Bitcoin ETFs in the U.S. see $30.4 million in inflows ahead of the Bitcoin halving, reversing a week-long outflow trend.

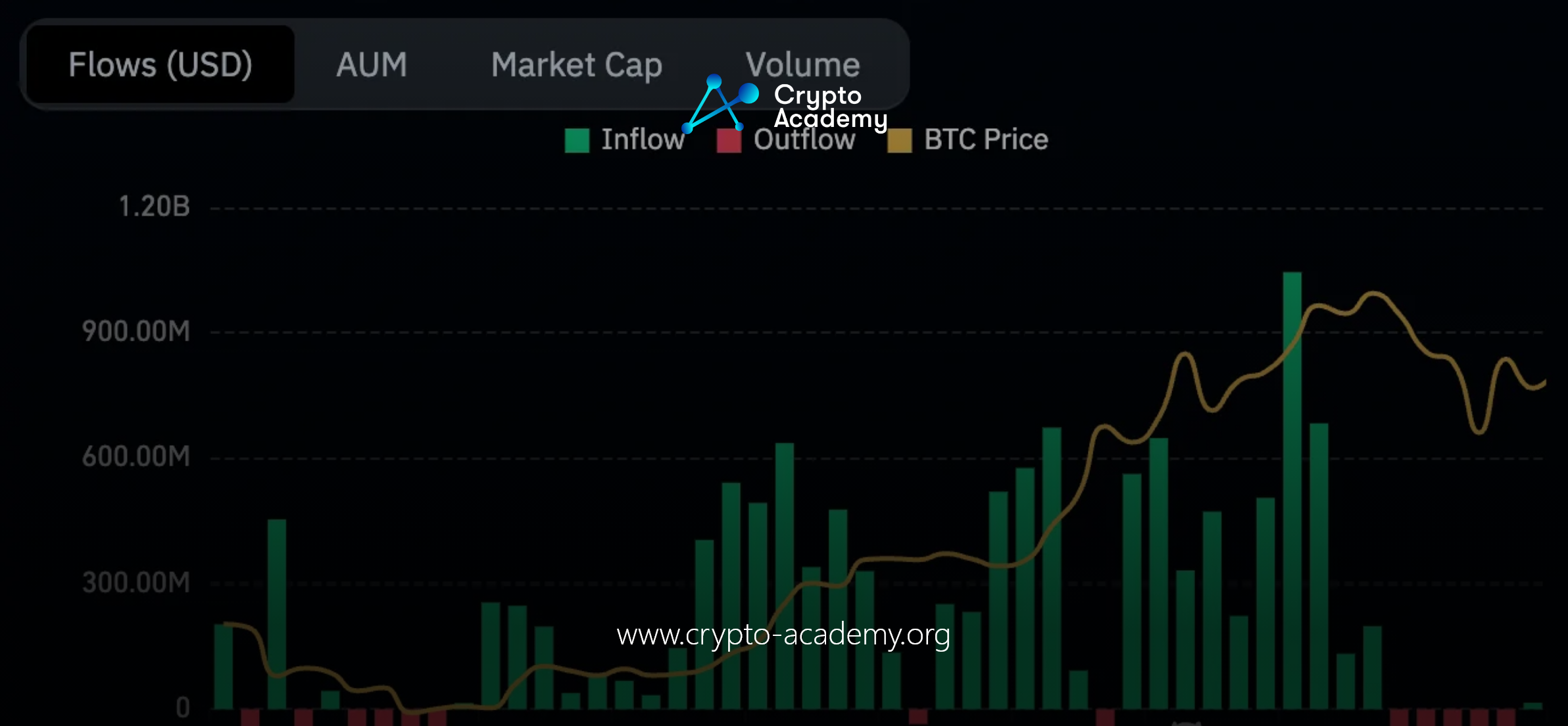

In terms of U.S. exchange-traded funds (ETFs), the Bitcoin sector has witnessed a significant reversal of fortune. After enduring a week-long sequence of outflows, the market saw substantial inflows amounting to $30.4 million into various Bitcoin ETFs. This shift in investment dynamics arrives on the cusp of the highly anticipated Bitcoin halving event, and it notably disrupts a prior streak of capital withdrawal that persisted from April 12 to April 18.

The latest data, analyzed from Farside, highlights that between these dates, the outflow predominantly involved the Grayscale Bitcoin Trust ETF (GBTC), which has been experiencing a consistent decline in investment since January. This period coincided with the Securities and Exchange Commission’s approval of spot Bitcoin ETFs, leading to a broader distribution of investor interest across newer funds.

On April 19, in a decisive turn, five out of the ten approved ETFs saw a surge in investments that not only compensated for the losses of GBTC but also marked an overall net gain for the sector. The ETFs that led this influx included the Fidelity Wise Origin Bitcoin Fund (FBTC), which alone attracted $54.8 million, dwarfing the collective outflows from both itself and GBTC. Other notable contributions came from the Bitwise Bitcoin ETF (BITB) at $4.9 million, the ARK 21Shares Bitcoin ETF (ARKB) with $12.5 million, the Invesco Galaxy Bitcoin ETF (BTCO) at $3.9 million, and the Franklin Bitcoin ETF (EZBC) at $1.9 million.

Impact of Bitcoin Halving on Market Dynamics

Historically, Bitcoin halving events—where the reward for mining new blocks is halved, thereby reducing the rate at which new bitcoins are generated—have catalyzed significant shifts in Bitcoin’s market value. The last halving on May 11, 2020, saw Bitcoin’s value initially pegged at approximately $8,500, escalating to around $65,000 over the subsequent four years. This pattern underscores the event’s propensity to enhance Bitcoin’s scarcity and, by extension, its market valuation.

The most recent halving, which occurred on April 20 at 12:09 am UTC, marked the fourth instance of such an event, captured notably in Bitcoin block 840,000. It spurred a momentary spike in network fees due to heightened demand, with Bitcoin users paying a cumulative 37.7 BTC in fees—equivalent to over $2.4 million—to secure transactions within this specific block.