People are becoming more familiar with the technology behind digital currencies as the cryptocurrency industry continues its rapid expansion. There is a constant emergence of innovative forms of digital currency, and a number of important financial institutions are actively exploring these new forms.

Large corporations and even financial institutions are gradually becoming more accustomed to using digital forms of currency. What factors have contributed to the development of central bank digital currencies (CBCDs) and what kind of influence do they have on the population as a whole? Read on further down to find out more information.

What are CBDCs?

A central bank digital currency, or CBDC, is a digital form of currency that may be issued by central banks and has the potential to be used by individuals as well as companies to make payments and retain value.

It is comparable to the fiat money that is in circulation, but it consists of digital money issued by the central bank in the national unit. This money represents legal tender and is backed by the central bank. Because of this, CBDCs are inherently safer and less prone to price swings than other virtual currencies.

A CBDC is readily comparable to traditional currencies such as the US dollar. However, CBDCs come in the form of digital tokens rather than physical ones. CBDCs are essentially the same as fiat money in that they are produced by the government and managed by the central bank of the country. In addition, CBDCs use a digital ledger as their foundation and may or may not make use of blockchain technology or distributed ledger technology.

It is essential to bear in mind that central bank digital currencies (CBDCs) are not the same thing as cryptocurrencies like Bitcoin (BTC). They are not value-dependent; rather, their worth is totally established by the market. They are analogous to electronic currency in that they include a claim against a middleman such as a commercial bank.

CBDCs are undergoing fast development, and the adoption of these currencies may be approached in a variety of ways depending on the central bank. Although it may be some time before CBDCs totally replace conventional cash, this possibility exists. In addition, it’s possible that CBDCs won’t provide the same level of anonymity that you get from using today’s cryptocurrencies.

One of the most significant challenges posed by CBCDs is access and availability. As a result, some people may be unable to use cutting-edge technology. This specific issue is also one of the most significant issues that may contribute to CBDCs having a difficult time supplanting standard money.

In general, CBDCs would provide not just a different form of currency issued by central banks but also a massive change in the architecture of payment systems. Because of this, it is essential to have a solid understanding of the advantages provided by CBDCs as well as the effects these benefits have on the overall payments environment.

Are CBDCs a Good Idea?

The rising digitalization of markets, the demand for real-time transactions and settlements, and the necessity for highly efficient producers and cross-border monetary transactions have all contributed to the need for CBDCs.

The International Monetary Fund (IMF) believes that centralized technologies like CBDCs have the potential to save costs, make it easier for money to move seamlessly, enhance financial inclusivity, and make it safer to get access to funds via digital platforms.

However, many centralized institutions are beginning to see the growing importance of crypto currencies and are becoming worried about the possible repercussions that these currencies may have on the financial sector.

It is still uncertain what the primary causes are for financial institutions’ interest in CBDCs; nonetheless, this trend is expected to continue. But at this point, we have an idea as to why they would be acting in such a manner.

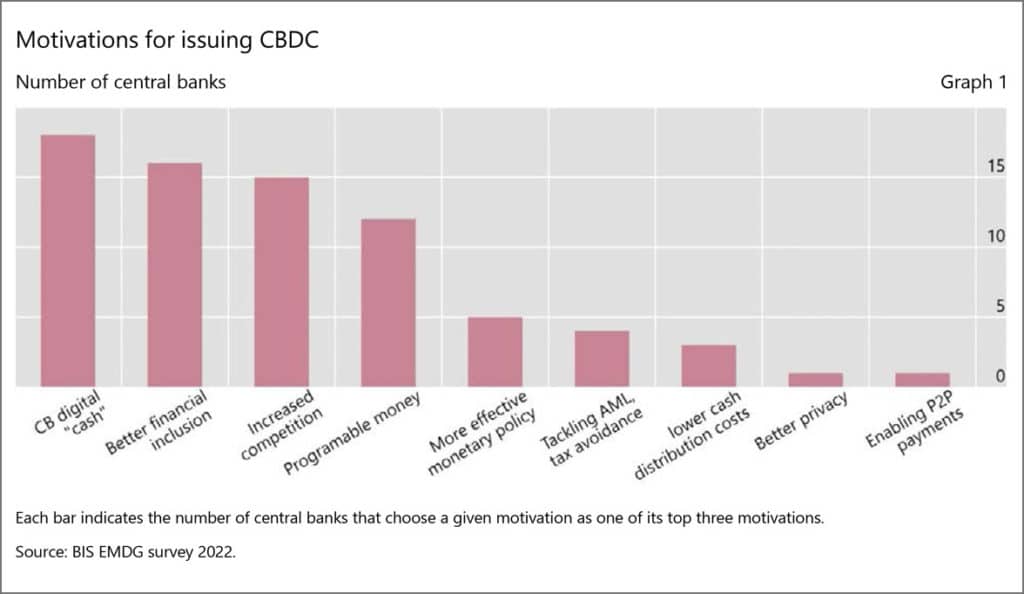

(Motivations for issuing CBDCs. Source: NFCW)

To begin with, CBDCs significantly enhance financial inclusion, which is highly vital to financial institutions and is considerably improved by these organizations.

CBDCs could make the financial scene increasingly robust by encouraging competition, productivity, regulation, and creativity in the financial sector. They would also tackle the diminishing use of cash by boosting the use of genuine central bank money and increasing the supply of such currency.

The Benefits of CBDCs

The use of CBDCs can be beneficial to both individuals and financial institutions in a variety of different ways. In this article, we will discuss some of the most significant benefits that come from utilizing CBDCs.

