The need for risk hedging is going through its own boom phase in line with the expansion of the market overall. Users of cryptocurrencies often incur losses as a result of a variety of risks, including smart contract hacks, de-pegs, unstable cryptocurrencies, and day-to-day market volatility. Insurance is the most effective risk hedging tool out there. Despite rising demand, fewer than 2% of the DeFi TVL is insured.

As a result, new insurance protocols are required to fill in the gaps that remain. Despite the fact that there has been enormously beneficial ecosystem development in the crypto scene, this expansion also opens the door for a high risk of cyberattacks and malicious actors.

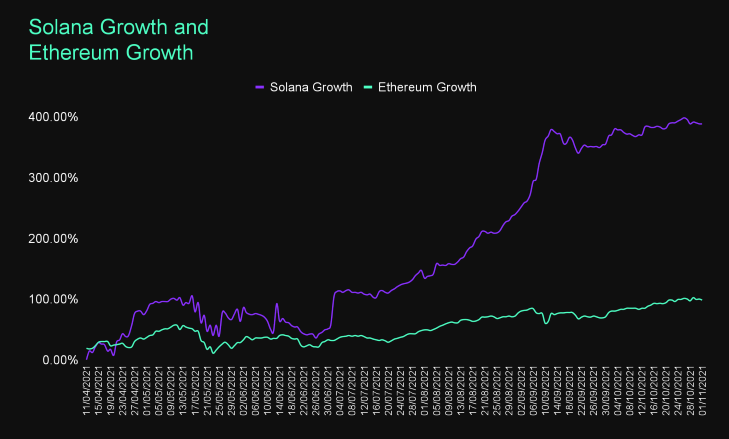

(Solana’s growth compared to Ethereum. Source: Amulet)

It is possible that there will be a significant demand for insurance and other risk assessment tools on Solana, and it is also possible that the wider Rust-based ecosystems may soon see their own user surge. Amulet will begin operations immediately in response to the growing need for security in the industry and address all of the issues.

What Is Amulet?

The Amulet Protocol is a decentralized insurance protocol that was developed for the Rust-based ecosystem, beginning with the Solana blockchain. Amulet has developed a new and open insurance model, which not only efficiently overcomes the main issues of current decentralized insurance protocols but also provides a new paradigm shift for the whole insurance industry.

Amulet will develop its own insurance capabilities and create a claim structure that utilizes a unique Yield Backed Claim (YBC) mechanism as part of this endeavor.

Amulet wants to share its concept of security as well as the ways by which they intend to implement it, specifically on Solana and All Rust-based ecosystems. The platform desires to reach its full potential so that it may fulfill its role as a crucial building component in the creation of future protocols.

The platform aims to provide easy, dependable insurance to enable users and protocols to manage risks and expand. Amulet welcomes you as a donor, investor, or if you’re just there for the ride. For an insurance system, the path ahead is rich with danger, but the potential to improve the crypto industry makes this a noble cause that Amulet is willing to take on.

Furthermore, the platform also strengthens the Solana ecosystem and provides users with increased levels of safety. Although it is a specific industry, insurance is an essential component of the economies of almost every country, both within and outside of the crypto community.

The Difficulties Amulet Faces

The platform is committed to making significant time and financial investments in the development of the cryptocurrency sector. It faces many challenges along the way, just like every other brand-new project that emerges on the cryptocurrency scene. Here are some of the difficulties Amulet has to deal with.

Building An Efficient Network

Developing distribution channels to expand capacity and coverage while retaining proper risk management is challenging. Regarding insurance procedures, it is impossible to overestimate the significance of maintaining robust networks.

Despite the fact that these dangers are known beforehand, insurance is often obtained after a user or protocol has been infiltrated, hacked, or otherwise abused. By getting insurance, investors and protocols can avoid some of these risks and keep going with their crypto adventures in a safe way.

Capital Management

In a disastrous case, gamblers might withdraw assets to protect their capital. From the insurers’ standpoint, this threatens the protocol’s longevity. This danger will exist until a procedure achieves critical mass and can cover costs with premiums and investment income. Without a good risk management framework, it is impossible to determine if threats are priced correctly and assets are distributed properly.

Capital and User Growth

Insurance procedures have the dual challenge of attracting and keeping invested capital. There is a risk involved of primary loss and stiff competition for user capital in a market with a high APY.

