The decentralized finance (DeFi) protocol dubbed Synthetix offers on-chain exposure to a wide range of digital and non-digital assets. This Synthetix price prediction explores the project, its scope, and the price movement in the year 2022 to the year 2030.

The Synthetix protocol gives users access to highly liquid synthetic assets. The protocol is built on the Ethereum (ETH) network (synths). Without requiring direct ownership of the asset, synths track and provide returns on the supported asset.

By adding non-blockchain assets, the platform seeks to diversify the blockchain sector providing a more developed financial system. Originally named Haven, the network was introduced by Kain Warwick in September 2017. A year later, the company changed its name to Synthetix.

In 2020, Synthetix’s management was transferred to three decentralized autonomous organizations (DAOs). It was previously working under the supervision of the Synthetix Foundation, an Australian non-profit foundation. The Grants DAO empowers the community suggestions for public products on Synthetix. On the other hand, Synthetix DAO finances organizations by further increasing the network’s growth, while the Protocol DAO manages protocol improvements and Synthetix’s smart contracts.

You can participate in the DeFi ecosystem even if you don’t own any DeFi assets. This is possible because of Synthetix’s exposure to a wide range of crypto and non-crypto assets in a decentralized, permissionless, and uncensored manner. The introduction of derivatives to the cryptocurrency market, led by Synthetix, has fastened the ecosystem’s development.

Kwenta is a decentralized marketplace where users can exchange synthesizers, which are also tradable across a variety of DeFi protocols. The exchange, unlike other DEXs, uses peer-to-contract trading, which means all trades are carried out against a smart contract rather than using an order book.

Price feeds from chainlink oracles are also utilized to determine the exchange rate for each asset. Each trade is subject to a variable cost of between 0.3% and 1%, which is added to a pool and made available to SNX stakers.

Users of Kwenta can purchase and trade 13 different cryptocurrencies, as well as inverse cryptocurrencies, which track the price of cryptocurrencies in the opposite direction. Synthetix also provides two other cryptocurrency indexes. These are sDEFI which follows a basket of DeFi assets, and sCEX, which tracks a basket of centralized exchange (CEX). Through community governance, both of these asset categories were chosen.

Synthetix protocol empowers two other products that are Lyra, the first decentralized options protocol, and Thales, a pari-mutuel market protocol to enable the trade on events like price action and sports.

Synthetix (SNX) Fundamental Analysis

Synthetix is a platform for synthetic assets and a decentralized exchange (DEX). The protocol is made up so that users can access the listed assets through synths without actually holding them. Users on the platform can independently trade and exchange synths. Additionally, it offers a stake pool where owners can stake their SNX tokens and receive a portion of the transaction fees from the Synthetix Exchange in return.

Using oracles, a kind of smart contract price delivery technology, the platform keeps track of the underlying assets. Users of Synthetix can trade synths without experiencing any concerns with liquidity or slippage. Furthermore, it eliminates the necessity for third-party facilitators.

For the synthetic assets, SNX tokens are utilized as collateral. SNX coins are locked up in a smart contract once synths are issued. The protocol has moved to the Optimistic Ethereum mainnet to help cut network gas costs and oracle latency since inception.

The ERC20 protocol for Ethereum is compatible with the SNX coin. Proof-of-stake (PoS) consensus is used to secure the Synthetix network. Owners of Synthetix stake their SNX and profit from the network fees. Staking rewards, a component of the protocol’s inflationary monetary policy, are another means for SNX stakers to receive rewards.

We can see various benefits of trading on Synthetix infrastructure compared to order book-based DEXs and controlled exchanges. Due to the absence of an order book, P2C trading is used to execute all deals. Through price feeds provided by an oracle, assets are given an exchange rate and can be converted using the Kwenta.io dApp. This offers zero slippage, permissionless on-chain trading in addition to infinite liquidity up to the total amount of collateral in the system.

How does Synthetix work?

Synthetic assets called synths follow the price of the underlying asset. They give owners access to a range of asset types on Ethereum without a need to possess the underlying assets themselves or have trust in a custodian. The Synthetix Network Token (SNX), which is pledged as collateral at a ratio of 400 percent, serves as the backing for synths.

Synthetix has released Perpetual Futures Beta allowing anyone with internet access to use an ever-growing list of synthetic assets with up to 10x leverage by using Synthetix’s infrastructure. The first partner to incorporate Synthetix’s perps is Kwenta, a completely decentralized and composable protocol with an intuitive trading UI. Through the Kwenta UI, users can access the Synthetix perps markets.

