Grayscale launches a Mini Bitcoin ETF with fees significantly lower than its GBTC to attract investors amid substantial outflows.

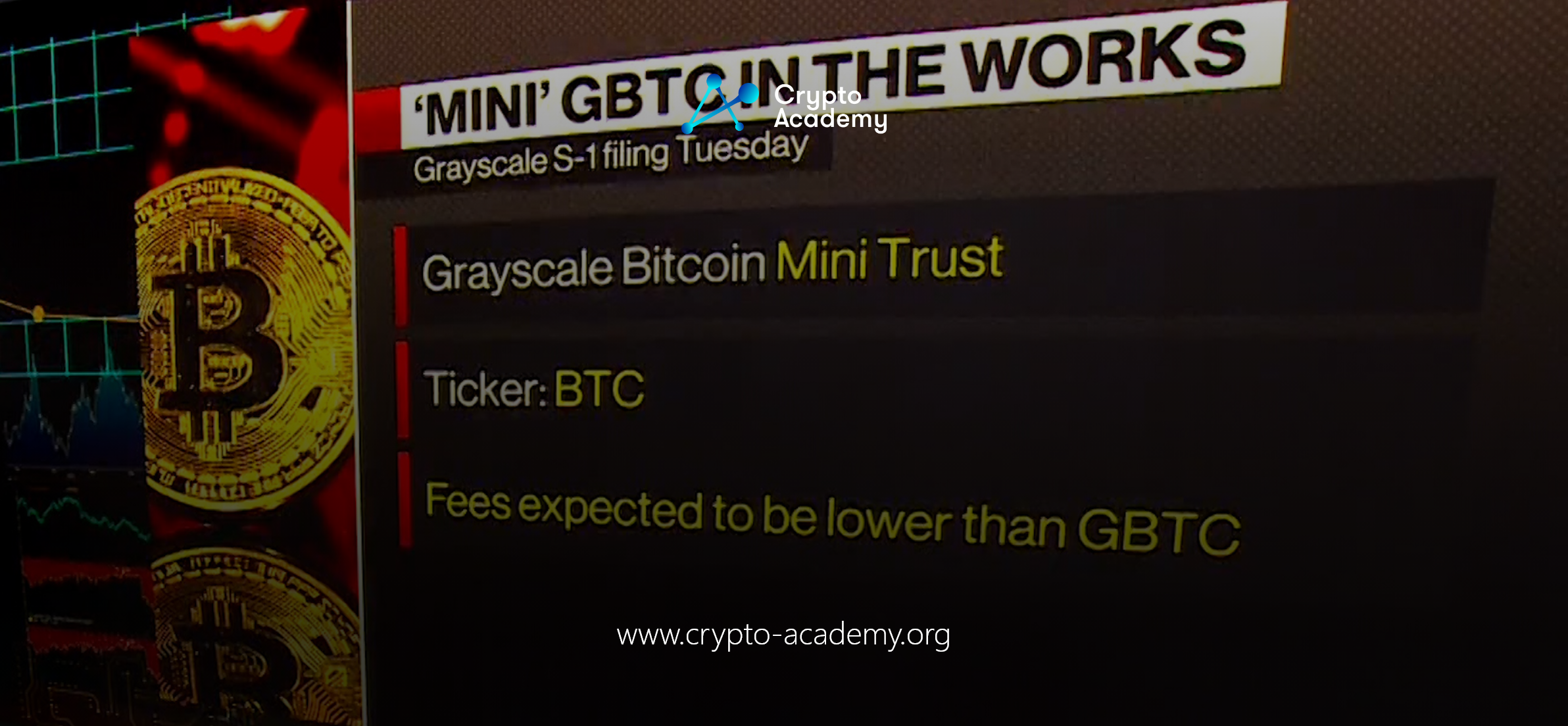

Grayscale Investments recently announced the launch of a new Mini Bitcoin ETF, promising significantly lower fees than its current Grayscale Bitcoin Trust (GBTC). The proposed fees for the Grayscale Bitcoin Mini Trust will be 0.15%, a drastic reduction from the 1.5% fee charged by GBTC. This move positions the new ETF as the most affordable among the 11 spot Bitcoin ETFs approved since January. Notable competitors include Franklin Templeton and Bitwise Bitcoin ETF, with fees of 0.19% and 0.20%, respectively.

Despite the attractive fee structure, Bloomberg ETF analyst Eric Balchunas advises caution. He points out that the proposed fees are not set in stone and primarily serve to draw investor interest. The final fee structure could change before the product’s official launch. Additionally, the lower fees are a strategic move by Grayscale to curb the significant outflows GBTC has experienced since the advent of competitive spot Bitcoin ETF offerings.

Market Impact and Investor Sentiment

Since the introduction of spot Bitcoin ETFs on January 11, GBTC has faced substantial withdrawals, amounting to approximately $16.73 billion, according to Farside data. The new Mini Bitcoin ETF is part of Grayscale’s broader strategy to regain market foothold and investor trust by offering more cost-effective investment options.

Thomas Fahrer, CEO of the crypto-focused reviews portal Apollo, highlights the necessity of this strategic pivot. He notes that since its inception, Grayscale has seen over 315K BTC in outflows. The introduction of a cheaper ETF option is vital to stem these losses and attract new investments.

The financial community is watching closely as Grayscale prepares to distribute shares of the new Bitcoin trust to existing GBTC shareholders. This distribution is part of a larger strategy to leverage GBTC’s resources and enhance the new trust’s market presence.