It makes no difference if you have experience with crypto or are just starting out. One of the most important characteristics that differentiate successful investors from those who are merely mediocre is the ability to monitor their cryptocurrency holdings through portfolio managers.

When it comes to the cryptocurrency business, investors who keep complete tabs on their crypto assets enjoy significant advantages. Because market prices are more unstable than they have ever been, it is essential for day traders to have an easy way to keep track of them.

The field of the cryptocurrency world has seen significant evolution throughout the course of recent years, along with the remarkable expansion of its user base. The widespread adoption of DeFi and the meteoric rise in popularity of NFTs were the primary contributors to this development. Because of this, there has been a wave of new ventures entering the cryptocurrency industry.

This also includes DeFi dashboards and portfolio managers. As a result of the fast-expanding industry, investors are required to maintain track of several wallet addresses.

As a result, portfolio trackers have become a popular choice for investors who need to monitor a broad multichain portfolio.

The following is a list of three decentralized apps, or DApps, for portfolio tracking that cryptocurrency traders and farmers may use to assist them in monitoring their assets.

Pacoca

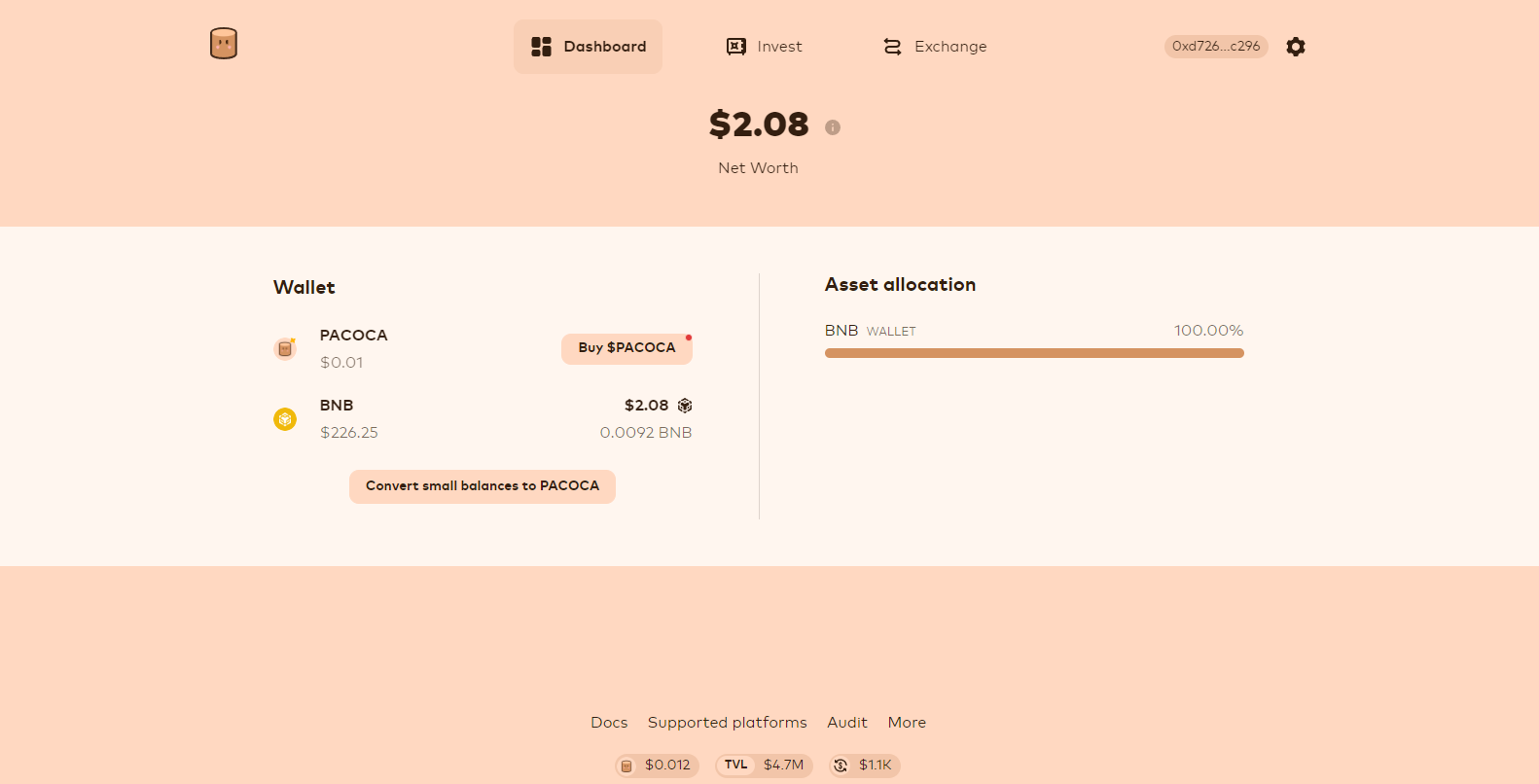

Pacoca is an all-encompassing DeFi hub that provides investors with a centralized location from where they can track and invest in multiple projects using a single platform. The platform has seen a significant level of success ever since it was initially made available, and an ever-increasing number of investors are currently making use of the platform.

Pacoca seeks to improve the user experience and reduce the learning curve associated with using DeFi so that even inexperienced users may quickly and simply make use of the blockchain. Because the majority of projects are designed for more experienced users, investing in DeFi can be challenging for beginners.