The perpetual futures offered by Synthetix allow a wide range of assets, providing a significantly extended and capital-efficient trading experience. Due to exchange and funding rate fees, futures offer SNX stakers an extra source of income. Additionally, due to intrinsic self-hedging and limited exposure provided by market size restrictions, futures also eliminate the need to hedge the additional debt.

The ability to expand support for new assets more easily for futures contracts than for spot contracts is another advantageous feature of Synthetix’s perps markets. This happens for more assets to be added safely, as permanent markets don’t have some of the restrictions and hazards associated with spot synths. As a result, the Synthetix protocol might soon provide more perpetual futures pairs than many of its opponents.

Synthetix Tokenomics

Synthetix simply operates by enabling users to create cryptocurrency assets or Synthetix assets on the Ethereum blockchain. The resulting digital assets, or Synths, are ERC tokens with the ability to track the value of underlying assets. Through a process called collateralization, Synthetix makes it possible to create new assets.

Users have to offer collateral in the form of SNX, the native token driving the Synthetix network, for constructing new synths. Users who want to produce new assets in this situation must first buy SNX tokens. The tokens are then locked in a unique contract and utilized to produce the new assets, i.e., synths.

Utilizing specialized data feeds like Oracles, the newly created synths can be used to track the value of underlying assets. Users and owners would be able to become exposed to profits or losses in those markets in this situation. Additionally, the value of the SNX tokens that have been locked up to be used in the creation of new assets has to stay at or above 750 percent of the value of the Synth created.

Synthetix has raised $30 million during the seed financing and token sale stages by selling more than 60 million tokens. Out of the 100 million coins that were distributed during the ICO, twenty percent went to the team and advisors, three percent to rewards and marketing incentives, five percent to partnership incentives, and twelve percent to tokens went to the foundation.

Synthetix Future Plans

Several upcoming achievements will facilitate Synthetix in achieving this objective. Recent activity has been largely driven by Cross Asset Swaps (released in June 2022), but there are still a number of optimizations and integrations that can channel a bigger portion of on-chain spot volume through Synthetix.

The prominent release of Perps V2, together with further releases from ecosystem partners like Kwenta and Polynomial, will further accelerate the adoption of Optimism. Synthetix perps have also had a respectable organic (and non-incentivized) volume. By converting the protocol into a permissionless derivatives platform, V3 aspires to achieve what Synthetix set out to do years ago.

Synthetix is excited to share the SNX 2022 Release Milestones

Many key features have been released this year, such as Synthetix Futures, and Atomic Swaps, and many more are coming such as:

– Future of Atomic Swaps

– Perps V2

– Synthetix V3Read more 👇https://t.co/zz8gJYBKJg

— Synthetix ⚔️ (@synthetix_io) July 13, 2022

In the upcoming weeks, more thorough summaries of the effects that each of these milestones will have on the protocol will be made available. The Synthetix community thinks that after these milestones are reached, the protocol will be well on its way to expanding as a foundation for DeFi derivatives.

By converting the protocol into a permissionless derivatives platform, V3 seeks to achieve what Synthetix set out to do many years ago. Synthetix has been completely rewritten as a more flexible protocol on a lot more effective architecture. Redesigns the protocol entirely from the ground up to make it easier to create fresh DeFi applications.

Their long-term goals include unrestricted asset creation. Synthetix V3 can be used as the foundation for any financial derivative. Stakers have more control over their credit because they can pick and choose which assets to use as security.

It will enhance the experience of hedging and permits new assets to expand their liquidity without seeking Spartan Council approval. Synthetix will be a protocol you build on improved liquidity for any financial derivative on-chain quickly. This is because of its debt pool and assets, rather than just being a protocol to route trading through.

V3 will appeal to builders as it supports almost all the financial derivatives they can choose to design for a pool. From conventional financial markets to more esoteric markets like no-loss lotteries or even backing liquidity for peers’ protocols, builders can find everything they ever want.

Theoretically, current (perceived) competent may source and route cash through Synthetix to expand their market reach. It also eliminates the issue of cold start liquidity and encourages experimentation by making it easier to provide liquidity for early markets. It is clear and easy to comprehend that Synthetix integration would not take weeks but rather days.

V3’s simpler staking might be a hit among stakers. It would be simple to stake SNX just like any other protocol. It will provide collateral to some asset pools and gets fees from them while avoiding exposure to all of the assets sponsored by the Spartan Council sponsors using a differentiated debt pool (as in V2x). Weighting for inflation will occur with veSNX gauges, and locked tokens for bigger rewards would act as incentives for staking. For beginner users who merely wish to hedge specific assets, staking would be very easy.

