Stellar is a payment protocol that enables fast transactions across borders and between different pairs of cryptocurrencies. It is based on distributed ledger technology and is much similar to other blockchain-based cryptocurrencies. They themself claim that it is a platform that connects banks, payment systems, and people. They further say that they intend to move money quickly, reliably, and at a negligible cost. Their native digital currency, Stellar Lumen, further powers the blockchain’s whole diversity of operations. It also serves to lower the transaction fees.

The Stellar Development Foundation (Stellar.org) initially created Stellar (XLM) as a peer-to-peer (P2P) decentralized network in 2014, and the network officially launched in 2015. It had the purpose of making the world’s financial systems inter-connected and ensuring a protocol for payers and financial institutions. It simply links investors, banks, and monetary institutes with each other for the creation and trade of multiple kinds of cryptos swiftly, safely, and at little to no cost.

Stellar (XLM) Fundamental Analysis

Stellar (XLM) is an open and interoperable payment source and a decentralized, permissionless, and independent network. Investors can trade peer-to-peer tokens on it, and users can issue their own tokens too. They can even transform currencies on the platform as soon as they enter the Stellar Lumens grid. Any user can have seamless transactions on the user’s and senders’ sides only through a stable internet connection and Lumen-enabled software. The transaction speed is about three to five seconds, which is faster than bank transfers and cross-border payments. The principle that holds great importance for them is transparency.

Apart from being fast and efficient, it helps save, trade, and spend digital currency among its users. Being an unrestricted financial infrastructure, it is easily and freely accessible to everyone on its grid. Their security system is strong and simplified due to its equipped cookie policy and other blocking structures on the Stellar Lumens grid. It needs no permission or applications to operate on the Stellar Lumens. It simplifies the fintech products on the Stellar Lumens orbit.

Stellar Updates

In 2017, they fixed the invalid use of cached data to avoid lumen creation. Rogue transactions were causing Lumen’s creation, and the Stellar Foundation burned Lumens through one of the fixed bugs to restore the ledger to the expected number of coins. They also fixed the bugs that prevented the peers from performing multiple handshakes at a time and denied other nodes from connecting. They also allowed different validation of values during nominations and ballot protocol.

In 2018, they fixed the overflow of the stack and some snapshot files that could have been corrupt at the time of generation. Changes were made to properly make the ledger computer from the next ledger start time and reduce the overall SCP time for closing a ledger. They updated the completion of signature verification at the transaction apply step, added liabilities to offers, and fixed rounding errors to prevent dust trades and large errors. In 2019, they managed to buy offers, improved transaction prices, and initial bucket entries, disabled 1% annual inflation, made path payment symmetrical, removed bucket shadowing, and fixed memory exhaustion from validators.

Tokenomics

The native token XLM is the medium of exchange in the Stellar network. The stellar network was initially launched in 2015, and a hundred billion XLM was issued. It is also used to stop spammers from clogging the ledger by paying transaction fees. Every authentic account in the Stellar network has to carry at least one XLM token. This currency is a bridge inside the Stellar Distributed Exchange, making it an asset that needs no anchorage for pairing up with any other asset to provide liquidity.

How Stellar Works?

Just like many other decentralized payment methods, Stellar basically operates by running a network of decentralized servers with a distributed ledger getting updated among all nodes in a couple of seconds. Stellar differs from bitcoin fundamentally in its consensus protocol. The consensus protocol of Stellar does not depend on the whole miner network for approving transactions but uses the Federated Byzantine Agreement (FBA) algorithm. In this method, transactions are processed faster because of its use of quorum slices (or a portion of the network) for approving and validating a transaction. Every node in the network has to choose another set of “trustworthy” nodes. After the approval of all nodes in the set, a transaction is considered approved.

This short process has fastened Stellar’s network very much, as it can approximately process more than a thousand network operations per second. The Stellar consensus mechanism secures the network. It entails decentralized control, flexible trust, low latency, and asymptotic security. This model allows anyone to join to gain consensus instead of a single entity taking up the whole power of decision-making. Confirmation of transactions is also cheap and fast and does not give bad actors some time to join.

