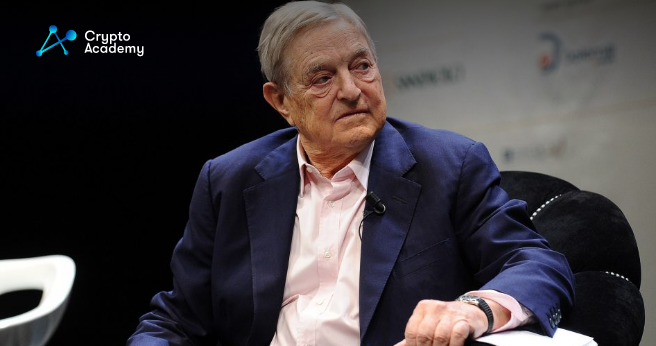

George Soros recently made interesting investments, including the acquisition of Tesla shares, crypto-related companies, and many more.

Billionaire investor and philanthropist George Soros made some interesting investment moves during the fourth quarter of 2022. His investment management firm, Soros Fund Management, boosted its stake in Tesla, Peloton, took new positions in Carvana, GM, crypto names, and dumped Zoom and Twitter in the last quarter of the year.

The fourth-quarter moves of Soros Fund Management were disclosed through a 13F filing with the U.S. Securities and Exchange Commission (SEC) dated December 31, 2022. It revealed that the firm purchased 242,399 shares of Tesla, a roughly 270% increase, bringing the fund’s total holdings to 332,046 Tesla shares. The move is surprising, given that the electric vehicle maker’s shares sank last year. However, Tesla’s electric vehicle market leadership and its valuation amid rising demand for electric cars could be attractive to Soros. Additionally, he invested in Cathie Wood’s Ark Innovation ETF, which is the largest shareholder of Tesla.

Soros’ fund also bought more than 83 million shares of Peloton, a 370% increase in the fund’s stake in the company. Peloton’s shares had taken a hit, following its earnings report last week. Soros also took a new stake in struggling used-car seller Carvana Co. and a new stake in Lyft, snapping up more than 83 million shares. He also hiked his stake in Uber Technologies.

Soros has also diversified into the financial sector. The filing also showed new stakes in big financial names Capital One Financial Corp., Citigroup Inc., and Discover Financial Services. Within the automotive industry, Soros Fund Management raised its stake in Ford Motor Co. by 6.4% to 83 million shares. The fund also acquired 500,000 shares of General Motors Co.

Soros Embraces the Crypto Industry

The firm’s interest in the cryptocurrency market is also noticeable as Soros took a new stake of nearly 40 million shares in Marathon Digital Holdings and acquired 17.2 million shares of Block Inc. The fund also took a smaller stake in crypto-friendly bank Silvergate Capital Corp. Soros Fund Management purchased $39.6 million worth of convertible debentures of Marathon Digital Holdings. Those are types of long-term debts that you can convert into stock after a specified period of time.

In addition to the common stock bets/hedges, the fund continued to hold nearly $200 million in MicroStrategy preferred shares. MicroStrategy could be considered a proxy for holding bitcoin because of the company’s large crypto holdings. The fund also disclosed a short position on beleaguered crypto-focused bank Silvergate Bank, holding 100,000 shares worth of put options. Soros’ bet is likely a hedging strategy on MicroStrategy shares through an option play.