The Wing Finance is a credit-based, decentralized network created for cross-chain communication between decentralized finance (DeFi) projects and crypto-asset lending. This Wing Finance price prediction explain the project insights, the future scope and the price movement.

The project’s goal is to increase accessibility to crypto lending services by doing away with the necessity for substantial collateral with a credit evaluation module. Users can participate in decision-making, product design, and business operations with Wing, a decentralized autonomous organization (DAO).

Wing offers a risk control method and decentralized governance to enhance the interactions between creditors, borrowers, and guarantors. The quantity and accessibility of DeFi projects using the platform have improved as a result of this. One of Wing DAO’s objectives is to find a solution to the over-collateralization problem that the DeFi business faces.

Wing Finance also introduced a decentralized autonomous organization (DAO) to facilitate community governance and user sovereignty in the spirit of further decentralization. Concepts like credit-based lending and extensible categories of digitized assets are what Wing brings to the table.

The platform promotes a community that is decentralized and autonomous and enables the formation of new blockchain applications. Wing DAO has developed a credit-based DeFi protocol that operates on the Ontology (ONT) blockchain in response to problems encountered by other DeFi projects. Users have complete control over the system, and no outside parties are needed to confirm transactions. The Wing is a cross-chain DeFi platform that uses credit that was created and is run by the Ontology team.

The developers of Ontology, a standard for enterprise blockchain solutions, also created Wing Finance. The creators wanted to solve the issues that existed in the widely used financial products used in DeFi. Wing Finance was developed by Ontology with the main goal of introducing credit aspects into the market.

The majority of DeFi products had over-collateralization restrictions, which have reduced the number of people who could really borrow cryptocurrency and the amount they could leverage. Although many crypto adopters had been waiting for these developments, they weren’t sufficient to draw in new adopters having no substantial crypto holdings to begin.

Wing Finance has developed a mechanism that makes it considerably simpler to borrow money and lend idle assets to earn returns without sacrificing the caliber of its liquidity pool. Additionally, it avoids the rising gas costs that other smart contract chains encounter because it runs on top of the Ontology system.

Users can vote on protocol parameters on its primary pools. The type of assets that can be borrowed, the minimum and maximum borrowing and lending amounts, and other risk control requirements are a few examples of the functions that can be put to a community vote.

Wing Finance (WING) Fundamental Analysis

The credit-based, cross-chain lending platform on DeFi is named ss Wing Finance ($WING). Its primary objective is to increase the accessibility of digital lending services for everyone by replacing troublesome collateralization rules with a credit evaluation module. The OScore system, a mechanism built on top of Ontology, is the central component of the credit evaluation framework. The key attributes of Wing Finance are:

- In a variety of DeFi projects, Wing Finance promotes cross-chain cooperation and decentralized governance.

- They have a risk management system that encourages constructive interactions between guarantors, creditors, and borrowers.

- Through its decentralized credit system, Wing Financial provides a link between the DeFi and conventional finance worlds.

One distinctive aspect of Wing is that it enables users to create a DAO proposal or sign up as an investor on the platform even if they have no prior experience with blockchain technology. When they submit proposals, Wing gives project creators the opportunity to receive financing. Smart contracts give investors the chance to participate in decision-making and receive a cut of future earnings in exchange.

Due to its capacity to establish collateral pools across many blockchains, Wing is developed on the Ontology blockchain. The digitalization of both new and old assets is made possible through ontology. A credit-scoring system called OScore is another component of the blockchain. OScore evaluates the information about users’ digital assets and lending/borrowing history.

To protect the privacy of user data, platform users have complete control over their accounts and may safely access their OScore. The amount of collateral needed to make loans on the platform is also lowered because borrowers must rely on their OScore data. Users in Wing’s inclusive pool are rewarded by maintaining a high credit score. Loan interest rates may be reduced for borrowers who make on-time repayments. Wing-like DeFi platforms like Uniswap and AAVE are also available.

OScore is a system for evaluating DeFi’s sovereign reputation and credit. The implementation of identities and credentials that are accepted in cross-chain transactions allows its operation. It is the system that develops a credit evaluation tool that takes into account a user’s holdings or balance as well as their track record of managing digital assets. In order to achieve this, OScore affixes a digital identity to a user’s assets, including those created on Ontology, Ethereum, and Bitcoin. This aids the system in calculating the credit score of a user.