Users will be able to transfer back and forth from Ethereum’s Optimism and mainnet due to the sBridge – 229 by DB. The capital efficiency of the network will be significantly enhanced as a result, and debt migration will be made possible. The Synthetix Perpetual Futures will benefit from Perps V2’s scaling and increase accessibility for more traders.

Significant updates to perpetual futures will be made to proceed with the major objectives, such as great improvement in user experience with cheaper costs and more dependable financing rates. Open interest ceilings would be raised, and more markets would be supported.

Synthetix (SNX) Price Analysis

The Synthetix price on July 29, 2022, is $4.20, with a trading volume of $288 million. The CoinMarketCap ranks it as #81, with a market cap of $482.5 million. It has a circulating supply of 114.8 million SNX coins and a maximum supply of 212.4 million SNX coins. It may have a bright future in price.

Rank: 103

Synthetix Price Prediction – Crypto Academy

Crypto Academy Synthetix price prediction is based on market precursors and SNX futures plans to assess the possible price hikes.

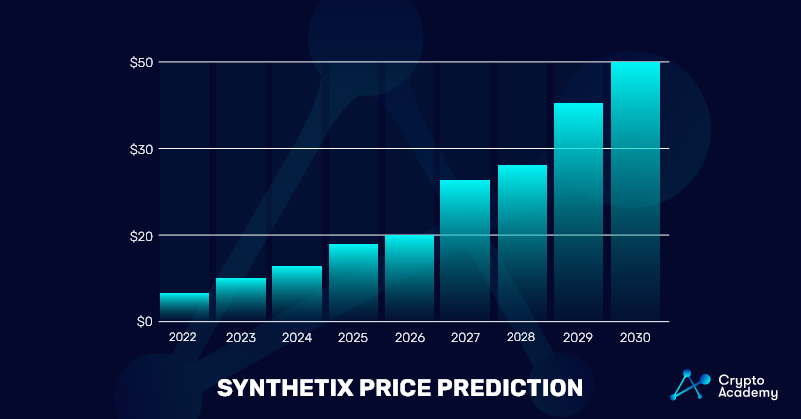

Synthetix Price Prediction 2022

According to a detailed technical analysis of historical price data from SNX, we expect Synthetix’s price to reach lowest level of $4 in 2022. SNX price could hit a high of $7 due to activity driven by Cross Asset Swaps, with an average trading price of $5.5.

Synthetix Price Prediction 2023

We predict the Synthetix prices to reach a price as low as $5 in 2023. Synthetix prices could reach as high as $9 with the release of Perps V2 with ecosystem partners like Kwenta and Polynomial, with an average price of $7 in 2023.

Synthetix Price Prediction 2024

According to price predictions and technical analysis, Synthetix’s price is anticipated to hit the lowest level of $7 in 2024. While the SNX price can reach a high of $12 by expanding as a foundation for DeFi derivatives, with an average trading price of $9.

Synthetix Price Prediction 2025

The price of a Synthetix is expected to reach the lowest level of $9 in 2025. SNX prices can be at an average of $13 in 2025 and can reach high levels of $17 due to the conversion of the protocol into a permissionless derivatives platform.

Synthetix Price Forecast 2026

The price of Synthetix is expected to reach the minimum possible level of $13 in 2026. According to our insight, the price of SNX can reach the maximum possible level of $20, with an average possible price of $16. This can be possible with its unrestricted asset creation.

Synthetix Price Forecast 2027

According to a detailed technical analysis of historical price data from SNX, Synthetix prices are expected to be at a minimum level of $17 in 2027. The price value of Synthetix may hit up to $26 as Synthetix V3 would be the basis of financial derivatives, and the average transaction price is $22.

Synthetix Price Prediction 2028

The price of Synthetix may reach the lowest level of $20 in 2028. The price of Synthetix can reach the highest level of $28 by giving more control to stakers their credit for choosing the security assets, with an average trading price of $24 in 2028.

Synthetix Price Prediction 2029

According to forecasts and technical analysis, the price of Synthetix is expected to reach a minimum price of $23 in 2029. SNX prices can reach a maximum price of $35 and an average of $29. This would be possible because of enhanced experience in hedging and permitting new assets for liquidity.

Synthetix Price Prediction 2030

The price of Synthetix might hit the low level of $29 in 2030. The price of Synthetix has an average trading price of $38 in 2030 and can reach the highest level of $50 due to improved liquidity for any financial derivative on-chain quickly through debt pool and assets.

Synthetix Price Prediction – Market Overview

Following are the price prediction for SNX given by different authority websites in the cryptocurrency space.