If this huge barrier can be overcome, it may be possible to entice a large number of new people to enter the cryptocurrency industry. Pacoca was developed for the sole purpose of enhancing the user experience provided by the Defi platform. Anyone looking for an appealing DeFi hub that also has an experienced portfolio watcher might consider Pacoca as a potential solution.

People have to go to each DeFi project on their own to put money in or take it out, earn rewards, or check their balances. In addition to causing additional problems and worries, this could cause customers to lose track of where their assets are located.

Pacoca has added a few new features that should make it easier for the average user to use DeFi and solve some of the problems that new users have. Pacoca has come up with different ways to help new users figure out how to use DeFi.

Pacoca has added a feature called “portfolio tracking” so that new customers can see all of their DeFi investments in one place and get real-time updates. Users can look at all of their DeFi stakings, borrowing, lending, rewards to harvest, tokens, NFT, and asset allocation on a single dashboard page.

Pacoca’s user-friendly layout makes the platform very easy to use. This makes sure that everything is easy to understand, safe, and has the shortest learning curve possible. To begin with, in order to utilize the site, you must first link your digital wallet to the platform. You will be sent to the main page after you have finished the connection procedure, where you will be able to fully use the platform.

With any browser, a wallet can be found by copying and pasting its unique address into an input box on the homepage. The user needs to link their digital wallet to Pacoca as a decentralized application in order to use the features that create transactions on the blockchain.

According to the project’s roadmap, several additional features will be added to the platform in the near future. Among these features are ZAP; PFP NFT collection; DAO; a HUB with a deposit, withdrawal, and harvest from other DeFi projects; NFTs that unlock special features; liquidation alerts for lending DeFi apps; and even cross-chain token and cross-chain Sweet Vaults. Finally, it seems that the platform’s future has a lot of promise.

