At first sight, KuCoin appears to be suitable for cryptocurrency traders with a lot of expertise. The platform allows you to trade in futures and margin products, using a vast variety of tokens to pick from. Moreover, KuCoin is an appealing cryptocurrency exchange because of its low costs and wide range of features.

KuCoin’s extensive features, cheap fees, and a large selection of cryptocurrencies are ideal for seasoned cryptocurrency traders. Unfortunately, KuCoin does not have an operating license in the United States, which limits its user range. Read further down below to find out if the platform is suitable for you.

What Is KuCoin?

KuCoin is a worldwide cryptocurrency exchange that began operations in 2017. It currently has 10 million members and offers a variety of trading alternatives to those customers. Trading on the spot, futures, margin, and peer-to-peer trading, as well as lending and staking, are all included in this category.

KuCoin claims that it provides the industry’s highest possible degree of security and a choice of around 400 different cryptocurrencies. In light of the extensive number of capabilities it offers, it is designed to be user-friendly for novices, with an interface that is streamlined and straightforward. Also, some of the platform’s fees are among the lowest in the cryptocurrency industry.

KuCoin has a preference for listing lesser-known crypto tokens that have a significant potential for expansion. In addition to this, it gives users access to a vast range of tokens, some of which are not as well-known as other cryptocurrencies. Furthermore, Holders of KuCoin (KCS) receive up to 90% of the money paid in trading fees.

KuCoin Fees

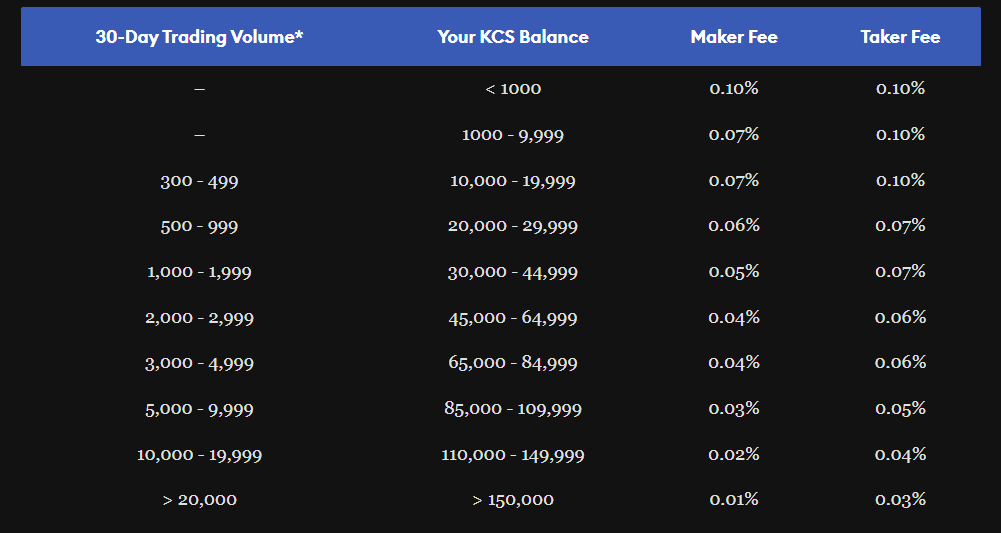

KuCoin’s trading fees are in line with those of Binance.US, the market leader in the cryptocurrency industry. In addition, investors have the option to achieve a discount that is proportional to either their monthly average holdings of the platform’s native coin, KCS, or the number of trades they made in the prior month. If customers pay using KCS instead of other methods, they are eligible for an additional 20% fee discount.

KuCoin, just like the majority of other cryptocurrency exchanges, has a maker-taker fee structure. This means that you will be charged various costs based on whether or not your order is determined to be a taker.

Makers are members of an exchange who generate liquidity by placing fresh open orders for other users to fulfill. Takers, on the other hand, lower liquidity by fulfilling the orders of current makers. Because you can’t know in advance whether the order will be a maker or a taker, it is highly unlikely that you will be able to accurately predict what your fees will be in advance.

The amount of money you’ll have to pay in fees is determined by how much you’ve traded in the previous month. Because the monthly trading volume on KuCoin is measured in Bitcoin (BTC) instead of U.S. dollars, it might be difficult to compare KuCoin’s costs to those of other exchanges’ fees.

To withdraw nearly any cryptocurrency from your KuCoin account, you are required to pay a fee, as is the case with the majority of cryptocurrency exchanges. If you intend to move your assets to some other wallet or platform in the future, you should examine the fees associated with the exact currency that you intend to buy before you actually make the transaction.

