The cryptocurrency market experienced its peak in the last quarter of 2021. After that, economists and other financial experts started to see the real potential of this industry, as even the opponents of cryptocurrencies acknowledged its impact on the world’s economy.

But as with every good deed in life, the bull run of 2021 came to an end as the year ended. The ones that invested early reaped what they sowed and earned a lot in terms of fiat. Other economic factors, including the war between Russia and Ukraine, started negatively impacting all financial markets, including cryptocurrencies. With that in mind, people needed more money at their disposal as a precaution. As of the end of the third quarter of 2022, Bitcoin and other altcoins are in a downtrend, which could last for quite a while as far as history is concerned. Whether this bear run will lead to an even bigger bull run afterward, we are going to find out soon.

Hence, this article explains some reasons why BTC is unlikely to recover any time soon, but when it does, it is likely to lead to unexplored highs in terms of its price.

Current State of the Crypto Market

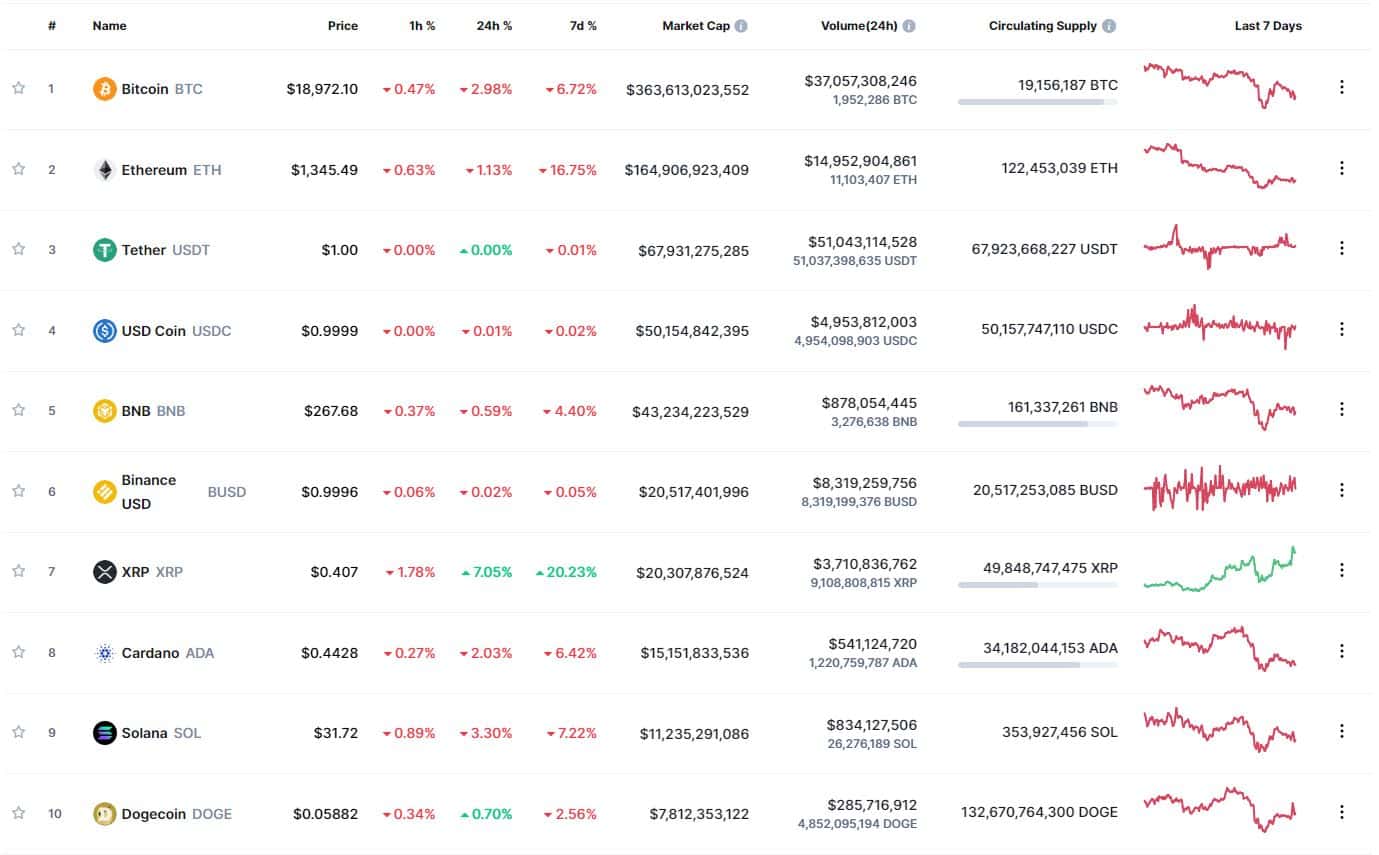

At the time of writing, Bitcoin still remains the leading cryptocurrency, with a price of around $18,500 and a market cap of $350 billion. Ethereum falls second with a price of $1,300, and stablecoins like Tether and USD Coin follow. Despite being the only meme-influenced coin in the list, Dogecoin still remains in the top 10 rankings, thanks to its support from Elon Musk.

