Dai is an Ethereum-based stablecoin overseen and developed by Maker Protocol and the MakerDAO decentralized anonymous organization. This Dai price prediction explores the project details and the price movement in the years to come.

A variety of other cryptocurrencies are put into smart-contract vaults with the issuance of a new DAI. This will serve as collateral and soft-peg the price of DAI to the US dollar. The savings rate of DAI enables users to earn revenue if they hold DAI tokens. Single-Collateral DAI (SAI), a previous form of the token, could not support it but could only collateralize a single cryptocurrency.

The DAI does not only have a single founder or a small group of co-founders. Instead, the MakerDAO and Maker Protocol supervised the creation of the software that runs it as well as the creates new tokens.

Rune Christensen, a businessman from Denmark, launched MakerDAO in its initial form in 2015. MakerDAO is a type of decentralized autonomous organization that uses smart contracts. These contracts are self-enforcing, are written in computer code, and are carried out on the Ethereum blockchain for decentralized operation. In November 2019, they introduced Multi-Collateral DAI.

Dai (DAI) Fundamental Analysis

Dai and similar smart contracts were formally introduced on the primary Ethereum network on December 18, 2017. The only acceptable collateral was Ether at that time, and its price had fallen by more than 80% during the same time period. However, the price of Dai had kept nearly one US dollar during its first year, successfully.

In September 2018, Andreessen Horowitz invested $15 million in MakerDAO to acquire 6% of all MKR tokens. In the same year, MakerDAO established the Maker Foundation, which is based in Copenhagen. This organization works to launch the ecosystem with other things, building the necessary code for the platform’s functionality and adaptability.

In 2019, MakerDAO went through a conflict over its interaction with a more established financial system. Greater regulatory compliance was something Christensen desired for assets other than cryptocurrencies to be used as collateral for Dai. The chief technical officer (CTO) of MakerDAO left as a result of the conflict.

Due to the COVID-19 pandemic’s extreme market volatility in March 2020, Dai had to go through a deflationary deleveraging spiral that allowed it to trade for as much as $1.11 at its all-time high before reverting to its original $1.00 valuation. The primary benefit of DAI is its flexible peg to the value of the Dollar. Even the most liquid coins, like Bitcoin, had to face price movements (both up and down) of 10% or more during the day.

The cryptocurrency market is considered risky for its price volatility. In these conditions, traders and investors are naturally inclined to diversify their portfolios with safe-haven assets, whose constant price may assist in counteraction of major market changes. Stablecoins, like DAI, are one such type. DAI is a digital currency whose value is linked to resources with a relatively steady value, most frequently traditional fiat currencies like the USD or EUR.

https://twitter.com/MauriceHarte1/status/1558701037820825603?

Another major benefit of DAI is that it is controlled through a software protocol by a decentralized autonomous organization rather than a private firm. As a result, self-enforcing smart contracts powered by Ethereum manage and publicly record all token issuance and burning events, making the system more transparent and less susceptible to fraud. Additionally, direct voting by the frequent users of the token’s ecosystem governs the development of the DAI software in a more democratic manner.

By market capitalization, Dai is the second-largest decentralized stablecoin after USDT, the native stablecoin of Terra. The conventional assets like cash, US treasuries, corporate bonds, and commercial papers back the most used stablecoins such as BUSD, USDT, and USDC. Both Dai and Terra are also based on cryptocurrencies and tied to the Dollar (which has come under increased scrutiny in the case of USDT).

Users can create Dai by adding digital assets to Maker Vaults on the Maker Protocol. Users can utilize Oasis Borrow or other community-built interfaces to access Maker Protocol and create Vaults. On Oasis Borrow, users can lock in collateral in the forms of ETH, UNI, WBTC, YFI, LINK, MATIC, MANA, and others. The collateral ratio varies from 101% to 175%, depending on the risk level of the asset locked. When the ratio is met, users can borrow DAI against their collateral.

DAI issuance is controlled by software that utilizes the Ethereum blockchain and is called Maker Protocol. The Maker Protocol enables the collateralization of every DAI token by a suitable number of other cryptocurrencies.