More assessment features and on-chain data are being incorporated into the OScore system by Ontology. However, they are currently integrating OScore into the wallets of their users. The Ontology-driven platform may handle a collateral pool with a range of cryptocurrencies even if they are on several blockchains because Ontology powers it. It is called Cross-chain assistance. Any asset can be digitized using Ontology’s decentralized identification and data functionalities.

Smart contracts power the platform’s decentralized and automated credit evaluation feature. Uninterruptible automated credit data verification and evaluation systems are made possible by decentralized identity and data protocols. Additionally, this is where the OScore system is located. The need for collateralization can be reduced further, if not eliminated altogether, now that lenders can rely on borrowers’ OScore information when making loans.

Assets can now be connected with credit elements from the on-chain data that OScore can gather, making it simpler to digitize assets on the platform. The platform may carry out user verifications without the assistance of a third party.

Instead, decentralized identifiers (DID), which are verifiable and decentralized, are used to power the credit elements that are used to tag persons. Additionally, smart contracts make sure that manual intervention is no longer required for the evaluation of these components.

How does Wing Finance work?

On Wing Finance, there are two different kinds of pools that are Flash Pool, NFT Pool, and Inclusive Pool. The Wing is implemented over six pools across four networks, including Ontology, Ethereum, OKXChain, BNB chain, and Ontology EVM.

Flash Pool: The platform’s Flash Pool from Wing Finance enables users to borrow and lend. Additionally, lenders are paid interest for contributing their funds to the site. It also has a pool of insurance that can protect against risks reducing the chance of asset losses. Here are the key features of Flash Pool.

- Anyone can contribute his cryptocurrency to the Flash Pool, which will use to lend it to platform users. Lenders are compensated with interest on both the given crypto and the WING tokens. The return relates to its annual percentage yield.

- Anyone can borrow cryptocurrency from the Flash Pool till they can provide the required collateral. They must first lock 3% of their WING tokens for receiving WING prizes.

- Users can participate in the platform’s insurance pool to ensure the reduction in potential risks by locking their WING tokens in the flash pool for a minimum of three days.

NFT Pool: The NFT Pool from Wing Finance is a fund pool that uses NFT collateral and runs on the Wing DAO platform. Six different NFT kinds are now supported by it: CryptoPunks, MAYC, BAYC, Meebits, Azuki, and CLONE X. Wing Finance NFT pool’s key selling point is the use of a peer-to-pool lending strategy to attempt to unleash the potential of NFTs in a novel and creative manner.

In the peer-to-pool lending mechanism, users contribute ETH to the asset pool to give the lending pool liquidity. These users receive pWING tokens, an ERC-20 protocol variation of the WING token, and interest payments in ETH from borrowers. Users can borrow ETH from the NFT pool by combining NFTs that enter the NFT-collateral pool. After that, the borrowers get a matching functional NFT. Then, NFT buyers might buy these NFTs on the liquidation market with the chance of a discount.

Inclusive Pool: Wing Finance’s Inclusive Pool is an asset pool that enables consumers to undervalue their possessions and increase their capacity to borrow. A supply and borrow pool, as well as an insurance pool, are included in the inclusive pool.

The Inclusive Pool supports the pDAI, pUSDT, and pUSDC assets. Users may borrow from the supply pool in accordance with the guidelines established by Wing Finance. Users can also lend out assets, but every time, they must accumulate a particular amount. Based on the OScore of the users, the amount is determined.

Wing Finance Tokenomics

Wing Finance’s governance token is called WING. WING is used to vote on and decide about the WING Improvement Proposals (WIPs). WING may also be staked in the Wing’s Insurance pool to give protection and insurance to the protocol and suppliers. The protocol offers stake benefits to stakers.

Based on the transaction volume of each product pool, the product pools will receive 80 percent of the total supply. The remaining 20% of the supply would be reserved for public custodian accounts with governance rights and no transferability.

Wing Finance Future Plans

Their approach to developing the Wing platform emphasizes innovation and optimization. To continue optimizing functionalities for the Wing Flash Pools in 2022, they will be concentrating on the following areas.

- They recommend pursuing additional risk control optimization in 2022.

- In order to develop a new front-end interface that people will connect with and recognize, we want to release it in the third quarter of 2022.

- The Wing is in a good position to lead the development of under-collateralized, secure, and even decentralized lending by offering users truly inclusive financing, which is in keeping with Ontology’s larger objective.

- The functionalities of the Flash Pool contract would be optimized for collateral liquidation, collateral swap, and collateral repayment.

