Nexo is a cryptocurrency exchange and lending company that offers interest on deposits and instant crypto-backed loans. In this article, we will explain how you can borrow on Nexo.

What Is Nexo?

With more than 4 million customers in 200 countries, Nexo has given its customers a lot of value on their crypto assets.

For both individuals and organizations, loan services provide a convenient and cost-effective option to keep and invest in crypto. This is becoming increasingly popular as part of the decentralized financial sector. There are no credit checks performed by Nexo, so there are no worries about credit scores. A speedier loan approval process is expected as a result of this.

Nexo allows you to use your crypto assets as collateral for a loan. This is in addition to the potential to earn interest on fiat money, daily interest payments, compounding, and an intuitive interface, the Nexo platform has a lot going for it.

Crypto Borrowing

Without a credit check, Nexo offers loans in cash or stablecoins. You don’t have to trade your crypto to get started and rates are as low as 0%. A credit line is the sum of money you can borrow. Borrowing amounts range from $50 to $2,000,000. As long as you don’t go over your credit limit, you can continue borrowing money.

In order to get the maximum amount of money, you need to deposit a certain amount of cryptocurrency. Depending on which cryptocurrency you use, it may have a higher or lower percentage.

Nexo will notify you if the price of your collateral drops and you need to deposit additional crypto to keep your collateral. If you don’t add extra crypto to your credit line wallet, to repay the debt, Nexo will begin to sell off the collateral you provided as security. The borrowed money can be spent in cash, cryptocurrency, or on the Nexo card.

How To Borrow On Nexo

This short tutorial, which we have provided for your ease, will teach you everything you need to know about borrowing money on Nexo.

Step 1: Create An Account

You must first create an account before you can begin your Nexo journey. This can be done simply by visiting the official Nexo website. On the homepage, in the top right corner, click the “Create Account” box.

Following that, a new tab will appear, prompting you to enter your email address and create a password. Before proceeding, make sure that you have read and agreed to the terms and conditions. After that, finish the verification process and confirm your email address by clicking the verification link in the confirmation email. Finally, click on “Continue to your Nexo account”. Congratulations! You have successfully created a Nexo account.

