What are ICO’s?

It’s tough to launch a new project without sufficient funds. To secure the money you need, you’ll often have to go through a lot of hoops and deal with many middlemen. Crowdfunding has been popular throughout recent years as a more straightforward way to collect funds rather than relying on investors for venture capital.

Initial Coin Offerings (ICOs), is a form of cryptocurrency crowdfunding that’s helped kickstart the growth of an ever-increasing number of cryptocurrency startups.

How Does an ICO Work?

A cryptocurrency startup will seek to raise funds through an initial coin offering (ICO). In order to do so, it’ll normally produce a whitepaper that lays out what the project’s about, the purpose it’ll serve when it’s completed, how much money is required, how many virtual tokens creators can hold, what kind of capital would be allowed, and how long the ICO campaign would last.

An ICO campaign works by having project followers and fans buy the project’s token using fiat or digital currencies. The buyers refer to these coins as tokens, which are the equivalent to the shares of a company that are offered to investors during initial public offerings (IPOs).

An ICO may fail if they don’t meet the firm’s minimum required amount of funds, in which case they return the money back to their followers. The money collected is used to achieve the project’s goals provided the financing criteria are accomplished throughout the prescribed timeline. Also, some companies perform pre-sale of crypto tokens or Pre-ICO. In most cases, this is an opportunity to get tokens at a much lower price. With a pre-sale list, you can track or buy digital assets even before the official public sale. Funds raised in this way are most often used for marketing campaigns or MVP development.

Are ICOs Regulated?

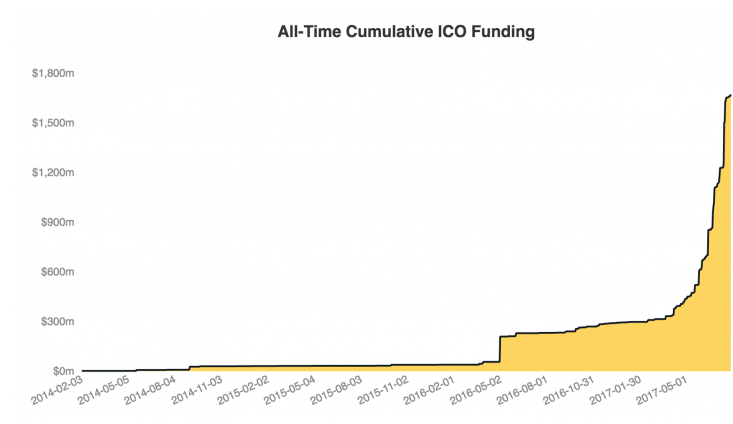

As the world of cryptocurrencies and blockchain markets grow, we’re seeing a steep rise in ICOs as well. However, with this, we’re also seeing new challenges, threats, and opportunities. ICOs are fraught with scams and con artists looking to take advantage of enthusiastic buyers and the lack of regulation. Since ICOs currently have no regulatory framework, it’s like a digital gold rush of crowd-sourced capital. Any funds lost due to theft or negligence can never be recovered because they’re not under the control of financial regulators like the SEC.

A lot of people invest in ICOs in the hopes of gaining a quick and easy return on their money. Some of the most successful ICOs in the last couple of years has driven this optimism because of their massive returns. This investor energy, on the other hand, may have the potential to drive people astray.

The Development of ICOs in the Crypto Markets

It’s become much easier for startups to build tokens with an ICO because of online services that have developed over the years. They make it possible to generate crypto tokens in a matter of seconds. Investors should keep in mind that tokens don’t bear any inherent value or legal assurances as a share would. ICO administrators create tokens according to the terms of the ICO stated on their whitepaper, and then assign them to individual investors once they collect them.

Because of ICOs, some people have become millionaires. To put it into perspective, 435 initial coin offerings were successful in 2017, each of them raising an average of $12.7 million. As a result, the overall amount of funds collected in 2017 was $5.6 billion, with the top ten programs accounting for 25% of the total. On top of this, the tokens bought in ICOs had returns valued at an average of 12.8 times the original investment.

Fans and investors hoping that a venture can prosper until it’s launched lays at the heart of ICOs. If the venture succeeds, the value of the tokens they bought during the ICO will rise above the price set when they bought initially, resulting in net profits. The biggest advantage of an ICO is the opportunity for extremely high returns if all goes well.

Takeaways

- Crowdfunding has been popular throughout recent years as a more straightforward way to collect funds rather than relying on investors for venture capital.

- Initial Coin Offerings (ICOs), is a form of cryptocurrency crowdfunding that’s helped kickstart the growth of an ever-increasing number of cryptocurrency startups.

- An ICO campaign works by having project followers and fans buy the project’s token using fiat or digital currencies.

- Whitepapers lay out all the details of what the project’s about and sets the framework for the ICO.

- 435 initial coin offerings were successful in 2017, each of them raising an average of $12.7 million.