Zapper

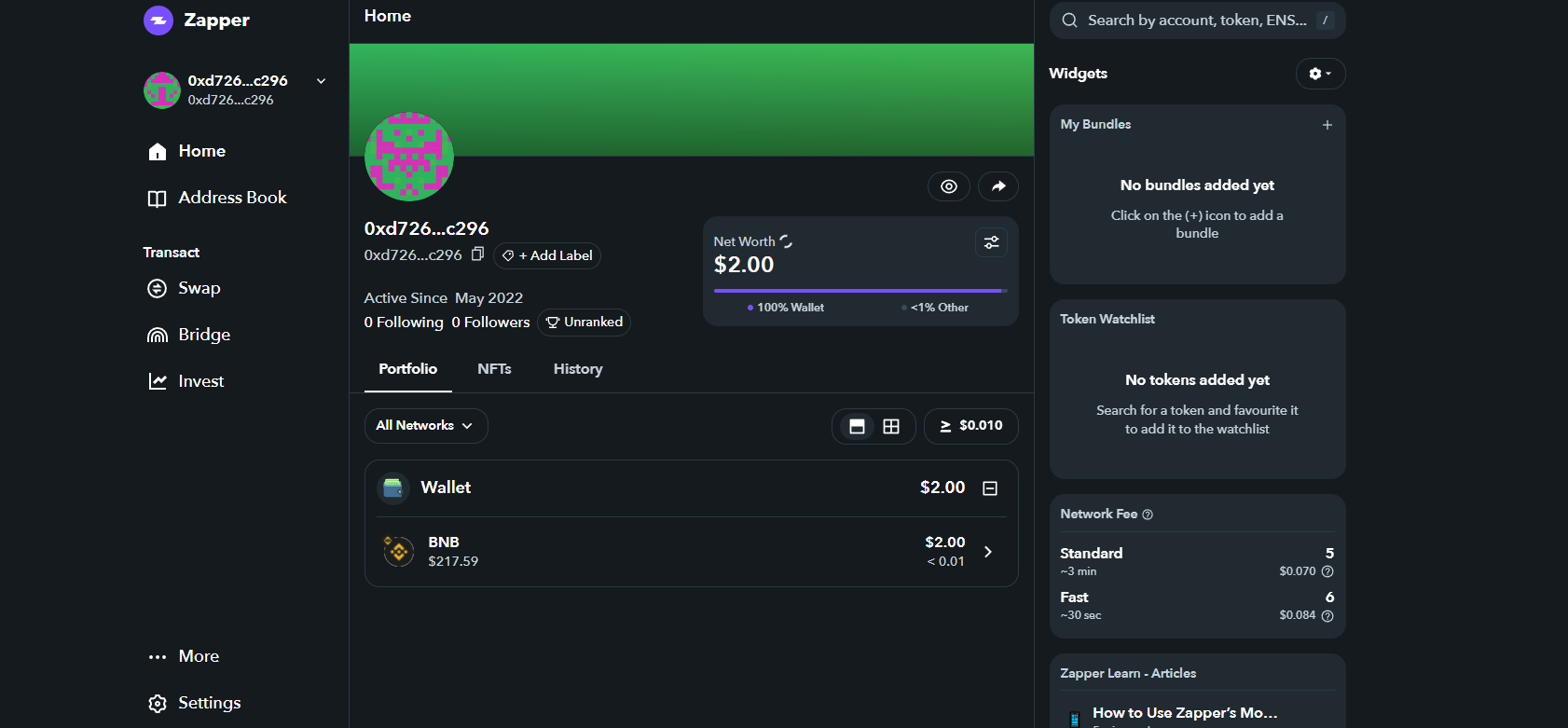

Zapper enables users to do strategic planning on the management of digital assets held on eleven distinct and prominent networks, including Ethereum, Polygon, BNB Chain, Fantom, and many more.

It also offers a summary of the asset value stored on each of the supported networks. The fundamental structure of the webpage gives data about the numerous protocols that the linked wallet is actively engaged with. Zapper is able to move you into and out of different DeFi positions with only the touch of a button.

Because of this, it is no longer necessary to deal with or navigate the sites of the many different DeFi platforms out there. This can be accomplished from a single user interface inside the Zapper platform, and the only thing it takes is confirmation from a single Ethereum address.

Users have the ability to make token swaps using a simple swap interface that interacts with liquidity on cryptocurrency exchanges like Uniswap, Pangolin, and QuickSwap. Additionally, users have the ability to utilize the bridging function to move assets across the supported chains.

Investors have the ability to transfer assets to pools on protocols that are connected with Zapper. Some examples of these protocols are SushiSwap, PancakeSwap, Curve, Aave, and Compound. Other interfaces also include the capability to transfer funds into vaults on the Yearn Finance platform as well as yield farming possibilities.

If there is one thing that can be said with absolute certainty, it is that Zapper is rapidly becoming a leading portfolio management tool for DeFi. Zapper has an enormous amount of community support, but the company is fully self-funded. This provides them with the autonomy and flexibility necessary to tackle their future in a way that is both comprehensive and organic.

