Huobi Token (HT) is one of the few cryptocurrencies in the market that is currently performing very well. Throughout the year, however, the price of HT has been in a downtrend because the crypto market in general is bearish.

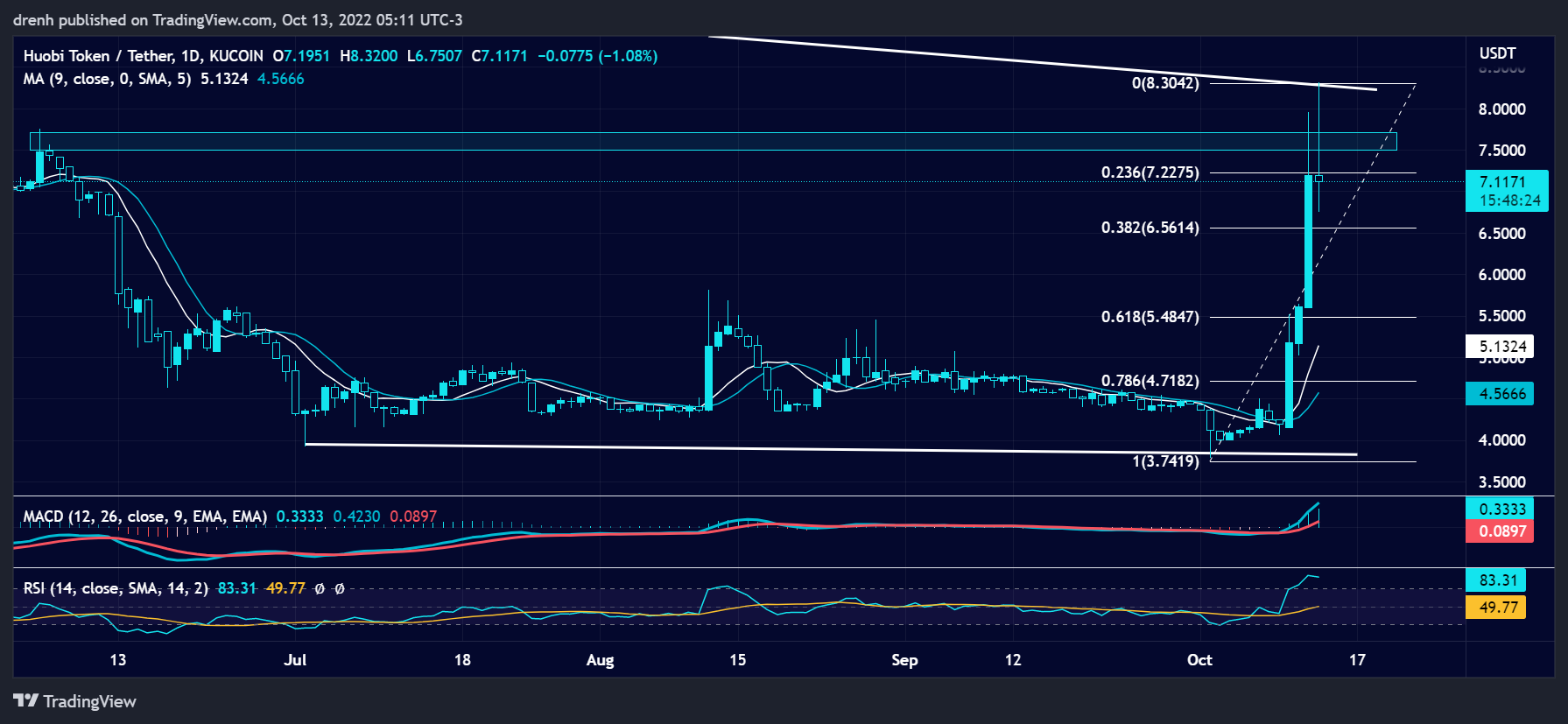

The price of HT has declined by around 60% in 2022. The price hit as low as $3.78 recently, finding support there. After that, there was a surge in the price of HT. The price increased by around 120% in the last few days, hinting at a reversal in the 1-day chart.