Priceprediction.net

PricePrediction.net analysts expect that at the end of 2022, the anticipated SNX price could be a high price of $3.59. The coin may easily pass the $14.80 mark by forecasting the five-year plan.

In terms of price, Synthetix has a significant potential to surge to new heights. The value of SNX is anticipated to increase by Experts and business professionals of this platform by the year 2030, with an estimated Synthetix price to reach its peak at $107.08.

Coin Codex

Per Coin Codex analysts, the best-case scenario, Synthetix price is anticipated to increase by 129.32% by 2024, lying somewhere between $5.31 to $9.19. According to their forecast for the growth of the tech sector, the SNX price would be between $6.79 and $20.40, which indicates in the best-case scenario, the price of Synthetix to increase by 408.71% in 2025.

According to their forecast for the price growth, the SNX price would range from $ 8.69 to $ 45.24, which shows that the price of Synthetix would increase by 1,028.47% under favorable circumstances in 2026.

Tech News Leader

According to Tech News Leader analysts, Synthetix price might reach $4.69 in a year. In five years, Synthetix can be worth $14.11. The possibility of Synthetix’s price rising to $91.36 in ten years are high. Within the next 8 to 10 years, the value of a Synthetix may cross a minimum price of $88.25 and a maximum price of $105.08.

Digital Coin Price

Digital Coin Price analysts predict the lowest Synthetix price in the future to be up to $5.52, and the highest price of Synthetix can be $22.24. The price of a Synthetix (SNX) can be approximately $5.52 to $6.52 in a year’s time, with an insignificant increase from the current SNX price.

The price of Synthetix after three years can be about $6.65, and after four years can be $7.87. After five and six years from now, the price can be nearly $11.43 and $14.07, respectively. Seven years from now, the price can hit a level of $17.15.

Wallet Investor

Wallet Investor analysts consider SNX to be a bad investment in terms of revenue. By the end of 2022, they predict the maximum price of $0.476. By the end of 2023 and 2024, the highest price level can be $0.242 and $0.426, respectively. The maximum price can be $0.566 and $0.343 by the end of 2025 and 2026. On the same date, in 2027 can be $0.446.

How to Buy Synthetix (SNX)?

You can easily purchase SNX on Binance with high security and for low costs.

Step 1: Create an Account.

A number of coins can be purchased with a Binance account. You must login/create an account on the Binance website or app by entering your email address or mobile number. Additionally, you need to verify your identity before opening an account to buy SNX.

Step 2: Select a payment method.

To buy the SNX item, you must select a payment method after making an account. The next step is to choose the “Buy Crypto” link from the Binance navigation. It will show you the options that are available in your country.

You might choose a stablecoin if you want to buy BTC with greater coin compatibility. The less complicated ways for new clients to purchase SNX include bank deposits, Visa, and Master Card. You can even buy SNX directly from a user using Binance’s peer-to-peer service or one of the various third-party payment options.

Step 3: Buy SNX

You have one minute to place your order at the current pricing. Based on this real-time market pricing, orders are updated every minute. To get the most recent order total, press the “Refresh” button.

Enter the required details; the last two steps are order confirmation and SNX storage in your account or coin wallet. After buying the token, you can stake them or trade them for another cryptocurrency on Binance Earn.

Frequently Asked Questions (FAQs)

Is SNX a Good Investment?

Yes, SNX is a good investment due to the decentralized finance (DeFi) protocol with a wide range of digital and non-digital assets.

Can SNX Reach $10?

Yes, SNX can reach $10 by 2024 by expanding as a foundation for DeFi derivatives.

Where to Buy SNX?

You can buy Synthetix on a top cryptocurrency exchange like Binance, OKX, Bybit, FTX, and BingX.

Takeaways

- A decentralized finance (DeFi) protocol called Synthetix offers on-chain exposure to a wide range of digital and non-digital assets.

- The protocol gives users access to highly liquid synthetic assets.

- The protocol is built on the Ethereum (ETH) network (synths).

- Synths track and provide returns on the supported asset without requiring direct ownership of the asset.

- Havven, the network’s original name, was introduced by Kain Warwick in September 2017. A year later, the company changed its name to Synthetix.

- SNX is a good investment due to the decentralized finance (DeFi) protocol with a wide range of digital and non-digital assets.

- SNX price could hit a high of $7 in 2022.

- SNX can reach $10 by 2024 by expanding as a foundation for DeFi derivatives.

- The price can reach the highest level of $50 in 2030.

- You can buy Synthetix on a top cryptocurrency exchange like Binance, OKX, Bybit, FTX, and BingX.