The cryptocurrency market saw an unprecedented shift in not just the prices but also the crypto trading trends after the COVID-19 waves hit the world one after another. The major shifts in the cryptocurrency market where gave a boom to the industry as a whole; they also gave way to the oldest of techniques emerging as the major crypto trading trends.

The future of cryptocurrency was still shady for many until the COVID-19 world, where some would still call it the dot.com bubble of the financial world, while others were rooting for the king of cryptocurrency, Bitcoin, to hit the $100,000 mark by the year 2022. Well, neither were actually true to the dot, but in their essence, the concerns and hopes raised were somewhat valid.

Coin Market Cap data reveals that with only 67 cryptocurrencies listed in January 2014 and only 2086 in January 2019, the number hit the 9,898 mark in July 2022. While statistics also reveal that in 2021 the daily cryptocurrency trading volume exceeded 500 billion dollars at one point.

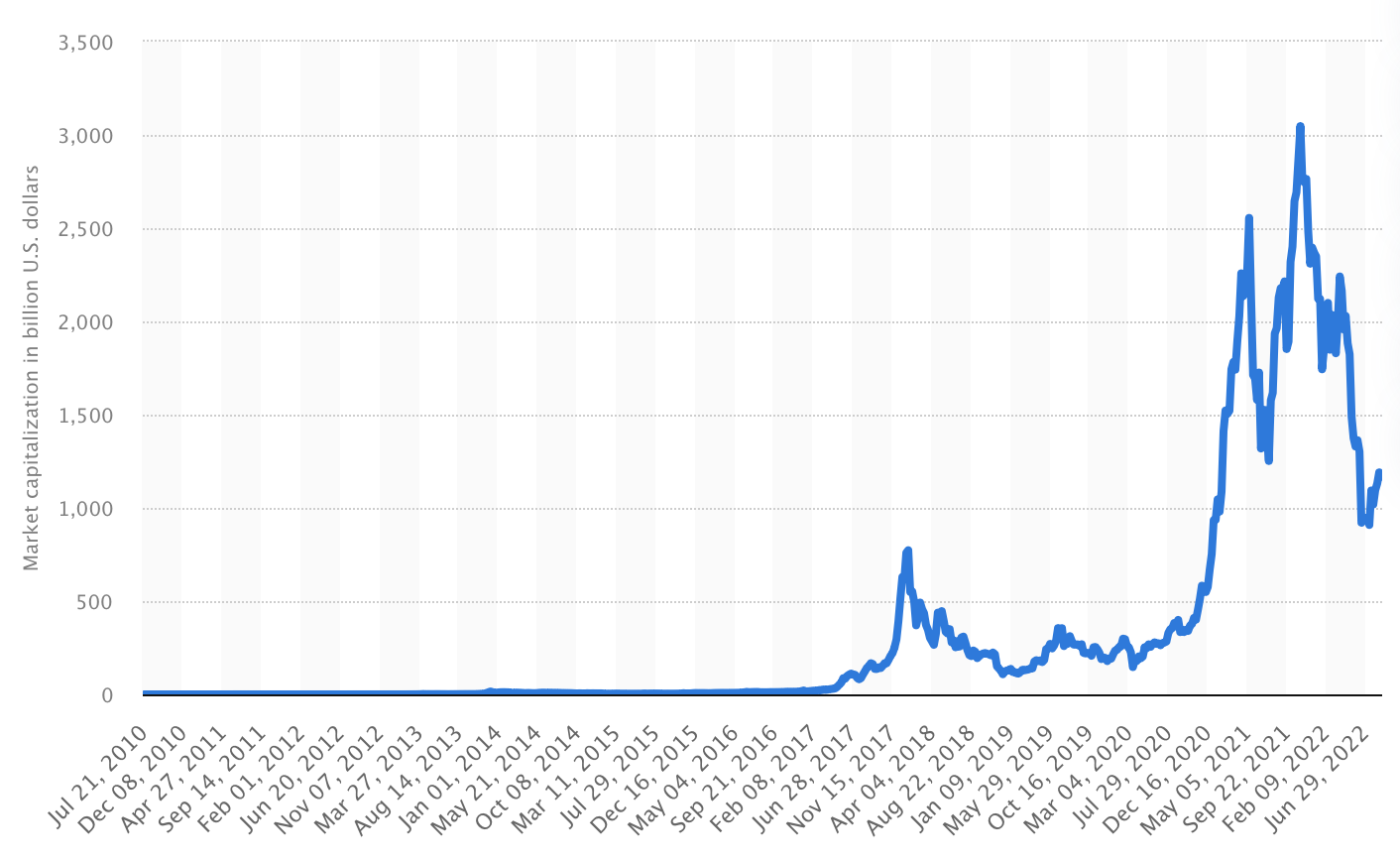

Cryptocurrency market capitalization chart by Statista

The combined cryptocurrency market capitalization saw an epic boom between July and December 2020. Bitcoin crossed the $38,000 mark for the first time in history, and the overall market saw a new era of boom giving way to new businesses as well. The era of cryptocurrency and blockchain adoption truly started in the year 2021, when the number of blockchains started increasing substantially.

