The Q1 profit of MicroStrategy amounted to $94 million, demonstrating its strong Bitcoin investment conviction and growth in business intelligence software.

MicroStrategy, a leading business intelligence platform, recently announced a significant Q1 profit of $94 million in 2023, its first profitable quarter since 2020. This remarkable achievement is largely due to a one-time income tax benefit worth $453.2 million and the company’s unwavering faith in its Bitcoin investment strategy. Additionally, MicroStrategy experienced a revenue increase of 2.2% compared to the same quarter last year, reaching $121.9 million.

Firm Commitment to Bitcoin Investment Strategy

Phong Lee, MicroStrategy’s CEO, reiterates the company’s steadfast conviction in its Bitcoin investment strategy. He highlights the ongoing maturation of the digital asset environment, and the firm’s intention to maintain cost discipline while pursuing growth opportunities. MicroStrategy remains dedicated to executing its two-pronged strategy of developing its business intelligence software business and acquiring more Bitcoin for the future.

Lee goes on to explain that MicroStrategy’s core business remains unaffected by short-term Bitcoin price fluctuations. The company’s founder and chairman, Michael Saylor, attributes the successful quarter to the efficient execution of its core business model and the adoption of its Bitcoin investment thesis. Saylor advocates for a focused Bitcoin strategy, asserting that the prudent acquisition and holding of Bitcoin can effectively outpace market performance.

Bitcoin to Benefit from Regulatory Developments

Saylor anticipates that investors will soon liquidate their positions in crypto assets subject to regulatory scrutiny, resulting in an influx of capital into Bitcoin. Furthermore, MicroStrategy’s CFO, Andrew Kang, notes that the company managed to decrease its leverage by repaying a $161 million Bitcoin-backed loan from the now-defunct Silverage Bank. This repayment allowed for the release of all Bitcoin collateral securing the loan, marking an important strategic move in achieving the company’s liability management objectives.

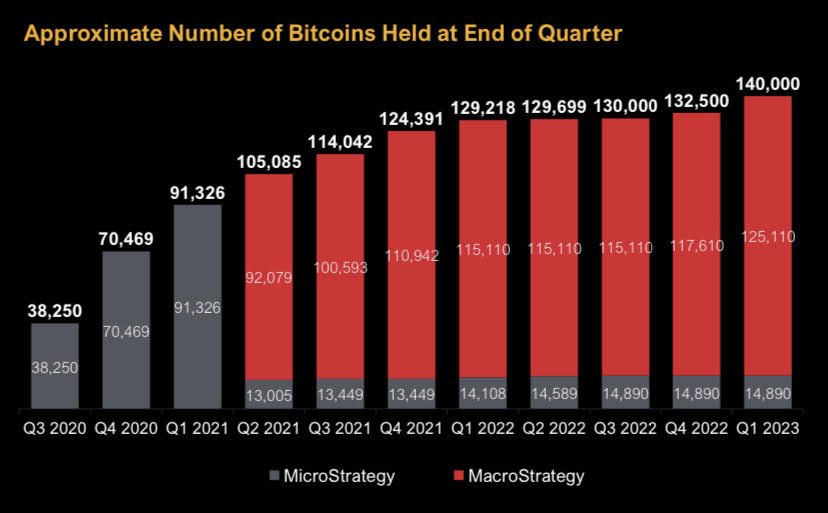

According to previous SEC filings, MicroStrategy added 7,500 BTC to its holdings during Q1, acquired through two separate purchases on March 23 and April 5, totaling an investment of $179 million. The company’s total Bitcoin holdings now amount to 140,000 BTC, with an average purchase cost of approximately $29,803.

Bitcoin’s Rise and MicroStrategy’s Crypto Investment

MicroStrategy’s announcement of its Q1 profit corresponds with Bitcoin’s impressive 72% surge over the first quarter, reaching a value of around $28,300. Despite the current BTC price of $28,100, MicroStrategy’s Bitcoin investment is down by approximately 5.7%. However, the firm did experience a period of positive returns in the previous month when BTC attained its most recent peak of $30,980 on April 15.

MicroStrategy embarked on its journey of investing cash reserves in Bitcoin on March 5, 2021, purchasing an initial 91,064 BTC, which currently represents 65% of its total Bitcoin holdings. Saylor recently divulged that MicroStrategy integrated the Bitcoin Lightning Network into his corporate email address.

Development of Bitcoin Layer-2 Lightning Network-Based Solution

MicroStrategy showcases its unwavering commitment to its Bitcoin investment strategy by actively developing a Bitcoin layer-2 Lightning Network-based Software as a Service (SaaS) solution for corporations. This initiative demonstrates the company’s dedication to incorporating cutting-edge digital asset technologies into its operations and product offerings, further cementing its reputation as a Bitcoin-focused firm.

As MicroStrategy continues to invest in Bitcoin and expand its business intelligence software business, the company’s strong Q1 profit and ongoing dedication to its Bitcoin investment strategy position it as a leader in the digital asset space. By remaining steadfast in its commitment to Bitcoin, MicroStrategy is poised to capitalize on the growing maturity and acceptance of digital assets, further solidifying its place as an innovative and forward-thinking organization in the rapidly evolving digital landscape.

MicroStrategy’s Future Outlook and Bitcoin’s Role

Moving forward, MicroStrategy aims to maintain its strong conviction in its Bitcoin investment strategy while continuing to grow its business intelligence software offerings. The firm is well-positioned to leverage the increasing maturity and acceptance of digital assets in the global market.

As the regulatory environment surrounding cryptocurrencies evolves, MicroStrategy’s proactive approach to investing in Bitcoin and developing Bitcoin-based solutions places the company at the forefront of digital asset adoption. The firm’s focus on providing cutting-edge products and services to its clients, combined with its strategic Bitcoin investments, sets MicroStrategy apart as an industry leader.

Adapting to Market Dynamics and Growth Opportunities

By keeping a close eye on market dynamics and responding to growth opportunities, MicroStrategy can further strengthen its position as a market leader in both the business intelligence software and digital asset sectors. The company’s dual strategy of expanding its core business while accumulating Bitcoin will allow it to capitalize on the growing demand for innovative, data-driven solutions and the increasing mainstream adoption of digital currencies.

MicroStrategy’s commitment to Bitcoin not only demonstrates its belief in the long-term potential of the cryptocurrency but also highlights its innovative and adaptive approach to business. As the digital asset environment continues to evolve, MicroStrategy’s unwavering conviction in its Bitcoin investment strategy and its ongoing development of Bitcoin-based solutions will undoubtedly serve the company well in the years to come.

In summary, MicroStrategy’s Q1 profit, strengthened by its Bitcoin investment strategy and a substantial one-time income tax benefit, signifies the company’s strong position within the digital asset space. The firm’s commitment to expanding its business intelligence software offerings and developing innovative Bitcoin-based solutions, while adapting to market dynamics and growth opportunities, ensures that MicroStrategy remains a leader in the rapidly evolving world of digital assets and business intelligence.