If you believe that you will be relocating assets on a regular basis, it may be worthwhile to compare the all-in trading and withdrawal fees of this platform with those of another platform, particularly one that allows a certain number of free withdrawals every month and is much more user-friendly for beginners.

KuCoin Features

KuCoin, like every other cryptocurrency exchange out there, has a few characteristics that set it apart from other exchanges and make it better to use. The following are a few of those features:

Margin Trading

Among the few cryptocurrency exchanges that allow citizens of the United States to open margin accounts is KuCoin. Customers are able to borrow money and leverage their investments in order to increase the amount of money they make.

While dealing with an asset that is already dangerous and has a history of being extremely volatile, using margin significantly increases the level of risk you are able to take on. Because of this, using margin should only be done by experienced crypto investors.

Crypto Lending

KuCoin members also have the option of lending their cryptocurrency holdings to other users who are interested in margin trading. The interest rates and the duration of the terms are different for each coin.

It should come as no surprise that crypto lending isn’t really risk-free. Even if the loans are secured and the receiver is required to have a particular balance, unpredictable losses may still occur if the price of the asset falls. When a user’s account falls below 97% of the amount they borrowed, KuCoin will immediately start margin calls, which will give you back any coins you lent to that user.

In the event that they are unable to fully refund you, KuCoin’s insurance will cover the shortfall. However, the terms of service for the exchange emphasize that this is not insured to entirely cover any losses that may occur.

Extra Features

KuCoin offers a large number of optional features. Nevertheless, you should give great consideration to whether or not you wish to utilize them. For example, margin trading lets you “leverage” your assets, which is basically the same as borrowing money to buy more cryptocurrency.

Leverage is a trading tool that should only be used by extremely experienced traders since it increases the volatility of an existing high-risk asset, such as bitcoin. The KuCoin mobile app also supports the use of automated trading tools or bots. Trading bots may purchase and sell cryptocurrencies on your behalf automatically.

This relieves you of the need to constantly monitor the market when you are away from your computer. When making purchases with the intention of holding on to them for an extended period of time, the effect of automated bots is minor. It’s not always clear how they invest your funds, so you must understand the cryptocurrency trading strategies that the bots use.

Solid Community

KuCoin says that its service is used by one in four cryptocurrency holders throughout the globe. Since there are more individuals trading, there is an increased likelihood that you will be able to make the transactions you desire.

This is the primary benefit of having such a large client base, which also contributes to the market’s overall liquidity. It also indicates that you have a good chance of becoming a part of a great community of investors.

KuCoin Token (KCS) Explained

The value of a wide variety of frequently used exchange tokens, including KuCoin’s native coin, KCS, is moving in an upward direction. KCS holders are eligible for daily incentives at the exchange. The total supply of this coin was initially set at 200 million. However, the deployment of the burning technique has lowered the count to about 145 million.

KCS now has a total market cap of $1,649,287,649 and is ranked 41 on CoinMarketCap at the time of this writing. The total quantity of KCS is limited to 170,113,638 and there are now 98,379,860.95 in circulation. KuCoin will continue to buy back and burn tokens until there are only 100 million left in circulation.

Is KuCoin Safe?

KuCoin has formed a partnership with a firm known as Onchain Custodian with the intention of enhancing the safety of the cryptocurrency assets that are held on its exchange. This includes Lockton’s protection against hacking and other cybercrimes. In addition to that, it features a bug bounty program that offers rewards to honest hackers who disclose vulnerabilities in the system.

KuCoin promises that client assets are stored offline in cold storage. However, it is unclear what fraction of data is retained offline. It must keep some cash online in hot wallets so that consumers can make transactions. KuCoin hot wallets got hacked late last year. However, insurance compensated for the losses. Moreover, KuCoin was open and quick to respond.

KuCoin provides strong user-level security as well. The website urges users to establish two-factor authentication and an extra password. You may also select safety words that will show up in KuCoin emails to prevent you from being scammed.

Takeaways

- KuCoin is a 2017 cryptocurrency exchange with 6 million members and a range of trading options.

- On KuCoin you can trade futures and margin products, and there are a lot of tokens to choose from.

- KuCoin is a prominent cryptocurrency exchange site, with a user interface basic enough for novices.

- On the platform, investors can get a discount based on their monthly average KCS holdings or transaction volume.

- KuCoin offers a few features that make it better than other cryptocurrency exchanges.

- KuCoin partnered with Onchain Custodian to protect users’ cryptocurrency assets on its exchange.

- With so many coins to choose from, KuCoin is a good place for people who are new to trading cryptocurrency to start.