Because of the volatility of the cryptocurrency markets, there are numerous scamming schemes out there. Market manipulation is common in a volatile market, with schemes such as churning, stock bashing, and the most popular, pump and dump.

In this article, we will discuss pump and dump schemes, which appear to be great get rich quick schemes for cybercriminals looking to buy low, sell high, and profit from volatility. Without further ado, let’s look at pumps and dumps.

What Are Pump and Dumps?

The market for cryptocurrencies has recently emerged as the most recent target for pump-and-dump operations. Due to the absence of regulation in the crypto space, its complexity, and the technical difficulty of crypto, pump-and-dump tactics are unfortunately extremely effective with cryptocurrencies.

Pump and dump schemes are similar to pyramid schemes. In general, the procedure begins when the organizers announce the day and time for the pump day and distribute it among the members.

The members then promote the event by inviting new members, generally with incentives such as giveaways. A buyer will choose a coin and buy it at a cheap price a few hours or even days before the pump day. When the token is publicly announced, members begin dumping a markup on other members. Pumping involves users purchasing coins and selling them at a higher price to other members.

This may go on indefinitely as long as there is demand, but what usually happens is a tremendous surge in the first few segments followed by a crash. This is because the last members have realized that no one else wants the currency and are attempting to sell it.

This implies that the initial demand is fabricated by people who believe they can get the currency at a lower price than the next person. These events provide no value to the folks at the front, who steal from the people in the rear, with the organizers coming out on top. This is an extremely immoral way of getting money, and the system relies on people’s greed, much like in gambling.

Recognizing a Pump and Dump

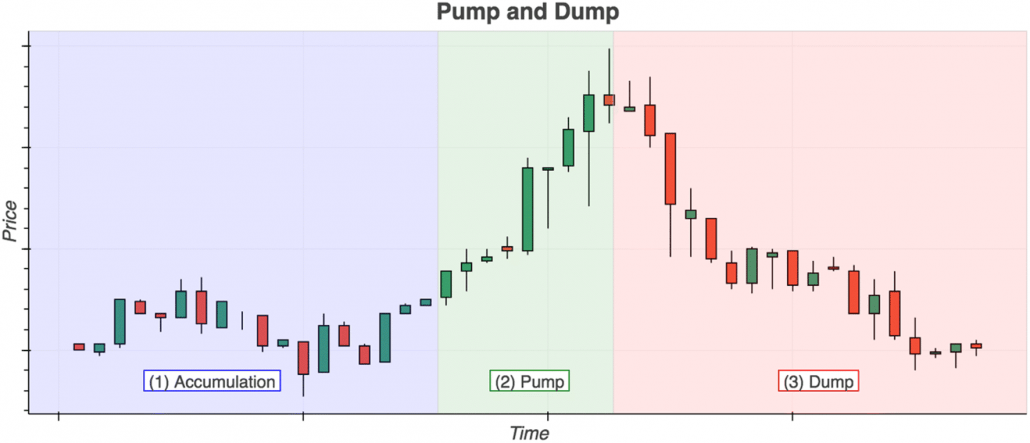

If you take any pump and dump scenario as an example, you’ll notice that a lot may happen in a very short amount of time. There are pump and dump schemes that may take place in a matter of seconds and result in enormous price rises.

(A crypto graph showing a pump and dump scheme. Source: Empirica)

In addition, some pumps and dumps are far larger than others, and substantial collaborations may make enormous profits from a single pump and dump.

Profiting from such scams is not only immoral but also hazardous. It’s difficult to make substantial money from such schemes if you’re at the bottom of the list, and if you buy at the pinnacle, you can lose all you put in. Here are some strategies to prevent a pump and dump plan.

Unsolicited Offers

It is common practice for members of such groups to be recruited using various online forums and social media platforms such as Telegram. Be on your guard if you get an unsolicited message alerting you about a fantastic “investment opportunity.”

You should take this warning very seriously. Ignore such communications since it is quite unlikely that anyone would truly earn from such activities due to the fact that they are almost always fraudsters. In most cases, messages are sent by email, a social networking website, a direct message, a phone call, or even a voicemail left on a recipient’s mobile device.

Do Your Homework

Before putting money into any endeavour, it is critical to carry out one’s own independent research first. Do your homework before putting your money into anything, since this is of the utmost significance, and I can’t stress its significance enough.

In addition, make it a habit to never invest more money than you can comfortably afford to lose. This is the first and most important rule of investment. There are a lot of examples of people losing more money than they could afford to lose when they invest.

Look Out for Red Flags

Be on the lookout for warning signs like the opportunity being too good to be true or there not being much information behind the initiative.

These are just two examples of red flags. If you are put under pressure to make a purchase at a specific time or spend a specific amount of money on anything, and the project is targeted toward a specific demographic, then this is usually a scam.

Stock Pumps and Dumps

Pump-and-dump is a dishonest method that uses phoney recommendations to inflate stock prices. These statements are based on inaccurate, misleading, or highly inflated information. Pump-and-dump culprits already own the company’s shares and will sell them once the publicity raises the price.

According to security legislation, this activity is prohibited and may result in large fines. Pump and dump techniques were much more common in the past than they are today.

Pump and dump systems are frequently shown in famous films such as “The Wolf of Wall Street” and “Boiler Room.”

Both films depicted a warehouse filled with telemarketing stockbrokers peddling undervalued stocks. In each instance, the brokerage business was a market maker and owned a substantial amount of stock in firms with dubious possibilities.

Takeaways

- Because of the volatility of the cryptocurrency markets, there are numerous scamming schemes out there.

- The market for cryptocurrencies has recently emerged as the most recent target for pump-and-dump operations.

- The pumping part involves users purchasing coins and selling them at a higher price to other members.

- This is an extremely immoral way of getting money, and the system relies on people’s greed, much like in gambling.

- Pump and dump systems are frequently shown in famous films such as “The Wolf of Wall Street” and “Boiler Room.

- Pump and dump techniques in the stock market were much more common in the past than they are today.

- Always remember that before putting money into any endeavour, it is critical to carry out one’s own independent research first.