Solana is a high-performance, decentralized blockchain platform designed to provide fast transaction processing and low transaction fees for developers to build decentralized applications and marketplaces. It uses a unique consensus mechanism called Proof-of-History (PoH) to enable high scalability and throughput of up to 65,000 transactions per second. Solana also offers smart contract functionality through its programming language, Rust, and supports interoperability with other blockchains through its Solana Wormhole bridge technology.

This article will explain thoroughly what Solana is and provide a price prediction.

What is Solana?

Solana is a blockchain platform that aims to provide a scalable, high-performance infrastructure for decentralized applications (dApps) and cryptocurrencies. It is designed to address some of the scalability limitations of traditional blockchains by utilizing innovative technologies and protocols. Solana’s key features include the following:

- High throughput: Solana can process tens of thousands of transactions per second (TPS), making it one of the fastest blockchains in transaction processing speed.

- Low transaction fees: Solana aims to keep transaction fees affordable, making it cost-effective for users and developers to interact with the blockchain.

- Scalability: Solana uses a unique consensus mechanism called Proof of History (PoH) that enables parallel transaction processing and allows for high scalability without sacrificing security or decentralization.

- Smart contracts: Solana supports smart contracts, self-executing contracts with predefined conditions running on the blockchain. Smart contracts enable the development of decentralized applications (dApps) and other use cases, such as decentralized finance (DeFi) applications.

- Interoperability: Solana supports interoperability with other blockchains through its Solana Wormhole bridge technology, allowing for the transfer of assets between different blockchains.

- Developer-friendly: Solana provides a developer-friendly environment with support for the Rust programming language, extensive documentation, and developer tools to facilitate the creation of dApps on the platform.

Solana aims to provide a scalable, fast, and cost-effective blockchain platform that empowers developers to build innovative decentralized applications and services.

How Does Solana Work?

At the heart of Solana’s design is Proof-of-History (PoH), a time-keeping mechanism that provides a historical record of all transactions and events on the blockchain. PoH generates a verifiable proof of elapsed time for each transaction, which enables parallel transaction processing without sacrificing security or decentralization.

Solana’s consensus algorithm is called Tower Byzantine Fault Tolerance (BFT). This algorithm uses PoH to reach a consensus on the order of transactions and prevent double-spending attacks. Tower BFT ensures the security and consistency of the blockchain. To optimize network communication, Solana uses the Gulf Stream protocol. Gulf Stream enables fast and efficient data transfer between nodes by using network-level batching, parallelizing, and pipelining to reduce communication delays and improve network efficiency.

Solana’s Turbine protocol optimizes transaction processing by grouping transactions into parallel pipelines that can process tens of thousands of transactions per second. Turbine uses PoH to ensure the integrity and consistency of transaction processing. Solana’s Archivers store the historical data of the blockchain, allowing new nodes to synchronize with the network quickly. Archives use a combination of compression and indexing to reduce storage requirements and optimize data retrieval.

Solana supports smart contracts through its programming language, Rust, and a runtime environment called the Solana WebAssembly (WASM) runtime. Solana’s smart contract capabilities enable developers to build decentralized applications and services on the platform. Overall, Solana’s innovative combination of technologies and protocols enables it to achieve high scalability and performance without sacrificing security or decentralization. Solana’s design makes it a promising platform for building decentralized applications and services.

Crypto Academy Solana (SOL) Price Prediction

Solana (SOL) Price Prediction 2023

It’s important to keep in mind that cryptocurrency markets are highly unpredictable in the present, and past performance may not be an accurate indicator of future results. Currently, Solana and other cryptocurrencies may show a bearish performance, but there is a possibility for them to recover during a potential bullish trend.

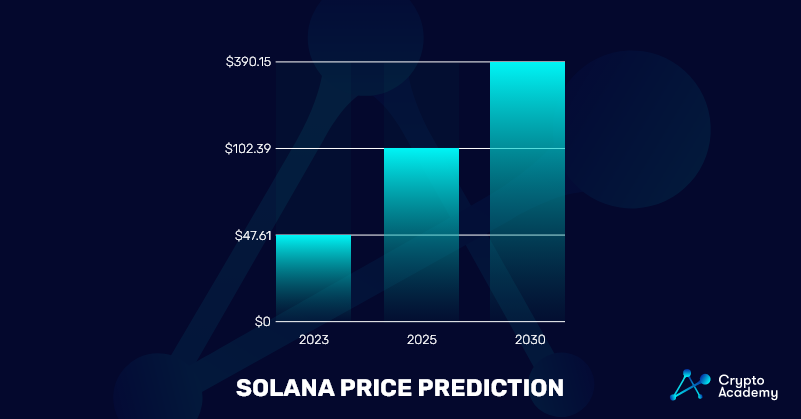

We at Crypto Academy predict that the coin may reach a maximum price of $47.61 by the end of 2023, with an average price of around $40.11. However, it’s crucial to consider the risk of a bearish trend, which could potentially bring the minimum price of Solana down to $28.59. In the event of a bull rally, the prices of Solana and other cryptocurrencies may surge beyond previous predictions.