With the market being in a downtrend, the likelihood that the price of the likes of BTC may decline is still high. Looking at the weekly chart of BTC, the price of BTC found support at around $18,000. If BTC goes below that, the price could decrease in the coming weeks/months.

With that in mind, if BTC does decline, it could go as low as $10,000, where it could find natural support. It is worth noting that this decline might not be quick; instead, it would be accompanied by numerous corrective ways until it gets there. This is because of the already oversold nature of BTC in the weekly chart.

Bitcoin as the Leader of all Cryptocurrencies

We often speak about how the price of one cryptocurrency is affected by its competitors. To illustrate, aggravation in the ecosystem of one of the “Ethereum Killers” directly can influence the price of ETH positively. That is not necessarily the case for Bitcoin, the world’s leading cryptocurrency. Bitcoin is influenced by Bitcoin, as simple as that. Many experts suggest that Ethereum may one day surpass BTC, especially now due to Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Moreover, it is obvious that Ethereum has much more use cases than Bitcoin.

Nonetheless, Bitcoin remains the first of its kind and has the biggest share in the market, which is enough to convince institutional investors to invest in BTC. Moreover, many well-known companies have adopted its use, and many others are planning to do the same. Even countries have adopted BTC as a legal tender. El Salvador is one example. As radical and risky as that decision might have been, it clearly shows the approach many people are willing to take on cryptocurrencies, particularly Bitcoin.

So in terms of altcoins surpassing BTC, it is quite hard to believe at the moment. Yes, BTC may not offer as much utility as the rest, but it remains the leader in a trillion-dollar industry, such as the cryptocurrency market.

Bitcoin Halving Explained

When speaking of Bitcoin and its price, it is essential to keep in mind the halving events that occur roughly every four years. Initially, each BTC block that was mined rewarded 50 new BTC. After the first BTC halving in 2012, each BTC block generated 25 BTC instead of 50. Four years later, after the BTC halving, only 12.5 BTC were mined with each block. Lastly, the latest halving that happened in 2020 lowered the mining rate to 6.25 BTC per block.

With this train of thinking, the next halving is going to lower the mining capacity to 3.125 BTC for each verified transaction. As of September 2022, the circulating supply of 19.1 million BTC. Therefore, the maximum supply that BTC will have is 21 million BTC. With BTC halving in mind and the fact that a block of transactions is verified every 10 minutes, Bitcoin is going to reach its maximum supply by 2140.

So why is this information relevant when talking about the price of Bitcoin? Well, the price of each good and service that we use is derived from the natural supply and demand factors.

The BTC halving has a direct impact on the supply of Bitcoin. As the mining reward is lowered every four years, the demand for BTC goes up to meet the new equilibrium. Hence, every BTC halving tends to lead to a bull run in the crypto market, given that the price of BTC affects all other cryptocurrencies.

Important Historical Turning Points

To prove the point, history shows that after each BTC halving, the price of BTC experienced increases, leading to bull runs in the crypto market.

For instance, in the first halving in 2012, BTC was less than $10. The bull run slowly started in the last months of the year, and it entered 2013 at around $13. Throughout the year, the price of BTC fluctuated, but it managed to eventually break $100 for the first time in its history. By the end of the year, BTC reached a new high and went past $1,000, which was back then a historical milestone for Bitcoin and the crypto market.

Nonetheless, after the bull run, it declined again. After a few years of price fluctuations, BTC had another halving in 2016. The price was less than $1,000. As expected by BTC proponents, a new bull run began with the new year. This bull run saw BTC reaching even higher highs, reaching $2,000 in May. The last quarter of 2017 saw BTC reach as high as $19,000. This bull run was a key point in terms of investors finally realizing Bitcoin’s potential as an investment.

The following years were of the same pattern, with the price stalling at times and fluctuating largely during turning points in the world’s economy. Surprisingly for some, that was not the case for the COVID-19 pandemic, which saw BTC increase even more. Midway through the year, BTC had its latest halving, which sparked the biggest bull runs in the market.

2021 & Beyond

Because of that, since its creation, 2021 has been the biggest year for cryptocurrencies. Not only BTC, but the majority of altcoins reached highs that were never expected before, including the likes of Dogecoin and Shiba Inu. As for Bitcoin, it reached an all-time high of around $69,000, surpassing $1 trillion in market cap all alone.

As expected by many, the price of BTC started declining after November of 2022. Currently, BTC resides below $20,000, and it may continue to fluctuate in the coming months until the next halving. At least, that’s what history suggests.

Here’s an illustration of how the price of BTC moved after each halving:

Other Bitcoin Price Factors

But taking into account only the supply of BTC and Bitcoin halvings is wrong. A plethora of factors plays a role in the price of cryptocurrencies.

