XRP was and continues to be one of the biggest cryptocurrencies in the market. When looking at its price and experts’ analysis, XRP has not yet fulfilled its full potential. One of the primary reasons for this is the SEC lawsuit against XRP, arguing that the latter is a security. Despite the fact that there may not be any truth in the accusation, this has heavily impacted the price of XRP in recent months and even years.

XRP had its all-time high in the bull run of 2018, where it reached as high as $3.84. The bull run ended, and the market entered a downtrend. Many expected XRP to recover by the end of 2020 as did most of the other cryptocurrencies. Then, the SEC lawsuit came forth. That saw a sudden decline in the price of XRP.

Nonetheless, the XRP army still did their best to try and reap the benefits of the bull run of 2021, where XRP went as high as $1.96. While it did not reach the heights that it once did, it still performed quite well despite the allegations from the Securities and Exchange Commission.

XRP again increased in the following months, but it was now in a downtrend when looking at the bigger picture. It failed to reach new highs in November (“Moonvember”) of 2021 as the majority did. XRP entered 2022 below $1, and it has remained below $1 ever since.

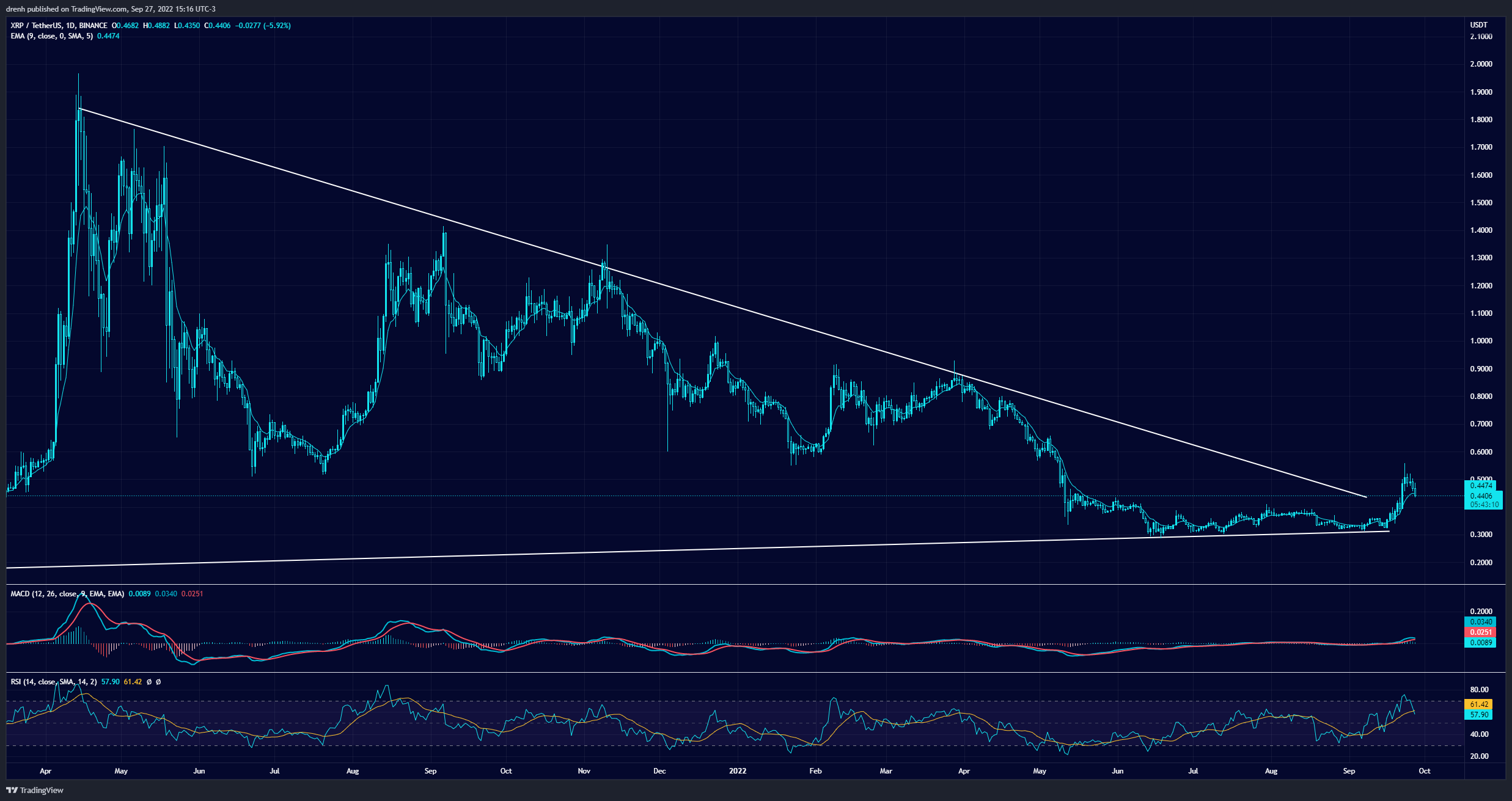

After finding support slightly below $0.30, XRP was in consolidation. Nonetheless, recently, XRP broke the descending wedge channel and increased by around 80% in about two weeks.

This increase could be attributed to different factors, both technical and fundamental. Here is what our analysis suggests.

