Fed Chair Powell warns U.S. debt growth unsustainable, hints at cautious rate cuts amidst inflation concerns.

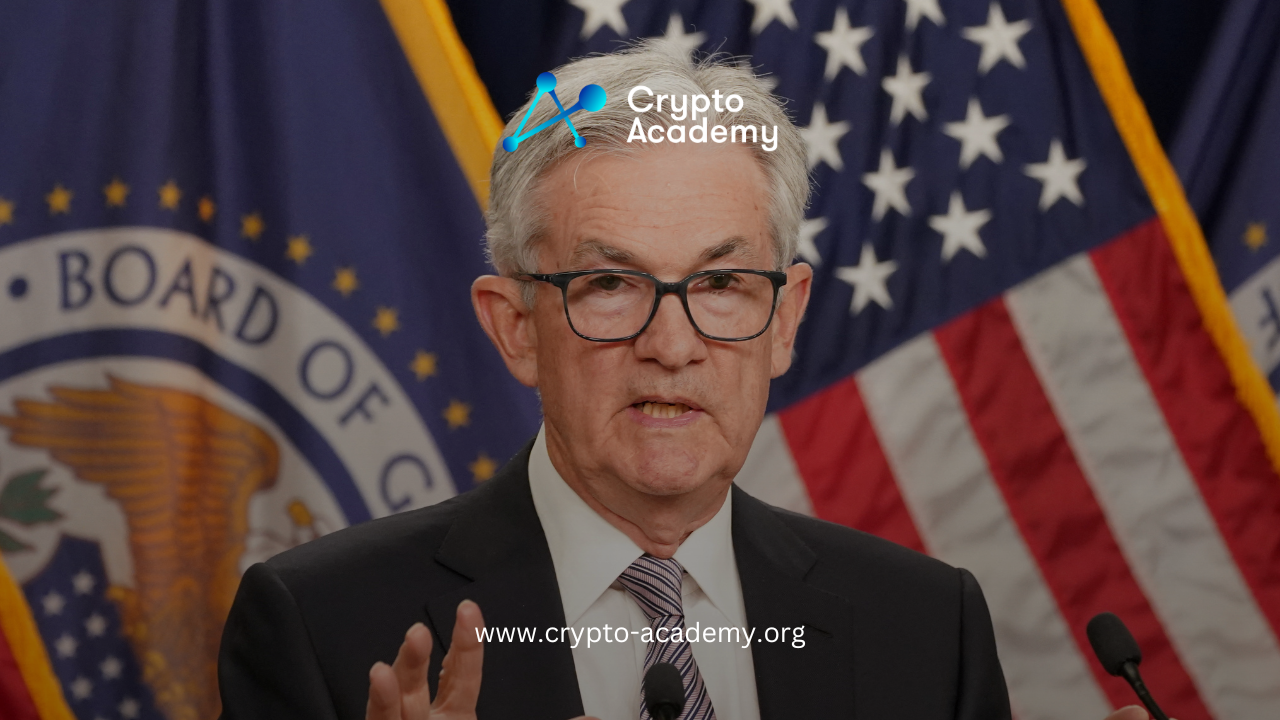

Jerome Powell, the Chairman of the Federal Reserve, has issued a stark warning about the United States’ current fiscal trajectory, stating that the nation’s debt growth is outstripping the economic expansion. During a recent interview on “60 Minutes” aired on January 4, Powell emphasized the urgent need for U.S. policymakers to engage in serious discussions aimed at curbing the economy’s escalating debt levels. He pointed out that the path the U.S. is on, with its debt expanding more rapidly than the economy, cannot be sustainable over the long term.

Powell’s comments come at a critical time, as the Federal Reserve decided to maintain interest rates between 5.25% and 5.50% last week, disappointing some investors who had hoped for rate cuts as early as March. The Fed’s stance remains cautious, with Powell explaining that the central bank requires more evidence of economic robustness and the effective management of inflationary pressures before considering a reduction in rates. This cautious approach reflects the Fed’s priority to ensure economic stability and inflation control before making any adjustments to interest rates.

Economic Indicators

The Federal Reserve’s decision-making process is closely watched by investors, as rate cuts typically signal increased borrowing capacity, leading to heightened spending and investment in riskier assets like cryptocurrencies and tech stocks. Powell’s message indicates a delay in rate cuts, possibly extending beyond the March meeting, as the Fed awaits clearer signs of economic strength and inflation control. Despite this, there’s a general consensus among Fed members that rate cuts could occur within the year, contingent upon positive economic indicators.

Powell remains optimistic that inflation will decrease in the first half of the year, suggesting that the Federal Reserve will reassess its position in the upcoming Federal Open Market Committee meeting in March. Factors influencing a more immediate rate cut include signs of labor market weakening or convincing evidence of a reduction in inflation.