Update: December 04, 2021 – Algorand continues to be one of the most serious projects in the crypto sphere. Crypto analysts believe that Algorand may continue increasing in price in the upcoming weeks and months.

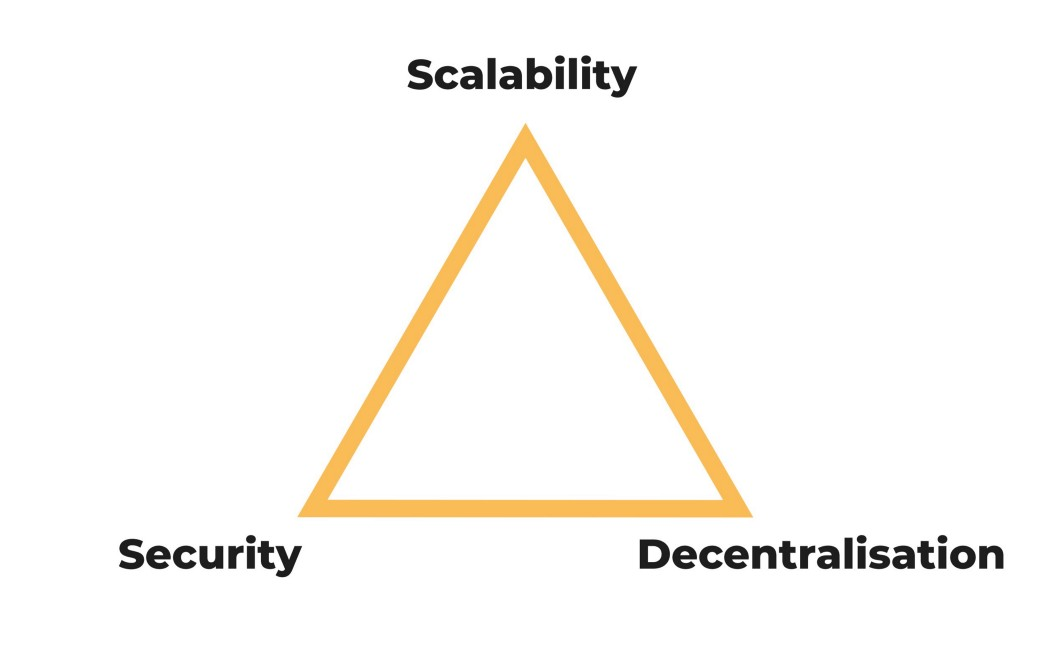

The crypto market is expanding each day as more cryptocurrencies are being launched. Each new cryptocurrency has a distinct purpose. Some may offer better, cheaper, faster, or safer services. Others may simply offer something that has not been yet offered by others. But not one cryptocurrency is perfect. Blockchain-based cryptocurrencies have a trilemma among three key components of cryptocurrencies, which are scalability, security, and decentralization. This trilemma exists because a cryptocurrency can’t excel in each of them, but they can only be placed somewhere within the trilemma triangle. They might focus only on one or perhaps focus moderately on each of them at smaller scales.

To fix this issue, many developers were looking at ways on how a blockchain can solve all the existing problems in the market, namely those of scalability, security, and decentralization. In this way, Algorand (ALDO) was formed.

Fundamental Analysis Of Algorand

Algorand is a relatively new cryptocurrency that aims to resolve the blockchain trilemma in the best possible way. As a cryptocurrency, ALDO has been a smart investment for many traders.

Algorand was created by Silvio Micali, an expert in the field of cryptography, who is also a professor at the Massachusetts Institute of Technology (MIT). Believe it or not, Micali is one of the first people involved with blockchain projects, being active in the field of cryptography for more than 30 years. His previous work was a stepping stone for projects such as Cardano. Judging by this incredible resume, Algorand had sufficient expertise for developing the project that it is today.

The work for Algorand started sometime during 2015, but the project was officially founded in 2017. In 2019, the Algorand mainnet was finally launched. The funding for the project was raised through an initial coin offering (ICO).

So how does Algorand attempt to solve the blockchain trilemma? There are numerous features in the Algorand network that co-work into achieving that perfect balance.