XRP Technical Analysis

As stated, XRP penetrated the upper descending trendline in the daily chart. A breakout was somewhat anticipated given that the wedge started to become narrower. Moreover, the fear and greed index had shown signs of fear for months, and recovery was in place in the 1-day chart given the 3-month consolidation period for XRP.

Still, this increase of around 80% saw XRP facing strong resistance at $0.55, as the selling pressure increased at large rates. Perhaps the ones who bought the dip took advantage of the increase and did not want to hold longer given the current state of the global economy. Still, without looking at the fundamentals, extreme greed shown in recent days saw the selling pressure vastly increase as XRP started to decline. Currently, XRP is sitting at around $0.45, with a circulating supply of 49.9 billion and a market capitalization of $22.2 billion. This market cap ranks XRP as number 6 in the crypto industry in terms of market share.

Hence, despite the challenges that XRP may have faced in the last few years, it has kept its place in the top 10 rankings due to its large support from the XRP community.

When looking at the Fibonacci retracement levels of the 1-day chart, we could see XRP find support at the 61.8% level in the short run, which coincides with the previous resistance structures of the past months at around $0.40. Still, there are hundreds of indicators that could suggest other outcomes for XRP.

Indicators

The Moving Average Convergence – Divergence (MACD) of the 1-day chart clearly shows that the MACD line is above the signal line, indicating that the current momentum is bullish. Nonetheless, the lines are currently converging, indicating that the momentum may shift soon, as seen by the declining price of XRP in the last few days.

With that in mind, the 50-MA of the 1-day chart is below the price, indicating that the trend now could be bullish for XRP, as it also penetrated resistance structures with its recent surge in price.

Due to the recent increase in the price of XRP, the Relative Strength Index (RSI) of a 1-day chart was above 70. This meant that XRP became overbought. Hence, many anticipated the recent downward correction for XRP. Now that the RSI is within the 30-70 range, XRP has more room for growth in the coming weeks.

XRP Fundamental Analysis

Perhaps the biggest factor in the price of XRP at the moment is the SEC lawsuit against Ripple, the US company that founded XRP. Initially, the lawsuit claiming that XRP is a security heavily affected the price of XRP for the worse.

The trial has gone on for almost two years now. As with every trial of such nature, one side wins some hearings, and the other side some other hearings. However, recently, there has been significant improvement in the morale of XRP, simply because SEC has failed time after time to prove that XRP is a security. Nonetheless, even if XRP has not been found as a security yet, the trial unveiled many wrongdoings of Ripple that occurred related to XRP. The same could be said about some parts of the SEC.

Recently, SEC and Ripple took the much-needed step for a summary judgment, which sees both sides finding peace with the findings so far. Regardless of what the judge’s verdict is, this was one of the best news for the XRP army in months because XRP may continue as a cryptocurrency without the legal constraints and scrutiny that it had because of the trial.

Nonetheless, this did not stop Ripple’s CEO Brad Garlinghouse from throwing shade at SEC. Here’s what he had to say:

Today’s filings make it clear the SEC isn’t interested in applying the law. They want to remake it all in an impermissible effort to expand their jurisdiction far beyond the authority granted to them by Congress. https://t.co/ooPPle3QjI

— Brad Garlinghouse (@bgarlinghouse) September 17, 2022

Uncertainty regarding XRP as an investment diminishes for institutional investors too, which could help the project regain its price heights of 2018 once again. After all, the ecosystem that XRP provides is one of the most efficient and promising in the market.

Other News Regarding XRP

Regarding other market news, the Federal Reserve recently announced a hike in the federal funds rate by 75 basis points. This affects all financial markets, including the crypto market and XRP. The tension between Russia and Ukraine still remains a big element in financial markets.

On a bullish note, Ripple is continually engaging itself with potential partnerships, more press releases, more media exposure, interviews, etc. This is contrary to what other entities do when SEC sues them. Perhaps Ripple is trying to be steps ahead and take advantage of the opportunities that may prevail if Ripple beat the lawsuit.

CEO @bgarlinghouse joined @CNBC Crypto World to recap the latest in the SEC v. Ripple lawsuit, recent U.S. regulatory action and what’s next for Ripple’s growth plans. Check out the full interview here: https://t.co/p1xlvMrqsR

— Ripple (@Ripple) September 26, 2022

XRP Price Prediction

Based on all these potential factors so far, the price of XRP looks promising in the long run, especially if XRP wins the trial.

Looking at the short-run chart, XRP could decline as low as $0.40 in the coming days, but it may bounce back again. Perhaps XRP could aim for $0.60 in the coming days.

If Ripple does indeed win the case before the end of the year, then XRP may outperform every other cryptocurrency in the market, with XRP army potentially pushing the price back to $1 in the coming months.

As for the long run, considering mass adoption, Ripple potentially winning the trial, BTC halving in 2024, and hundreds of other factors, then the price of XRP is predicted to increase, other things equal. XRP may go at least as high as $5 in the coming years.

Takeaways

- XRP had a bullish breakout recently due to recent developments regarding the SEC lawsuit.

- Indicators suggest that the price may have a correction in the coming days, but the bullish momentum may continue.

- The trial has given a boost in morale to the XRP army.

- In the long run, XRP may eventually hit $5.