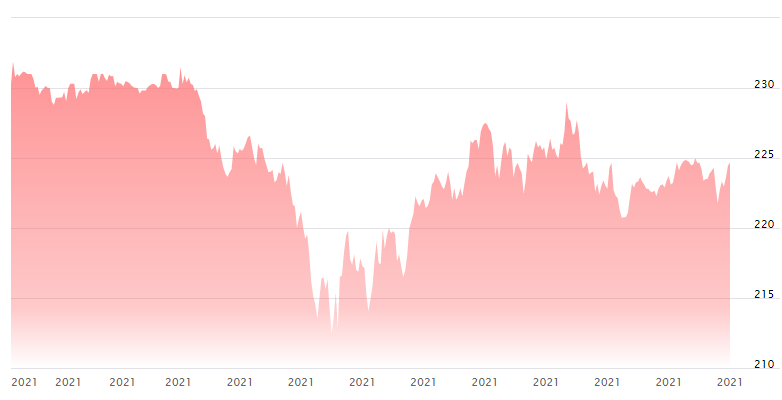

Coinbase shares have seen a drop in their value throughout a 30-day period, opening at $342 per share at the beginning of the month. The company’s shares have dropped over 27%, which translates to a price of $248 per share since the Nasdaq listing that occurred in mid-April. On Monday, the firm announced its intention to sell $1.25 billion of convertible debt.

Coinbase Shares Drop Below Reference Rate

It was announced on Monday that, depending on market conditions, Coinbase Global, Inc. intends to sell $1.25 billion of convertible debt. A shareholder letter published four days ago by the company notes that the firm has met strong competition in the digital currency industry.

Furthermore, the Coinbase shareholder letter states that “Despite our strong Q1 results, the rapid expansion of the crypto economy also creates challenges for Coinbase. Competition is increasing as new market entrants join the crypto economy every month.”

The announcement happened at a time in which the company is facing a decrease in the price of their shares, closing below their $250 reference price at $248 per share. Just as the company’s shares have lost value during the last month, so has the COIN token, decreasing concurrently.

Other Tech Stocks Experienced Drops

Correspondingly, tech stocks that are exposed to cryptocurrencies and the blockchain technology industry have seen drops in value that are similar to those above-mentioned.

Among those that have been affected and have seen drops in value are stocks like Canaan (CAN), Marathon Digital Holdings (MARA), Riot Blockchain (RIOT), and Microstrategy (MSTR). Alongside many digital asset trusts, The Grayscale Bitcoin Trust (GBTC) has seen a drop in price as well.

Coinbase announcement comes after the revenue report that was published on Thursday. In the revenue report, it was said that the company has experienced earnings of $3.05 per share and accrued $1.80 billion of revenue in a Securities and Exchange Commission (SEC) filing.

The company is up from $585 million in Q4 2020, expecting a 63% increase on its monthly transacting users of 5.5 million. Moreover, Coinbase which originally started off in San Francisco, announced that the firm operates remotely without a physical headquarters.

According to the Form 8-K SEC filing, the $1.25 billion of convertible debt will be used to cushion the company’s holdings.

The filing notes state: “The capital raise represents an opportunity to bolster Coinbase’s already strong balance sheet with low-cost capital that maintains operating freedom and minimizes dilution for Coinbase’s stockholders.”

Takeaways

- Coinbase shares have seen a drop in their value throughout a 30-day period, opening at $342 per share at the beginning of the month.

- It was announced on Monday that, depending on market conditions, Coinbase Global, Inc. intends to sell $1.25 billion of convertible debt.

- Correspondingly, tech stocks that are exposed to cryptocurrencies and the blockchain technology industry have seen drops in value that are similar to those above-mentioned.

- Coinbase announcement comes after the revenue report that was published on Thursday. In the revenue report, it was said that the company has experienced earnings of $3.05 per share and accrued $1.80 billion of revenue in a Securities and Exchange Commission (SEC) filing.