As per Reuter’s report, more crypto regulation may come into the EU in accordance with Environmental, Social, and Governance (ESG) rules.

On Tuesday, EU legislators will cast their ballots on a bill that incorporates stricter regulations for cryptocurrencies and Environmental, Social, and Governance (ESG) risks for financial institutions. The bill, which is being proposed by the European Parliament’s economic affairs committee, is based on the remaining elements of Basel III, a global agreement that necessitates banks to hold more capital to endure market shocks without depending on taxpayer support.

One of the key provisions in the bill states that banks must set aside a significant amount of capital, equivalent to a risk-weighting of 1,250%, to cover their holdings of cryptocurrencies. This requirement is consistent with recommendations from the global Basel Committee of banking regulators, which were issued in December.

The bill also introduces a definition of “shadow banking.” Shadow banking pertains to the vast sector of insurers, hedge funds, and investment funds that make up around half of the world’s financial system. They are typically less regulated than banks. The provision requires the EU’s executive European Commission to publish a report by June 2023 that assesses the feasibility of introducing “prudential” limits on banks’ exposures to shadow banks.

Another crucial aspect of the bill is that it requires banks to align their compensation policies with their transition plans to address ESG risks over the short, medium, and long term. This is a significant change as it will ensure that banks take into account the environmental, social, and governance risks when making decisions.

More Details on Crypto Regulation in the EU

The bill also introduces a new “fit and proper” regime for appointing bankers. The provisions state that there should be targets for a bank’s management body to ensure that they are diverse. That includes age, gender, geographical and educational background. This is an important step towards ensuring that the banking industry is more inclusive and represents the diversity of society.

In contrast to the changes proposed by EU states, which focused on temporary exemptions on some of the requirements to give banks more time to adapt, the provisions proposed by the EU legislators generally go further and are more comprehensive.

After Tuesday’s vote, legislators and EU states will collaborate to finalize a deal that would come into effect in 2025. The new regulations are likely to have a significant impact on the banking industry. The key focus would be in the areas of cryptocurrencies and ESG risks. Banks will need to ensure that they have sufficient capital to cover their cryptocurrency holdings. They will also need to adopt a more holistic approach to managing ESG risks.

Overall, the bill aims to make the banking industry more resilient and better equipped to handle market shocks, while also taking into account the long-term risks and opportunities presented by cryptocurrencies and ESG. It is a significant step towards ensuring that the banking industry serves the best interests of society. This would also be presumably more sustainable in the long run.

ECB’s Plans for a Digital Euro

The European Central Bank (ECB) has announced plans to create a digital euro. They want to respond to the growing preference for electronic payments in the Eurozone. The investigation into a digital euro, which has been underway for over a year, has been a priority for the ECB. They have been working closely with the European Parliament to develop the project.

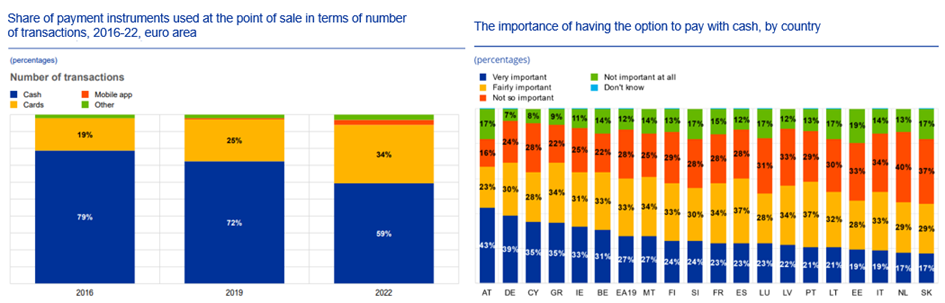

According to the ECB, cash payments in the Eurozone have dropped from 72% to 59% over the past three years. Their studies show that digital payments are becoming increasingly popular. In countries like the Netherlands and Finland, cash is now only used in one-fifth of transactions.

A digital euro would make public money available in digital form, alongside cash. It would also offer Europeans access to means of payment that allow them to pay everywhere in the Eurozone.

The ECB has emphasized that the digital euro would not replace other electronic payment methods or cash. Instead, it would complement them. This would safeguard monetary sovereignty and strengthen Europe’s strategic autonomy. The initial releases would focus on enabling access to the digital euro for Eurozone residents.

The ECB has stated that it believes the digital euro should be easily accessible and usable throughout the Eurozone, similar to cash today. To achieve this, the ECB is proposing a digital euro scheme. This includes a single set of rules, standards, and procedures. This then would allow intermediaries to develop products and services built on a digital euro.

The digital euro usage would be free of additional fees. However, people would have the option to make use of additional services offered by participating intermediaries. These intermediaries, however, may come with a fee. The ECB plans to conclude the investigation phase and present its legislative proposal in 2023.

Implications of a Digital Euro

While some of the concerns regarding CBDCs were addressed by ECB’s Fabio Panetta, the crypto community remains skeptical regarding their centralized nature. Moreover, many are seeing these attempts by central banks as simple means to “shut down” the hype for crypto. It is clear that the core idea of cryptocurrencies conflicts with the entire banking system.

However, history suggests that centralization in the money market is not necessarily effective. The most ideal example would be the financial crisis of 2008. Furthermore, the mere possibility of control over the duration that people can use CBDCs is against the principles of democracy, let alone cryptocurrencies.

The debate regarding CBDCs continues to heat up. While digitalization is crucial for advancement, centralizing it may not be good for society, as well as the crypto market. On that note, sensible regulation is a must in this industry. But, even regulation should not exceed the threshold on which authorities can begin to control what happens in the market.