- There may be an introduction to NFT and GameFi.

- With the addition of more asset types, expansion into new chains, community campaigns, listing on more exchanges, and WING token allocation optimization, Wing Finance may continue to grow and draw in more users.

- They believe that if the insurance pool can lock more WING, the guarantee function will be adequate.

Wing Finance Price Analysis

The Wing Finance price on July 31, 2022, is $40.56. It has a trading volume of $777.58 million and a market capitalization of $110 million. The CoinMarketCap currently ranks it as number 247. It has a maximum supply of 5 million WING coins and a circulating supply of 2.7 million WING coins. It can be a very good investment expected to increase in price.

Wing Finance Price Prediction – Crypto Academy

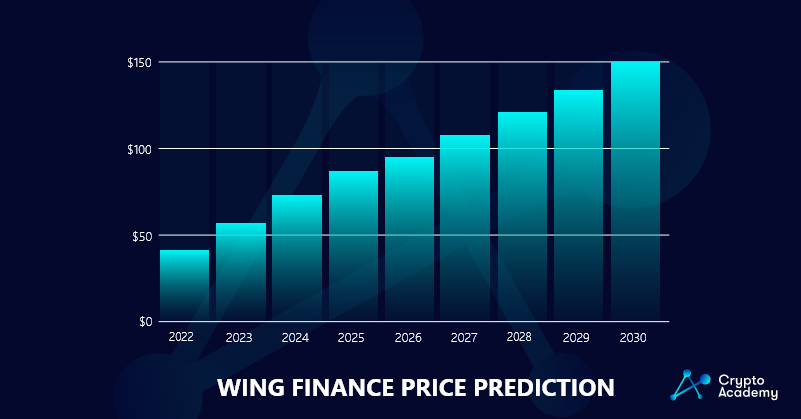

We have predicted the future prices of Wing Finance on the basis of its future plans and the predictable market movements.

Wing Finance Price Prediction 2022

According to our technical analysis of historical price data of WING in 2022, the price of Wing Finance is predicted to reach a minimum level of $35. The WING price can reach a maximum level of $45 due to innovation and optimization of functionalities for the Wing Flash Pool, with an average trading price of $40.

Wing Finance Price Prediction 2023

The price of Wing Finance is predicted to reach a minimum level of $40 in 2023. The Wing Finance price can reach a maximum level of $56 by pursuing extra risk control optimization, with an average price of $48 throughout 2023.

Wing Finance Price Prediction 2024

As per the forecast price and technical analysis in 2024, the price of Wing Finance is predicted to reach a minimum level of $45. The WING price can reach a maximum level of $75 by developing a new front-end interface, with an average trading price of $60.

Wing Finance Price Prediction 2025

The price of Wing Finance is expected to reach a minimum level of $50 in 2025. The WING price can reach a maximum level of $83 by developing an under-collateralized, secure, and even decentralized lending system, with an average price of $68 throughout 2025.

Wing Finance Price Prediction 2026

Wing Finance’s price might reach the lowest possible level of $65 in 2026. As per our findings, the WING price could reach a maximum possible level of $90 by offering inclusive monetary services to users truly as per Ontology’s larger objective, with the average forecast price of $72.

Wing Finance Price Prediction 2027

The historical price performance of WING shows that in 2027, the price of Wing Finance can be around a minimum value of $70. The Wing Finance price value can reach a maximum of $110 due to the optimization of the Flash Pool contract for collateral liquidation, collateral swap, and collateral repayment, with an average trading value of $90.

Wing Finance Price Prediction 2028

The price of Wing Finance is predicted to reach a minimum value of $85 in 2028. The Wing Finance price could reach a maximum value of $125 by introducing NFT and GameFi, with an average trading price of $100 throughout 2028.

Wing Finance Price Prediction 2029

Our technical analysis for 2029 indicates the price of Wing Finance is expected to reach a minimum price value of $95. The WING price can reach a maximum price value of $135 with an average value of $115. This can be done by campaigning, adding more assets, expanding into new chains, and getting listed on more exchanges with WING token allocation optimization.

Wing Finance Price Prediction 2030

The price of Wing Finance is predicted to reach a minimum value of $110 in 2030. The Wing Finance price could reach a maximum value of $150 by locking more WING tokens in the Insurance pool, with the average trading price of $130 throughout 2030.

Wing Finance Price Prediction – Market Overview

There are several important websites that give mixed opinions about the future prices of Wing Finance.

