When it comes to cryptocurrency taxation, which are the best countries to be based in – and which are the worst? Cryptocurrency is always good for headlines, price falls, fortunes made, and fraud all gain leader coverage across the press. Less written about, and perhaps more mythologized, are the tax implications on all those gains – or losses – that people around the world incur when crypto trading.

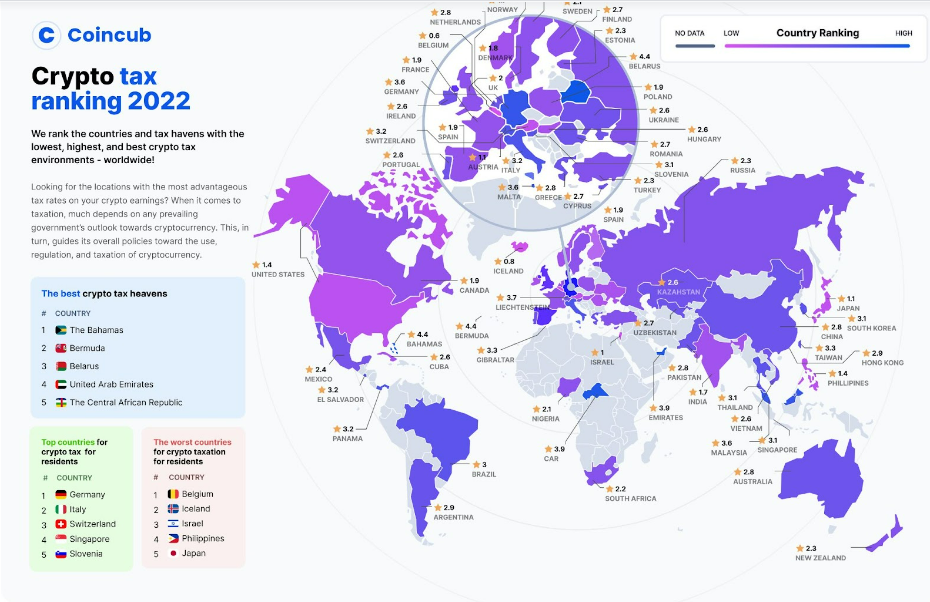

The new Coincub.com tax rankings provide a much-needed starting point in the analysis of variations of cryptocurrency taxes around the world.

Does that sunny tax haven in the Caribbean let you off your crypto tax burden? Is Lichtenstein’s interest in Bitcoin the same as the UAE’s? Do mainstream western economies such as Germany, Switzerland, and the US make the same tax demands as India, Brazil, and Mexico? Decentralized finance may herald a brave new era in transactional freedom, but tax is sure to bring it back down to earth.

Part of the problem is confusion and lack of awareness over the tax position that exists in many countries. For a long time, countries have vacillated over how to define crypto, how to control it, and how to tax it – India, Pakistan, the UAE, and Brazil to name a few. Even in mainstream economies, crypto tax requirements are widely misunderstood.

With this in mind, coincub.com, the site that ranks the crypto-friendliness of the world’s economies every quarter has recently added a new category to its output: worldwide tax rankings.

The overwhelming take-home of the rankings is that taxation of crypto around the world is far from consistent, very often not entirely understood, and subject to all manner of hopes and aspirations of respective governments. Moreover, the tax policy in any one country is as much to do with national characteristics as it is with reason.

Cryptocurrency Taxation: A Tax haven or Mainstream Economy?

The top ten locations where you’ll pay the least tax on your crypto gains are, unsurprisingly enough, dominated by classic tax havens. The first six places in the ranking are taken by the Bahamas, Bermuda, Belarus, the UAE, the Central African Republic (an ambitious newcomer to the game), and good, reliable Lichtenstein. It’s not until number seven that a mainstream economy, Germany, enters the list.

Germany has adopted a progressive attitude to crypto and its taxation and allows its biggest national savings institution, the Sparkasse Bank, to allow crypto investment – an almost unparalleled move. Germany also demands no tax on any crypto gains if the crypto in question is held – and not traded onwards – for one year. A fantastic savings incentive. Germany is an exception in the top ten, however, and following on at eight, nine, and ten are Malta, Malaysia, and Gibraltar respectively.

