Bitcoin has joined the market over 14 years ago. Until today, this cryptocurrency has brought unprecedent returns to retail and institutional investors. Throughout the years, new projects joined Bitcoin and a whole new industry was created. Despite over 20,000 crypto projects joining the market, Bitcoin still stands firm as the sole king of this industry. The crypto industry has come a long way, but what has changed? Does this industry still hold the same principles as it did back in 2008?

There is a lot to discuss on what has and has not changed when it comes to Bitcoin and the crypto market. Nevertheless, one thing that has yet to change is the potential of Bitcoin, its uses, and its potential returns for investors. With institutional investors joining the market, new goals have been set for Bitcoin’s price. During the past few months, giants like Blackrock and Fidelity Investments have applied for Bitcoin ETFs. Today, we will discuss on the potential impact of such an ETF on the overall market.

The Basics: What is a Bitcoin ETF and Why Does It Matter?

You may be thinking, if Bitcoin has been performing superbly in over 10 years, why is a Bitcoin ETF necessary. Well, the answer is simplicity. It may not seem as important, but simplicity is one of the main reasons why everything you know today exists. To better explain the industry with and without a Bitcoin ETF, we asked AI to give us an analogy on the situation. Here is the response:

Think of the crypto market as a bustling farmer’s market, filled with a variety of produce and vendors. Bitcoin is like the premium organic apple stand that everyone’s curious about but not everyone feels comfortable buying from directly.

The market without a Bitcoin ETF: It’s like having to buy these premium apples only from the farmer himself, who requires you to understand apple varieties, growing conditions, and even asks for special payment methods. While this might appeal to apple enthusiasts, it can be a barrier for the average consumer who just wants an apple without the complications.

The market with a Bitcoin ETF: Imagine now there’s a new vendor at the farmer’s market who sells pre-packaged, assorted fruit baskets that include these premium apples. This vendor accepts all payment types and you don’t need to be an apple expert to enjoy one. With this easy new option, the number of people getting access to the prized apples— or in this case, Bitcoin—skyrockets, as it’s now effortlessly available to the masses, boosting overall sales at the market.

OpenAI’s ChatGPT

In our case, Bitcoin will be accessible by millions of new investors; big and small; institutional and retail. Blackrock and Fidelity Investments together manage around $20 trillion yearly. To put this number into perspective, Bitcoin’s all-time high market capitalization stands at around $1.2 trillion. These statements do not claim that all of the assets under management or the above-mentioned giants will go directly to Bitcoin, however, a Bitcoin ETF would serve as a link between the investors and Bitcoin.

The Arrival of the First Major Bitcoin ETF: A Milestone Moment in Cryptocurrency

One of the biggest misconceptions on the market right now is the difference between current Bitcoin ETFs and spot Bitcoin ETFs. There are several active and approved Bitcoin ETFs in the market right now, with one of the biggest being the ProShares Bitcoin Strategy ETF, a future-based ETF. While these ETFs serve their purpose, they are totally different from spot Bitcoin ETFs. The main reason for this being is that spot Bitcoin ETFs track the spot price of Bitcoin directly while future-based (the existing) Bitcoin ETFs do not.

The arrival of a spot Bitcoin ETF, especially through a giant like Blackrock, would change the way investors, governments, and institutions look at Bitcoin forever. This would be the biggest turning-point for Bitcoin – one that would be remembered in history. So, based on what was said until now, a spot Bitcoin ETF would drastically increase Bitcoin’s credibility and accessibility. With these two, history has shown us that something else increases – and that is demand. With Bitcoin having a capped supply and its price being based on the law of supply and demand, with demand increasing, the price is set to increase as well. On that note, some experts are expecting Bitcoin to hit a staggering price of $1 million by the end of the decade.

