Polygon (previously known as Matic Network) is a layer-2 scaling solution for Ethereum, designed to improve its scalability, lower transaction fees, and enhance the overall user experience. It aims to address the scalability issues of the Ethereum blockchain, which can become congested during periods of high demand, leading to increased fees and slower transaction times.

Polygon operates as a sidechain to Ethereum, allowing developers to build and deploy decentralized applications (dApps) on its network while still benefiting from Ethereum’s security and liquidity. It achieves this by utilizing a modified version of the Plasma framework, which enables faster and cheaper transactions by batching multiple transactions into a single commitment on the Ethereum mainnet.

What is Polygon?

One of the key features of Polygon is its interoperability with the Ethereum network. Developers can easily port their existing Ethereum dApps to the Polygon network or create new dApps directly on Polygon. This interoperability allows projects to leverage the existing Ethereum ecosystem and tap into a large user base while benefiting from Polygon’s scalability and cost-efficiency.

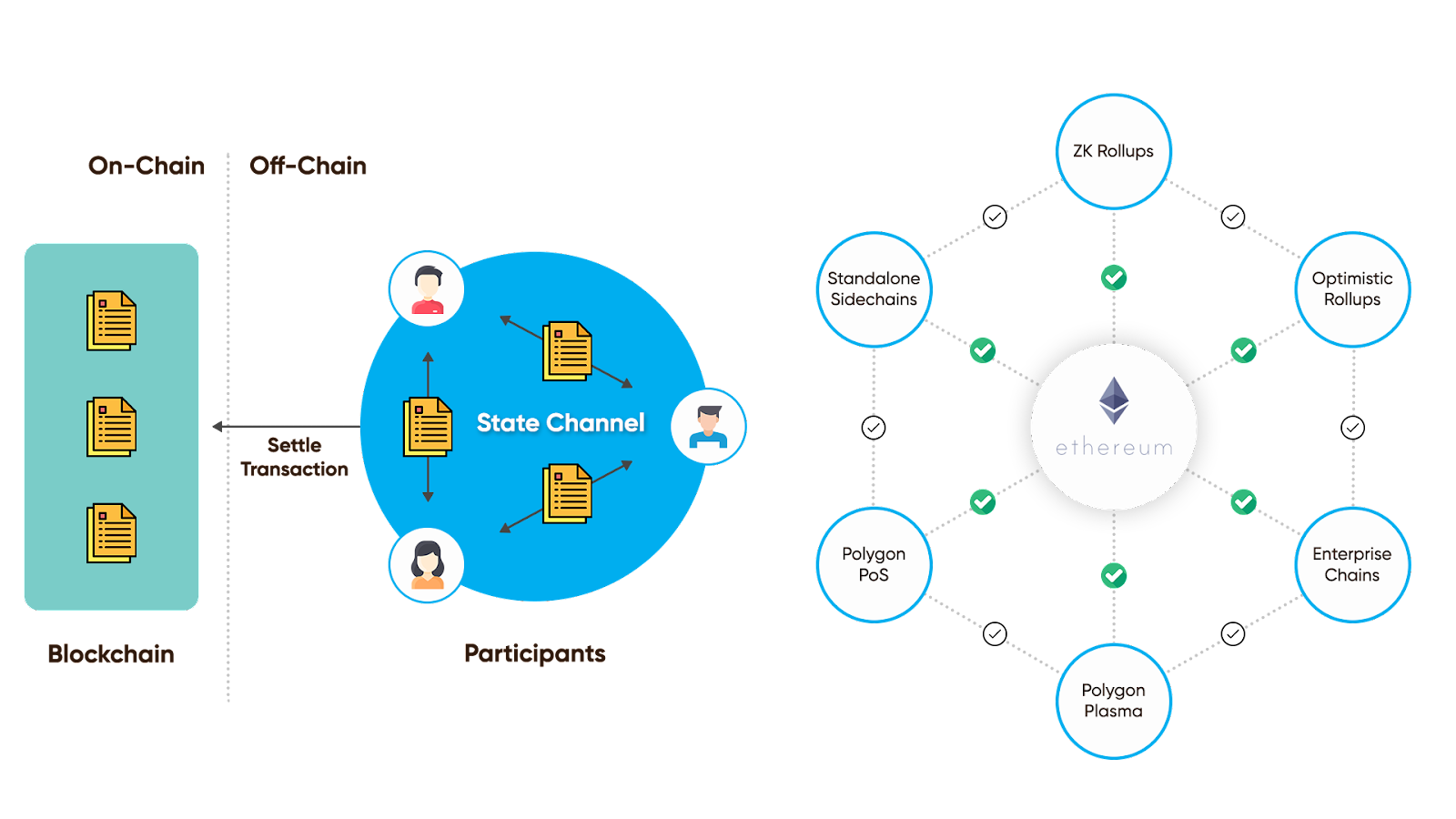

Polygon offers different scaling solutions to cater to various needs. These solutions include:

Polygon PoS Chain: This is the primary layer-2 solution provided by Polygon. It employs a Proof-of-Stake (PoS) consensus mechanism, where validators stake MATIC tokens to secure the network and validate transactions. The PoS Chain provides high throughput and significantly reduces transaction costs compared to the Ethereum mainnet.

Polygon SDK: The Polygon Software Development Kit (SDK) allows developers to build their own customized layer-2 solutions. It provides a framework and tools to create sidechains, plasma chains, and other layer-2 constructions, enabling developers to tailor their scaling solutions to specific requirements.

Polygon Bridge: The Polygon Bridge facilitates the seamless transfer of assets between the Ethereum mainnet and the Polygon network. Users can transfer tokens from Ethereum to Polygon and vice versa, enabling liquidity and interoperability between the two chains.

The growth of Polygon has led to a vibrant ecosystem of dApps and protocols. Many decentralized exchanges, lending platforms, gaming projects, and NFT marketplaces have been deployed on the Polygon network. Additionally, Polygon has gained strategic partnerships with prominent projects in the crypto space, including Aave, SushiSwap, and Decentraland, among others.

It’s important to note that while Polygon provides scalability and cost advantages, it operates as a layer-2 solution and relies on the security of the Ethereum mainnet. The security of transactions on the Polygon network is ultimately tied to the underlying Ethereum network’s consensus mechanisms.

How Does Polygon Work?

Polygon works as a layer-2 scaling solution that operates alongside the Ethereum blockchain. It achieves scalability and improved transaction speeds by leveraging a combination of sidechains, plasma chains, and a Proof-of-Stake (PoS) consensus mechanism. Here’s a high-level overview of how Polygon works:

- Sidechains and Plasma Chains: Polygon utilizes sidechains and plasma chains to process transactions off the Ethereum mainnet. These chains act as independent blockchains with their own consensus mechanisms and transaction processing capabilities. By moving transactions to these layer-2 chains, Polygon alleviates congestion on the Ethereum mainnet, resulting in faster and cheaper transactions.

- Polygon PoS Chain: The Polygon PoS Chain, previously known as Matic PoS Chain, is the primary layer-2 solution provided by Polygon. It employs a PoS consensus mechanism where validators stake their MATIC tokens to secure the network. Validators are responsible for validating transactions and producing new blocks on the PoS Chain. This mechanism allows for faster block confirmations and higher transaction throughput compared to the Ethereum mainnet.

- Security and Interoperability: Although the actual transaction processing occurs on the layer-2 chains, Polygon maintains a strong connection to the Ethereum mainnet. It achieves this through security checkpoints and by periodically committing the layer-2 chain’s state to the Ethereum mainnet. These checkpoints ensure the integrity and security of transactions, as the finality of layer-2 transactions is backed by the security of the Ethereum network.

- Polygon Bridge: The Polygon Bridge facilitates the movement of assets between the Ethereum mainnet and the Polygon network. Users can transfer tokens from Ethereum to Polygon by depositing them on the Ethereum mainnet, and the corresponding tokens are minted on the Polygon network. This bridge allows for interoperability and liquidity between the two chains, enabling users to benefit from the scalability of Polygon while still utilizing Ethereum’s ecosystem.

- MATIC Token: The MATIC token is the native cryptocurrency of the Polygon network. It serves multiple purposes, including staking for network security, participating in governance decisions, paying transaction fees, and participating in the network’s PoS consensus mechanism. MATIC tokens are used to incentivize validators and secure the PoS Chain.

By implementing these mechanisms, Polygon provides a scalable and efficient solution for building and running decentralized applications (dApps) on the Ethereum ecosystem. It aims to offer faster transaction times, lower fees, and a better user experience while maintaining the security and interoperability of the Ethereum network.

Crypo Academy Polygon (MATIC) Price Prediction

Polygon (MATIC) Price Prediction 2023

If the Polygon platform continues to attract a thriving user base and experiences increased adoption and collaborations, it has the potential for significant growth in 2023. The scalability and cost advantages offered by Polygon make it an attractive solution for developers and users looking to build and interact with decentralized applications.