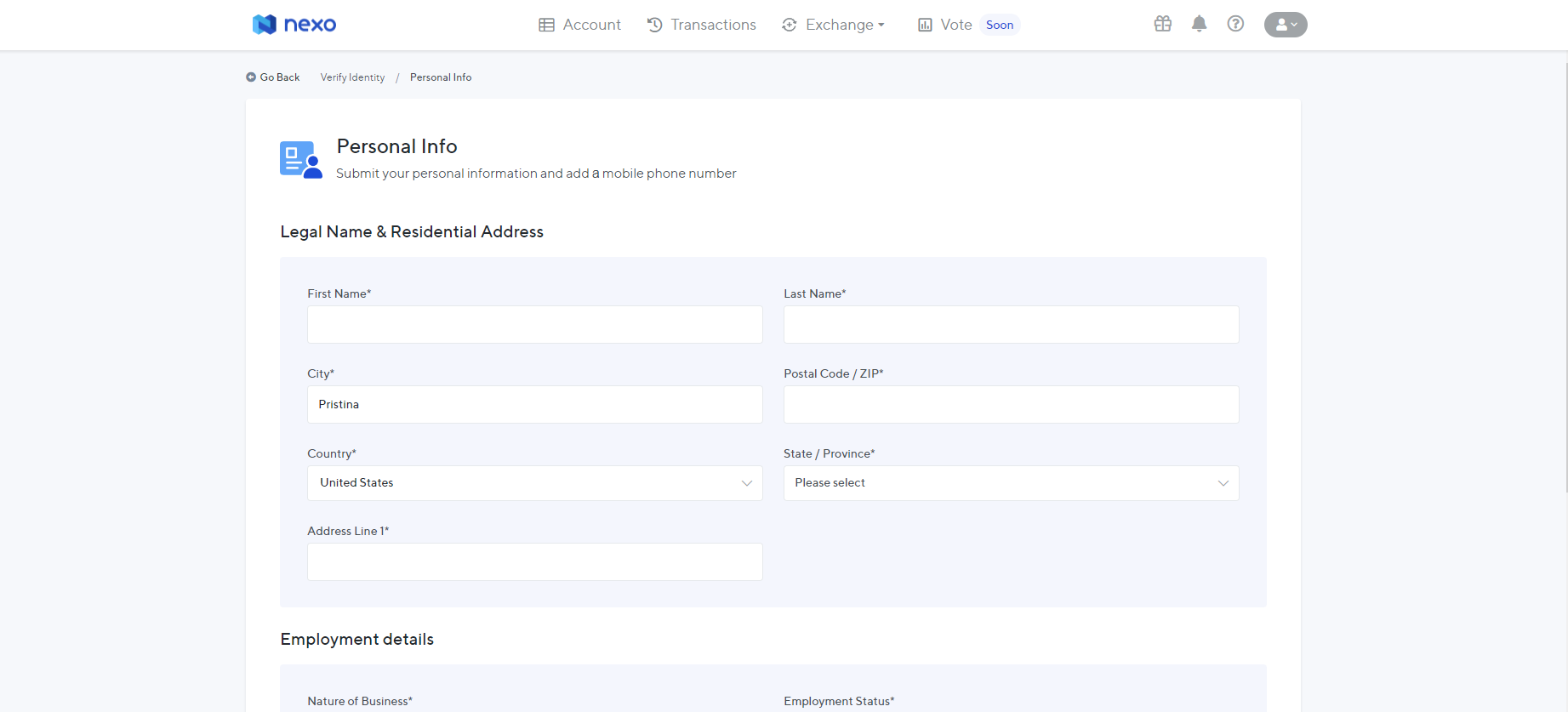

Step 2: Verify Your Identity

You must first verify your identity before proceeding and borrowing money. This is accomplished by first selecting “Identity Verification” and then clicking on “Start Verification.” There, enter all of your information and double-check that it is correct before submitting it.

After completing and verifying your identity, you will gain access to all of the platform’s features, including the ability to borrow money with Nexo.S

Step 3: Top Up Your Nexo Wallet

Simply scroll down on the “Account” tab, select one of the cryptocurrencies you want to use, and then click “Top Up.” Then you’ll be given a deposit address, which you should copy before topping up your wallet. When you add any of those assets, they will be added to your savings wallet, and you will be able to earn daily interest on them.

Alternatively, you can buy crypto with your bank card or a bank transfer. Card payments are processed instantly and you can transfer your assets to your Credit Line Wallet.

Step 4: Borrow Money

Finally, on the account tab, click “Withdraw Funds from Credit Line” to borrow cash. Then, at the very top, you can see how much money you can borrow. Select the method by which you want to receive your funds directly below it. Enter the amount of your withdrawal and the currency of your account further down.

Enter the country where your bank is located and select the type of transfer. After selecting the transfer type, you will be prompted to enter additional information. As our transfer type in this example, we will select “Individual SWIFT.” Following that, we will enter the recipient’s name and address. You must also include your beneficiary country, IBAN, and BIC/SWIFT information.

At the bottom of the screen, a question will appear asking you about the source of your crypto assets that you are using as collateral for the loan. Make absolutely sure you answer the question correctly. After that, simply confirm everything and congratulate yourself! You have just borrowed money via Nexo!

Summary

- Nexo offers cash or stablecoin loans with no credit check and rates as low as 0%.

- To begin your Nexo journey and borrow money, you must first create an account on the official Nexo website.

- Before borrowing money, you must verify your identity, your account will be fully activated once your identity has been verified.

- Before borrowing money on Nexo, make sure to top up your wallet by choosing one of the cryptocurrencies supported by the platform.

- Finally, you can easily borrow money on Nexo by providing all of the requested information.