Other Altcoins

While it was implied that other altcoins do not necessarily impact BTC, it is impacted by investors who invest in those altcoins. Simply put, if people lose trust in other altcoins, they may lose faith in Bitcoin too. This is important to understand, especially after the horrific outcome from the Terra Luna ecosystem and the UST stablecoin. When even a stablecoin was depegged, how can investors trust highly volatile currencies such as Bitcoin? These are the kind of questions to keep in mind since the fall of Terra Luna affected the whole market, including Bitcoin.

Moreover, putting away the possibility that Ethereum may not surpass Bitcoin after a while is wrong. While it may not be possible now, taking Bitcoin’s market share is quite possible, especially with the Serenity update.

Mass Adoption

For many people, crypto mass adoption is inevitable. We have already seen the use cases of many cryptocurrencies, especially the ones that use smart contracts. Supply chain management, databases, transactions, financial services, gaming, entertainment, and hundreds of other services are now available in a decentralized manner because of blockchain. Hundreds of companies have already integrated cryptocurrencies into their businesses. With Bitcoin as the leading cryptocurrency, it is likely to be further adopted in many other countries and major businesses. This, in turn, increases the demand for BTC, further increasing its price, other things equal.

Legal & Political Factors

While mass adoption positively affects the crypto market, banning cryptocurrencies may have the opposite effect. Some countries have already taken that stance toward cryptocurrencies. One worth mentioning is China. Others may have taken less severe measures, such as banning crypto mining due to the presumable negative effects on the environment. Moreover, political tensions between countries alone can cause panic. As suggested in the intro of this article, the tensions between Russia and Ukraine affected all spheres of the global economy, including cryptocurrencies.

Fiat Currencies

There is an abundance of factors that affect both fiat currencies and cryptocurrencies. Usually, we speak of the price of a cryptocurrency in relation to a fiat currency such as dollars. A dollar depreciation automatically means an appreciation for Bitcoin if we look at the BTC/USD chart.

Since we still use fiat to compare the prices of cryptocurrencies, commodities, goods, and services, it is hard to comprehend an environment where cryptocurrencies serve as media of exchange, stores of value, units of account, and lucrative investments at the same time.

Some believe that if mass adoption is to take place, we might not have fiat currencies after all, whereas BTC might be the unit of account for all the goods and other altcoins. This was, after all, the key goal of Bitcoin as described in its whitepaper: not to rely on central authorities such as central banks when it comes to the money supply; not to rely on commercial banks when it comes to borrowing/lending, etc. However, for now, that remains a hypothetical situation.

As of now, cryptocurrencies and fiat are largely related. And because of that, the least we can do is assume that fiat still plays a huge role in the outcome of cryptocurrencies because the latter is still perceived as an investment rather than as a means of payment on a daily.

Other External Factors

Besides the hundreds of economic factors that can influence cryptocurrencies, such as Bitcoin, changes in the Federal Funds rate, inflation, fiscal policies, interest rates, etc., have done the trick in the past too. In addition, outcomes in the stock market or other financial markets also affect Bitcoin directly.

What Next for Bitcoin and Other Cryptocurrencies?

So what’s next for cryptocurrencies? The main excitement about this industry is its unpredictability. Hence, Bitcoin and its descendants remain highly volatile. Generally speaking, when looking at history and the vast price factors, we might not see a recovery in the market as of now. Surely, there may be corrective ways that could suggest trend reversals, but until the next BTC halving, the likes of BTC may stall in terms of huge changes in the price.

What to Expect in the Next BTC Halving?

As for the next BTC halving, we at Crypto Academy predict that it is going to have a similar effect on the overall market. Increased difficulty in the mining rate lowering the supply increase could spike the demand for BTC by the last quarter of 2024. Hence, we predict one of the biggest bull runs in the crypto market to occur throughout 2025.

Will Bitcoin Reach $200,000?

Judging by the percentage increase in the previous bull runs, a price of $200,000 is quite reachable for BTC. Of course, that would mean a market capitalization of almost $4 trillion in Bitcoin alone, but that’s what you expect with mass adoption. So it would not be surprising if BTC goes beyond that by the last quarter of 2025.

Frequently Asked Questions (FAQ)

How many halvings will Bitcoin have?

Bitcoin will have halvings roughly every four years until the year 2140 when it reaches its maximum supply.

When is the 2024 Bitcoin halving?

The next BTC halving is supposed to occur at some point between March and May of 2024.

What was the price of 1 Bitcoin in 2009?

In its creation, Bitcoin was almost $0.

What will BTC be worth in 2030?

Considering all the price factors of BTC, some believe that BTC may hit $1,000,000 by 2030.

Takeaways

- After BTC reached its all-time high, the crypto market has been in a downtrend.

- Bitcoin is currently trading below $20,000.

- Bitcoin halving occurs every four years.

- The next BTC halving will occur midway through 2024.

- History suggests that Bitcoin halvings have a huge impact on the price of BTC.

- Other price factors include other altcoins, mass adoption, outcomes in other financial markets, politics, etc.

- It is expected that BTC may not recover in terms of price until the next halving.

- Bitcoin may surpass $200,000 by 2025 after the next halving.