Better Transparency

CBDCs provide improved visibility over the economic activity that is taking place throughout the nation. In today’s world, the nation’s central bank has almost no visibility into the financial dealings that are carried out with cash. While this is excellent news for those who engage in dishonest behavior, it is not so good for the overall economic policy of any country.

By making use of CBDCs, the central bank will be able to see, to some extent, all of the transactions that are carried out and will, as a result, be in a position to lower the level of financial risk.

Preventing Fraud

The use of CBDCs is extremely helpful in the fight against money laundering. A standard banknote is the method of transaction that is currently the most anonymous, and it is still the case that the majority of the time, illegal activities are conducted using this method. For the first time ever, CBDCs have the potential to put a stop to money laundering.

Financial Inclusion

This particular topic has already been discussed at length here. CBDCs have the potential to improve financial inclusion, which is especially important during challenging times like a pandemic. Two groups of people are negatively impacted as a direct result of people’s growing reluctance to use cash.

To begin with, individuals who are not banked and therefore do not have a bank account, as well as senior citizens who have less experience with technology and are less adept at making digital payments. However, with the help of a digital CBDC, money can be sent to anyone and at any time with relative ease.

This can be accomplished through the use of a mobile application, which may be simple to operate and quick to access, and the government will be able to send money to anyone at any time.

In addition, a CBDC that is based on blockchain technology enables a wide variety of possibilities that do not exist in the current world, such as programmable money through smart contracts that give us the ability to input monetary policy.

The Disadvantages of CBDCs

As we’ve seen, CBDCs have a number of advantages over the fiat currency that’s currently in use. However, anything that does have advantages also typically has disadvantages. Let’s look at these disadvantages in more detail below.

Disintermediation of Banks

When it comes to CBDCs, there is a risk of bank disintermediation. The impact of replacing a $1 banknote with a $1 CBDC is minimal. On the other hand, if the public begins to substitute CBDC for their bank balances, this reduces the bank balances that banks hold, increases their funding costs, and reduces their profatibility.

Acceleration of Bank Runs

In the event of a crisis, a CBDC can hasten the process of customers withdrawing their money from banks, which presents central banks with another significant challenge. Using an ATM, you are able to completely withdraw all of the money from a bank account today.

However, the amount of money that can be taken out of an ATM is subject to certain physical restrictions. You are going to run into a lot of challenges, such as finding a secure place to keep all of this cash in its physical form.

In a world where CBDC exists, you will be able to swiftly transfer the funds held at your bank to your digital wallet, and there will be no restrictions placed on the total amount of money that you can store digitally. This is one of the most significant issues that is prompting financial institutions to reevaluate their utilization of CBDCs.

Potential Privacy Problems

Even though increased transparency and giving the central bank the ability to view all transactions is beneficial for putting a stop to fraudulent behavior, it also raises privacy concerns for regular people.

An increased level of transparency on individuals’ day-to-day dealings may prove to be a source of inconvenience for people, many of whom already have a diminished level of faith in the government in comparison to how they once felt. Because of the potential risks to their privacy, some individuals might not be willing to use CBDCs.

What Can We Expect from CBDCs?

Central banks all over the world are examining different approaches to the construction of CBDCs while taking accessibility, confidentiality, and distribution into consideration. Token-based and account-based designs are the two most frequent formats for CBDCs’ underlying architecture. Each strategy utilizes a unique set of technological components, in addition to providing variable degrees of access and confidentiality.

Token-based CBDCs make use of an electronic token, and in order to use the platform or make a claim, consumers need to be aware of the token. This strategy normally provides a high level of privacy. However, central banks have the option of imposing identification restrictions on users of the network in order for them to participate.

When using a system that is based on tokens (token-based approach), financial institutions would need to be the initial line of protection in terms of complying with legislation regarding KYC and AML/CFT. However, compared to previous models, this strategy makes it more difficult to monitor the legislation, while it does have the potential to enable accessibility to CBDCs.

Accessibility to the CBDC and the filing of claims via an account-based system are both connected to a bank account that may be associated with the identification of the owner. As it is still necessary to have a financial connection, this strategy poses difficulties for achieving widespread access.

Institutions must handle each transaction by taking money out of the CBDC account of the sender and putting it into the CBDC account of the recipient when they are asked to transfer assets between accounts. Transactions have to be confirmed using user IDs, and as a result, comprehensive authentication systems are necessary to retain a unique identification per person across banking systems.

The Future of CBCDs

The advent of CBDCs is a game-changer for the financial sector. It increases the effectiveness of payments and provides an extra option to the way money is modeled at the moment, both from a technical and a practical viewpoint.

Central banks should take advantage of this window of opportunity to examine the environment of virtual money and envision it in terms of emergent services, opportunities, and creating value since central banks are making quick progress toward adoption.

Even though we do not fully understand the effects that CBDCs have, we must not lose sight of the fact that they have the real potential to alter the course of finance history.

Takeaways

- People are becoming more familiar with the technology behind digital currencies as the cryptocurrency industry continues its rapid expansion.

- There is a constant emergence of innovative forms of digital currency, and a number of important financial institutions are actively exploring these new forms.

- CBDCs are digital currencies issued by central banks that individuals and companies can use to make payments and store value.

- CBDCs are comparable to the fiat money that is in circulation, but it consists of digital money issued by the central bank in the national unit.

- It is essential to bear in mind that central bank digital currencies (CBDCs) are not the same thing as cryptocurrencies like Bitcoin (BTC).

- CBDCs could make the financial scene increasingly robust by encouraging competition, productivity, regulation, and creativity in the financial sector.

- Token-based and account-based designs are the two most frequent formats for CBDCs’ underlying architecture.

- CBDCs have the potential to improve financial inclusion, which is especially important during challenging times like a pandemic.