NFTBank

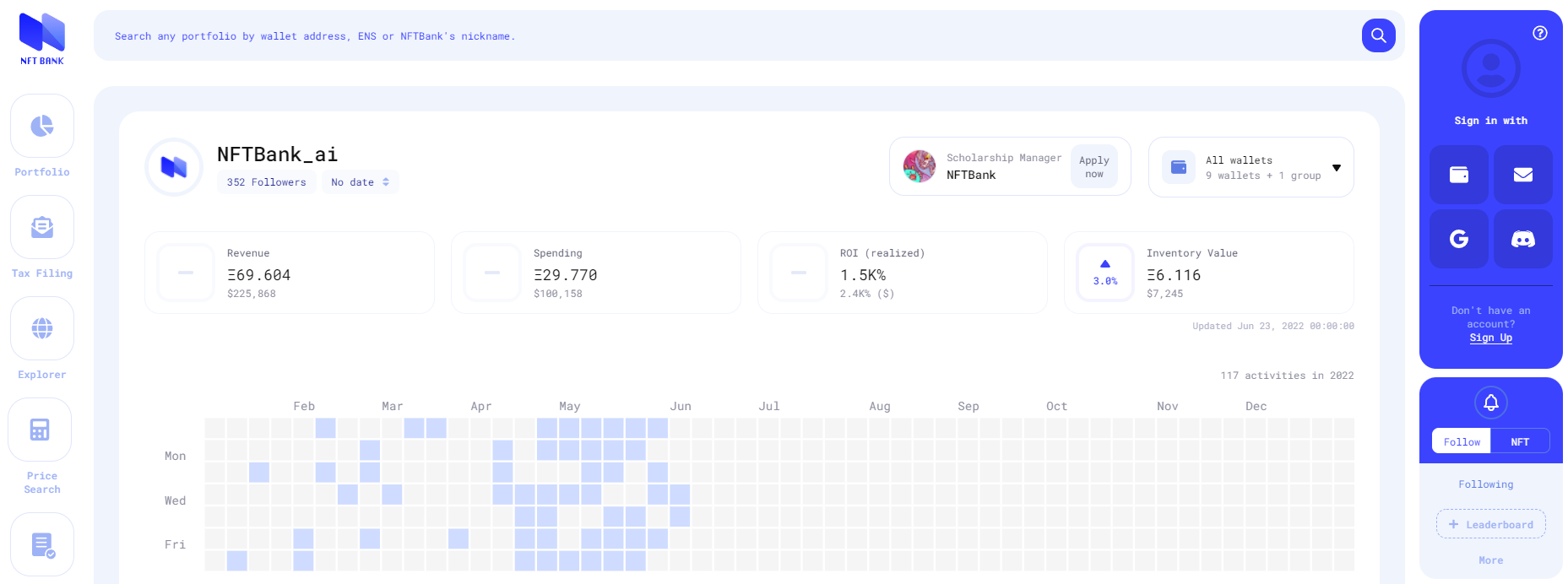

NFTBank is a portfolio manager that traders can use for free and that was developed exclusively to assist users in managing their holdings of NFTs. It does this by offering a number of tools that may assist with monitoring and analysis.

The primary interface for the portfolio provides a straightforward explanation of the cash flows generated by the NFTs stored in the attached digital wallet. This is accomplished by providing information regarding the total income, the amount spent, return on investment, and current stock value of the assets that are being kept.

On the home page, there is also a condensed annual calendar that shows which dates saw the most engagement for the digital wallet or collection of wallets under consideration. Additionally, there is the opportunity to post a snapshot of the progress made by the portfolio on one of the several social media platforms.

Investors can see a much more detailed list of their assets, track how each one is doing, see a record of all interactions between their different collections, and get tax forms to send their profits to the right government agencies.

In addition, the website is loaded with a diverse selection of features, which provides its customers with a highly enjoyable experience when trading. The user interface of the website is really clean and simple, which makes the experience simple and straightforward for first-time visitors.

The valuation models provided by the website also make it possible to identify potential markets in which one might discover listings that are undervalued. The platform estimates prices based on transaction statistics and asset information, and the platform is always working to improve its model so that it can more accurately estimate prices.

An NFT explorer is also available from NFTBank. This explorer lets you look through Ethereum, Klaytn, Ronin, and Polygon collections to see recent and historical floor values, percent change, 30-day volumes, and the number of newly added NFTs every day for each collection.

Takeaways

- When it comes to the cryptocurrency business, investors who keep complete tabs on their crypto assets enjoy significant advantages.

- Because crypto prices are more unstable than they have ever been, it is essential for day traders to have an easy way to keep track of them.

- Pacoca was developed for the sole purpose of enhancing the user experience provided by the Defi platform.

- Pacoca has added a few new features that should make it easier for the average user to use DeFi and solve some of the problems that new users have.

- Zapper enables users to do strategic planning on the management of digital assets held on eleven distinct prominent networks.

- If there is one thing that can be said with absolute certainty, it is that Zapper is rapidly becoming a leading portfolio management tool for DeFi.

- NFTBank is a portfolio manager that traders can use for free and that was developed exclusively to assist users in managing their holdings of NFTs.

- NFTBank’s primary interface for the portfolio provides a straightforward explanation of the cash flows generated by the NFTs stored in the attached digital wallet.