With more projects choosing to deploy their applications on Polygon, the demand for its services may increase, leading to a higher value for its native cryptocurrency, MATIC. Additionally, collaborations with established projects in the crypto space can enhance the visibility and credibility of Polygon, further driving its growth.

We at Crypto Academy predict the price range for Polygon in 2023 to be between $1.31 and $1.74, and the estimated average price of $1.38. The actual price movement may differ from these predictions due to unpredictable market conditions and factors that can influence cryptocurrency prices.

Polygon (MATIC) Price Prediction 2025

According to the technical analysis conducted by our cryptocurrency experts, they have projected potential price ranges for MATIC in 2025. The minimum estimated price of approximately $2.29 suggests a lower price level that MATIC may reach, while the maximum estimated price of around $4.09 represents a higher price level that MATIC could potentially reach.

The average expected trading cost of $3.37 reflects the midpoint between the projected minimum and maximum prices.

Polygon (MATIC) Price Prediction 2030

We at Crypto Academy predict that the price of Polygon (MATIC) might significantly increase by the end of 2030.

As such, if the market is relatively bullish, the maximum trading price might be around $10.50. On the other hand, if the market is bearish, the minimum and average price might range between $5.21 and $9.83.

Is Polygon (MATIC) A Good Investment?

The future outcome is uncertain and will be influenced by market dynamics as a whole and investor sentiment towards a company that has undergone significant workforce reductions.

In the volatile world of cryptocurrency markets, conducting thorough research is crucial to assess the suitability of a particular coin or token for your investment portfolio. Whether investing in the MATIC token aligns with your risk tolerance and investment goals depends on various factors, including the amount you intend to invest.

Remember that historical performance does not guarantee future returns, and it is essential to exercise caution and only invest funds that you can afford to lose.

Frequently Asked Questions (FAQs)

Should I invest in Polygon?

Determining whether or not to invest in MATIC is a personal decision that requires careful consideration. It is essential to conduct thorough research, not only on Polygon but also on other layer-2 coins and tokens. Evaluating the potential risks and rewards associated with the investment is crucial.

As with any investment, it is important to exercise caution and only invest funds that you can afford to lose. Cryptocurrency markets can be volatile, and prices can fluctuate both positively and negatively. By being mindful of your financial situation and risk tolerance, you can make more informed investment decisions.

Ultimately, the decision to invest in MATIC or any other cryptocurrency should be based on your own analysis, understanding, and assessment of the project, its technology, market conditions, and future prospects. Consulting with financial professionals or experts can also provide valuable insights and guidance tailored to your specific circumstances.

What is a disadvantage of Polygon (MATIC)?

One potential disadvantage of Polygon (MATIC) is its reliance on the Ethereum network for security. While Polygon provides layer-2 scaling solutions to address Ethereum’s scalability issues, the ultimate security of transactions on the Polygon network is dependent on the underlying Ethereum mainnet. Any vulnerabilities or attacks on Ethereum’s network could potentially impact the security and integrity of transactions conducted on Polygon. This interdependency introduces an element of risk, as the stability and security of the Polygon ecosystem are tied to the health and security of the Ethereum network.

What will MATIC be worth in 2030?

Polygon $MATIC is expected to significantly increase in the future. That being said, the coin could reach a maximum trading price of $10.50 by the end of 2030, if the market is on its side. On the other hand, if the market is on the bearish side, Polygon could trade at a minimum price of $5.21 with an average price of $9.83.

Takeaways

- Polygon is a layer-2 scaling solution for Ethereum, designed to improve its scalability, lower transaction fees, and enhance the overall user experience.

- One of the key features of Polygon is its interoperability with the Ethereum network.

- Polygon offers different scaling solutions to cater to various needs.

- It achieves scalability and improved transaction speeds by leveraging a combination of sidechains, plasma chains, and a Proof-of-Stake (PoS) consensus mechanism.

- If the Polygon platform continues to attract a thriving user base and experiences increased adoption and collaborations, it has the potential for significant growth in 2023.

- The price range for Polygon in 2023 can be between $1.31 and $1.74, and the estimated average price $1.38.

- The maximum trading price of MATIC might be around $10.50 by the end of 2030.

Disclaimer: The information provided on this page is most accurate to the best of our knowledge; however, subject to change due to various market factors. Crypto-Academy encourages our readers to learn more about market factors and risks involved before making investment decisions.