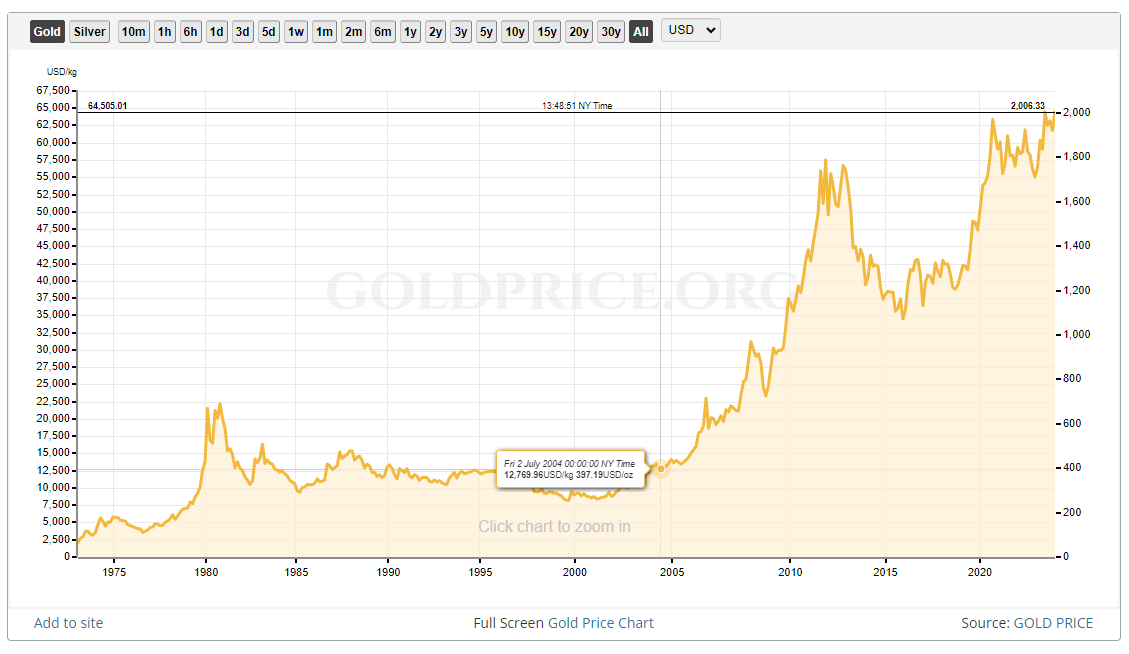

One way to portray the impact of a spot ETF on a market is to show the chart of gold’s price before and after the first ETF was accepted. The first gold ETF in the United States was accepted on 2004. At that time, gold was trading at a price of ~$400. Today, gold is trading at over $2,000, marking an increase of over 350%.

Also Read: Bitcoin vs. Gold: Evaluating Modern and Traditional Inflation Hedges

Price Momentum: How Bitcoin ETFs Could Fuel a New Bull Run

These past couple of months have been crucial for the cryptocurrency market, especially Bitcoin. That is because Q4 of 2023 marks the “beginning of the end” of the recovery phase of the market. With the Bitcoin halving around the corner, everyone in the market is hyped up and that is directly reflected on the charts. On 1 January 2023, Bitcoin was trading at a price of ~$16,500. At the time of writing, Bitcoin is trading at a price of ~$34,400, marking a double in price. On other terms, the YTD returns of Bitcoin for 2023 currently stand at +108%.

There are three main cycles Bitcoin undergoes every 4 years. The first one is the bull cycle: this one lasts around 2 years and is characterized by huge returns and market prosperity. The second one is the bear cycle: this cycle lasts around 1 year and is distinguished by fear, instability, and doubt. After the bear cycle, the market always experiences a recovery cycle: this one is characterized by hope and mixed investor sentiment. When these three come together, we get a full cycle of the market; one that the crypto market undergoes every four years.

To visualize this, Bitcoin’s last bull cycle lasted from the 2020 halving until early 2022. After that, the market experienced a devastating bear cycle until early 2023. From the first quarter of 2023, the market entered the recovery phase, with Bitcoin and the whole market slowly recovering. This led to Bitcoin reaching a price above $34,000.

2024: The Year of Bitcoin

If a spot Bitcoin ETF is to be approved, it is likely to happen during the first or second quarter of 2024. This is because BlackRock applied for a spot Bitcoin ETF back in June and the SEC takes around 8 months to give a definite answer on ETF applications. If the answer for a spot Bitcoin ETF is positive, it could potentially trigger growth in the market. Around that time, the next Bitcoin halving is set to occur. This is likely to have a drastic effect on the market, leading to a next bull run.

Market Stability: Can the First Bitcoin ETF Tame Bitcoin’s Volatility?

One of the main reasons behind Bitcoin’s volatility is its low market capitalization. Bitcoin’s market cap allows big players to affect the market easily when compared to bigger markets like gold. Because Bitcoin is still unregulated, it makes it even easier for such price manipulation. Nevertheless, since a Bitcoin ETF increases exposure for Bitcoin, it could also mean that the market cap of this cryptocurrency grows bigger. This would make the price harder to manipulate. Again, if we check gold’s volatility before and after the ETF, we can come to the same conclusion. These two “assets” are not the same because they exist in different timelines. Nonetheless, they share many similarities and that could help us get a better idea on how a US spot Bitcoin ETF would affect the market.