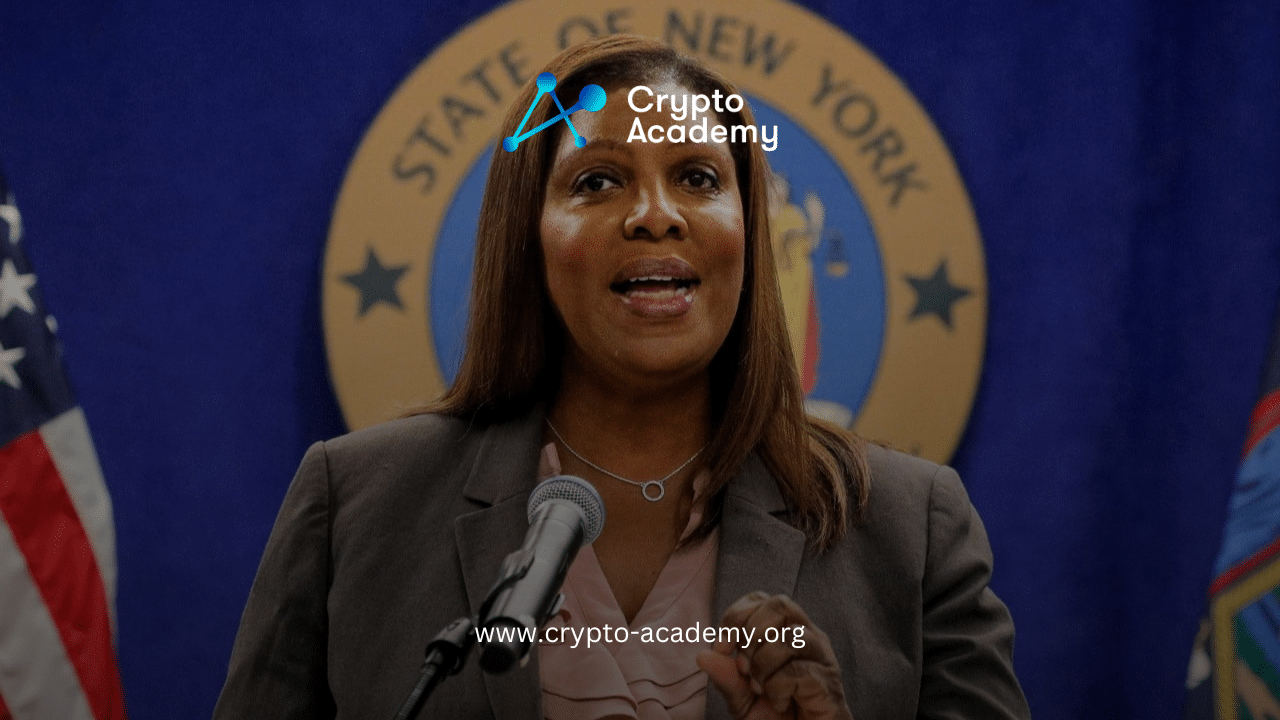

Gemini, a cryptocurrency exchange, will pay $50 million to settle a fraud claim in New York. The settlement, announced by New York Attorney General Letitia James, includes a ban on Gemini operating lending programs in the state.

Settlement and Reimbursement

Attorney General James stated that the $50 million will reimburse investors affected by Gemini’s Earn program. This initiative will help over 230,000 investors, including 29,000 New Yorkers. Investors will receive refunds without needing to take any action.

The lawsuit alleged that Gemini deceived investors out of more than $3 billion. Internal documents showed that Gemini was aware of the program’s “high risk.” Attorney General James emphasized that Gemini’s actions broke the trust of “hundreds of thousands of people.”

“Gemini marketed its Earn program as a way for investors to grow their money but lied and locked investors out of their accounts,” said James. She noted that this settlement serves as a warning to cryptocurrency companies about the consequences of deceiving investors.

Background of Gemini Earn Program

Gemini Earn offered high-interest rates for investors lending crypto to Genesis Global Capital. Genesis Global Capital is a part of Digital Currency Group. Gemini charged agent fees exceeding 4% for this service.

In November 2022, Genesis suspended redemptions after the FTX cryptocurrency exchange collapse. Subsequently, Genesis filed for Chapter 11 bankruptcy. This left investors unable to access their investments.

Gemini is operated by billionaire twins Cameron and Tyler Winklevoss. Their exchange now faces significant regulatory scrutiny and legal challenges.

This settlement aims to restore investors’ trust and highlights the risks associated with cryptocurrency investments.