CFTC Chairman Rostin Behnam accuses Binance of intentionally violating U.S. regulations, escalating the ongoing legal battle with the exchange.

The Commodity Futures Trading Commission (CFTC) seems determined to hold Binance, one of the largest cryptocurrency exchanges globally, accountable for its actions. Moreover, in a recent event at Princeton University, CFTC Chairman Rostin Behnam accused Binance’s top executives of intentionally operating outside the boundaries of U.S. laws related to commodities and futures trading. This strong statement intensifies the ongoing legal conflict between the exchange and the regulatory body.

Reports from Bloomberg reveal that Behnam made these remarks during a fireside chat at the DeCenter Spring Conference. The CFTC Chairman claimed that Binance’s leaders consciously violated the rules, enabling U.S. citizens to trade on the platform by using virtual private networks (VPNs) and other technologies to conceal their identities.

CFTC’s Case Against Binance: A Comprehensive Overview

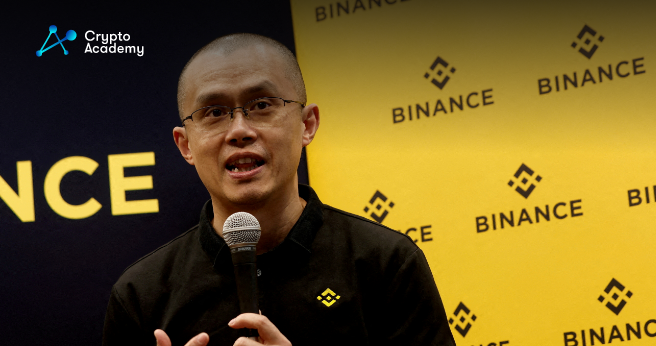

Behnam’s allegations are part of a broader legal dispute involving Binance, its CEO Changpeng “CZ” Zhao, and the CFTC. The regulator filed a lawsuit against the exchange and its CEO, citing several trading violations. Also, the charges include conducting unregistered futures transactions, offering illegal commodities options, failing to register as a Futures Commission Merchant, Designated Contract Market, or Swap Execution Facility, and neglecting to implement sufficient anti-money laundering (AML) and know-your-customer (KYC) procedures.

The crux of the CFTC’s lawsuit against Binance revolves around the argument that the platform continued to accept U.S. customers despite having a policy that explicitly forbade such actions. Furthermore, the lawsuit alleges that Binance participated in unlawful futures trading, violating U.S. AML regulations in the process.

Examining the Potential Consequences of Behnam’s Public Statement

It is uncertain why the CFTC Chairman decided to discuss an ongoing investigation in a public setting. However, Behnam’s public condemnation of Binance suggests that the regulatory agency is committed to pursuing the case against the exchange and its leadership. Hence, this development could mark a pivotal moment in the legal battle, with regulators potentially adopting a more assertive approach to enforcing compliance.

Conversely, Binance insists that it has always made sincere efforts to adhere to global regulations. The exchange has yet to comment on Behnam’s statements during the Princeton event.

Implications for the Wider Cryptocurrency Sector

The CFTC’s claims against Binance and its executives have repercussions that reach beyond the exchange itself. If the CFTC’s allegations are substantiated, it could signal an increase in regulatory oversight within the cryptocurrency industry. Other exchanges might find themselves under heightened scrutiny from regulators, compelling them to enhance their compliance measures or risk facing similar legal challenges.

In the interim, the ongoing legal conflict between Binance and the CFTC serves as a vivid reminder to cryptocurrency exchanges and their users that regulatory authorities are closely monitoring the sector. Therefore, as the case progresses, it is likely to shape the future of cryptocurrency regulation and may even prompt significant operational changes within exchanges.

To summarize, CFTC Chairman Rostin Behnam’s recent accusations against Binance underscore the escalating tensions between cryptocurrency exchanges and regulatory agencies. As the legal battle unfolds, the outcome could have far-reaching consequences for the entire industry. The situation highlights the importance of maintaining compliance in an increasingly regulated landscape, ensuring that exchanges operate within the bounds of the law.