Crypto taxation is fast-changing, and countries have been increasingly applying flat tax rates to simplify tax take, Coincub said in a new study. https://t.co/9cpedB2d8B

— Cointelegraph (@Cointelegraph) September 8, 2022

Cryptocurrency Taxation – A Playing Field Leveler

Somewhat ironically, the tax situation in many tax havens is often clearer and more defined than in traditionally taxed economies. The reason is undoubted that professional investors (with professional tax advisers) are invited to deduce the benefits of locating their operations in tax havens much more easily.

Setting aside the classic tax havens mentioned above, some newer and more ambitious names enter the ranking. At five is the Central African Republic whose president sees the opportunity of turning his country into a crypto-powered hub, gaining status and income by opening up to crypto investors.

The country has also declared Bitcoin as legal tender and produced its own cryptocurrency the Sango. At number 12 is El Salvador, another country that sees crypto as a means of elevating itself up into the big league by declaring Bitcoin as a legal tender. El Salvador even reckons with harnessing the thermal power of volcanoes to produce the energy required for mining Bitcoin. In both countries, crypto investors are more than welcome.

Coming down the rankings past the top ten and we start to see more mainstream economies appearing which are not tax havens as such but have less onerous tax burdens on crypto trading. At 13, 15, and 16 are Italy, Switzerland, and Singapore respectively. All of these countries offer attractive income tax and capital gains tax allowances against trading gains. Singapore especially is one of the most crypto-friendly countries in the world for a host of other reasons too and continually remains in the top five of Coincub’s wider crypto ranking of most progressive crypto and blockchain economies.

At the opposite end of the ranking are the countries where you’ll pay the most tax. One of the fastest movers in this regard is India which shot down to number 53, just nine places from the bottom. India has seen years of uncertainty over how to tax cryptocurrency but recently took a strong line with a flat-rate, but chunky, tax of 30% on all profits or income from cryptocurrency. There is also a 1% tax on crypto transactions exceeding 50,000 INR (approx $600) in a financial year – a pretty low threshold for regular investors.

Other high-tax economies include Japan, Israel, and Iceland at numbers 58, 59, and 60 on the list with Belgium right on the bottom at 61 thanks to severe taxes on income and capital gains from cryptocurrency trading where professional income can be taxed as high as 50%. Nb – it’s worth bearing in mind that high taxation doesn’t always deter crypto investment, and a clear but high taxation regime can encourage more crypto trading than a confused taxation regime. For example, Japan and the US, both confer a wide range of taxes on crypto trading but both see higher than average volumes of activity.

Flat Rates and Thresholds

Much of taxation policy centers around allowances and thresholds – or even where you live. The levels at which taxation kicks in once some thresholds are reached vary enormously. Italy, for example, offers an exemption from tax on crypto asset gains that do not exceed a whopping €51,000. On the other hand, in Iceland, the taxation threshold is very low, and any crypto gains up to $7k will incur approx 40% tax.

Hungary, having considerable problems with crypto tax avoidance (or negligent reporting to coin a phrase) decided to slap a very generous 15% fixed rate tax on all crypto gains no matter how high they were. This strategy aims to increase the population’s compliance and thus result in a healthy tax take. Yet again, in the UAE and Switzerland, the exact amount of tax that crypto activity incurs can simply vary according to which area you live in. Lugano in Switzerland has declared Bitcoin as a legal tender yet is the only Canton in the country to have done so. In the UAE, location in one of the country’s free zones will determine the tax – if any – you might pay.

Methodology

Coincub’s methodology for the cryptocurrency taxation index has been to review each country and award and subtract points according to levels of tax, levels of thresholds, and levels of time required to keep currency before it is taxed. All to gain an overall points position. Naturally, tax havens come out on top – but in like-for-like comparisons of mainstream economies Germany Singapore, Switzerland, Italy and Slovenia do the most for their citizens in terms of lowest crypto taxes.

Good Advice is Always Key

In any event, it is essential to have excellent tax advice because wherever you live or choose to move to, any gains you make can be a moveable feast – especially when it comes to crypto earnings. This is because crypto taxation is subject to a myriad of considerations. So, when you read headlines about which country has a 0% tax on crypto or hear stories about how the average street cleaner is making millions with his Bitcoins in Belarus, very often these headlines only tell one small part of the taxation story.

Find out how your country rates on the full Coincub tax ranking here.