Digital asset funds saw $600 million in weekly outflows, led by Bitcoin, despite positive inflows into altcoins.

In the digital asset market, digital asset funds experienced their largest weekly outflow since March, with total outflows reaching $600 million as of June 14. This data, revealed in a CoinShares report, highlights a major shift in investor sentiment, particularly towards Bitcoin investment vehicles.

Bitcoin Leads Outflows Amid Fed’s Hawkish Stance

The CoinShares “Weekly Asset Fund Flows” report indicated that Bitcoin investment vehicles bore the brunt of these outflows, amounting to $621 million. This substantial movement of capital away from Bitcoin underscores a growing cautiousness among investors, driven by the Federal Reserve’s unexpectedly hawkish outlook. The Fed’s stance on maintaining high interest rates has prompted a shift away from fixed-supply assets like Bitcoin, as investors seek to navigate the uncertain economic landscape.

In contrast, short Bitcoin funds observed a modest inflow of $1.8 million. This suggests that while long positions in Bitcoin are being reduced, some investors are betting on potential further declines in Bitcoin’s price.

Altcoins Buck the Trend with Positive Inflows

Amidst the overall outflow from digital assets, altcoins displayed resilience, attracting notable inflows. Ether investment vehicles led the way with $13.2 million in weekly inflows. Other altcoins also saw positive movements, with LIDO investment products receiving $2 million and XRP investment products attracting $1.1 million.

Additional altcoins such as BNB, Litecoin, Cardano, and Chainlink experienced smaller yet positive inflows, contributing to the broader trend of investor interest in diversifying digital asset portfolios. Despite these gains, the overall decline in total assets under management in the digital asset sector was apparent, dropping from $100 billion to $94 billion within the week.

Institutional Adoption Still Nascent

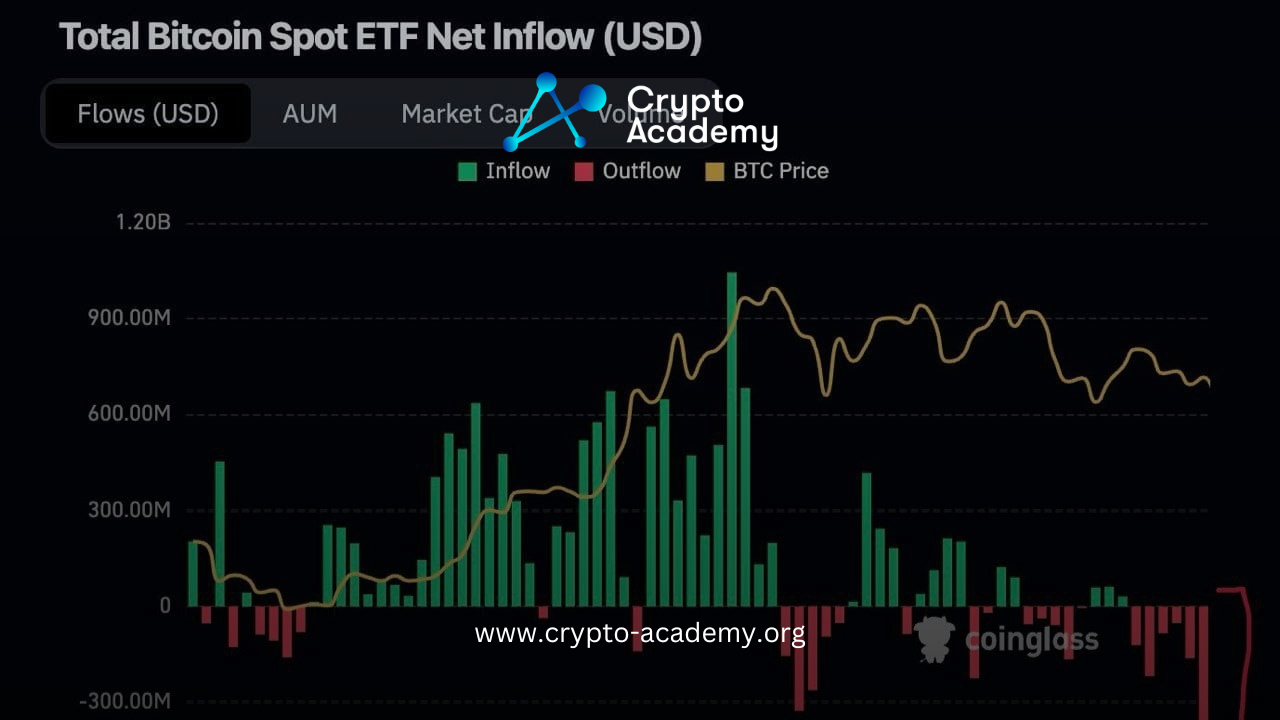

The current landscape of institutional adoption of digital assets suggests a gradual but steady growth trajectory. Despite initial enthusiasm surrounding Bitcoin exchange-traded funds (ETFs) in the United States, broader institutional engagement remains in its early stages. Industry experts emphasize that corporate adoption of Bitcoin and other digital assets is still developing, with substantial room for growth.

Bitcoin ETFs, for instance, have accumulated between $60 billion and $70 billion to date, a figure that pales in comparison to the capital flows seen in traditional financial institutions. For perspective, JPMorgan alone saw $489 billion in net new client inflows in 2023, highlighting the disparity between traditional and digital asset investments.

Looking ahead, industry leaders believe that institutional interest and capital deployment in digital assets will increase significantly in the coming years. The current phase of adoption is seen as the beginning, with a more substantial wave of institutional investment expected as market infrastructure and regulatory clarity improve