecoins, including Dogelon Mars, whose name comprises both DOGE and Elon.

McDonald’s then replied that they would be willing to do that if Elon Musk’s Tesla would accept payments in GrimaceCoin, which was just launched, presumably by McDonald’s.

only if @tesla accepts grimacecoin https://t.co/CQrmAFelHR pic.twitter.com/to9HmYJhej

— McDonald’s (@McDonalds) January 25, 2022

Grimace then experienced a 100x increase within hours of launching, hinting at the influence that both Elon and McDonald’s could have in the crypto market.

McDonalds pulled up to crypto Twitter and dropped a 100x 💀 pic.twitter.com/3JEV1UYkqA

— The Chairman (@WSBChairman) January 26, 2022

Therefore, despite the bearish tendency that ELON currently has, the trend could easily reverse if the likes of DOGE keep getting this kind of exposure in social media. If the trend reverses, then ELON could easily enter in the top 100 rankings once again considering the momentum it can build.