The first one is the consensus mechanism of Algorand. It uses a Pure Proof-of-Stake (PPoS) mechanism, which has proved to be more efficient than Proof-of-Work (PoW), the mechanism that Bitcoin uses. In PoS networks, mining does not require powerful mining rigs that are costly in both the technological and energy aspects. Instead, PoS requires that users stake their tokens. Staking is the process of locking up your tokens so that the network can use them to secure itself. After the staking period is over, you receive your staked tokens back together with additional tokens as a reward. The more you stake, the more you can be rewarded. Moreover, the more you stake, the more votes belong to you during network decisions.

Another feature of Algorand is that it uses the Byzantine Agreement protocol. This protocol tolerates corrupted or malicious nodes to participate in the network safely. If a leading node is ‘honest’, a consensus is achieved immediately. If the leader is malicious, the consensus process has several other steps that need to ensure security. Only private keys need to be held by users. This helps the network to avoid harmful activity if the address of a user is made known to others.

Algorand also uses Verifiable Random Function (VRF) for consensus purposes. This feature alerts the participants every time a new block is added to the blockchain. Nodes use VRF operations for proving the blocks. Anyone who wants to be involved in this process can do so for low energy costs. The purpose of VRF is to make users decide for themselves on whether they want to be involved in the consensus protocol or not, and it also serves as proof to the network for the staked tokens that a user earns.

The next feature of Algorand is its speed. All transactions are instantly completed and cannot be changed. There can be as many as 1,000 transactions per second in the Algorand network. All this scalability is achieved while still maintaining decentralization since no entity controls any of the operations within the network.

The addition of new nodes would not slow or congest the network in terms of securing the network due to all these reasons.

Algorand also uses smart contracts and provides a medium for launching and creating decentralized applications (DApps) within the network, including the Decentralized Finance (DeFi) sector.

Now let’s look at the tokenomics of Algorand. The native token of Algorand is ALGO. This token is used for transactions within the Algorand network. There is a limited max supply of 10 Billion ALGO, with 3.08 Billion already in circulation (31% of the supply).

Rank: 67

If you want to trade ALGO tokens at one point in your life, you should use a safe and trusted cryptocurrency exchange that offers good services. Since Algorand has made a name for itself from the moment that it was launched, it was immediately added to some of the world’s biggest cryptocurrency exchanges. Some of these exchanges are Coinbase, Binance, OKEx, Kraken, Huobi, etc.

After purchasing your ALGO tokens, you need to store them in a safe cryptocurrency wallet to avoid the chance of someone accessing your account and stealing your assets. There are plenty of wallets that support the ALGO token. The best software wallets are MyALGO Wallet (a wallet designated for ALGO tokens), Algorand Core Wallet (mobile wallet designated for ALGO tokens), Atomic Wallet, Coinomi Wallet, Exodus, etc. The best hardware wallet for Algorand as of June 2021 is the Ledger.

Algorand Price Prediction 2021

Since Algorand has not exceeded its initial price, there is a lot of growth potential in the price of ALGO. Società Italiana degli Autori ed Editori (SIAE), management of author’s rights organization (a legal monopoly), has recently launched 4 million NFTs in the Algorand network. With around 100,000 authors involved in this work, the NFT marketplaces in the Algorand network have been enriched with incredible works of art that can be rather lucrative for investors. With the future revolving around NFTs, this has been an incredible addition for Algorand, which can drive the demand for ALGO tokens even higher. This is likely to increase the price of Algorand in 2021. Moreover, if the price of BTC increases again this year, an increase in the price of other cryptocurrencies is inevitable. Because of this, it is predicted that the price of ALGO can go to $5 in the following months, exceeding the highest of all time.

Algorand Price Prediction 2022

As for 2022, the price of ALGO is expected to keep increasing for several reasons. First, the supply of Algorand is decreasing. The second reason might be Algorands implementation in several companies and other countries since it has been in the top 50 ranks for quite some time now, which can increase the demand for ALGO tokens. Other things equal, Algorand can go up to $10 in 2022.

Price Prediction For The Next 5 Years

Cryptocurrencies, in general, are going to be even more important in the next five years since they are viewed as the future of the internet and finance. The likes of Algorand are the pillars of blockchain technology with all the features that they offer. Furthermore, Algorand is one of the very few cryptocurrencies that provide a solution to the blockchain trilemma of scalability, decentralization, and security. Once other institutional investors realize this, they may choose Algorand instead of its competitors because good scalability, full decentralization, and high security are difficult to achieve and rarely coexist. Moreover, the BTC halving of 2024 is most likely to cause another bullish run in 2025, where the likes of Algorand are probably going to be affected as well. Due to these reasons, the price of ALGO can go as high as $25 in the next five years.