In the changing cryptocurrency sphere, coins that once ruled the market perished, although Bitcoin, Ethereum, and a few other pioneers have been an exception. The dynamics in the year 2022 also changed when the market capital finally dropped back down below the $1 trillion mark. Albeit briefly, this sent panic waves across the cryptocurrency market, pushing traders to seek desperate measures.

Crypto Trading Trends in 2022

Cryptocurrency trading trends shift with the market year upon year; however, where the trading analysis patterns and techniques remain the same, the global shift in the market can sway the best of analysis by the long margin.

Swarm Pump and Dump

Recent Crypto Academy Bitcoin price analyses displayed one of the major shifts in the industry trends that can be the critical deciding factor for the price movement. The factor in play, the swam pump and dump, triggers new patterns in the market that would allow the group of traders to make calculated buying and selling decisions in order to ensure better yields.

Pump and Dump action is one of the major issues that remain unsolved in the absence of a centralized authority; where in the past, such price sways were only seen with whale movements, it is becoming more of a norm in the year 2022. However, in 2022 it is rather pools of traders who are now able to act as a whale to sway the market in order to gain better trading yields.

Boomers, Gen X joining Millenials after Institutions

Research statistics show that about 67% of Millenials already believe in the king Bitcoin as a safe haven asset, and their faith in cryptocurrency stands strong. However, in 2021 and 2022, the older generations, Boomers I, Boomers II, and Generation X, started looking into cryptocurrency as an investment option. With the success stories and the number of millionaires and billionaires in the cryptocurrency sphere on the rise, this interest was inevitable; however, better than never.

Institutional investors had already started pouring money into the cryptocurrency sphere in the pre-COVID-19 era; however, it took a pandemic, inflation, and hundreds of success stories for the older generations to start changing their minds. The confidence level in cryptocurrency investment is at an all-time high, constantly hitting the 100% mark, with more people joining the bandwagon across the globe in fear of missing out.

Liquidity Pools

Trading through liquidity pools is the newest and one of the fastest growing crypto trading trends in the year 2022. The liquidity pools are not only a trading trend in themselves but also sway the market enabling the average trader to pair with thousands of others for swarm pump and dump through massive buying and selling. Most trading pools work with the same basic formula; traders come together, liquidating their assets to join the larger pool in order to make better yields. Most of these pools are interest-based; they create a sub-layered fear and greed sentiment movement on top of the current movements making the market more volatile and, in turn, the cryptocurrency sphere, bringing the negative impact of interest-based economies to the decentralized world.

Whereas investors can also join the pools by simply staking – read lending – their money to the pool and make profit yields. This gives way to systematic manipulation of the cryptocurrency trading trends making the liquidity pool tokens and cryptocurrencies one of the highest rising cryptocurrencies in the market on the one hand and enabling traders to manipulate the market on the other. Uniswap, CurveDao and other such pools are top of the list in 2022.

Inflation, Influence and Political Sway

Last but not least, the world as a whole is seeing the highest inflation rates in quite a few decades, and even the first world countries such as the United Kingdom and the United States are facing heavy troubles keeping the economy stable, the inflation rates in check and the employment rate in balance. One of the recent examples of the political sway affecting the cryptocurrency sphere is the recent Bitcoin price drop to below $20,000 after a long while owing to the Federal Reserve signaling a stricter policy for the king of cryptocurrencies.

While influencers manage to give short boosts to one cryptocurrency or another, celebrities like Elon Musk are known to sway the prices by a good margin, as seen in the case of Dogecoin and recently in the case of Twitter, where Musk backed off paying a fine over the canceled deal; however, the hype created around the deal swelled the Twitter stock and tokenized stock prices enough to make many folds more money in the process.

Crypto Trading Trends in 2022: Conclusion

The fall of cryptocurrency market capital to the below $1 trillion mark may seem to be the end of the cryptocurrency bubble era; however, in the past two years, utility-based blockchain solutions have emerged to take control of the sphere as a whole.

Technology where makes the world a better and more liveable place in terms of transparency; the trends in 2022 are mostly driven out of fear of missing out and the fear and greed index.