The development of liquidity locusts may be caused solely by yield variations, leaving many protocols at the control of their staking community. This compels others to enhance incentives to keep staked wealth. This isn’t a sustainable approach and generates a debt cycle that grows harder to escape over time.

Processing Claims

It’s hard to provide a reliable, unbiased claim procedure at a fair cost while matching parties’ interests. Insurers are rewarded based on total profitability, whereas claimants desire to limit premium costs and maximize payments.

The biggest problems with the present DeFi insurance processes are their underwriting and claims systems. All present insurance procedures rent underwriting capacity from staked players and pay claims from this pool. This creates liquidity issues for claims, making the protocol unsustainable. Amulet came up with new ideas because it saw and understood these problems.

What Amulet Has To Offer

Product Offerings

Amulet takes what they’ve learned from existing insurance protocols and tries to cover a wide range of risks at first, such as smart contract vulnerabilities, stable coin de-peg risk, and more.

As the protocol expands, other solutions, such as NFT asset risk and price volatility risk, will be developed. In addition to the solutions listed above, Amulet may develop packaged and portfolio-based coverages to reduce costs and simplify user experiences. To improve the user experience, cover operation services such as cover suggestion, cancel, renewal, and rollover will be made available.

Reliable Pricing Model

Insurance is a risk-mitigation strategy in which the insured exchanges risk with underwriters via insurance premiums on contracts. The cost of insurance products is at the heart of each company, and Amulet bases its pricing model on tested analysis as well.

The goal of pricing, in general, is to establish a fair, accessible, competitive cost level for users and to be very flexible in an ever-changing risk environment. A common technique would be to create a bonding curve between price and insurance capacity. The lower the price, the higher the capacity, and vice versa.

This encourages user adoption while simultaneously acting as a proxy for risk. The platform guarantees that these parameters will be carefully selected and defined at the start of the protocol, followed by continual refinement as new data emerges.

As more information is gathered about the protocol and the market, more complex information pricing models may be made. These models and parameters may be improved over time by using different methods to smooth out and improve the model’s parameters.

Amulet’s Token

Using Amulet’s native token ($AMT), members of the community will be able to make suggestions and vote on them. A number of changes have been made, including new product listings and treasury buyback limits as well as changes in future protocol goals.

Future Amulet holders may learn about the token distribution strategy and value accumulation. The total supply of $AMT is fixed at one billion (1,000,000,000). For the most part, the $AMT supply (68%) is kept for ecosystem expansion and devoted to delivering incentives to businesses. 50% of the supply is allocated to business growth incentives, such as liquidity mining, underwriting incentives, CAP awards, and airdrops.

18% is set aside for liquidity provision on exchange listing, strategic partnerships, marketing, and PCUV reserve. The remaining 32% is used for fundraising, liquidity bootstrapping, and team rewards. Where 10% of the proceeds go straight to fundraising. 15% to the team and advisers, 5% to the IDO, and the remaining 2% for the initial liquidity bootstrap.

The developers behind Amulet came up with the idea for the token holder incentive system by combining the lessons learned from previous successful DeFi protocols. Connecting them with the requirements that an insurance company has for user capital.

In addition to serving as our governance token, the $AMT token also comes equipped with value accumulation mechanisms. These mechanics are most beneficial to holders and stakers of the token over lengthy periods of time.

Amulets Future

Because of its quick development and enormous promise, Amulet’s first installation is on the Solana network. Amulet wants to grow into more Rust-based ecosystems in the future and protect protocols across all of these chains.

As another generation of crypto enthusiasts enters the crypto scene, the platform intends for insurance solutions to be available throughout all chains and that users should be able to obtain coverage for whatever risks they wish. This makes all consumers feel safer, which makes them more likely to use blockchain technology.

Takeaways

- In tandem with the market’s general development, the need for risk hedging is seeing a rise in user consumption.

- Amulet wishes to share its security strategy and implementation plans for Solana and Rust-based ecosystems.

- Amulet is dedicated to making significant financial and time investments in the growth of the cryptocurrency industry.

- The platform intends to offer simple, trustworthy insurance to allow users and protocols to manage risks and grow.

- Amulet learns from previous insurance systems and covers smart contract vulnerabilities, stable currency, de-peg risk, and more.

- Using Amulet’s native token ($AMT), members of the community will be able to make suggestions and vote on them.

- Amulet wants to expand into more Rust-based ecosystems in the future and protect protocols across all of these chains.