This preserves the soft price peg to the US dollar. As part of this procedure, the Protocol enables any user to mint an equivalent number of new DAI tokens by depositing their cryptocurrency as collateral into the vault, a smart contract on the Ethereum blockchain.

DAI is an ERC-20 compliant, Ethereum-based coin. The Ethash algorithm of Ethereum is therefore used to safeguard Dai.

Dai (DAI) Price Analysis

The Dai price on August 23, 2022, is $1.00, with a trading volume of more than $49 million. The CoinMarketCap is ranking it as #13, with a market cap of $6.98 billion. It has a circulating supply of about 6.98 billion DAI coins. It has been proved as stable in price growth.

Rank: 25

Dai Price Prediction – Crypto Academy

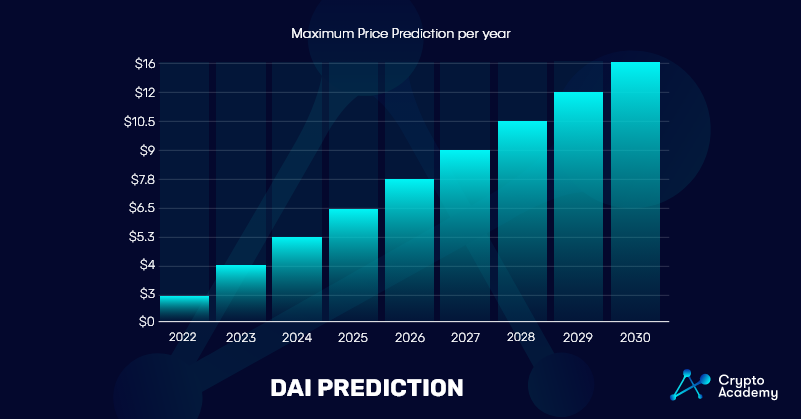

We have predicted the future price movement for DAI while considering their key milestones of user experience, governance, and market price movement.

Dai Price Prediction 2022

We expect the Dai price to reach a minimum level of $1.5, with a maximum price of $3 for 2022. The Dai price might reach an average level of $2 by rebranding its system and making its terms easier to understand.

Dai Price Prediction 2023

For 2023, we predict the price of Dai to be a minimum level of $2 and a maximum level of $4 throughout 2023. The average price of DAI can be $3 in 2023 by constructing a multi-collateral CDP portal.

Dai Price Prediction 2024

In 2024, the price of Dai can reach a minimum level of $2.3, with an average trading price of $3.4. The Dai price can hit a maximum level of $5.3 by improving the performance of the governance platform and user experience.

Dai Price Prediction 2025

The price of Dai might reach a minimum level of $2.7 in 2025. The Dai price might have a maximum level of $6.5 with an average price of $4.4 throughout 2025 by completely redesignation of the Maker website, product portals, and social channels.

Dai Price Prediction 2026

We anticipate the minimum possible price of Dai to be $3.2 in 2026. The Dai price might reach a maximum level of $7.8 with an average level of $5 while they construct the migration app encouraging upgrades in Dai and CDP to MCD.

Dai Price Prediction 2027

In 2027, the price of Dai might be around a minimum value of $3.8. The Dai price value can hit a maximum of $9 with an average trading value of $6 by engaging multiple independent and reputed third parties. This will protect and audit MCD contracts and publish their reports.

Dai Price Prediction 2028

We predict the price of Dai to hit a minimum level of $4.5 and a maximum level of 10.5 in 2028. The Dai price can be at an average trading price of $7.5 throughout 2028. This can happen through their bug bounty program.

Dai Price Prediction 2029

In 2029, the price of Dai can reach a minimum level of $6. The Dai price can reach a maximum price value of $12 with an average value of $9 by the highly engaging community as paramount for fulfilling the critical milestones of governance.

Dai Price Prediction 2030

In 2030, we expect the price of Dai to reach a minimum value of $8 and an average trading price of $12 throughout 2030. The maximum price can be $16, taking a huge step toward their mutual goal of achieving financial stability and transparency in the global economy.