Algorand Market Prediction

Wallet Investor

WalletInvestor predicts a steady increase in the price of ALGO in both the short run and the long run. Within 12 months, ALGO is likely to exceed its all-time high and reach at least $3.

As for the longer term, the price of ALGO is predicted to go from around $12 to $13 in the next five years according to WalletInvestor.

Previsioni Bitcoin

PrevisioniBitcoin also predicts an increase in the price of ALGO in the following months of 2021. They predict that ALGO is likely to surpass its highest of all time and go to around $2.65 at one point this year. They also predict that it can reach $4.37 in May of 2022.

Our Algorand Prediction

Based on all the price factors affecting Algorand as well as the future outcomes of such a project, we at Crypto Academy predict that the price of ALGO can reach $3 by the end of 2021. As for the long-term price of Algorand, we forecast that ALGO can go to at least $20 in the next five years.

Historic Market Sentiments

2019

Unfortunately for Algorand, its initial price of $2.16 when it was launched in June of 2019 was its highest of all time. This is because Algorand was launched during the bearish trend in the crypto market, which followed after the bullish run of 2018. While it may have seen as a loss for the ones who purchased ALGO tokens during its ICO at $2.40. However, this could easily change in the future. Throughout the last two quarters of 2019, the price of ALGO ranged from $0.20 to $0.80, which was volatile enough for day traders to profit from ALGO.

2020

In 2020, the price of ALGO did not go to impressive highs, but it still managed to fluctuate roughly for traders to be able to make decent profits. At the beginning of the year, the price was around $0.21, which went to $0.50 in February. This was more than a 2x increase in the price. The price dropped back to $0.15 in March, but it increased again to $0.67 in August. After another dip to around $0.30 in the following months, ALGO finished the year at $0.48.

2021

ALGO started 2021 at $0.40. It followed the bullish trend caused by the Bitcoin halving of 2020. Because of this, the price of ALGO went to a price of $1.82 on February 13 of this year. This was a 355% increase in just one month. In March, the price had dropped to around $1, but it increased once again to $1.82 in April. The price has dropped ever since and it is averaging $1 midway through June 2021. Overall, the first two quarters of 2021 for Algorand have been quite successful.

With an average price of $1 and a circulating supply of around 3.08 Billion, the market capitalization of ALGO is around $3.1 Billion. This ranks Algorand at number 32 in the crypto market. The fully diluted market cap of ALGO is around $10.2 Billion.

FAQ

Is Algorand a good investment?

Since Algorand is yet to reach its growth potential by surpassing its initial price, the price of ALGO can increase in the future, making it a worthy investment.

Can Algorand’s price ever reach $10?

With a limited supply, blockchain trilemma solution, as well as its network features (DeFi, NFTS, etc) the price of NFT can go to soaring highs in the long term. The price may surpass $10 at one point in the coming years.

Is Algorand worth buying in 2021?

Since Algorand is predicted to increase by various experts, it may be worth buying in 2021. Moreover, using ALGO tokens for staking or DeFi in the Algorand network might be worth it as well.

Can Algorand price increase?

Yes, the price of ALGO can increase due to its limited supply and increase in demand.

How to buy ALGO?

You can buy ALGO using cryptocurrency exchanges such as Coinbase, Binance, OKEx, Kraken, Huobi, etc.

Also Read: Decentraland Price Prediction 2021 and Beyond – Is MANA a Good Investment?

Takeaways

- Algorand is a Pure Proof-of-Stake (PPoS) cryptocurrency that aims to solve the blockchain trilemma of decentralization, security, and scalability.

- It uses protocols such as VRF and Byzantine Agreement for securing the network.

- The limited supply of Algorand is 10 Billion ALGO, with 3.08 Billion already in circulation.

- The price of ALGO has not exceeded its initial price or ICO price yet, but it has the potential to outgrow it in the coming months.

- The price of ALGO is predicted to increase at large rates in the following years.