Roadmap

Their old roadmap consists of accomplishments occurring from 2017 to 2019. For 2022, the designed roadmap revolves around three strategic building blocks. First, they want to increase network capacity using order of magnitude and enable trust-minimized innovation to enhance network scalability and innovation. Secondly, they want to activate more participation in the network using ecosystem input and engagement to establish great commitment, broaden the community and partnerships, and ownership in the ecosystem, and guide a long-lasting roadmap with better marketing, technology, innovation, investments, and activities. The third is the demand and promotion of diverse and inclusive paths for their mission in the ecosystem and creating a more justified financial system and network through research.

The objectives behind this roadmap were to make Stellar more inclusive and interoperable between conventional and contemporary financial rails. Creating a more engaging and different ecosystem will take Stellar innovation to new heights and develop new strengths to increase Stellar’s competitive advantages. Stellar wants to be positioned as an original and leading-edge innovator on the mission to integrity by the end of 2022. So various strategies would be used to accomplish these blocks and develop Stellar in 2022.

Stellar (XLM) Price Analysis

The Stellar price is $0.13 at present, and CoinMarketCap ranks it as #27. With a trading volume of $170 million, it has a market capitalization of more than $3.2 billion. It has a maximum supply of 50 billion XLM coins with 24.78 billion XLM coins in circulation. It is ranked among the best cryptocurrencies.

Rank: 40

Crypto Academy Stellar (XLM) Price Prediction

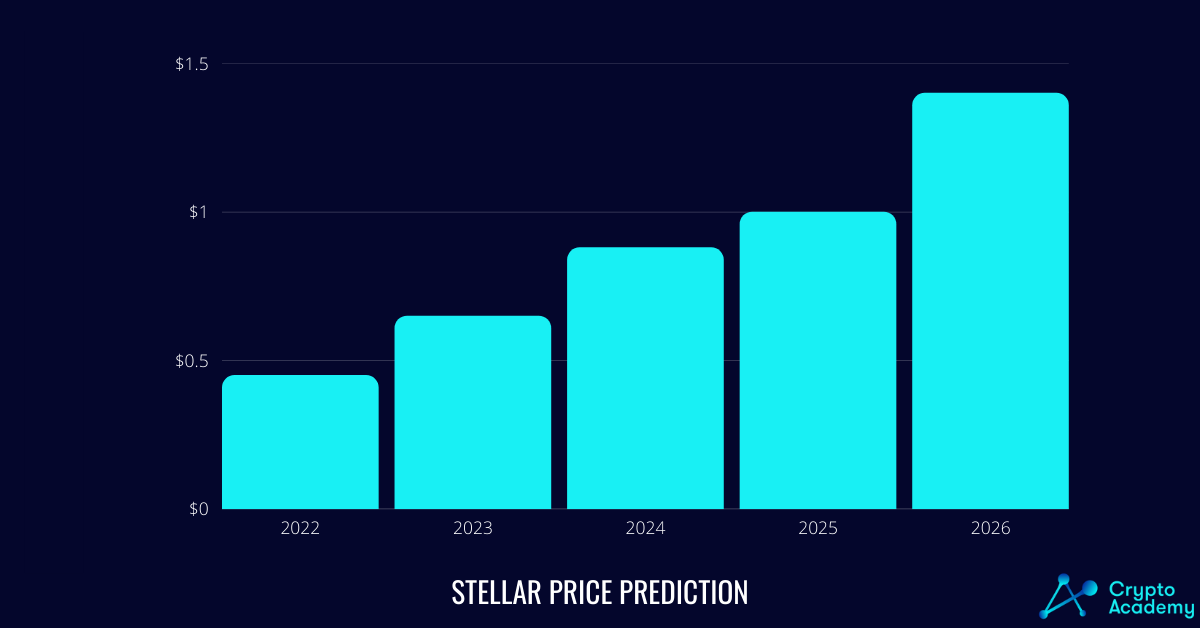

By observing the technical analysis, market capitalization, and price predictions for Stellar in 2022 and years beyond, we hope for it to achieve maximum growth in upcoming years while not considering uncertain negative future possibilities.

Stellar (XLM) Price Prediction 2022

We predict the price of Stellar as $0.3 on average throughout the year 2022. We can hope for the highest possible value of $0.45 and the minimum value of $0.27 due to an increase in the network capacity, scalability, and innovation.

Stellar (XLM) Price Prediction 2023

The Stellar Lumens may continue to move upwards through an increased engagement of the community and their participation, with the maximum price of $0.65 by the end of 2023. They predicted the minimum price of $0.53 and the average price of around $0.57.