The price went as high as $8.30, where it faced huge resistance. The recent increase could be attributed to numerous factors, both technical and fundamental.

Here is what our analysis suggests on the recent price movement of Huobi Token (HT).

Huobi Token (HT) Technical Analysis

Huobi Token (HT) hit resistance at around the same region where it did back in June of this year. This surge in the price of HT could mark a reversal in the trend of Huobi Token. Nonetheless, the long-term chart suggests that HT is still bearish since the upper trendline is still downward. Still, considering that HT recently hit the lowest in the while, it could also mean that the price may be facing upward in the coming weeks.

Recent support at $3.74 remains strong for HT. Still, considering the current momentum, it is likely to not retest that structure in the coming days.

This sudden increase in the price was expected to have a retracement, and it most certainly did. In the last 24 hours, the price of HT has retraced by more than 10%, suggesting that buyers are quickly taking their profits. Looking at the Fibonacci retracement levels, the price could find support at the 38.2% level if it continues to retrace. The 61.8% level at around $5.50 could also be strong because it also aligns with previous resistance levels.

Indicators

The fear and greed index showed signs of greed in the 1-day chart given the recent increase. Nonetheless, the fear and greed indicator is relatively stable at the moment given the recent retracement. Traders should hope that if the price continues to increase, traders do not become too greedy. Hence, these retracements are necessary if the price is to continue increasing in the coming days/weeks.

The RSI of a 1-day chart is over 70, suggesting that HT is currently overbought, despite the retracement. This shows that the price is likely to continue retracing in the short run, probably in the coming days.

The MACD line of a 1-day chart is also way above the signal line and the baseline, indicating huge bullish momentum for HT. This showcases the high buying pressure that HT has at the moment. Nonetheless, the lines are now slowly converging given the recent retracement. Still, HT remains bullish in the short run.

Huobi Token (HT) Fundamental Analysis

Despite what technical indicators suggest, fundamental factors are probably the main reason of the recent increase in the price of HT.

Recently, it was rumored that Justin Sun, founder of Tron, bought the Huobi Global company. The rumors emerged as fake, however. That is not to say that Justin Sun has not been involved with the Huobi Token. Recently he admitted to having an advisory role in Huobi Global and the Huobi Token’s development. Even though he was not involved in the acquisition of Huobi Global in any form, this alone was enough to push the crypto community to believe in the potential of the Huobi Token.

I am very honored to be appointed as a member of the Global Advisory Board of @HuobiGlobal and work with industry, academic, and policy leaders to help guide and grow this innovative, vibrant, and resilient organization in its latest chapter of global expansion. Full sail ahead. https://t.co/txZspJaV4Q

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) October 9, 2022

To put Sun’s work into context, Tron recently became a legal tender in the Government of Dominica. This suggests the influence that his work can have on a project such as Huobi Global. Immediately after Tron’s recent approval as a legal tender in the Government of Dominica, Justin Sun proposed to have Huobi Global as the main exchange there. That would do wonders for the exchange as well as the price of HT.

Dominica 🇩🇲 is the first country in the world to designate blockchain as their national infrastructure and it is #TRON. I changed my name ticker into Dominica 🇩🇲flag. I may suggest to move @HuobiGlobal exchange to Dominica as the national exchange 😎 https://t.co/5mevNNWzEN

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) October 12, 2022

HT Price Prediction

Based on this price analysis of Huobi Token, the price is currently bullish in the short run. HT could have another surge in price in the coming days. It may aim to reach $10 in the coming weeks.

As for the long run, fundamentals suggest that HT could be quite bullish. While it may not reach its all-time high quite soon, a price of $20 is quite realistic in the coming months, other things equal.

Takeaways

- Huobi Token increased a surge in price in the last few days.

- Technical indicators suggest that the momentum is quite bullish for HT.

- Justin Sun’s recent involvement with Huobi Global led to a huge increase in the price of HT.

- Huobi Token (HT) could reach $10 in the coming weeks.