The king of cryptocurrency, Bitcoin, has been facing a major drop in price after the recent remarks from the United State Federal Reserve to increase taxation. This Bitcoin price analysis explores the factors that can sway the BTC price down to the $14,000-$15,000 levels.

Bitcoin Price Analysis: Major Factors

Global Ownership

There once was a time the United States was leading cryptocurrency owners with a dominating margin. But the power to sway the market alone has long been shifted to other countries. At the time of writing, India, Pakistan, Nigeria, and Vietnam combined have more than double the cryptocurrency owners than that in the U.S. While; despite the rapid boom of various cryptocurrencies, Bitcoin remains the market capitalization leader with 47% percent of the total. A 2021 report reveals that the lowest number of cryptocurrency owners are in Bermuda (681); however, when seen as the percentage of the population, it is %0.97.

European countries with a significant number of owners include Germany (5.80%), France (5.04%), and Turkey (4.50%); however, countries like Saudi Arabia (1.48%), Kuwait (1.20%), and Israel (1.47%) where a single citizen can own a fortune are capable of swaying prices. The richest economies still include Kuwait, Bahrain, Oman, Jordan, Cayman Island, and Switzerland, as leaders with above-the-dollar currency conversion rates. While Singapore, Bulgaria, Holland, and Norway also hold strong importance in this sway.

Inflation driving FoMo and Sentiments

Although Nigeria and Pakistan were hit hard by inflation in 2022, none of the countries with swaying power come even near the top 10 countries, including Venezuela, Iran, and others, with the exception of Turkey, standing at 36.1% inflation.

On the other hand, countries with swaying power include Saudi Arabia, Bahrain, and the likes, where a single citizen can sway the market as a whale; therefore, the total number of cryptocurrency users doesn’t matter much. Regardless of the top figures, the post-Covid-19 world is not ready to change easily and those already hooked into the system as daily traders are now going to use all in their power to keep the king stable. It is an unsaid fear-driven rule that Bitcoin sway, sways the market, a reason to drive sentiments in the market.

Political Powerplay

An interesting statement was made on the 14th of August when the Bitcoin market saw a huge rise in the price, coinciding with the Independence Day of Pakistan. Such a display of coincident power display is a political statement in itself that goes unchecked by most daily traders for their mere lack of important dates. However, the authorities concerned always look at matters differently.

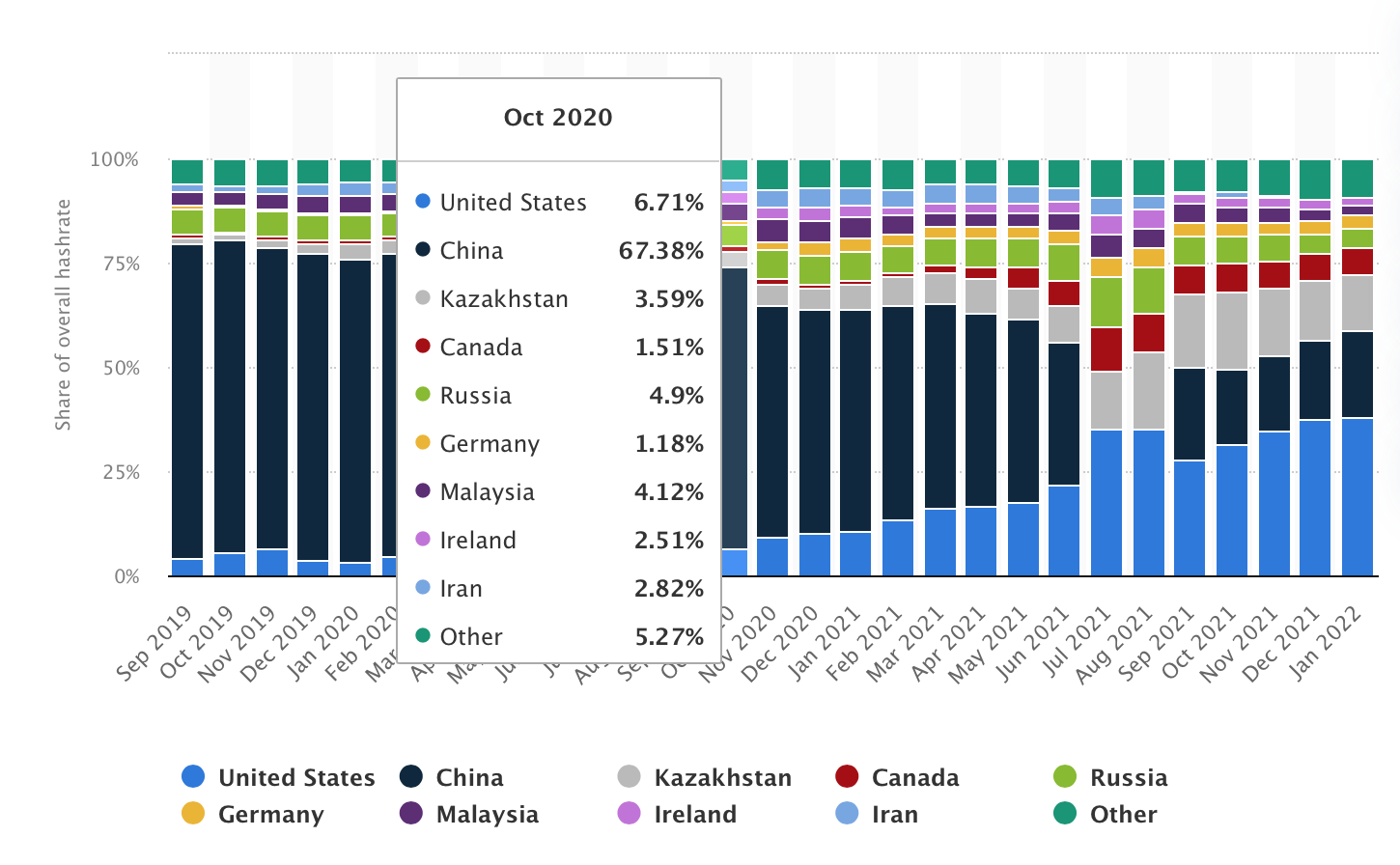

Bitcoin mining hash rate chart by Statista

Another interesting fact is that China owned as much as 67% of the total Bitcoin mining and hashing power in October 2020; however, since then, the figures have changed drastically. As of January 2022, the United States owns 37.84% of the hashing power, while China now owns only 21.11%. Kazakhstan is the only other country that owns more than 10% standing at 13.22%. It is no secret that more hashing power means more Bitcoin rewards, and the Federal Reserve’s decision to clamp down on Bitcoin taxation may just be driven by the need of the hour.

Concluding for the traders, Bitcoin price sways are still a possibility; however, the major causes of concern would be the trading and trader’s sentiment along with the political and calamity factors.

Disclaimer: The information provided on this page is most accurate to the best of our knowledge; however, subject to change due to various market factors. Crypto-Academy encourages our readers to learn more about market factors and risks involved before making investment decisions.