Therefore, it’s important to make investment decisions based on careful research and analysis and involve a level of risk management to protect against market volatility.

Solana (SOL) Price Prediction 2025

It’s believed that Solana Coin has great potential for long-term growth. According to some analyses, the coin’s prices will continue to increase over the next three years, especially with more investment and adoption. Based on these projections, the average price of SOL (Solana) in 2025 could be around $95.27. If the market trend is bullish, the maximum price of Solana could reach up to $102.39 in 2025, while the minimum price may be around $72.51.

It’s important to note that cryptocurrency markets are highly volatile, and unexpected changes could significantly affect prices. However, if a bull rally occurs in 2025, Solana may break all previous records and achieve a new all-time high. It’s always important to conduct thorough research and analysis before making investment decisions and consider implementing risk management strategies to mitigate potential losses.

Solana (SOL) Price Prediction 2030

The current year may prove to be a pivotal year for the cryptocurrency market, where cryptocurrencies with real-world applications can potentially outperform the market. Solana, along with several other cryptocurrencies, may experience significant growth. Based on our analysis of Solana’s past price history, it’s believed that by 2030, Solana could reach a maximum price level of $390.15.

If the crypto market continues to invest in Solana, its price may exceed our long-term forecast. However, it’s important to note that unforeseen market conditions can significantly impact cryptocurrency prices. By the end of 2030, the average price of Solana may be around $275.32, with a potential minimum price of $249.13.

Is Solana A Good Investment?

SOL has gained immense popularity in the blockchain domain and is considered one of the most successful projects. Its ability to generate smart contracts and real-world applications makes it a powerful coin in the Solana blockchain ecosystem. As a result, SOL holders are increasing steadily, and many crypto traders are considering Solana as their primary Altcoin. CoinMarketCap data confirms that Solana currently ranks in the top 10 projects in the crypto market.

Solana Coin is an attractive long-term investment option considering past performances and current market conditions. However, it’s important for crypto traders to conduct their own research before investing in Solana or any other cryptocurrency, as market conditions can change suddenly, resulting in either a bearish or bullish market. Accurately predicting cryptocurrency prices is challenging, so it’s essential to implement risk management strategies and make informed decisions.

Frequently Asked Questions (FAQs)

What is Solana’s Native Token?

The total supply of Solana’s native token, SOL, is 488,585,135. There are currently 392 million SOL in circulation. The total supply and circulating supply are increasing based on inflation and vesting schedules.

The community owns 38% of the tokens. The Solana Foundation is committed to assisting projects and establishing long-term commitments to Solana. The token pool is used for bounty programs, incentive programs, marketing, and grants.

What will Solana be worth by 2030?

Solana is a coin with a lot of potential; therefore, we expect it to trade at around $390.15, with a minimum price of approximately $249.13 and an average price of $275.32. However, this price might change due to the high volatility of cryptocurrencies and market circumstances.

How can I stake SOL?

When staking Solana, you have the option to delegate a specific amount of SOL to a validator and start earning rewards immediately. You can stake any amount of SOL, but keep in mind that while staked, you can only conduct transactions with the remaining unspent SOL in your wallet.

What are the biggest drawbacks of Solana?

Understanding the potential vulnerabilities of Solana’s network is crucial for its long-term sustainability. Two major vulnerabilities to consider are its monolithic structure, which could lead to centralization and overall security concerns.

Takeaways

- Solana is a high-performance, decentralized blockchain platform designed to provide fast transaction processing and low transaction fees for developers to build decentralized applications and marketplaces.

- Solana uses Proof of History (PoH), a time-keeping mechanism that provides a historical record of all transactions and events on the blockchain.

- Solana’s Turbine protocol optimizes transaction processing by grouping transactions into parallel pipelines that can process tens of thousands of transactions per second.

- Solana Coin is an attractive long-term investment option considering past performances and current market conditions

- Solana is currently trading at $21.86.

- By 2025, Solana might trade at $102,39, while by 2030, at $390.15.