Priceprediction.net

PricePrediction.net experts expect the maximum WING price to be at a level of $3.92 at the end of 2022. The average price of Wing Finance can reach $3.53 by the end of this year. For the next five-year plan, they estimated the coin to easily reach the $13.75 mark. Their experts and analysts for the year 2030 predict the highest price of Wing Finance to hit $102.75.

Digital Coin Price

Digital Coin price analysts explain that the lowest price of Wing Finance can be $57, and the highest price of $218 in the future. The price of a Wing Finance (WING) can be approximately $57.47 to $66.68 in a year. In the next three years, the price can be $73.84, and in four years, it can be $82.73. After five, six, and seven years, the price can be $109.92, $146.86, and $171.62, respectively.

Coin Codex

Their tech sector growth prediction estimated the WING price to be between $ 57.07 and $98.90 in 2024. It can be between $73.06 and $219.39 in 2025 and between $93.52 and $486.66 in 2026. The price of Wing hence under the best scenarios of 2024, 2025, and 2026 can be on revenue of 145.67%, 444.96%, and 1,108.89%.

Tech News Leader

According to Tech News Leader analysts, the Wing Finance price will go as high as $6.35 in a year. The price can be worth $17.50 in five years, with high chances of reaching $106.88 in the next ten years. The value of a Wing Finance token for eight to ten years can be between the lowest and highest level of $103.10 and $128.52.

Wallet Investor

Wallet Investor analysts consider WING to be a bad investment in terms of price. The maximum price of a token by the end of 2022 can be $0.542. The price may fall to $0.0957 and $0.1031 by the end of 2023 and 2024. At the end of 2025 and 2026, the price can be $0.0812 and $0.10092, respectively. Five years from now, the highest price can be $0.165.

How to Buy Wing Finance (WING)

You can easily buy Wing Finance (WING) with the minimum fees and maximum security on Binance.

Step 1: Create an Account.

You need a Binance account to act as the gateway to the crypto trade. You need to login or make an account and verify your identity before you can buy Wing Finance (WING). You have to register through the Binance App or website using your email address or mobile number.

Step 2: Select a Payment Method.

Next, you have to choose a payment method to buy the Wing Finance (WING) asset. Then click on the “Buy Crypto” link at the top of the Binance website to see the available options in your country. You can consider purchasing stablecoin, such as USDT or BUSD, to buy WING for better coin compatibility.

For new users, it is easier to buy WING through credit/debit cards or bank deposits. The platform also supports Visa and MasterCard. You can also buy Wing Finance (WING) from another user directly with Binance’s P2P service or use one of the multiple options of third-party channels.

Step 3: Buy WING

You next have to fulfill the requirements for trade within a minute to confirm your order at the current price. After each minute, the order is recalculated according to the real-time market price. You have to click ‘Refresh’ to observe the new order amount. After buying it, the user can hold tokens in the Binance account, trade or stake them or store them in another crypto wallet.

Frequently Asked Questions (FAQs)

Is WING a Good Investment?

Yes, Wing is a good investment because of interoperability between decentralized finance (DeFi) projects and crypto-asset lending.

Can WING Reach $100?

WING can reach $100 by the year 2027 by optimization of the Flash Pool contract.

Where to Buy WING?

You can buy Wing Finance stock from Binance, OKX, MEXC, AAX, and CoinW.

Takeaways

- The Wing is a credit-based, decentralized network created for cross-chain communication between decentralized finance (DeFi) projects and crypto-asset lending.

- The project’s goal is to increase accessibility to crypto lending services by doing away with the necessity for substantial collateral with a credit evaluation module.

- Users can participate in decision-making, product design, and business operations with Wing, a decentralized autonomous organization (DAO).

- Wing offers a risk control method and decentralized governance to enhance the interactions between creditors, borrowers, and guarantors.

- One of Wing DAO’s objectives is to find a solution to the over-collateralization problem that the DeFi business faces.

- The Wing is a good investment because of the interoperability between decentralized finance (DeFi) projects and crypto-asset lending.

- The WING price can reach a maximum level of $45 in 2022.

- The WING price can reach a maximum level of $83 in 2025.

- WING can reach $100 by the year 2027 by optimization of the Flash Pool contract.

- The Wing Finance price could reach a maximum value of $150 in 2030.

- You can buy Wing Finance stock from Binance, OKX, MEXC, AAX, and CoinW.