Dai Price Prediction – Market Overview

Some well-known cryptocurrency analyses websites have given their price predictions for DAI as follows.

Digital Coin Price

Digital Coin Price analysts predict the price of Dai to be around $1.01, with a price rise of 44.64% in the future. In three and five years from now, the price of Dai can be $1.01 and $1.01. The price rise can be 128.5% and 139.6%, respectively.

Coin Codex

Coin Codex experts have determined the Dai price to be between $1.28 and $2.22 in 2022, with a rise of %121.96 under the best conditions. In a similar scenario, the price estimated is between $1.64 and $4.93, indicating a revenue of %392.38 by 2025. During the year 2026, the price can range from $2.10 to $10.93, which is a price hike of %992.24 under favorable circumstances.

Wallet Investor

Wallet Investor analysts consider DAI as a good investment. It can prove to be a profitable investment with a good return. On August 23, 2022, one can buy 100.034 DAI using $100. In the long-term, the expected increase in price for the same date in 2027 is $1.004. This would be a revenue of +0.4% in the next five years making your current investment of $100 to be about $100.4 in 2027.

How to Buy DAI?

Binance is one of the trustworthy marketplaces that offer a smooth user experience while purchasing legitimate cryptocurrencies like Dai.

Step 1: Login/Create an Account.

You need to create an account on Binance before making any specified cryptocurrency purchases since this will serve as your gateway to cryptocurrency trading. Therefore, log in to your existing account or use your email address and mobile number to register an account. After that, verify your account on the Binance app or website.

Step 2: Select a Payment Method.

You must next choose a way to fund your account in order to buy Dai (DAI) tokens. When using the Binance platform, click the “Buy Crypto” button on the website navigation to check out all the options available in your area.

If you’re using Binance for the first time, utilizing a credit card or bank transfer is the simplest option for you. Binance accepts payments made using Visa and MasterCard. There are various options for third-party payment methods, and you can even buy Dai directly from other users via Binance’s peer-to-peer technology.

Step 3: Buy Dai

You have to input your order information within the first minute at the current price after selecting your payment method. You have to click the “Refresh” button on the page if a minute has passed in order to see the newest real-time order pricing.

Confirm the exchange of your assets after confirming each detail. After purchasing cryptocurrency, keep it in your Binance account or your own wallet. Additionally, Binance allows the stake or exchange of tradable assets.

Frequently Asked Questions (FAQs)

Is Dai a Good Investment?

Yes, Dai is a very good investment because the organization is trying to launch the ecosystem and other upgrades for building the necessary code for the functionality and adaptability of the platform.

Can Dai Reach $10?

Yes, Dai can reach $10 by the year 2029 by the maximum engagement of the community is paramount to accomplishing the major milestones for governance.

Where to Buy Dai?

You can buy Dai from a reliable cryptocurrency exchange at suitable prices, such as Binance, BTCEX, OKX, Bybit, and MEXC.

Takeaways

- DAI is an Ethereum-based stablecoin overseen and developed by Maker Protocol and the MakerDAO decentralized anonymous organization.

- A variety of other cryptocurrencies are put into smart-contract vaults with the issuance of a new DAI.

- The Savings rate of DAI enables the users to earn revenue if they hold DAI tokens.

- The DAI does not only have a single founder or a small group of co-founders.

- DAI is an ERC-20 compliant, Ethereum-based coin, and its Ethash algorithm is therefore used to safeguard DAI.

- Dai is a very good investment because the organization is trying to launch the ecosystem and other upgrades for building the necessary code for the functionality and adaptability of the platform.

- A maximum price of $3 is expected for 2022.

- The Dai price value can hit a maximum of $9 in 2027

- Yes, Dai can reach $10 by the year 2029 by the maximum engagement of the community is paramount to accomplishing the major milestones for governance.

- You can buy Dai from a reliable cryptocurrency exchange at suitable prices, such as Binance, BTCEX, OKX, Bybit, and MEXC.

Disclaimer: The information provided on this page is most accurate to the best of our knowledge; however, subject to change due to various market factors. Crypto-Academy encourages our readers to learn more about market factors and risks involved before making investment decisions.