Stellar (XLM) Price Prediction 2024

The Stellar Lumens predictions for 2024 say that it can have a minimum price of $0.7 by the end of the year. The average price can be $0.75, and the maximum price can be $0.88 this year through the inclusive and diverse ecosystem.

Stellar (XLM) Price Prediction 2025

By fixing all the bugs and working on strategies for a diverse and interoperable ecosystem till 2025, we can predict the XLM can have a price as low as $0.93 and as high as $1, with the average trading price of $0.96 throughout the year.

Stellar (XLM) Price Prediction 2026

The Stellar could reach $1.4 by the end of 2026, with an average price of $1.25. The minimum price can be $0.9 under adverse circumstances.

Stellar Market Price Prediction

Following are the price forecasts given by different crypto experts regarding Stellar (XLM)

Wallet Investor

They forecast a positive price increase in Stellar Lumens price. Currently, 573 XLM can be bought using 100 dollars. As a long-term increase in price can take place, it can reach $0.64 in the next five years, which is an increase of +268%. Hence, this $100 investment might go up to $368.39 in 2027.

Priceprediction.net

The XLM maximum price predicted by them for the end of 2022 is $0.29, with the average trading price of $0.26 by the end of this year. They estimated that the coin could effortlessly reach $1.13 using their five-year plan. Their experts and analysts related to business discovered that it may hit the maximum price of $8.65 by 2030.

Digital Coin Price

Digital Coin Price has predicted the highest possible value of XLM to be $0.28 by the end of 2022. The minimum and average prices predicted for this year were $0.24 and $0.27, respectively. By the end of 2023, they anticipate the maximum price of $0.32 and a continuation of this uptrend with the price of $0.41 by the end of 2025.

Coinpedia

The Coinpedia thinks that the digital asset can hit a maximum of $0.975 by the end of 2022 and $1.83 by the end of 2023. They also think that a negative market dump can cause the price to be $1.018 by 2023. In the next five years, the price might go up to $6.87, but in the presence of a bearish market, it may suppress the price to $3.97.

How to Buy Stellar

We have given below an easy guideline for buying Stellar.

Step 1: Create an Account

To buy an altcoin, such as Stellar Lumens, you need to create an account on such a platform that would support the trade of that digital asset. Some platforms, like Coinbase and eToro, let you buy and sell cryptocurrencies directly through the market. You should use one of these platforms to buy the asset, as both are them are best for XLM. Follow their terms and policies for making an account.

Step 2: Fund your account

Select a payment method, such as bank transfer or credit card, based on your comfort and affordability. After selecting the method, add funds in the form of fiat money (USD or EUR) to your account. Funds should be enough for the network fees and the amount of XLM you are expecting in the outcomes.

Step 3: Buy XLM

After funding your account, you are ready to make a purchase. For placing an order, first, read the sets of instructions and then expected outcomes in the form of XLM coins or buy orders. Fill in the information for that trade and your order details. Please review all the information and place the order and wait for its completion. After some time, you will see your coins have arrived at your trading account. After buying them, you can store them in a cold storage wallet that supports your asset, as it will prevent them from getting hacked. If the order is not completed due to any reason, the platform will cancel it and inform you about the problem.

Frequently Asked Question (FAQs)

Is Stellar (XLM) a good investment?

Yes, Stellar is a good investment option for its strong fundamentals and fast-driven price. Its vision is bright, with various milestones and updates making it one of the most favorable cryptocurrencies.

Will XLM Reach $1?

Stellar has a high chance of reaching $1 in the year 2025, or at least in 2026.

Where to Buy Stellar (XLM)?

XLM is available for trade across prominent cryptocurrency exchange platforms such as Coinbase, eToro, Kraken, Binance, Huobi, and Upbit.

Takeaways

- Stellar (XLM) is an open and interoperable payment source and a decentralized, permissionless, and independent network.

- Investors can trade peer-to-peer tokens on it, and users can issue their own tokens too.

- They even transform currencies on the platform as soon as they enter the Stellar Lumens grid. .

- The transaction speed is about three to five seconds, which is faster than bank transfers and cross-border payments. The principle that holds great importance for them is transparency.

- Stellar is a good investment option for its strong fundamentals and fast-driven price.

- Stellar has a high chance of reaching $1 in the year 2025, or at least in 2026.

- XLM is available for trade across prominent cryptocurrency exchange platforms such as Coinbase, eToro, Kraken, Binance, Huobi, and Upbit.